Answered step by step

Verified Expert Solution

Question

1 Approved Answer

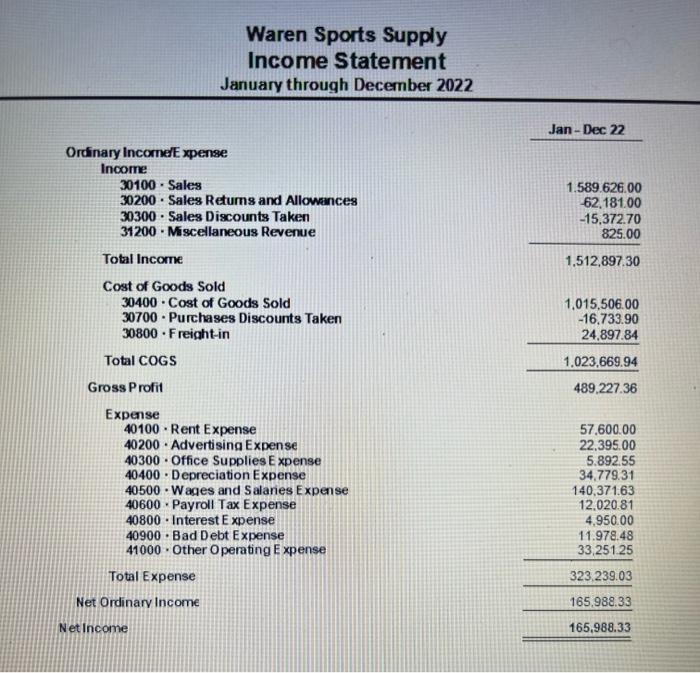

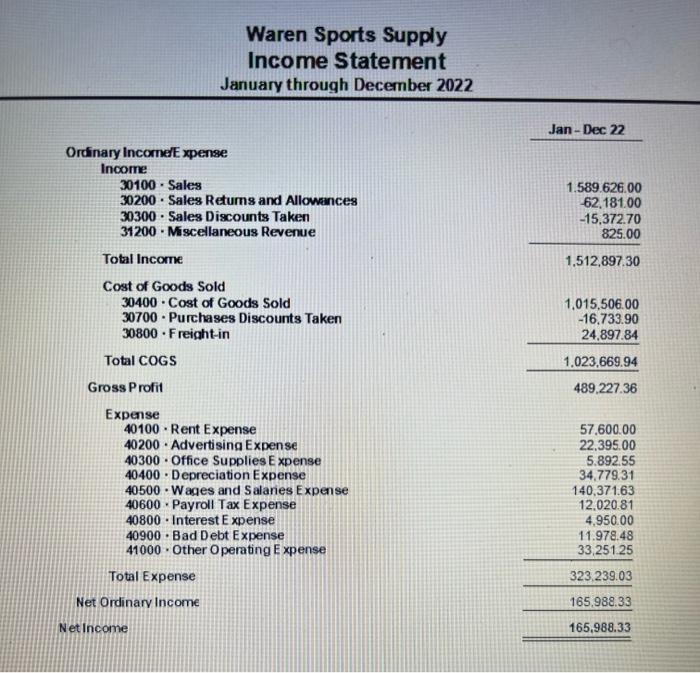

Cost of goods sold Year end closing entry: QuickBooks automatically debits cost of goods sold and credits inventory for the product cost for each sale.

Cost of goods sold Year end closing entry: QuickBooks automatically debits cost of goods sold and credits inventory for the product cost for each sale. The inventory account is also automatically updated for inventory purchases and purchases returns . Therefore , the QuickBooks data does not include the following accounts from the SUA / E - S SUA : A / C # 30500 (Purchases ) and A / C #30600 ( Purchase Returns and Allowance). Waren treats purchase discounts taken and freight -in as a part of cost of goods sold but records them in separate accounts during the accounting period . Therefore , these two accounts must be closed to A/ C #30400 ( Cost of Goods Sold): A / C # 30700 ( Purchases Discounts Taken) and A / C # 30800 ( Freight-In).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started