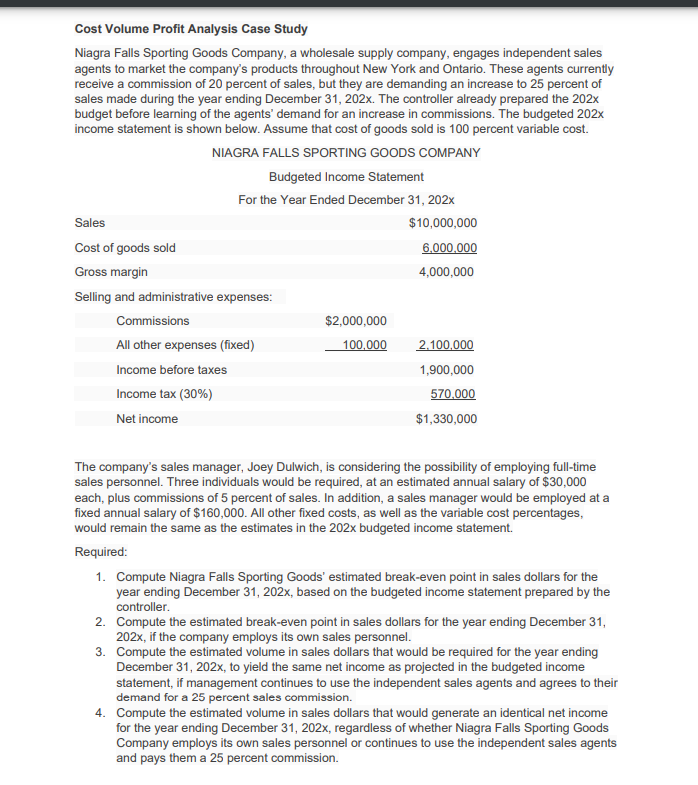

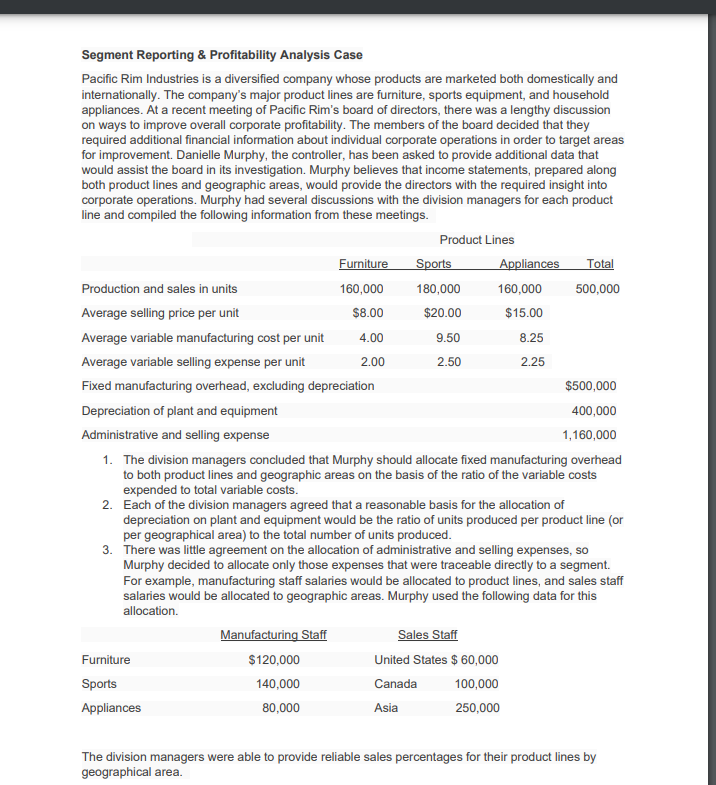

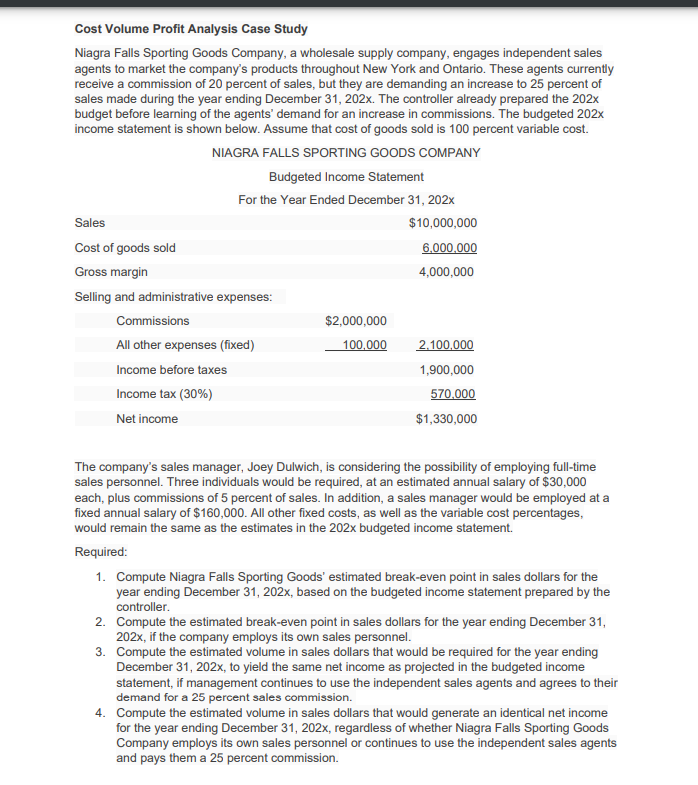

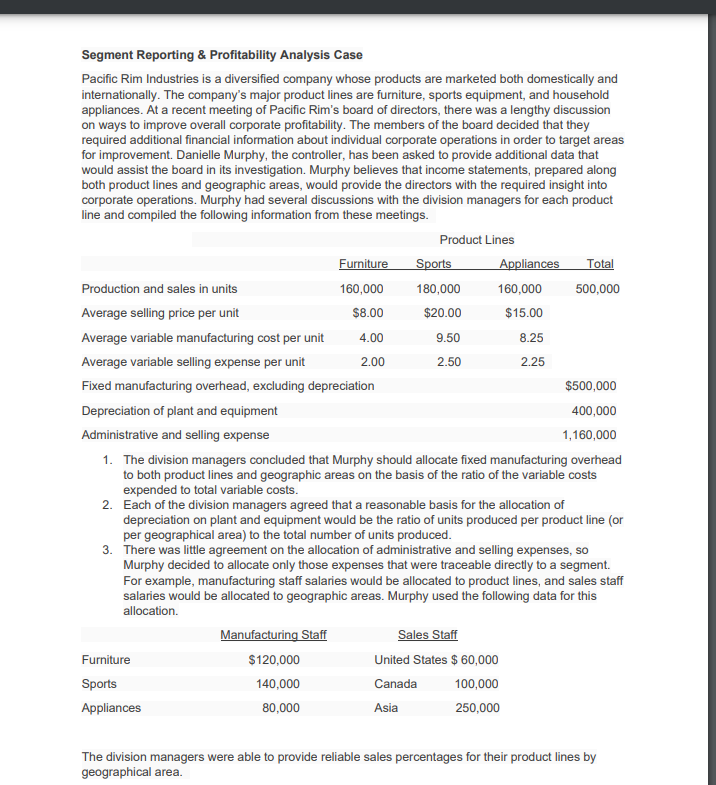

Cost Volume Profit Analysis Case Study Niagra Falls Sporting Goods Company, a wholesale supply company, engages independent sales agents to market the company's products throughout New York and Ontario. These agents currently receive a commission of 20 percent of sales, but they are demanding an increase to 25 percent of sales made during the year ending December 31, 202x. The controller already prepared the 202x budget before learning of the agents' demand for an increase in commissions. The budgeted 202x income statement is shown below. Assume that cost of goods sold is 100 percent variable cost. The company's sales manager, Joey Dulwich, is considering the possibility of employing full-time sales personnel. Three individuals would be required, at an estimated annual salary of $30,000 each, plus commissions of 5 percent of sales. In addition, a sales manager would be employed at a fixed annual salary of $160,000. All other fixed costs, as well as the variable cost percentages, would remain the same as the estimates in the 202x budgeted income statement. Required: 1. Compute Niagra Falls Sporting Goods' estimated break-even point in sales dollars for the year ending December 31, 202x, based on the budgeted income statement prepared by the controller. 2. Compute the estimated break-even point in sales dollars for the year ending December 31 , 202x, if the company employs its own sales personnel. 3. Compute the estimated volume in sales dollars that would be required for the year ending December 31,202x, to yield the same net income as projected in the budgeted income statement, if management continues to use the independent sales agents and agrees to their demand for a 25 percent sales commission. 