Question

Cost of the equipment is $2,500,000 and it costs $200,000 to have it delivered and installed. It is estimated the equipment will have a

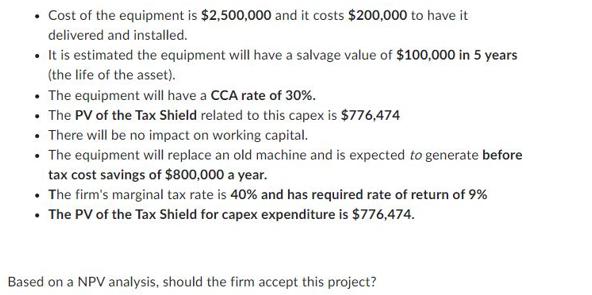

Cost of the equipment is $2,500,000 and it costs $200,000 to have it delivered and installed. It is estimated the equipment will have a salvage value of $100,000 in 5 years (the life of the asset). The equipment will have a CCA rate of 30%. The PV of the Tax Shield related to this capex is $776,474 There will be no impact on working capital. The equipment will replace an old machine and is expected to generate before tax cost savings of $800,000 a year. The firm's marginal tax rate is 40% and has required rate of return of 9% The PV of the Tax Shield for capex expenditure is $776,474. Based on a NPV analysis, should the firm accept this project? Based on an IRR analysis, should the firm accept this project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

3rd edition

9781337909402, 978-1337788281

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App