Answered step by step

Verified Expert Solution

Question

1 Approved Answer

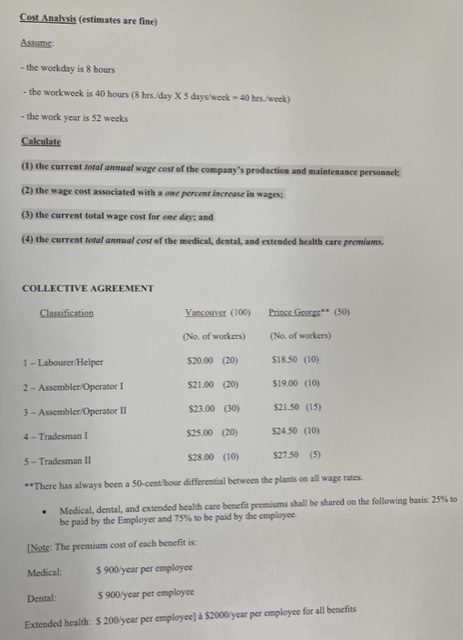

CostAnalysis(estimatesarefine) Assume: - the workday is 8 hours - the workweek is 40 hours ( 8 hrs.diry X 5 drys weck =40 hrs. weck) -

CostAnalysis(estimatesarefine) Assume: - the workday is 8 hours - the workweek is 40 hours ( 8 hrs.diry X 5 drys weck =40 hrs. weck) - the work year is $2 weeks Calculate (1) the current toral amnual wage cosf of the company's production and mainteanace personnel; (2) the wage cost associated with a ome percent increase in wages: (3) the current total wage cost for one dog; and (4) the curreat total anmual cost of the medical, dental, and exteaded health care premiams. * There has always been a 50-cent hour differential between the plants on all wage rates. - Mctical, dental, and extended health care benefit peemiums shall be shared on the following basis: 25% to be paid by the Employer and 75% to be paid by the empioyee. [Note: The premium cost of each benefit is: Medicat: $900 year per employce Dental: $900 year per employee Extended bealth: $200 year per employec] a \$2000 year per employee for all benefits

CostAnalysis(estimatesarefine) Assume: - the workday is 8 hours - the workweek is 40 hours ( 8 hrs.diry X 5 drys weck =40 hrs. weck) - the work year is $2 weeks Calculate (1) the current toral amnual wage cosf of the company's production and mainteanace personnel; (2) the wage cost associated with a ome percent increase in wages: (3) the current total wage cost for one dog; and (4) the curreat total anmual cost of the medical, dental, and exteaded health care premiams. * There has always been a 50-cent hour differential between the plants on all wage rates. - Mctical, dental, and extended health care benefit peemiums shall be shared on the following basis: 25% to be paid by the Employer and 75% to be paid by the empioyee. [Note: The premium cost of each benefit is: Medicat: $900 year per employce Dental: $900 year per employee Extended bealth: $200 year per employec] a \$2000 year per employee for all benefits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started