4. Compute the estimated volume in sales dollars that would generate an identical net income for the year ending December 31, 202x, regardless of whether Niagra Falls Sporting Goods Company employs its own sales personnel or continues to use the independent sales agents and pays them a 25 percent commission. Segment Reporting \& Profitability Analysis Case Pacific Rim Industries is a diversified company whose products are marketed both domestically and internationally. The company's major product lines are furniture, sports equipment, and household appliances. At a recent meeting of Pacific Rim's board of directors, there was a lengthy discussion on ways to improve overall corporate profitability. The members of the board decided that they required additional financial information about individual corporate operations in order to target areas for improvement. Danielle Murphy, the controller, has been asked to provide additional data that would assist the board in its investigation. Murphy believes that income statements, prepared along both product lines and geographic areas, would provide the directors with the required insight into corporate operations. Murphy had several discussions with the division managers for each product line and compiled the following information from these meetings. 1. The division managers concluded that Murphy should allocate fixed manufacturing overhead to both product lines and geographic areas on the basis of the ratio of the variable costs expended to total variable costs. 2. Each of the division managers agreed that a reasonable basis for the allocation of depreciation on plant and equipment would be the ratio of units produced per product line (or per geographical area) to the total number of units produced. 3. There was little agreement on the allocation of administrative and selling expenses, so Murphy decided to allocate only those expenses that were traceable directly to a segment. For example, manufacturing staff salaries would be allocated to product lines, and sales staff salaries would be allocated to geographic areas. Murphy used the following data for this allocation. The division managers were able to provide reliable sales percentages for their product lines by geographical area