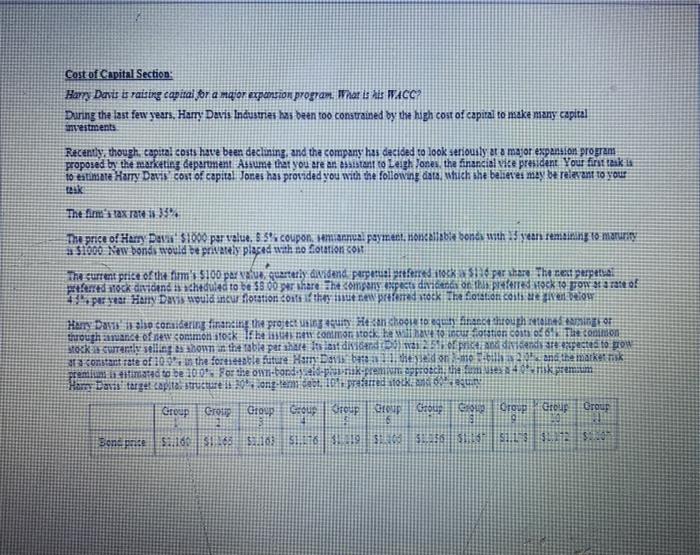

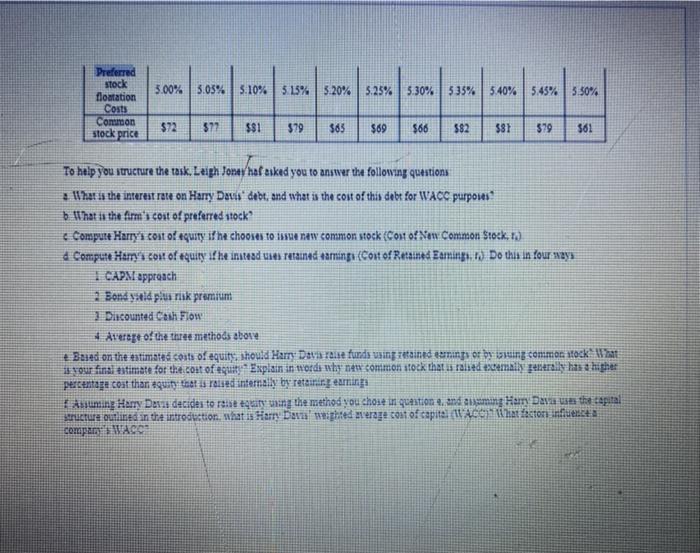

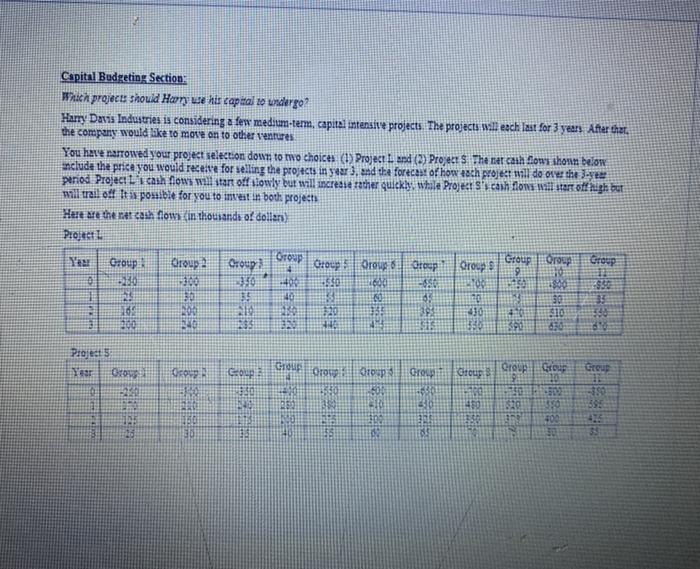

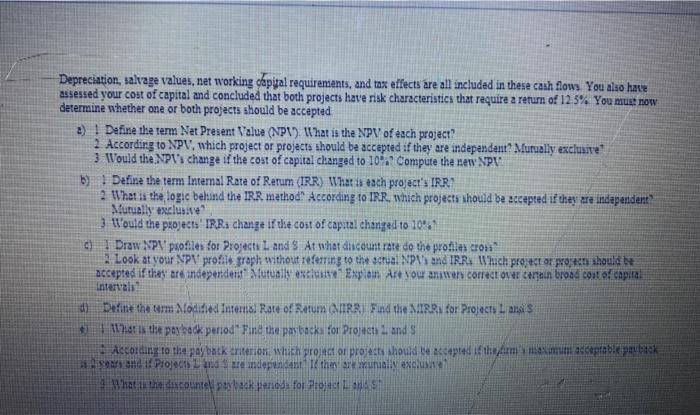

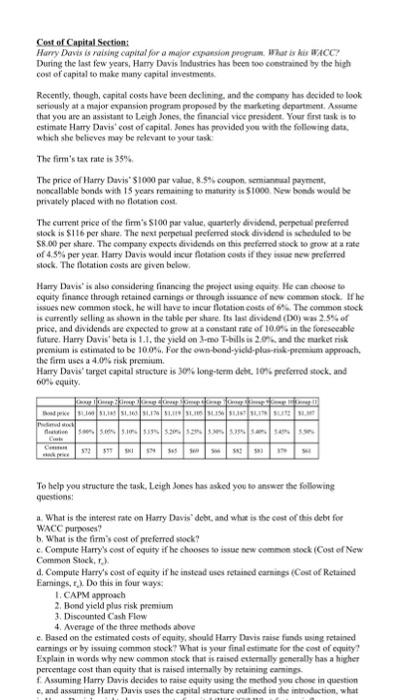

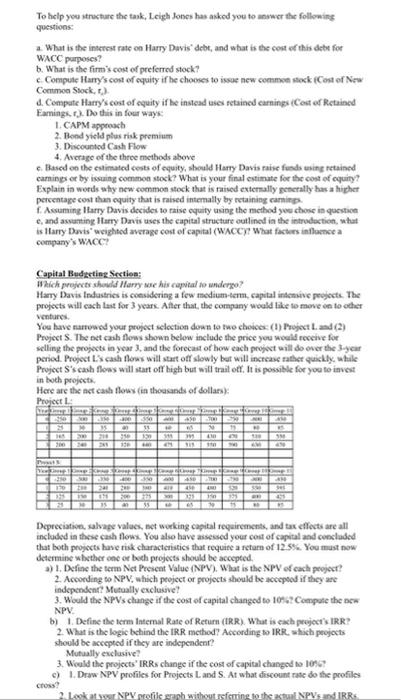

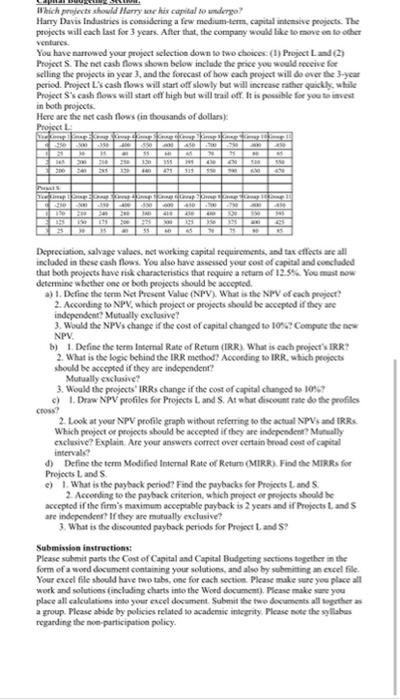

Cost of Capital Section Harry Davis is raising capital for a maior expansion program. That is this PACC? During the last few years. Harry Davis Industnes has been too constrained by the high cost of capital to make many capital vestments Recently, though, capital costs have been declining, and the company has decided to look seriously a major expansion program proposed by the marketing department Assume that you are an assistant to Leigh Jones, the financial vice president Your first tasks to estimate Harry Davis cost of capital Jones has provided you with the following data which she believes may be relevant to your tek The firm's tax rates 3344 the price of Harry Dava 31000 per value. 8:55. coupon, Hemiannual payment. Habe bonds with an remaining to maturity a $1000 New bonds would be privately placed with no ftation con The current price of the firm's 5100 par value, quarterly anidend perpetual pit ferred to as per thare The rett perpetual portferred stock dividend is scheduled to be $8.00 per hare the company anpects devriend on pred Hosk 10 por arratto per year Henry Davis would incurforstion cost that predatok The flotations collow Harry Davis alio considering financing the projet Usait Hanchool to equity fit through the IEEE through nuance of new common stock liber color tok til have to cu flotation costs of 6. That Conton Merk curently selling is shown in the table per shart 3) 255 per a donde se espectes to grow constant rate of 10 in the fortista le future Home -110 illi and the market tik Hinated to be 100. For the on-bondpork-free approach the funnik premium Greus Group Croix GO Group Coup Seous Streep up 12.10 1.7621 51 Send price SI 5.00% 3.05% 5:10% 5 15% 5.20% 5.25% 5.30% 535% 5.40% 5.45% 3.50% Preferred stock floatation Costs Common stock price 572 572 $81 $79 365 $69 $66 882 387 $79 361 To help you structure the task. Leigh Joneshafiked you to answer the following questions . ll hat is the interest rate on Harry Davis debt, and what is the cost of this debt for WACC purposes b What is the fire's cost of preferred stock? & Compute Harry's cost of equity if he chooses to 14 new common stock (Cost of New Common Stock, d Compute Hai cont of equity if he instead uses retained damingi (Cost of Retained Eemings to Do this in four ways I CAPM approach Bond yeld plus rlik premium Discounted Cash Flow terest of the three methods above + Baied on the estimated costs of equity, should Harry Dars raise funds using retained canings or by taking common stock Wat is your final estimate for the cost of equity Explain in words why new common stock that a raised eemally generally has a higher percentage cost than equity that is raised internally by retaining amningi siuming Harry Dart decides to rest equity in the method you chose in question 4, and assuming Harry Dava uss the capital ructure outlined in the introduction, what is Harry Daval weighted merge cost of capital Achat facton flects company ACC Capital Budgeting Section: Which projects should Harne his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive projects. The projects will each last for 3 years After that. the company would like to move on to other ventures You have narrowed your project selection down to two choices (1) Project Liend (2) Project 3 The ner cash flow shond below include the price you would receive for selling the projects in year, and the forecast of how each project will de over the 3-ye period Project L cash