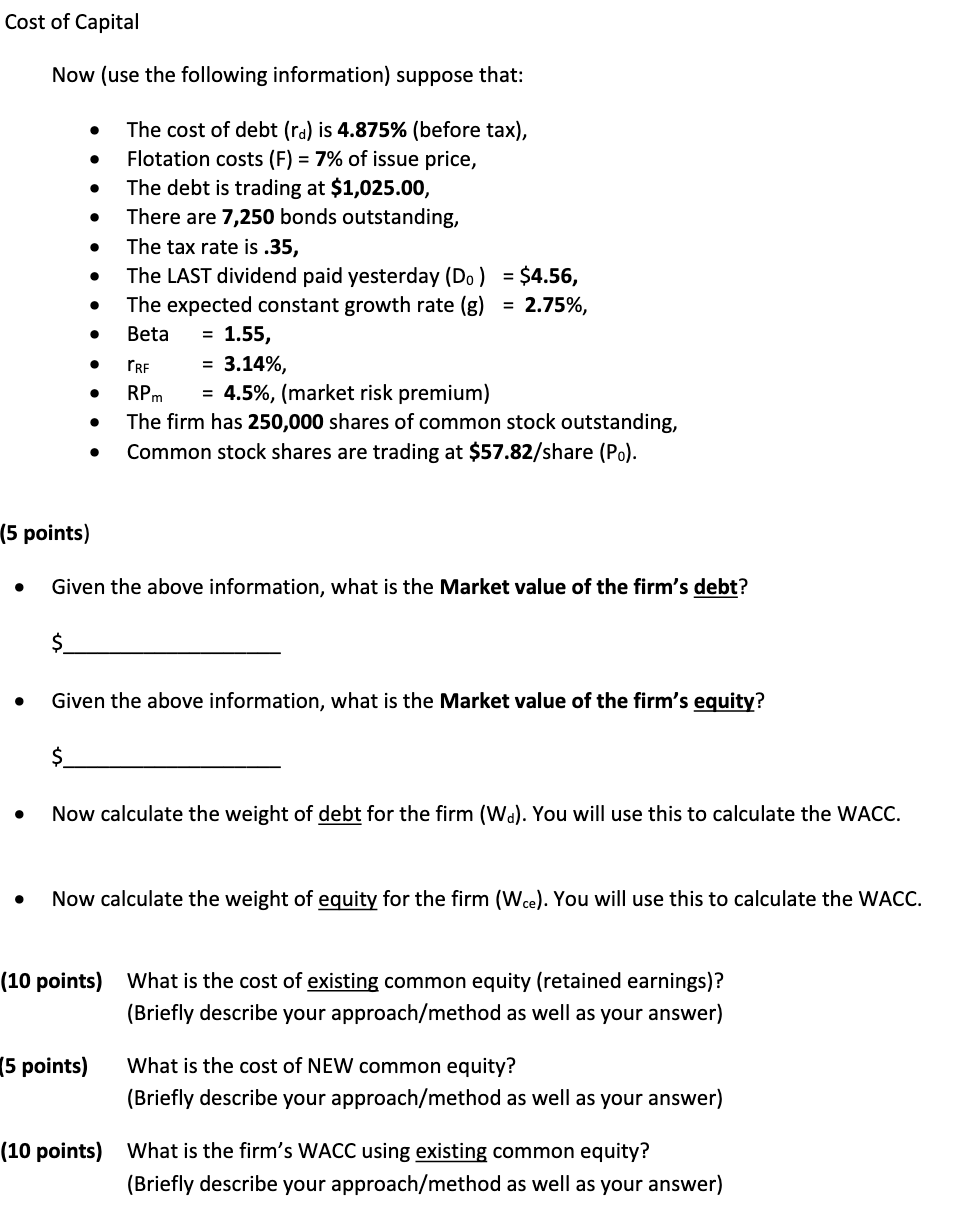

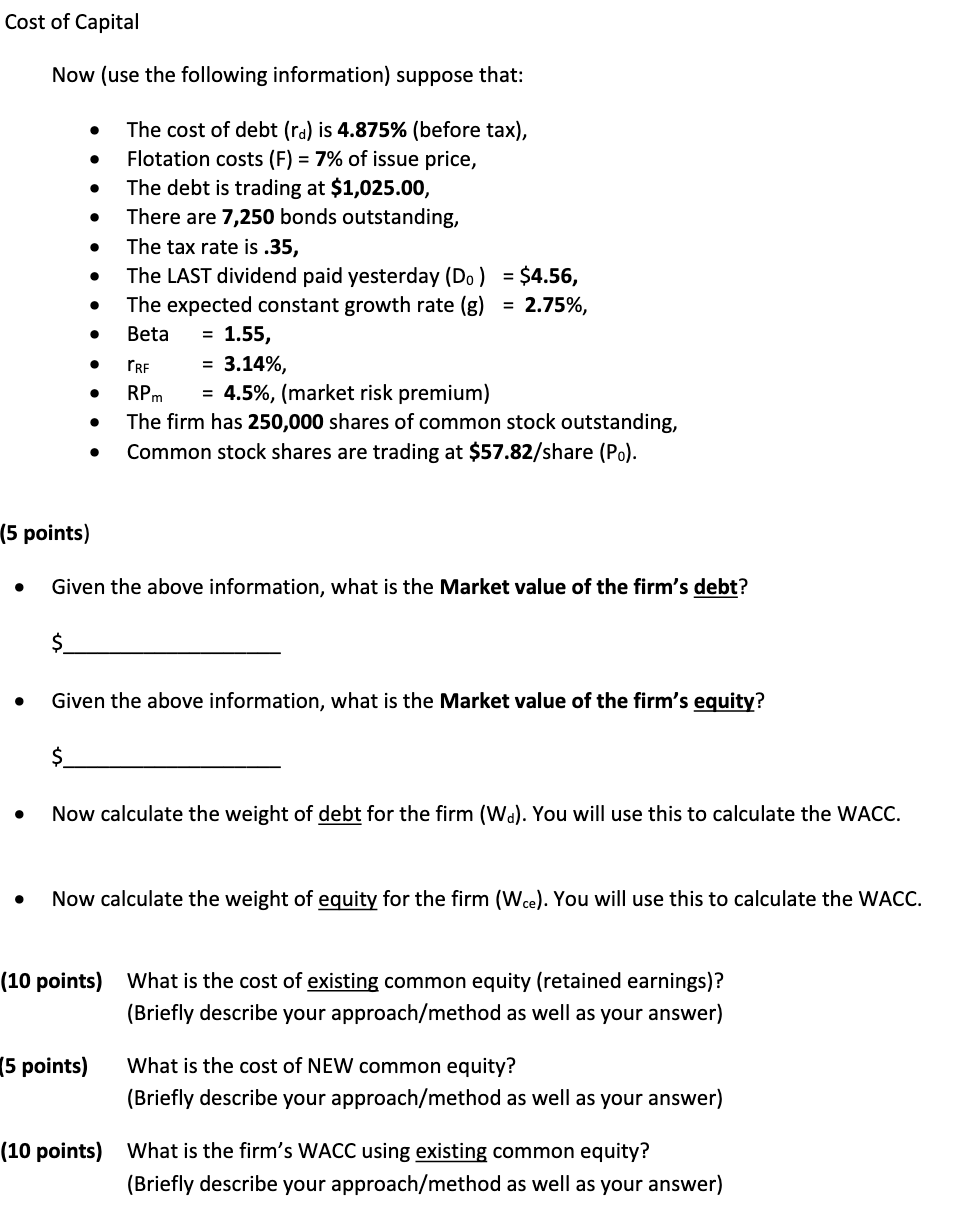

Cost of Capital Now (use the following information) suppose that: The cost of debt (ra) is 4.875% (before tax), Flotation costs (F) = 7% of issue price, The debt is trading at $1,025.00, There are 7,250 bonds outstanding, The tax rate is .35, The LAST dividend paid yesterday (Do) The expected constant growth rate (g) Beta = 1.55, = $4.56, = 2.75%, TRE = 3.14%, RPm = 4.5%, (market risk premium) The firm has 250,000 shares of common stock outstanding, Common stock shares are trading at $57.82/share (Po). (5 points) Given the above information, what is the Market value of the firm's debt? $ Given the above information, what is the Market value of the firm's equity? $ Now calculate the weight of debt for the firm (Wa). You will use this to calculate the WACC. Now calculate the weight of equity for the firm (Wce). You will use this to calculate the WACC. (10 points) What is the cost of existing common equity (retained earnings)? (Briefly describe your approach/method as well as your answer) (5 points) What is the cost of NEW common equity? (Briefly describe your approach/method as well as your answer) (10 points) What is the firm's WACC using existing common equity? (Briefly describe your approach/method as well as your answer) Cost of Capital Now (use the following information) suppose that: The cost of debt (ra) is 4.875% (before tax), Flotation costs (F) = 7% of issue price, The debt is trading at $1,025.00, There are 7,250 bonds outstanding, The tax rate is .35, The LAST dividend paid yesterday (Do) The expected constant growth rate (g) Beta = 1.55, = $4.56, = 2.75%, TRE = 3.14%, RPm = 4.5%, (market risk premium) The firm has 250,000 shares of common stock outstanding, Common stock shares are trading at $57.82/share (Po). (5 points) Given the above information, what is the Market value of the firm's debt? $ Given the above information, what is the Market value of the firm's equity? $ Now calculate the weight of debt for the firm (Wa). You will use this to calculate the WACC. Now calculate the weight of equity for the firm (Wce). You will use this to calculate the WACC. (10 points) What is the cost of existing common equity (retained earnings)? (Briefly describe your approach/method as well as your answer) (5 points) What is the cost of NEW common equity? (Briefly describe your approach/method as well as your answer) (10 points) What is the firm's WACC using existing common equity? (Briefly describe your approach/method as well as your answer)