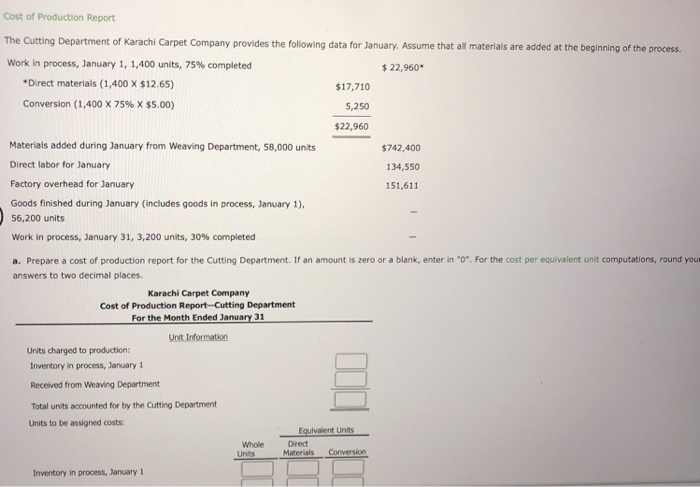

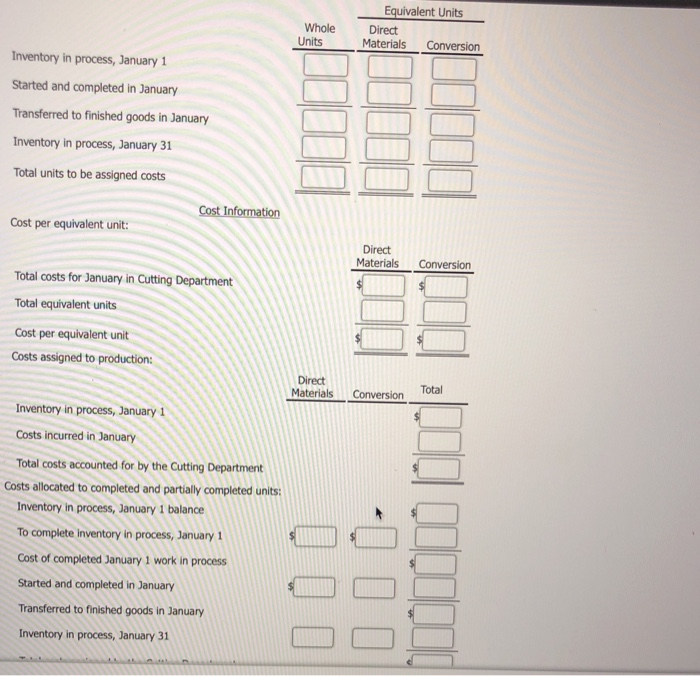

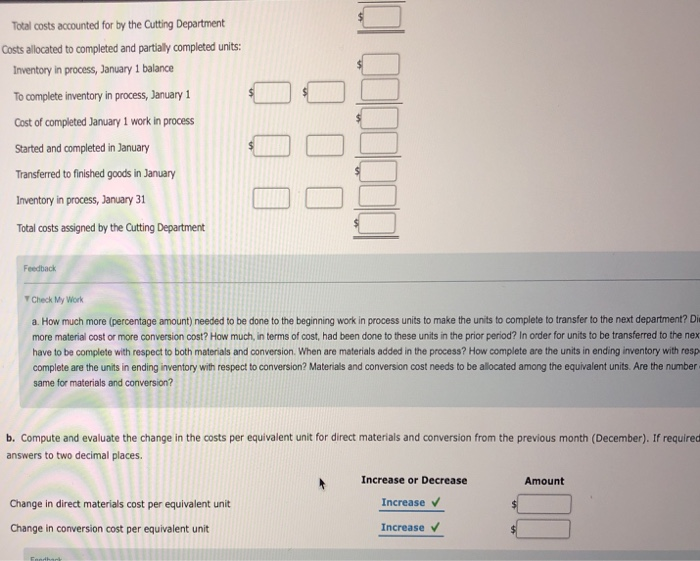

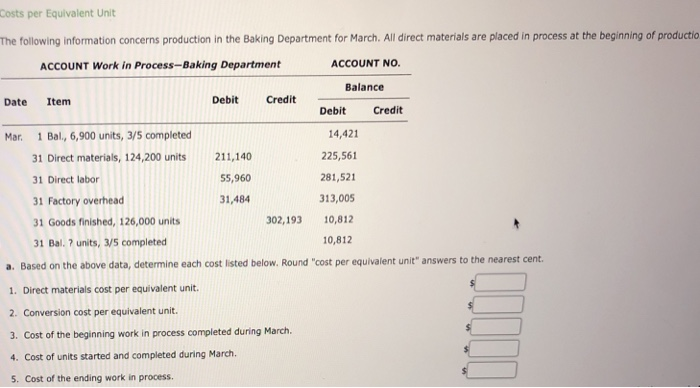

Cost of Production Report The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. work in process, January 1, 1,400 units, 75% completed 22,960 Direct materials (1,400 X $12.65) Conversion (1,400 X 75% X $5.00) $17,710 5,250 $22,960 Materials added during January from Weaving Department, 58,000 units Direct labor for January Factory overhead for January Goods finished during January (includes goods in process, January 1), 56,200 units work in process, January 31, 3,200 units, 30% completed a. Prepare a cost of production report for the Cutting Department. If an amount is zero or a blank, enter in "O". For the cost per equivalent unit computations, round your answers to two decimal places. $742,400 134,550 151,611 Karachi Carpet Company Cost of Production Report Cutting Department 31 For the Month Ended Unit Information Units charged to production Inventory in process, January1 Received from Weaving Department Total units accounted for by the Cutting Department Units to be assigned costs: Equivalent Units WholeDirect Units Inventory in process, January 1 Whole Units Direct Materials Conversion Inventory in process, January 1 Started and completed in January Transferred to finished goods in Januany Inventory in process, January 31 Total units to be assigned costs Cost per equivalent unit Direct Materials Conversion Total costs for January in Cutting Department Total equivalent units Cost per equivalent unit Costs assigned to production: Materials Conversion Waterials i Conversion Total Inventory in process, January 1 Costs incurred in January Total costs accounted for by the Cutting Department Costs allocated to completed and partially completed units Inventory in process, January 1 balance TO complete inventory in process, January 1 ] Cost of completed January 1 work in process Started and completed in January Transferred to finished goods in Januany