flows will start off slowly but will incresia rather quickly, while Project Siscaih tons will start of high but will trail off it is possible for you to invest in both projects Here are the net cash flows in thousands of dollars) Project Yes Group Group 2 Group Oroup Group Group Oroup Group Group Groups BRO 300 -400 +550 1600 ESSE 100 1800 1 30 15 4 18 33 5229 32 310 200 165 35 NE STS Sed 60 Group 80 Projects Yes Do 21 OF Copia GE Drop op Groep Otcup QgQroup -390 09 390 400 50 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.5% You must now determine whether one or both projects should be accepted 2) | Define the term Net Present Value (NPV). What is the NPV of each project? 2. According to NPV, which project or projects should be accepted if they are independent? Mutually exclusive 3 Would the NPV's change if the cost of capital changed to 10% Compute the new NPU b) | Define the term Internal Rate of Rerum (IRR) What is each projects IRR 2. What is the logic behind the IRR method" According to IRR, which projects should be accepted if they are independent Mutually exclusse 3 Would the projects IPRa change if the cost of capital changed to 1051 Draw NPV profiles for Project L and $ At what discount rate do the profiles cron" 2. Look at your NP profits graph without referring to the sctual NPU and IRR: l'hich project or pron should be accepted if they are independent Alutually estiune Espion Are you aniwer correct our certain broad cost of capital Interval Define the term Modified Intem Rate of Raum (NTIRRFind the Mirra for Projects Land's ather is the payback period" Find the payback for Projects Land's According to the paybatkerteton which project or projects should be accepted if the firm's en acceptable back again and I Projects and sendependenti I then mutually excuse het discounteli poytack periods for Poet LASI Cost of Capital Section: Harry Davis Is raising capital for a major expansion program. Wat is WACC? During the last few years, Harry Davis Industries has been to constrained by the high Con of capital to make many capital investments Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department Assame that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Harry Davis cost of capital. Jones has provided you with the following data which she believes may be relevant to your task The firm's tax rate is 35% The price of Harry Davis' 1000 par value, 8.5% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1000. New bonds would be privately placed with no flotation con The current price of the firm's S100 par value, quarterly dividend, perpetual preferred stock is $116 per share. The next perpetual preferred stock dividend is scheduled to be S8.00 per share. The company expects dividends on this preferred stock to grow at a rate of 4.5% per year. Harry Davis would incur flotation costs if they we new preferred stock. The flotation costs are given below. Harry Davis' is also considering financing the project using equity. He can choose to equity finance through retained camnings or through issuance of new common stock. If he issues new common stock, he will have to incur flotation costs of the common stock is currently selling as shown in the table per share. Its last dividend (DO) was 2.5% of price, and dividends are expected to grow at a constant rate of 10.0% in the foreseeable future. Harry Davis' beta is 1.1. the yield on S-mo T-bills is 2.0% and the marker risk premium is estimated to be 100%. For the own-bond-yidid-plus-risk premium approach, the firm uses a 4.0% tisk premium. Harry Davis' target capital structure is 80% long-term deht 10 preferred stock and 60% equity Mar To help you structure the task. Leigh Jones has asked you to answer the following questions 1. What is the interest rate on Harry Davis" debt, and what is the cost of this debt for WACC purposes? b. What is the firm's cost of preferred stock? c Compute Harry's cost of equity if he chooses to issue sew common stock (Cost of New Common Stockr.) 