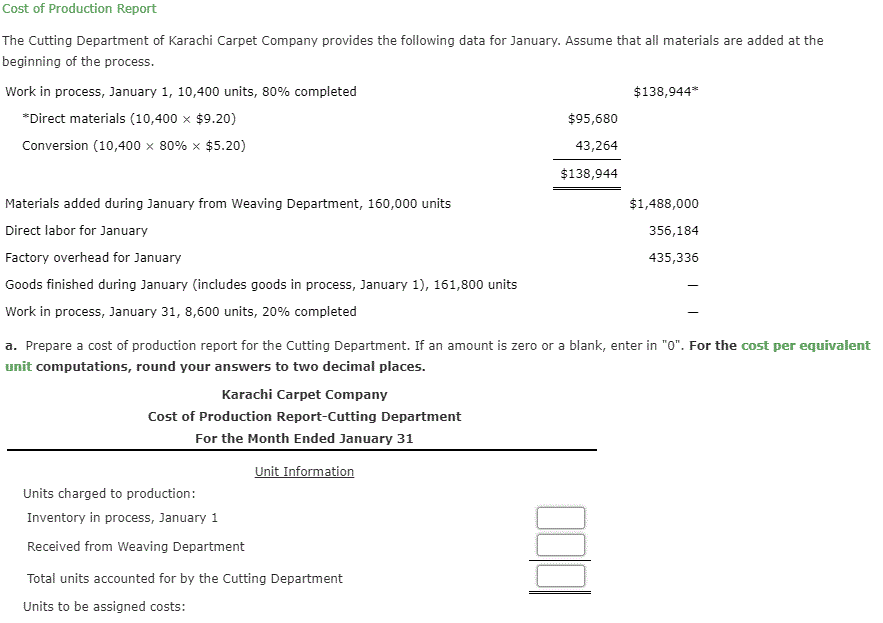

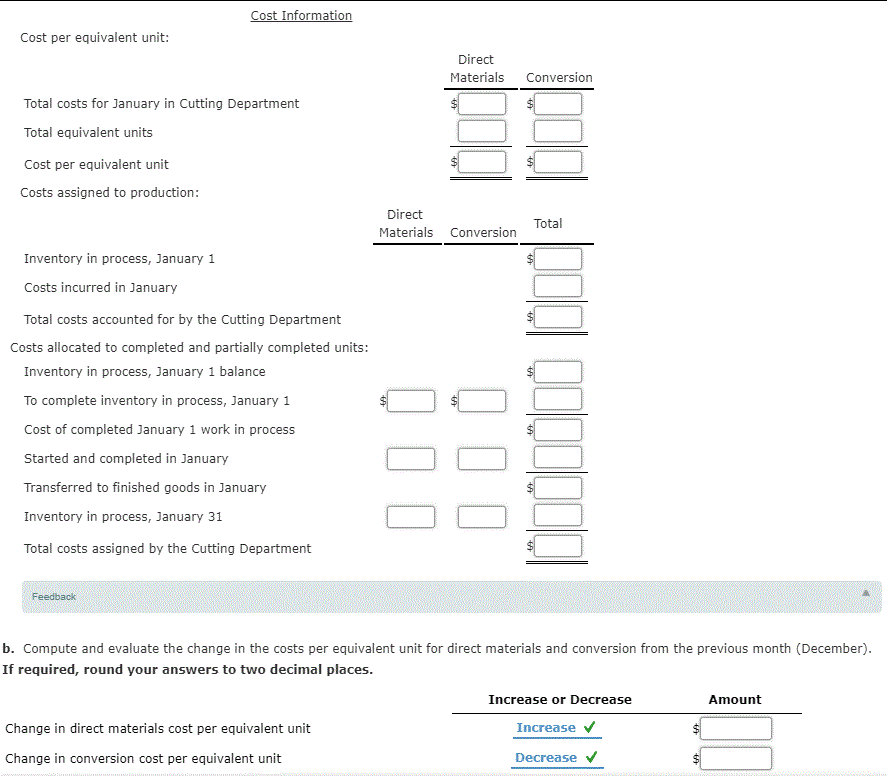

Cost of Production Report The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. Work in process, January 1, 10,400 units, 80% completed $138,944* *Direct materials (10,400 x $9.20) $95,680 Conversion (10,400 x 80% x $5.20) 43,264 $138,944 Materials added during January from Weaving Department, 160,000 units $1,488,000 Direct labor for January 356,184 Factory overhead for January 435,336 Goods finished during January (includes goods in process, January 1), 161,800 units Work in process, January 31, 8,600 units, 20% completed a. Prepare a cost of production report for the Cutting Department. If an amount is zero or a blank, enter in "0". For the cost per equivalent unit computations, round your answers to two decimal places. Karachi Carpet Company Cost of Production Report-Cutting Department For the Month Ended January 31 Unit Information Units charged to production: Inventory in process, January 1 Received from Weaving Department Total units accounted for by the Cutting Department Units to be assigned costs: Cost Information Cost per equivalent unit: Direct Materials Conversion Total costs for January in Cutting Department Total equivalent units Cost per equivalent unit Costs assigned to production: Direct Materials Conversion Total Inventory in process, January 1 Costs incurred in January Total costs accounted for by the Cutting Department Costs allocated to completed and partially completed units: Inventory in process, January 1 balance To complete inventory in process, January 1 Cost of completed January 1 work in process Started and completed in January Transferred to finished goods in January Inventory in process, January 31 Total costs assigned by the Cutting Department $ $ $ Feedback b. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (December). If required, round your answers to two decimal places. Amount Increase or Decrease Increase Change in direct materials cost per equivalent unit Change in conversion cost per equivalent unit $ $ Decrease