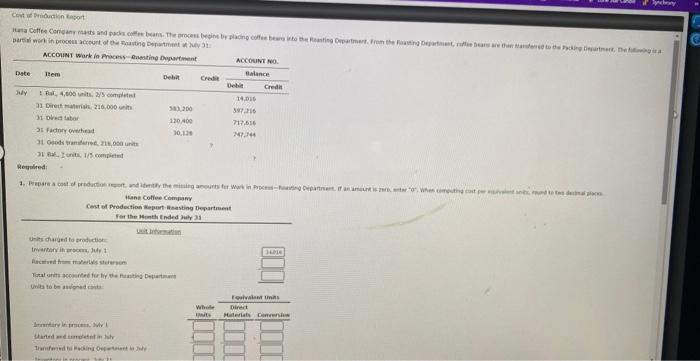

Cost of production report

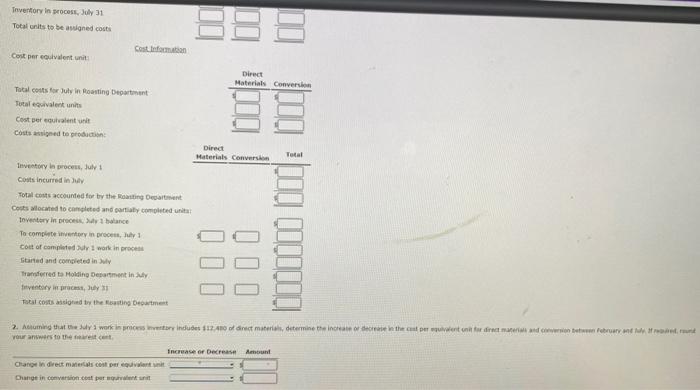

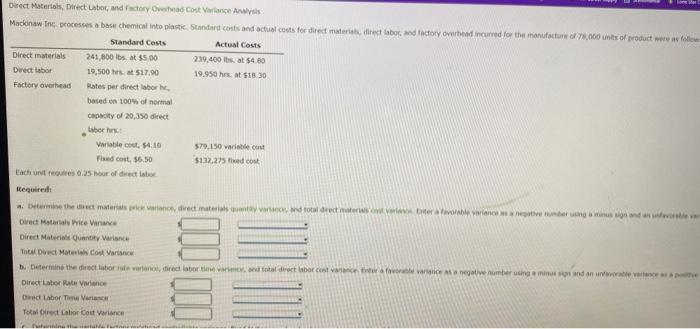

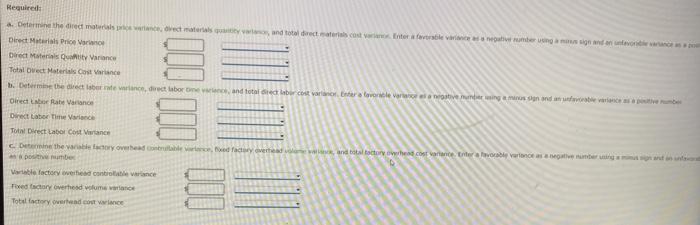

Cost of Production Report Hana Coffee Company masts and packs coffee beans. The process begine by placing coffee bears into the Roasting Department. From the Roasting Department of bears are the tandened to the Packing Department. The wings a partial work in process account of the Roasting Department at My 31 ACCOUNT Work in Process Roasting Department Date July Item Bal, 4,500 units, 2/5 completed 31 Direct materials, 216,000 units 31 Direct labor 21 Factory overhead 31 Gods transferred, 215,000 units 31 Bal 1 units, 1/5 compte Required: Units charged to production Inventory in proces, July 1 Total units accounted for by the Run De Units to be assigned cast Debit entry in process, July 1 Started and completed in July Transferred to acking Department in Jud 183,200 120,400 30,129 Credit " ACCOUNT NO. Balance Debit 1. Prepare a cost of production report, and identify the missing amounts for Work in Process-Ring Department. If an amount is zero, entar "0". When computing cost p Hana Coffee Company Cast of Production Report Roasting Department For the Month Ended July 31 mation 14,016 397,216 717,616 747244 Credit 14016 Forvalt mits Direct Whole Units Materials Conversio if Syncry de Inventory in process, July 31 Total units to be assigned costs Cost per equivalent unit Cost Information Total costs for July in Roasting Department Total equivalent units Cost per equivalent unit Costs assigned to production: Inventory in process, July 1 costs incurred in July Total costs accounted for by the Roasting Department Costs allocated to completed and partially completed unit Inventory in process, July 1 balance To complete inventory in process, July 1 Cost of completed July 1 work in process Started and completed in July Transferred to Holding Department in July Inventory in process, July 31 Total costs assigned by the Roasting Department 888 Change in direct materials cost per equivalent unit Change in conversion cost per equivalent unit Direct Materials Conversion Direct Materials Conversion 000000000000 2. Assuming that the July 1 work in process inventory indudes $12,400 of direct materials, determine the increase or decrease in the cast per equivalent unit for direct materials and conversion between February and haly If reared, round your answers to the recent Increase or Decrease Amount Total Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follow Actual Costs Standard Costs 241,800 lbs. at $5.00 19,500 hrs at $17.90 Rates per direct labor he 239,400 lbs. at $4.60 19,950 hrs at $18.30. based on 100% of normal capacity of 20,350 direct labor hr Direct materials Direct labor Factory overhead Variable cost, $4.10 Fixed cost, $6.50 Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materias on varias Enter a favorable variance as a negative number using a minus sign and an unfavorable vam Direct Materials Price Variance Direct Materials Quantity Variance Total Direct Materials Cost Variance b. Determine the direct labor rate variance, direct labor time varience, and total direct labor cost varnance, Enter a favorable variance as a negative number using a minus sign and an unfavorable vartence as a pove Direct Labor Rate Variance Direct Labor Time Variance 1 S Total Direct Labor Cost Variance termine the rate $79,150 variable cost $132,275 fixed cost Required: a. Determine the direct materials pics wertance, direct materials quantity vartans, and total direct materials cost variano Enter a favorable variance as a negative number using a mass sign and an unfavorable vanance as a p Direct Materials Price Variance Direct Materials Quality Variance Total Direct Materials Cost Variance b. Determine the direct laber rate variance, direct labor time variance, and total direct labor cost varianor. Enter a favorable variancel a rative under using a manos sign and an unfavorable variance as a pitive numb Direct Labor Rabe Variance Direct Labor Time Variance Total Direct Labor Cost Vrance c. Determine the variable factory overhead controllable variance, fixed factory overhead, and total tactory overhead cost varlarice. Enter a favorable variance as a negative number using a sign and in una positive number Variable factory overhead