Answered step by step

Verified Expert Solution

Question

1 Approved Answer

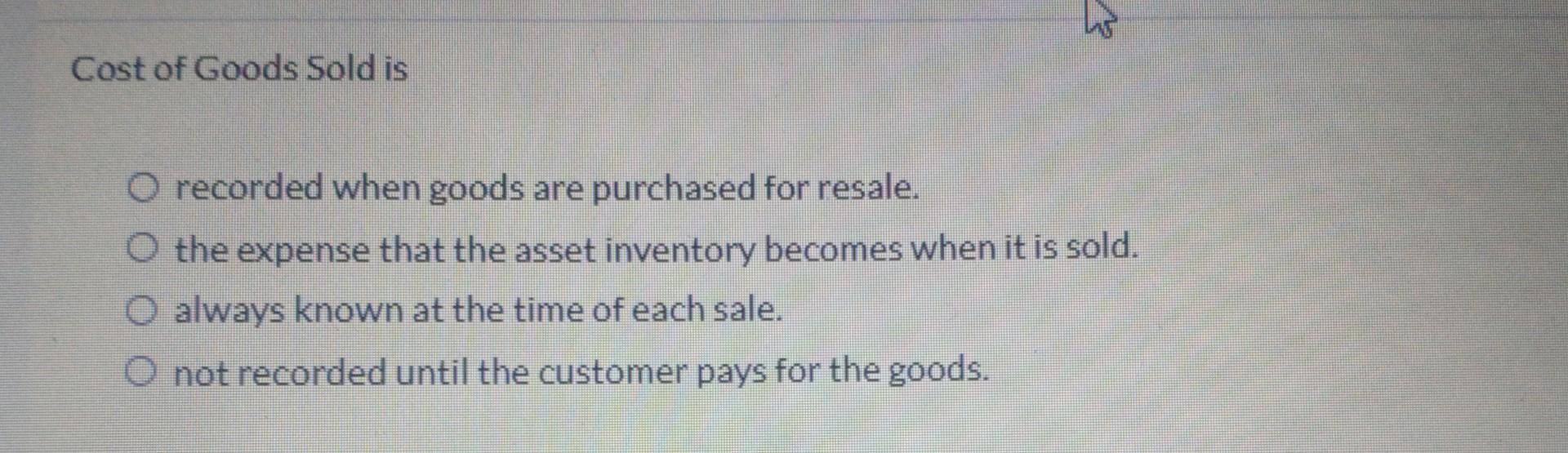

Cost of Goods Sold is recorded when goods are purchased for resale. the expense that the asset inventory becomes when it is sold. always known

