Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost paid to retire $ 251,500.00 Book vlaue of bonds retired $(247,500.00) Constructive Loss on Bond Retirement $ 4,000.00 Son's Reported Income $ 4,900.00 Constructive

| Cost paid to retire | $ 251,500.00 |

| Book vlaue of bonds retired | $(247,500.00) |

| Constructive Loss on Bond Retirement | $ 4,000.00 |

| Son's Reported Income | $ 4,900.00 |

| Constructive Loss | $ (2,800.00) |

| Recognition of Constructive Loss | $ 700.00 |

| Income from Son Allocated to Parent | $ 2,800.00 |

Please give the year 1 consolidated statement and other necessary entries.

year 1 should be something like...

| Bonds Payable | ||||

| Interest Income | ||||

| Loss | $ 4,000.00 | |||

| Interest Expense | ||||

| Investment in bonds | ||||

OR

| Loss on retirement | $ 4,000.00 | |||

| interest payable | ||||

| interest income | ||||

| bonds payable | ||||

| Investment in Son | ||||

| Interest receivable | ||||

| Interest expense | ||||

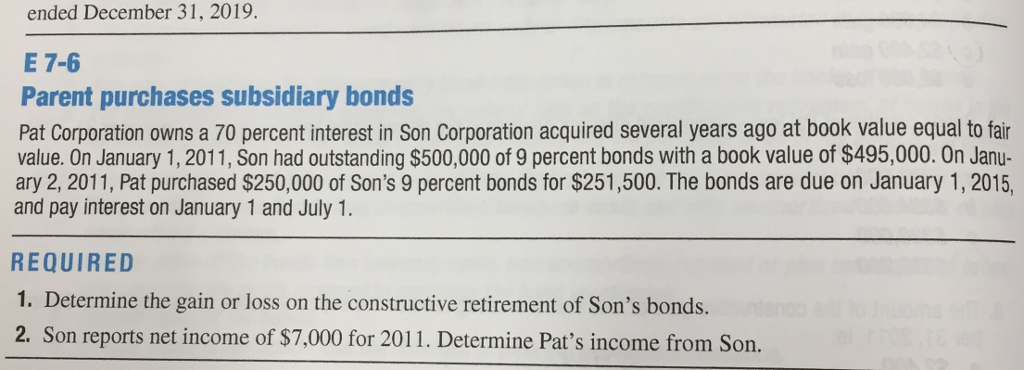

ended December 31, 2019. E 7-6 Parent purchases subsidiary bonds Pat Corporation owns a 70 percent interest in Son Corporation acquired several years ago at book value equal to fair value. On January 1,2011, Son had outstanding $500,000 of 9 percent bonds with a book value of $495,000. On Janu- ary 2, 2011, Pat purchased $250,000 of Son's 9 percent bonds for $251,500. The bonds are due on January 1, 2015, and pay interest on January 1 and July 1 REQUIRED 1. Determine the gain or loss on the constructive retirement of Son's bonds. 2. Son reports net income of $7,000 for 2011. Determine Pat's income from Sorn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started