Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost of Capital for Master Tools You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded

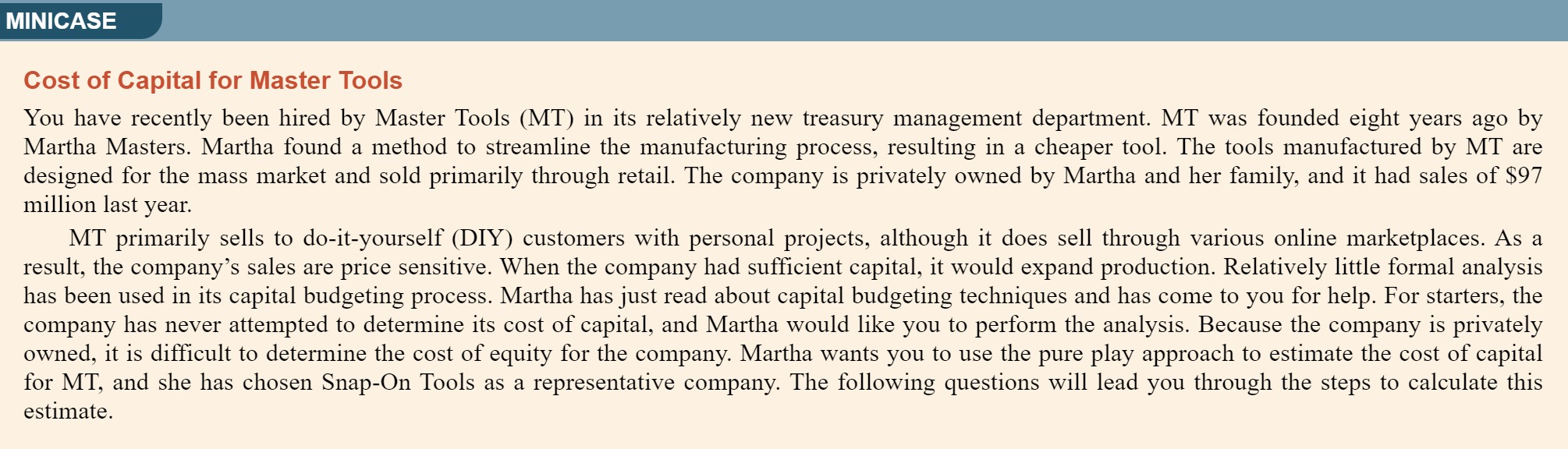

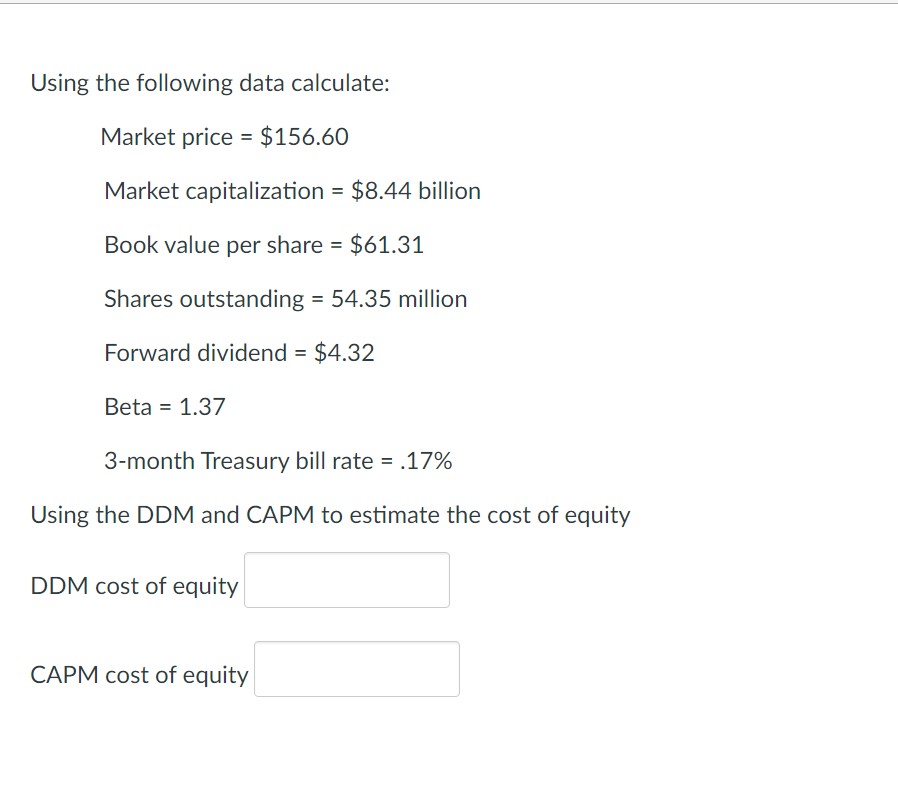

Cost of Capital for Master Tools You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded eight years ago by Martha Masters. Martha found a method to streamline the manufacturing process, resulting in a cheaper tool. The tools manufactured by MT are designed for the mass market and sold primarily through retail. The company is privately owned by Martha and her family, and it had sales of \\( \\$ 97 \\) million last year. MT primarily sells to do-it-yourself (DIY) customers with personal projects, although it does sell through various online marketplaces. As a result, the company's sales are price sensitive. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Martha has just read about capital budgeting techniques and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Martha would like you to perform the analysis. Because the company is privately owned, it is difficult to determine the cost of equity for the company. Martha wants you to use the pure play approach to estimate the cost of capital for MT, and she has chosen Snap-On Tools as a representative company. The following questions will lead you through the steps to calculate this estimate. Using the following data calculate: Market price \\( =\\$ 156.60 \\) Market capitalization \\( =\\$ 8.44 \\) billion Book value per share \\( =\\$ 61.31 \\) Shares outstanding \\( =54.35 \\) million Forward dividend \\( =\\$ 4.32 \\) Beta \\( =1.37 \\) 3-month Treasury bill rate \=.17 Using the DDM and CAPM to estimate the cost of equity DDM cost of equity CAPM cost of equity Cost of Capital for Master Tools You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded eight years ago by Martha Masters. Martha found a method to streamline the manufacturing process, resulting in a cheaper tool. The tools manufactured by MT are designed for the mass market and sold primarily through retail. The company is privately owned by Martha and her family, and it had sales of \\( \\$ 97 \\) million last year. MT primarily sells to do-it-yourself (DIY) customers with personal projects, although it does sell through various online marketplaces. As a result, the company's sales are price sensitive. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Martha has just read about capital budgeting techniques and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Martha would like you to perform the analysis. Because the company is privately owned, it is difficult to determine the cost of equity for the company. Martha wants you to use the pure play approach to estimate the cost of capital for MT, and she has chosen Snap-On Tools as a representative company. The following questions will lead you through the steps to calculate this estimate. Using the following data calculate: Market price \\( =\\$ 156.60 \\) Market capitalization \\( =\\$ 8.44 \\) billion Book value per share \\( =\\$ 61.31 \\) Shares outstanding \\( =54.35 \\) million Forward dividend \\( =\\$ 4.32 \\) Beta \\( =1.37 \\) 3-month Treasury bill rate \=.17 Using the DDM and CAPM to estimate the cost of equity DDM cost of equity CAPM cost of equity

