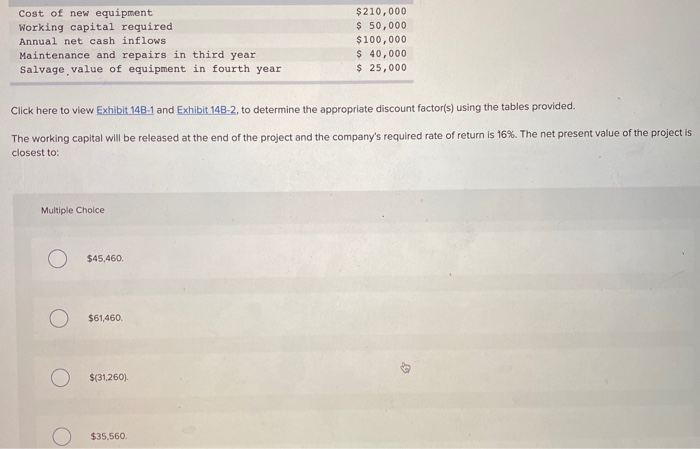

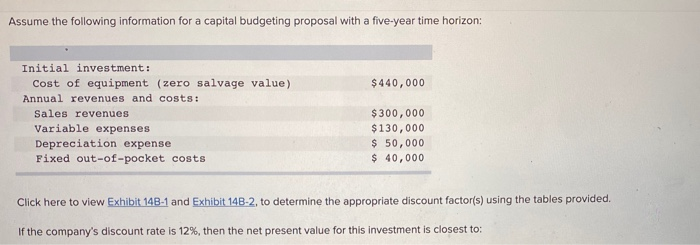

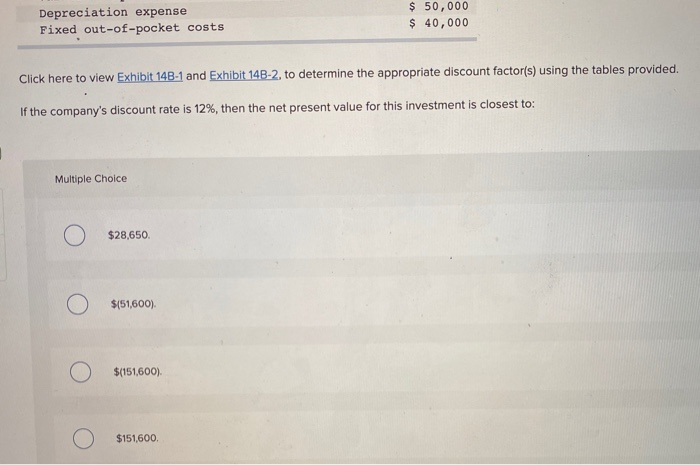

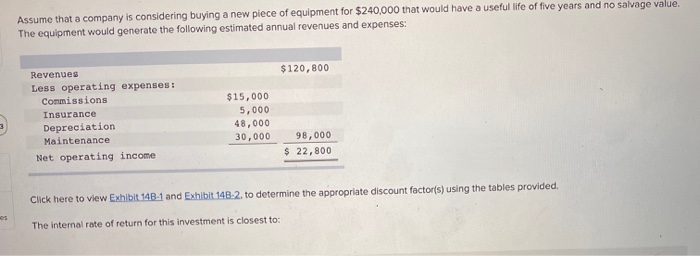

Cost of new equipment Working capital required Annual net cash inflows Maintenance and repairs in third year Salvage value of equipment in fourth year $210,000 $ 50,000 $100,000 $ 40,000 $ 25,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The working capital will be released at the end of the project and the company's required rate of return is 16%. The net present value of the project is closest to: Multiple Choice $45,460 $61,460 $(31,260) $35,560 Assume the following information for a capital budgeting proposal with a five-year time horizon: $440,000 Initial investment: Cost of equipment (zero salvage value) Annual revenues and costs: Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket costs $300,000 $130,000 $ 50,000 $ 40,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. If the company's discount rate is 12%, then the net present value for this investment is closest to: Depreciation expense Fixed out-of-pocket costs $ 50,000 $ 40,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using the tables provided. If the company's discount rate is 12%, then the net present value for this investment is closest to: Multiple Choice O $28,650 $(51,600) $(151,600) $151,600 Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses: $120,800 Revenues Less operating expenses: Commissions Insurance Depreciation Maintenance Net operating income $15,000 5,000 48,000 30,000 98,000 $ 22,800 Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using the tables provided. The internal rate of return for this investment is closest to: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determin The internal rate of return for this investment is closest to: Multiple Choice O 17%. O 19%. O 13%. 15%