4. Compute Harry's cost of equity if he instead uses retained earnings (Cost of Retained Earnings, t.) Do this in four ways 1. CAPM approach 2. Bond yield plus risk premium 3. Discounted Cash Flow 4. Average of the three methods above e. Based on the estimated costs of equity, should Harry Davis raise funds using retained carlings or by issuing common stock? What is your final estimate for the cost of equity? Explain in words why new common stock that is raised externally generally has a higher percentage cost than equity that is raised internally by retaining caring f. Assuming Harry Davis decides to raise equity using the method you chose in question e, and assuming Harry Davis uses the capital structure outlined in the introduction, what To help you structure the task, Leigh Jones has asked you tower the following questions: 2. What is the interest rate on Harry Davis" debt, and what is the cost of this debe for b. What is the firm's cost of preferred stock? c. Compute Harry's cost of equity if he chooses to issue new common stock (Cost of New Common Stockt.) 4. Compute Harry's cost of equity if he instead uses retained earnings (Cost or Retained Faming. Do this in four way 1. CAPM approach 2. Bond yield plus riik premium 3. Discounted Cash Flow 4. Average of the three methods above c. Based on the estimated costs of equity, should Harry Davis raise funds using retained camins or by issuing common stock? What is your final estimate for the cost of quity? Explain in words shy new common stock that is raised externally generally has a higher percentage cost than equity that is raised internally by retaining camp f. Assuming Harry Davis decides to raise equity using the method you chose in question e, and assunting Harry Davis uses the capital structure outlined in the introduction, what is Harry Davis' weighted average cost of capital (WACCY? What factors influence a company'WACCP Capital Budgeting Section; Which projects should Harry so his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive project. The projects will cach last for 3 years. After that, the company would like to move on to other Ventures You have marrowed your project sclection down to two choices (!) Project Land (2) Project S. The net cash flows shown below include the price you would receive for selling the projects in year 3, and the forecast of how each project will do over the year period. Project L's cash flows will start off slowly but will increase rather quickly, while Project S's cash flows will start off high but will trait off. It is possible for you to invest in both project Here are the net cash flows (in thousands of dollars: Project L 40 SUS VERSE 210 To 11 Depreciation, salvage values, networking capital requirements, and tax effects are all included in these cash flow. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.5%. You must now determine whether one or bech projects should be accepted. a) 1. Define the term Net Present Value (NPV). What is the NPV of cach project? 2. According to NPV, which project or projects should be accepted if they are independent Mutually exclusive! 