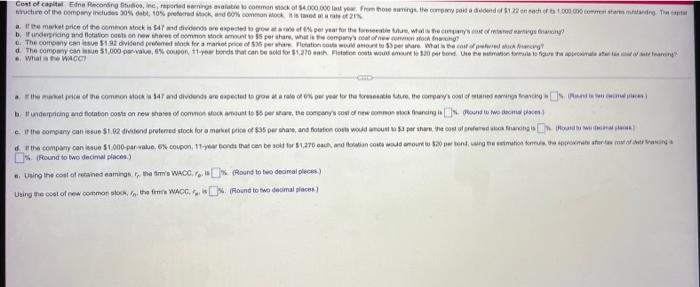

Cost of capital Edna Recording Studios, inc, raported earings valable to common stock of $4.000.000 last year from those savings, the company paid a duldend of $1.22 on each of ts 1,000,000 comment shares landing. The capt mucture of the company includes 30% dabt, 10% preferred stack, and 60% common stock it is taxoa 21% at the market price of the common stock is $47 and dividends are expected to grow at a rate of 6% per year for the foreseeable ture, what is the company's cost of retsed earnings fang b. If underpricing and flotation oasts on new shares of common stock amount to $5 per share, what is the company's coat of new common stock fnancing? c. The company can issue $1.92 dividend prefemed stock for a market price of $35 per share Flotation costs would amount to 53 per share. What is the cost of prog? d. The company can issue $1,000 par-value, 6% coupon, 11-year bonds that can be sold for $1,270 each Flatation costs would emount to 120 per bond. Use the station formule to figure the appemata atatofaring? What is the WACC) at the market price of the common stock is 147 and dividends are expected to grow at a rate of 6% per year for the foressatie tuture, the company's cost of retained earnings financing and s b. If underpricing and flotation costs on new shares of common stock amount to 55 per share, the company's cost of new common stock financing is sound to wo decal places) c. If the company can issue $1.92 dividend preferred stock for a market price of $35 per share, and flotation costs would amount to $3 per share the cost of prefered alock finanong in (Round to two decal p d the company can issue $1.000-par-value, 6% coupon, 11-year bonds that can be sold for $1,270 each, and folation costs would amount to $20 per bond, using the estimation formus, the appromats after tas at of drawings % (Round to two decimal places) e. Using the cost of retained eamings, the firm's WACC. (Round to two decimal places) Using the cost of new common stock, the firms WACC%. (Round to two decimal places) Cost of capital Edna Recording Studios, inc, raported earings valable to common stock of $4.000.000 last year from those savings, the company paid a duldend of $1.22 on each of ts 1,000,000 comment shares landing. The capt mucture of the company includes 30% dabt, 10% preferred stack, and 60% common stock it is taxoa 21% at the market price of the common stock is $47 and dividends are expected to grow at a rate of 6% per year for the foreseeable ture, what is the company's cost of retsed earnings fang b. If underpricing and flotation oasts on new shares of common stock amount to $5 per share, what is the company's coat of new common stock fnancing? c. The company can issue $1.92 dividend prefemed stock for a market price of $35 per share Flotation costs would amount to 53 per share. What is the cost of prog? d. The company can issue $1,000 par-value, 6% coupon, 11-year bonds that can be sold for $1,270 each Flatation costs would emount to 120 per bond. Use the station formule to figure the appemata atatofaring? What is the WACC) at the market price of the common stock is 147 and dividends are expected to grow at a rate of 6% per year for the foressatie tuture, the company's cost of retained earnings financing and s b. If underpricing and flotation costs on new shares of common stock amount to 55 per share, the company's cost of new common stock financing is sound to wo decal places) c. If the company can issue $1.92 dividend preferred stock for a market price of $35 per share, and flotation costs would amount to $3 per share the cost of prefered alock finanong in (Round to two decal p d the company can issue $1.000-par-value, 6% coupon, 11-year bonds that can be sold for $1,270 each, and folation costs would amount to $20 per bond, using the estimation formus, the appromats after tas at of drawings % (Round to two decimal places) e. Using the cost of retained eamings, the firm's WACC. (Round to two decimal places) Using the cost of new common stock, the firms WACC%. (Round to two decimal places)