Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost of Goods Sold Cash Distribution to Harry Municipal Bond Interest Short-Term Capital Gains Employee Wages Rent Charitable Contributions Sales Repairs and Maintenance Long-Term

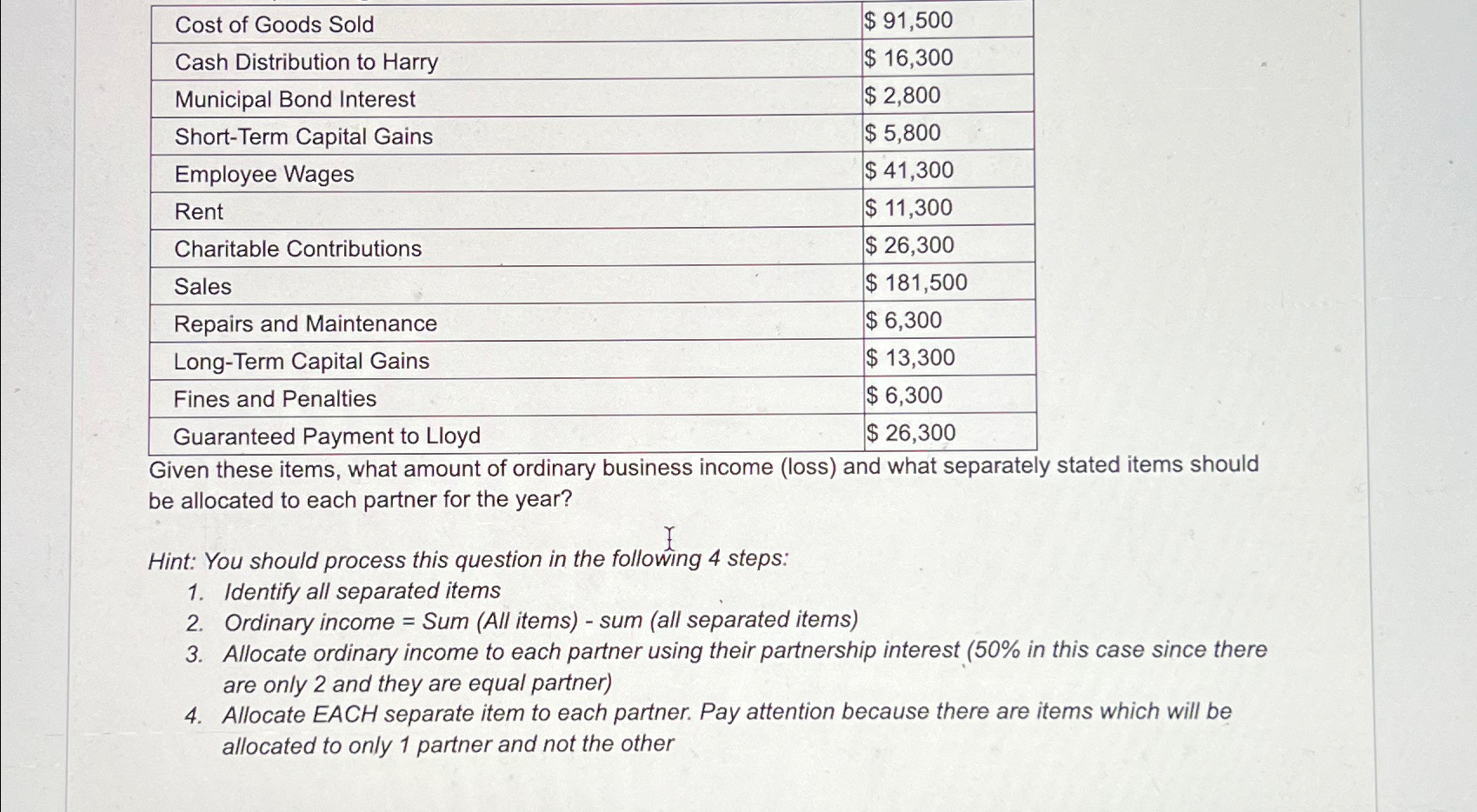

Cost of Goods Sold Cash Distribution to Harry Municipal Bond Interest Short-Term Capital Gains Employee Wages Rent Charitable Contributions Sales Repairs and Maintenance Long-Term Capital Gains Fines and Penalties Guaranteed Payment to Lloyd $91,500 $ 16,300 $ 2,800 $5,800 $41,300 $ 11,300 $ 26,300 $ 181,500 $6,300 $ 13,300 $6,300 $ 26,300 Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year? Hint: You should process this question in the following 4 steps: 1. Identify all separated items 2. Ordinary income = Sum (All items) - sum (all separated items) 3. Allocate ordinary income to each partner using their partnership interest (50% in this case since there are only 2 and they are equal partner) 4. Allocate EACH separate item to each partner. Pay attention because there are items which will be allocated to only 1 partner and not the other

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started