Question

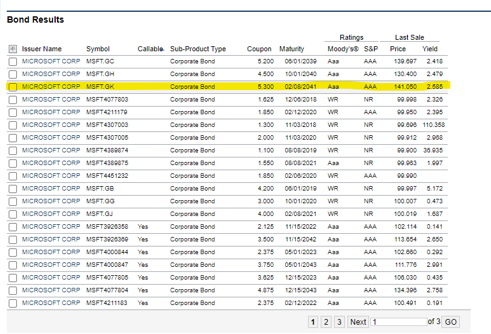

Cost of Debt Estimate Microsofts before-tax cost of debt by using the yield to maturity on its existing long-term bonds. If the company does not

Cost of Debt Estimate Microsofts before-tax cost of debt by using the yield to maturity on its existing long-term bonds.

If the company does not have any outstanding bond issues, one can use the effective rate on the companys long-term liabilities to proxy for its cost of debt. It can be calculated by dividing the companys reported interest expense by its total long-term liabilities. Note: To obtain yields to maturity on the companys outstanding bonds, go to finra-markets.morningstar.com. Under Market Data, select Bonds. Under Search, click Corporate, and type the companys name.

A list of the firms outstanding bond issues will appear. Bond issues may be listed on multiple pages. Assume that the firms policy is to use the expected return on its noncallable long-term obligations as its cost of debt. Find the noncallable bond issue (which does not have Yes in the column titled Callable) with the longest time to maturity and non-missing reported yield. Yields to maturity are reported in the last column titled Yield. If the company does not have non-callable bonds outstanding, simply use the yield to maturity on the bond with the longest time to maturity. Collect the yield and maturity date for your chosen bond issue.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started