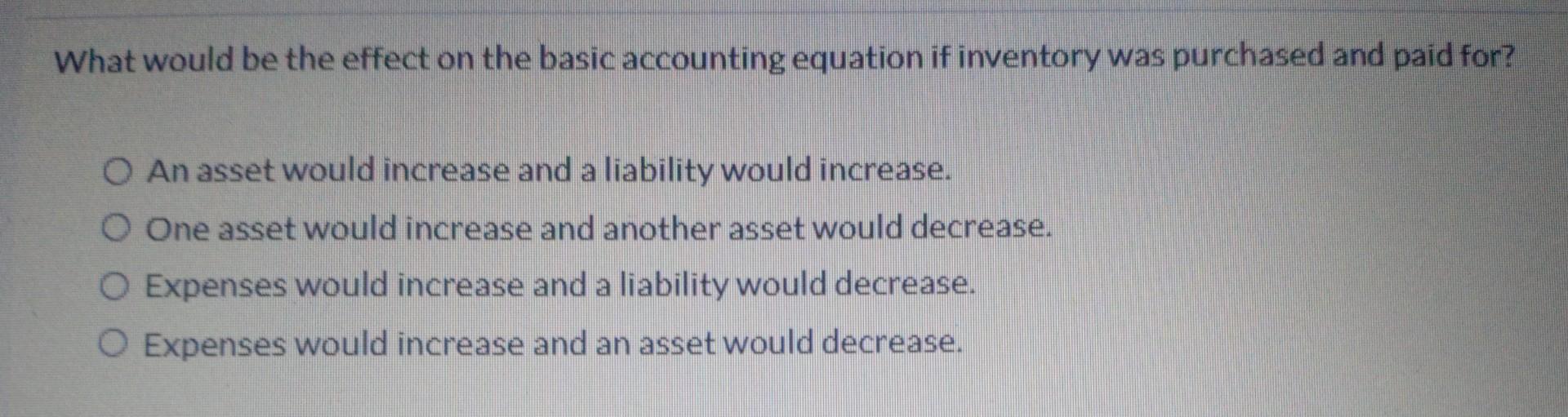

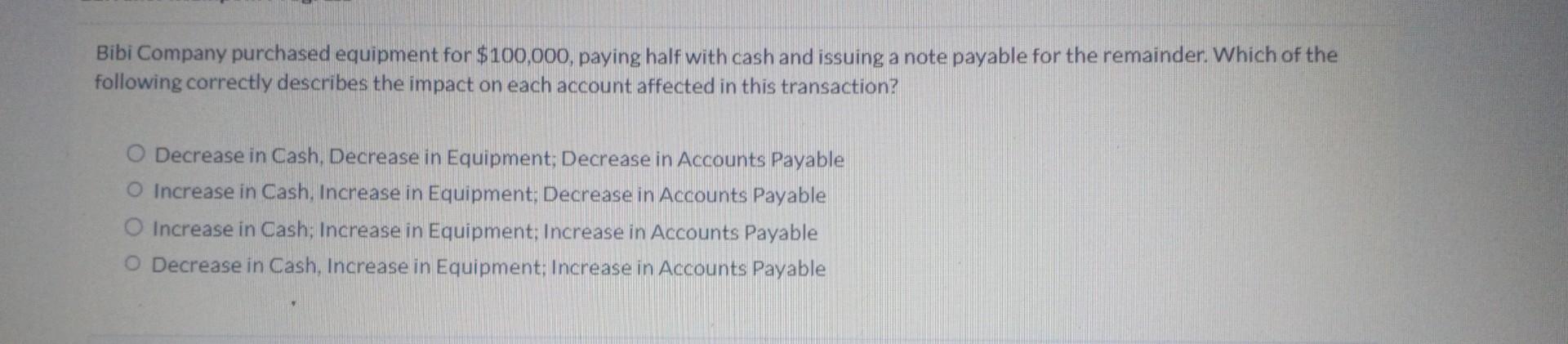

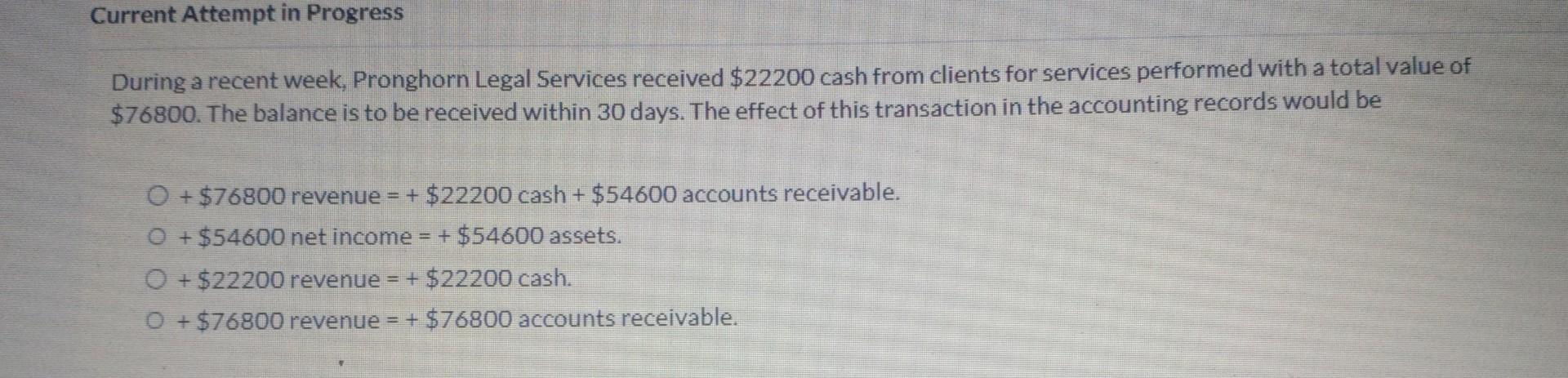

Cost of Goods Sold is recorded when goods are purchased for resale. the expense that the asset inventory becomes when it is sold. always known at the time of each sale. not recorded until the customer pays for the goods. What would be the effect on the basic accounting equation if inventory was purchased and paid for? An asset would increase and a liability would increase. One asset would increase and another asset would decrease. Expenses would increase and a liability would decrease. Expenses would increase and an asset would decrease. Bibi Company purchased equipment for $100,000, paying half with cash and issuing a note payable for the remainder. Which of the following correctly describes the impact on each account affected in this transaction? Decrease in Cash, Decrease in Equipment; Decrease in Accounts Payable Increase in Cash, Increase in Equipment; Decrease in Accounts Payable Increase in Cash; Increase in Equipment; Increase in Accounts Payable Decrease in Cash, Increase in Equipment; Increase in Accounts Payable During a recent week, Pronghorn Legal Services received $22200 cash from clients for services performed with a total value of $76800. The balance is to be received within 30 days. The effect of this transaction in the accounting records would be +$76800 revenue =+$22200 cash +$54600 accounts receivable +$54600 net income =+$54600 assets. +$22200 revenue =+$22200 cash. +$76800 revenue =+$76800 accounts receivable Oxford Company paid $22,000 for goods it had purchased last month on account. What is the effect of the payment? 3 decrease in accounts payable 3m increase in cost of goods sold 3m increase in inventory a decrease in inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started