Question

Cost of Capital Estimation: Estimate the cost of capital for Yahoo (Ticker: YHOO) and Altria (Ticker: MO), in December 2004. At the time, the yield

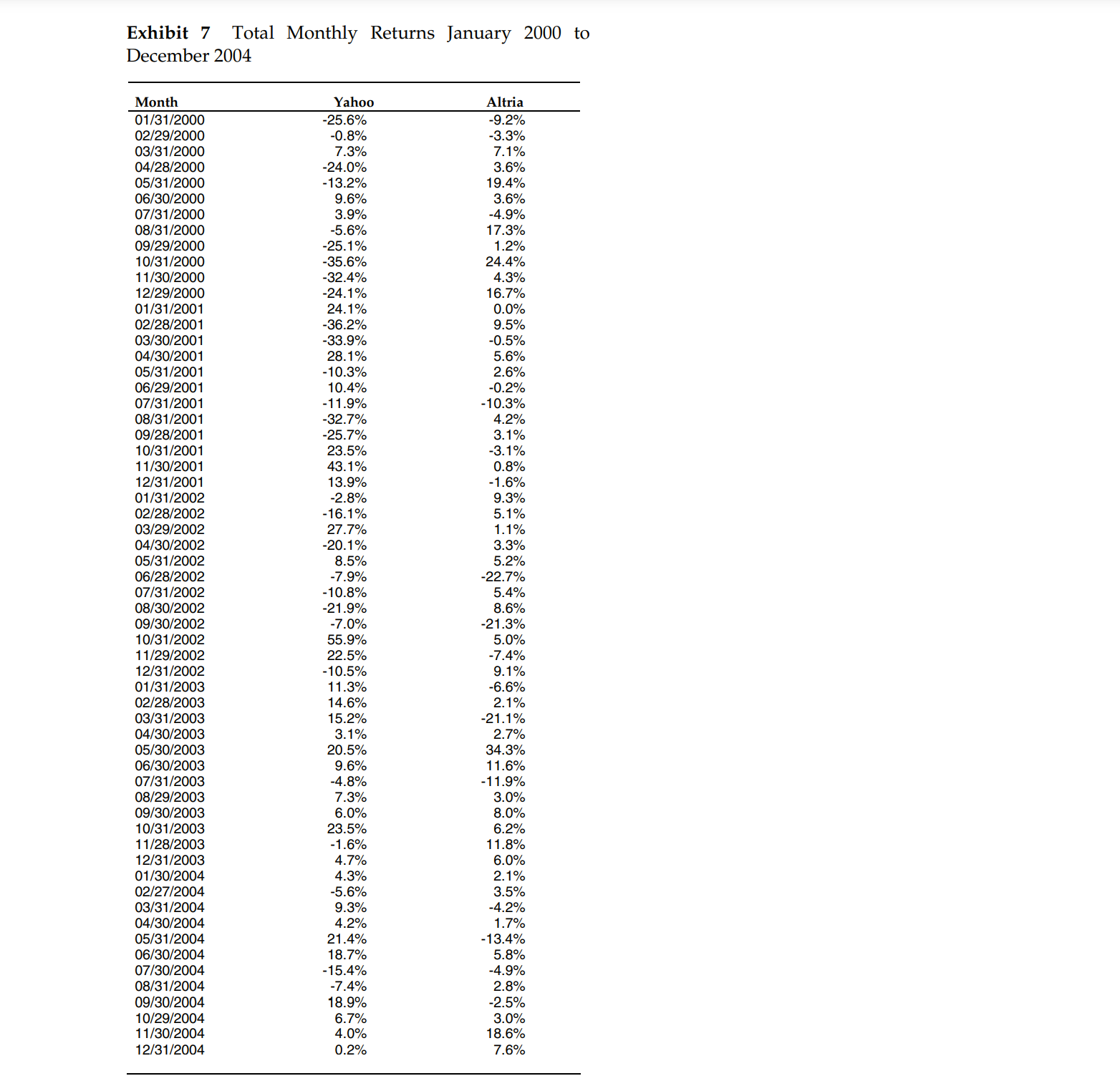

Cost of Capital Estimation: Estimate the cost of capital for Yahoo (Ticker: YHOO) and Altria (Ticker: MO), in December 2004. At the time, the yield on the 10 year and 30-year U.S. government bonds was 4.2% and 4.9%, respectively (The profiles of the two firms is given below and Exhibit 7 shows monthly total returns for the period from January 2000 through December 2004.) Both firms have opportunities to make new investments that are broadly similar to their existing assets and are expected to produce an equity return of 10% per year. The investments would be financed with the same historical mix of debt and equity. In other words, focusing directly on the cost of equity is sufficient. No unlevering or relevering is necessary. Would you give these projects the green light? Do they create value for shareholders?

Companys Profiles:

Yahoo (YHOO) Stanford University graduates Jerry Yang and David Filo founded Yahoo in 1994, seeking to develop an easier way to navigate the nascent World Wide Web. The companys IPO, delivered two years later, marked the beginning of a rapid expansion process that included forays into online auctions, games, shopping and other services. Yahoo relied on an ad-based revenue stream and was one of the few dot. Coms to generate consistent profits during the tech bubble of the late 1990s.

Altria (MO) The Altria Group, formerly Phillip Morris, began as a tobacco shop in London in 1847 and went public in 1881. The cigarette-maker continued to expand and in the 1950s introduced its Marlboro brand, pitched by the iconic Marlboro Man, which went on to become the best-selling product in the world. In response to the flood of anti-tobacco litigation that targeted the company in the 1990s, the company changed its name to Altria (Philip Morris remained as a subsidiary).

Exhibit 7 Total Monthly Returns January 2000 to Danamham onne Exhibit 7 Total Monthly Returns January 2000 to Danamham onne

Exhibit 7 Total Monthly Returns January 2000 to Danamham onne Exhibit 7 Total Monthly Returns January 2000 to Danamham onne Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started