Answered step by step

Verified Expert Solution

Question

1 Approved Answer

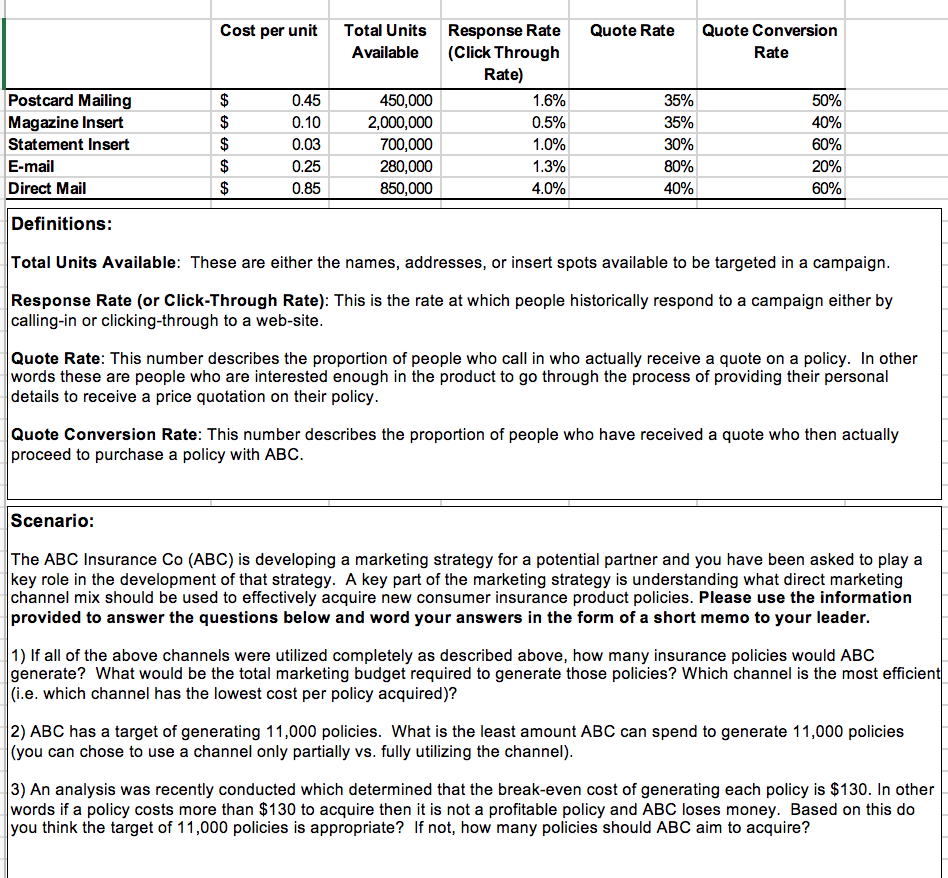

Cost per unit Total Units Available Response Rate (Click Through Quote Rate Quote Conversion Rate Rate) Postcard Mailing Magazine Insert Statement Insert E-mail Direct

Cost per unit Total Units Available Response Rate (Click Through Quote Rate Quote Conversion Rate Rate) Postcard Mailing Magazine Insert Statement Insert E-mail Direct Mail SASASAGA EA $ 0.45 450,000 1.6% 35% 50% $ 0.10 2,000,000 0.5% 35% 40% 0.03 700,000 1.0% 30% 60% $ 0.25 280,000 1.3% 80% 20% $ 0.85 850,000 4.0% 40% 60% Definitions: Total Units Available: These are either the names, addresses, or insert spots available to be targeted in a campaign. Response Rate (or Click-Through Rate): This is the rate at which people historically respond to a campaign either by calling-in or clicking-through to a web-site. Quote Rate: This number describes the proportion of people who call in who actually receive a quote on a policy. In other words these are people who are interested enough in the product to go through the process of providing their personal details to receive a price quotation on their policy. Quote Conversion Rate: This number describes the proportion of people who have received a quote who then actually proceed to purchase a policy with ABC. Scenario: The ABC Insurance Co (ABC) is developing a marketing strategy for a potential partner and you have been asked to play a key role in the development of that strategy. A key part of the marketing strategy is understanding what direct marketing channel mix should be used to effectively acquire new consumer insurance product policies. Please use the information provided to answer the questions below and word your answers in the form of a short memo to your leader. 1) If all of the above channels were utilized completely as described above, how many insurance policies would ABC generate? What would be the total marketing budget required to generate those policies? Which channel is the most efficient (i.e. which channel has the lowest cost per policy acquired)? 2) ABC has a target of generating 11,000 policies. What is the least amount ABC can spend to generate 11,000 policies (you can chose to use a channel only partially vs. fully utilizing the channel). 3) An analysis was recently conducted which determined that the break-even cost of generating each policy is $130. In other words if a policy costs more than $130 to acquire then it is not a profitable policy and ABC loses money. Based on this do you think the target of 11,000 policies is appropriate? If not, how many policies should ABC aim to acquire?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started