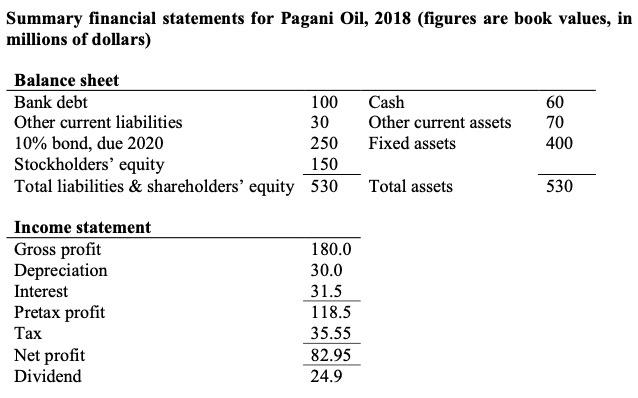

Cost of Financing:

Edison says that the cost of outside financing is more expensive than the cost of internal financing, due to the flotation costs charged by the investment bankers. What are these flotation costs and how do they impact corporate finance decision-making? Given the data you have, what do you say is the firms cost of internal equity financing?

Assume Pagani Oil can borrow at 9% interbank rate plus a margin of 1.7%. What is the firms after tax debt?

Given the cost of debt and the cost of internal equity financing, why doesnt Pagani Oil just borrow the total amount needed to fund the capital budget and the dividend as well?

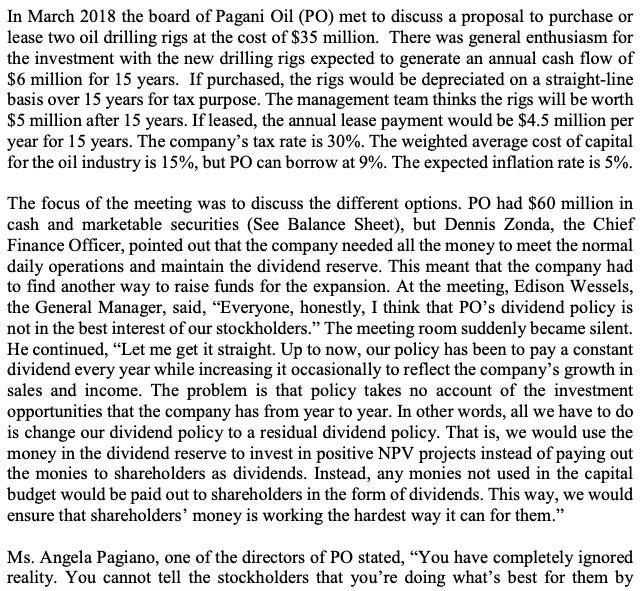

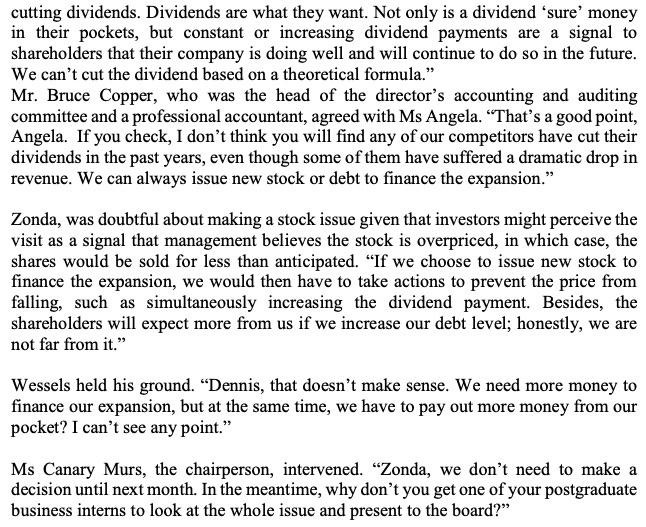

In March 2018 the board of Pagani Oil (PO) met to discuss a proposal to purchase or lease two oil drilling rigs at the cost of $35 million. There was general enthusiasm for the investment with the new drilling rigs expected to generate an annual cash flow of $6 million for 15 years. If purchased, the rigs would be depreciated on a straight-line basis over 15 years for tax purpose. The management team thinks the rigs will be worth $5 million after 15 years. If leased, the annual lease payment would be $4.5 million per year for 15 years. The company's tax rate is 30%. The weighted average cost of capital for the oil industry is 15%, but PO can borrow at 9%. The expected inflation rate is 5%. The focus of the meeting was to discuss the different options. PO had $60 million in cash and marketable securities (See Balance Sheet), but Dennis Zonda, the Chief Finance Officer, pointed out that the company needed all the money to meet the normal daily operations and maintain the dividend reserve. This meant that the company had to find another way to raise funds for the expansion. At the meeting, Edison Wessels, the General Manager, said, "Everyone, honestly, I think that PO's dividend policy is not in the best interest of our stockholders. The meeting room suddenly became silent. He continued, Let me get it straight. Up to now, our policy has been to pay a constant dividend every year while increasing it occasionally to reflect the company's growth in sales and income. The problem is that policy takes no account of the investment opportunities that the company has from year to year. In other words, all we have to do is change our dividend policy to a residual dividend policy. That is, we would use the money in the dividend reserve to invest in positive NPV projects instead of paying out the monies to shareholders as dividends. Instead, any monies not used in the capital budget would be paid out to shareholders in the form of dividends. This way, we would ensure that shareholders' money is working the hardest way it can for them." Ms. Angela Pagiano, one of the directors of PO stated, You have completely ignored reality. You cannot tell the stockholders that you're doing what's best for them by cutting dividends. Dividends are what they want. Not only is a dividend 'sure' money in their pockets, but constant or increasing dividend payments are a signal to shareholders that their company is doing well and will continue to do so in the future. We can't cut the dividend based on a theoretical formula." Mr. Bruce Copper, who was the head of the director's accounting and auditing committee and a professional accountant, agreed with Ms Angela. That's a good point, Angela. If you check, I don't think you will find any of our competitors have cut their dividends in the past years, even though some of them have suffered a dramatic drop in revenue. We can always issue new stock or debt to finance the expansion." Zonda, was doubtful about making a stock issue given that investors might perceive the visit as a signal that management believes the stock is overpriced, in which case, the shares would be sold for less than anticipated. "If we choose to issue new stock to finance the expansion, we would then have to take actions to prevent the price from falling, such as simultaneously increasing the dividend payment. Besides, the shareholders will expect more from us if we increase our debt level; honestly, we are not far from it." Wessels held his ground. Dennis, that doesn't make sense. We need more money to finance our expansion, but at the same time, we have to pay out more money from our pocket? I can't see any point." Ms Canary Murs, the chairperson, intervened. Zonda, we don't need to make a decision until next month. In the meantime, why don't you get one of your postgraduate business interns to look at the whole issue and present to the board? Summary financial statements for Pagani Oil, 2018 (figures are book values, in millions of dollars) Balance sheet Bank debt 100 Other current liabilities 30 10% bond, due 2020 250 Stockholders' equity 150 Total liabilities & shareholders' equity 530 Cash Other current assets Fixed assets 60 70 400 Total assets 530 Income statement Gross profit Depreciation Interest Pretax profit Tax Net profit Dividend 180.0 30.0 31.5 118.5 35.55 82.95 24.9