3. Would the NPVs change if the cost of capital changed to 1042 Compute the new NPV b) 1. Define the term Internal Rate of Return (IRR) What is cach project's IRR? 2. What is the logic chind the IRR method? According to IRR which projects should be accepted if they are independent? Mutually exclusive 3. Would the projects' IRRs change if the cost of capital changed to 10% ). Draw NPV profiles for Projects Land S. At what discount rate do the profiles 2. Look at NPV profile graph without fcming to the stul NPVs and IRR Cost of Capital Section Harry Davis is raising capital for a maior expansion program. That is this PACC? During the last few years. Harry Davis Industnes has been too constrained by the high cost of capital to make many capital vestments Recently, though, capital costs have been declining, and the company has decided to look seriously a major expansion program proposed by the marketing department Assume that you are an assistant to Leigh Jones, the financial vice president Your first tasks to estimate Harry Davis cost of capital Jones has provided you with the following data which she believes may be relevant to your tek The firm's tax rates 3344 the price of Harry Dava 31000 per value. 8:55. coupon, Hemiannual payment. Habe bonds with an remaining to maturity a $1000 New bonds would be privately placed with no ftation con The current price of the firm's 5100 par value, quarterly anidend perpetual pit ferred to as per thare The rett perpetual portferred stock dividend is scheduled to be $8.00 per hare the company anpects devriend on pred Hosk 10 por arratto per year Henry Davis would incurforstion cost that predatok The flotations collow Harry Davis alio considering financing the projet Usait Hanchool to equity fit through the IEEE through nuance of new common stock liber color tok til have to cu flotation costs of 6. That Conton Merk curently selling is shown in the table per shart 3) 255 per a donde se espectes to grow constant rate of 10 in the fortista le future Home -110 illi and the market tik Hinated to be 100. For the on-bondpork-free approach the funnik premium Greus Group Croix GO Group Coup Seous Streep up 12.10 1.7621 51 Send price SI 5.00% 3.05% 5:10% 5 15% 5.20% 5.25% 5.30% 535% 5.40% 5.45% 3.50% Preferred stock floatation Costs Common stock price 572 572 $81 $79 365 $69 $66 882 387 $79 361 To help you structure the task. Leigh Joneshafiked you to answer the following questions . ll hat is the interest rate on Harry Davis debt, and what is the cost of this debt for WACC purposes b What is the fire's cost of preferred stock? & Compute Harry's cost of equity if he chooses to 14 new common stock (Cost of New Common Stock, d Compute Hai cont of equity if he instead uses retained damingi (Cost of Retained Eemings to Do this in four ways I CAPM approach Bond yeld plus rlik premium Discounted Cash Flow terest of the three methods above + Baied on the estimated costs of equity, should Harry Dars raise funds using retained canings or by taking common stock Wat is your final estimate for the cost of equity Explain in words why new common stock that a raised eemally generally has a higher percentage cost than equity that is raised internally by retaining amningi siuming Harry Dart decides to rest equity in the method you chose in question 4, and assuming Harry Dava uss the capital ructure outlined in the introduction, what is Harry Daval weighted merge cost of capital Achat facton flects company ACC Capital Budgeting Section: Which projects should Harne his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive projects. The projects will each last for 3 years After that. the company would like to move on to other ventures You have narrowed your project selection down to two choices (1) Project Liend (2) Project 3 The ner cash flow shond below include the price you would receive for selling the projects in year, and the forecast of how each project will de over the 3-ye period Project L cash flows will start off slowly but will incresia rather quickly, while Project Siscaih tons will start of high but will trail off it is possible for you to invest in both projects Here are the net cash flows in thousands of dollars) Project Yes Group Group 2 Group Oroup Group Group Oroup Group Group Groups BRO 300 -400 +550 1600 ESSE 100 1800 1 30 15 4 18 33 5229 32 310 200 165 35 NE STS Sed 60 Group 80 Projects Yes Do 21 OF Copia GE Drop op Groep Otcup QgQroup -390 09 390 400 50 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.5% You must now determine whether one or both projects should be accepted 2) | Define the term Net Present Value (NPV). What is the NPV of each project? 