Answered step by step

Verified Expert Solution

Question

1 Approved Answer

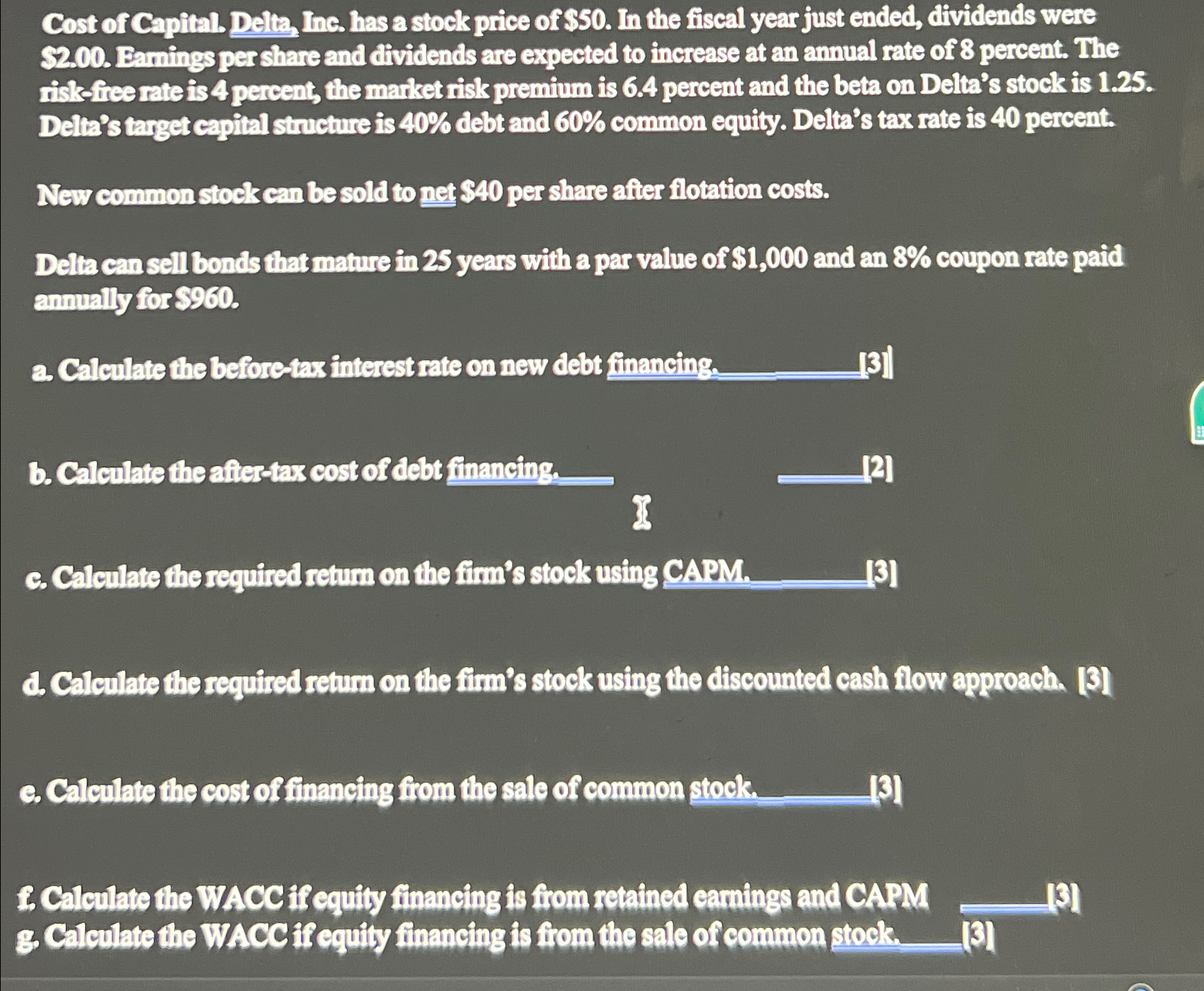

Cost of Capital. Delta, Inc. has a stock price of $ 5 0 . In the fiscal year just ended, dividends were 5 2 .

Cost of Capital. Delta, Inc. has a stock price of $ In the fiscal year just ended, dividends were Eamings per share and dividends are expected to increase at an annual rate of percent. The risksfiee rate is percent, the market risk premium is percent and the beta on Delta's stock is Delta's target capital stucture is debt and common equity. Delta's tax rate is percent.

New common stoek can be sold to net $ per share after flotation costs.

Delta can sell bonds that mature in years with a par value of $ and an coupon rate paid annually for

a Calculate the beforetax interest rate on new debt financing.

b Calculate the aftertax cost of debt financing.

C Calculate the required retum on the firm's stock using CAPM.

d Calculate the required retum on the firm's stock using the discounted cash flow approach.

e Calemlate the cost of finanging from the sale of common stock.

Caleulate the WACC if equity financing is from retained camings and CAPM

g Calenlate the WACC if equily financing is from the sale of common strock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started