controllable variance Fixed factory overhead volume variance Total factory overhead cost variance S Cost of Production Report Hana Coffee Company masts and packs coffee beans. The process begine by placing coffee bears into the Roasting Department. From the Roasting Department of bears are the tandened to the Packing Department. The wings a partial work in process account of the Roasting Department at My 31 ACCOUNT Work in Process Roasting Department Date July Item Bal, 4,500 units, 2/5 completed 31 Direct materials, 216,000 units 31 Direct labor 21 Factory overhead 31 Gods transferred, 215,000 units 31 Bal 1 units, 1/5 compte Required: Units charged to production Inventory in proces, July 1 Total units accounted for by the Run De Units to be assigned cast Debit entry in process, July 1 Started and completed in July Transferred to acking Department in Jud 183,200 120,400 30,129 Credit " ACCOUNT NO. Balance Debit 1. Prepare a cost of production report, and identify the missing amounts for Work in Process-Ring Department. If an amount is zero, entar "0". When computing cost p Hana Coffee Company Cast of Production Report Roasting Department For the Month Ended July 31 mation 14,016 397,216 717,616 747244 Credit 14016 Forvalt mits Direct Whole Units Materials Conversio if Syncry de Inventory in process, July 31 Total units to be assigned costs Cost per equivalent unit Cost Information Total costs for July in Roasting Department Total equivalent units Cost per equivalent unit Costs assigned to production: Inventory in process, July 1 costs incurred in July Total costs accounted for by the Roasting Department Costs allocated to completed and partially completed unit Inventory in process, July 1 balance To complete inventory in process, July 1 Cost of completed July 1 work in process Started and completed in July Transferred to Holding Department in July Inventory in process, July 31 Total costs assigned by the Roasting Department 888 Change in direct materials cost per equivalent unit Change in conversion cost per equivalent unit Direct Materials Conversion Direct Materials Conversion 000000000000 2. Assuming that the July 1 work in process inventory indudes $12,400 of direct materials, determine the increase or decrease in the cast per equivalent unit for direct materials and conversion between February and haly If reared, round your answers to the recent Increase or Decrease Amount Total Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follow Actual Costs Standard Costs 241,800 lbs. at $5.00 19,500 hrs at $17.90 Rates per direct labor he 239,400 lbs. at $4.60 19,950 hrs at $18.30. based on 100% of normal capacity of 20,350 direct labor hr Direct materials Direct labor Factory overhead Variable cost, $4.10 Fixed cost, $6.50 Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materias on varias Enter a favorable variance as a negative number using a minus sign and an unfavorable vam Direct Materials Price Variance Direct Materials Quantity Variance Total Direct Materials Cost Variance b. Determine the direct labor rate variance, direct labor time varience, and total direct labor cost varnance, Enter a favorable variance as a negative number using a minus sign and an unfavorable vartence as a pove Direct Labor Rate Variance Direct Labor Time Variance 1 S Total Direct Labor Cost Variance termine the rate $79,150 variable cost $132,275 fixed cost Required: a. Determine the direct materials pics wertance, direct materials quantity vartans, and total direct materials cost variano Enter a favorable variance as a negative number using a mass sign and an unfavorable vanance as a p Direct Materials Price Variance Direct Materials Quality Variance Total Direct Materials Cost Variance b. Determine the direct laber rate variance, direct labor time variance, and total direct labor cost varianor. Enter a favorable variancel a rative under using a manos sign and an unfavorable variance as a pitive numb Direct Labor Rabe Variance Direct Labor Time Variance Total Direct Labor Cost Vrance c. Determine the variable factory overhead controllable variance, fixed factory overhead, and total tactory overhead cost varlarice. Enter a favorable variance as a negative number using a sign and in una positive number Variable factory overhead controllable variance Fixed factory overhead volume variance Total factory overhead cost variance S