2. According to NPV, which project or projects should be accepted if they are independent? Mutually exclusive 3 Would the NPV's change if the cost of capital changed to 10% Compute the new NPU b) | Define the term Internal Rate of Rerum (IRR) What is each projects IRR 2. What is the logic behind the IRR method" According to IRR, which projects should be accepted if they are independent Mutually exclusse 3 Would the projects IPRa change if the cost of capital changed to 1051 Draw NPV profiles for Project L and $ At what discount rate do the profiles cron" 2. Look at your NP profits graph without referring to the sctual NPU and IRR: l'hich project or pron should be accepted if they are independent Alutually estiune Espion Are you aniwer correct our certain broad cost of capital Interval Define the term Modified Intem Rate of Raum (NTIRRFind the Mirra for Projects Land's ather is the payback period" Find the payback for Projects Land's According to the paybatkerteton which project or projects should be accepted if the firm's en acceptable back again and I Projects and sendependenti I then mutually excuse het discounteli poytack periods for Poet LASI Cost of Capital Section: Harry Davis Is raising capital for a major expansion program. Wat is WACC? During the last few years, Harry Davis Industries has been to constrained by the high Con of capital to make many capital investments Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department Assame that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Harry Davis cost of capital. Jones has provided you with the following data which she believes may be relevant to your task The firm's tax rate is 35% The price of Harry Davis' 1000 par value, 8.5% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1000. New bonds would be privately placed with no flotation con The current price of the firm's S100 par value, quarterly dividend, perpetual preferred stock is $116 per share. The next perpetual preferred stock dividend is scheduled to be S8.00 per share. The company expects dividends on this preferred stock to grow at a rate of 4.5% per year. Harry Davis would incur flotation costs if they we new preferred stock. The flotation costs are given below. Harry Davis' is also considering financing the project using equity. He can choose to equity finance through retained camnings or through issuance of new common stock. If he issues new common stock, he will have to incur flotation costs of the common stock is currently selling as shown in the table per share. Its last dividend (DO) was 2.5% of price, and dividends are expected to grow at a constant rate of 10.0% in the foreseeable future. Harry Davis' beta is 1.1. the yield on S-mo T-bills is 2.0% and the marker risk premium is estimated to be 100%. For the own-bond-yidid-plus-risk premium approach, the firm uses a 4.0% tisk premium. Harry Davis' target capital structure is 80% long-term deht 10 preferred stock and 60% equity Mar To help you structure the task. Leigh Jones has asked you to answer the following questions 1. What is the interest rate on Harry Davis" debt, and what is the cost of this debt for WACC purposes? b. What is the firm's cost of preferred stock? c Compute Harry's cost of equity if he chooses to issue sew common stock (Cost of New Common Stockr.) 