Inventory in process, January 31 otal costs accounted for by the Cutting Department Costs allocated to completed and partially completed units: Inventory in process, January 1 balance To complete inventory in process, January 1 Cost of completed January 1 work in process Started and completed in January Transferred to finished goods in January Inventory in process, January 31 Total costs assigned by the Cutting Department Feedback Check My Work a. How much more (percentage amount) needed to be done to the beginning work in process units to make the units to complete to transfer to the next department? Di more material cost or more conversion cost? How much, in terms of cost, had been done to these units in the prior period? In order for units to be transferred to the nex have to be complete with respect to both materials and conversion. When are materials added in the process? How complete are the units in ending inventory with resp complete are the units in ending inventory with respect to conversion? Materials and conversion cost needs to be allocated among the equivalent units. Are the number same for materials and conversion? b. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (December). If required answers to two decimal places t Increase or Decrease Amount Change in direct materials cost per equivalent unit Increase Change in conversion cost per equivalent unit Increase V Costs per Equivalent Unit The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of productio ACCOUNT NO. Balance Debit Credit ACCOUNT Work in Process-Baking Department Date Item Debit Credit 14,421 225,561 281,521 13,005 302,193 10,812 10,812 Mar. 1 Bal., 6,900 units, 3/5 completed 31 Direct materials, 124,200 units211,140 55,960 31,484 1 Direct labor 31 Factory overhead 1 Goods finished, 126,000 units 31 Bal. ? units, 3/5 completed Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit. 3. Cost of the beginning work in process completed during March. 4. Cost of units started and completed during March. 5. Cost of the ending work in process a