Cost of Capital for Master Tools You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded eight years ago by Martha Masters. Martha found a method to streamline the manufacturing process, resulting in a cheaper tool. The tools manufactured by MT are designed for the mass market and sold primarily through retail. The company is privately owned by Martha and her family, and it had sales of \\( \\$ 97 \\) million last year. MT primarily sells to do-it-yourself (DIY) customers with personal projects, although it does sell through various online marketplaces. As a result, the company's sales are price sensitive. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Martha has just read about capital budgeting techniques and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Martha would like you to perform the analysis. Because the company is privately owned, it is difficult to determine the cost of equity for the company. Martha wants you to use the pure play approach to estimate the cost of capital for MT, and she has chosen Snap-On Tools as a representative company. The following questions will lead you through the steps to calculate this estimate. Using the following data calculate: Market price \\( =\\$ 156.60 \\) Market capitalization \\( =\\$ 8.44 \\) billion Book value per share \\( =\\$ 61.31 \\) Shares outstanding \\( =54.35 \\) million Forward dividend \\( =\\$ 4.32 \\) Beta \\( =1.37 \\) 3-month Treasury bill rate \=.17 Using the DDM and CAPM to estimate the cost of equity DDM cost of equity CAPM cost of equity Cost of Capital for Master Tools You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded eight years ago by Martha Masters. Martha found a method to streamline the manufacturing process, resulting in a cheaper tool. The tools manufactured by MT are designed for the mass market and sold primarily through retail. The company is privately owned by Martha and her family, and it had sales of \\( \\$ 97 \\) million last year. MT primarily sells to do-it-yourself (DIY) customers with personal projects, although it does sell through various online marketplaces. As a result, the company's sales are price sensitive. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Martha has just read about capital budgeting techniques and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Martha would like you to perform the analysis. Because the company is privately owned, it is difficult to determine the cost of equity for the company. Martha wants you to use the pure play approach to estimate the cost of capital for MT, and she has chosen Snap-On Tools as a representative company. The following questions will lead you through the steps to calculate this estimate. Using the following data calculate: Market price \\( =\\$ 156.60 \\) Market capitalization \\( =\\$ 8.44 \\) billion Book value per share \\( =\\$ 61.31 \\) Shares outstanding \\( =54.35 \\) million Forward dividend \\( =\\$ 4.32 \\) Beta \\( =1.37 \\) 3-month Treasury bill rate \=.17 Using the DDM and CAPM to estimate the cost of equity DDM cost of equity CAPM cost of equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started