4. Compute Harry's cost of equity if he instead uses retained earnings (Cost of Retained Earnings, t.) Do this in four ways 1. CAPM approach 2. Bond yield plus risk premium 3. Discounted Cash Flow 4. Average of the three methods above e. Based on the estimated costs of equity, should Harry Davis raise funds using retained carlings or by issuing common stock? What is your final estimate for the cost of equity? Explain in words why new common stock that is raised externally generally has a higher percentage cost than equity that is raised internally by retaining caring f. Assuming Harry Davis decides to raise equity using the method you chose in question e, and assuming Harry Davis uses the capital structure outlined in the introduction, what To help you structure the task, Leigh Jones has asked you tower the following questions: 2. What is the interest rate on Harry Davis" debt, and what is the cost of this debe for b. What is the firm's cost of preferred stock? c. Compute Harry's cost of equity if he chooses to issue new common stock (Cost of New Common Stockt.) 4. Compute Harry's cost of equity if he instead uses retained earnings (Cost or Retained Faming. Do this in four way 1. CAPM approach 2. Bond yield plus riik premium 3. Discounted Cash Flow 4. Average of the three methods above c. Based on the estimated costs of equity, should Harry Davis raise funds using retained camins or by issuing common stock? What is your final estimate for the cost of quity? Explain in words shy new common stock that is raised externally generally has a higher percentage cost than equity that is raised internally by retaining camp f. Assuming Harry Davis decides to raise equity using the method you chose in question e, and assunting Harry Davis uses the capital structure outlined in the introduction, what is Harry Davis' weighted average cost of capital (WACCY? What factors influence a company'WACCP Capital Budgeting Section; Which projects should Harry so his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive project. The projects will cach last for 3 years. After that, the company would like to move on to other Ventures You have marrowed your project sclection down to two choices (!) Project Land (2) Project S. The net cash flows shown below include the price you would receive for selling the projects in year 3, and the forecast of how each project will do over the year period. Project L's cash flows will start off slowly but will increase rather quickly, while Project S's cash flows will start off high but will trait off. It is possible for you to invest in both project Here are the net cash flows (in thousands of dollars: Project L 40 SUS VERSE 210 To 11 Depreciation, salvage values, networking capital requirements, and tax effects are all included in these cash flow. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.5%. You must now determine whether one or bech projects should be accepted. a) 1. Define the term Net Present Value (NPV). What is the NPV of cach project? 2. According to NPV, which project or projects should be accepted if they are independent Mutually exclusive! 3. Would the NPVs change if the cost of capital changed to 1042 Compute the new NPV b) 1. Define the term Internal Rate of Return (IRR) What is cach project's IRR? 2. What is the logic chind the IRR method? According to IRR which projects should be accepted if they are independent? Mutually exclusive 3. Would the projects' IRRs change if the cost of capital changed to 10% ). Draw NPV profiles for Projects Land S. At what discount rate do the profiles 2. Look at NPV profile graph without fcming to the stul NPVs and IRR