Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost-based pricing: Marjor airlines like Anerican, Delta, and United are struggling to meet the challenges of budget carriers such as Southwest and JetBlue. Suppose the

Cost-based pricing:

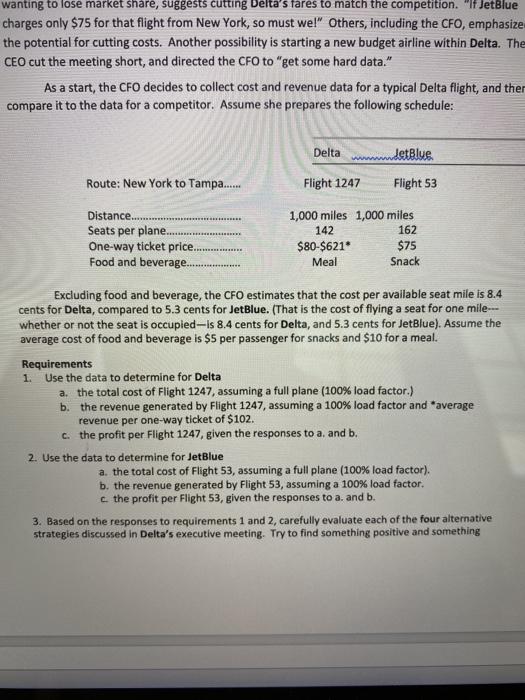

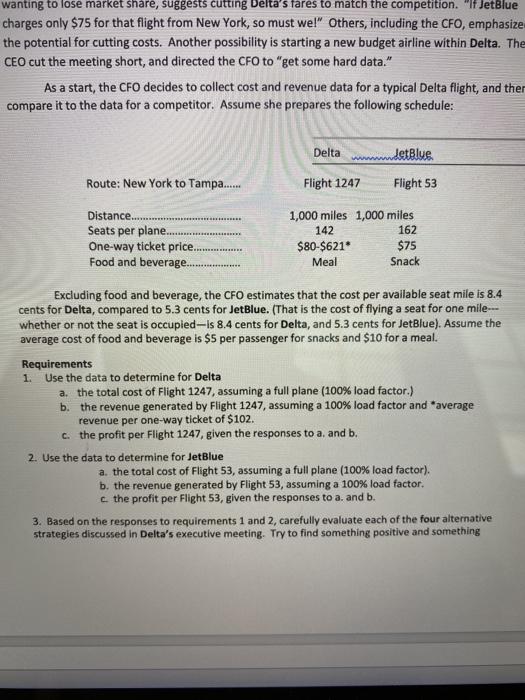

wanting to lose market share, suggests cutting Delta's fares to match the competition. "If JetBlue charges only $75 for that flight from New York, so must wel" Others, including the CFO, emphasize the potential for cutting costs. Another possibility is starting a new budget airline within Delta. The CEO cut the meeting short, and directed the CFO to "get some hard data." As a start, the CFO decides to collect cost and revenue data for a typical Delta flight, and the compare it to the data for a competitor. Assume she prepares the following schedule: Delta www.detBlue Route: New York to Tampa...... Flight 1247 Flight 53 Distance.. Seats per plane.. One-way ticket price. Food and beverage... 1,000 miles 1,000 miles 142 162 $80-$621 $75 Meal Snack Excluding food and beverage, the CFO estimates that the cost per available seat mile is 8.4 cents for Delta, compared to 5.3 cents for JetBlue. (That is the cost of flying a seat for one mile--- whether or not the seat is occupied-Is 8.4 cents for Delta, and 5.3 cents for JetBlue). Assume the average cost of food and beverage is $5 per passenger for snacks and $10 for a meal. Requirements 1. Use the data to determine for Delta a. the total cost of Flight 1247, assuming a full plane (100% load factor.) b. the revenue generated by Flight 1247, assuming a 100% load factor and average revenue per one-way ticket of $102. c. the profit per Flight 1247, given the responses to a. and b. 2. Use the data to determine for JetBlue a. the total cost of Flight 53, assuming a full plane (100% load factor). b. the revenue generated by Flight 53, assuming a 100% load factor, c. the profit per Flight 53, given the responses to a. and b. 3. Based on the responses to requirements 1 and 2, carefully evaluate each of the four alternative strategies discussed in Delta's executive meeting. Try to find something positive and something Requirements 1. Use the data to determine for Delta a. the total cost of Flight 1247, assuming a full plane (100% load factor.) b. the revenue generated by Flight 1247, assuming a 100% load factor and "average revenue per one-way ticket of $102. c. the profit per Flight 1247, given the responses to a. and b. 2. Use the data to determine for JetBlue a. the total cost of Flight 53, assuming a full plane (100% load factor). b. the revenue generated by Flight 53, assuming a 100% load factor. c. the profit per Flight 53, given the responses to a. and b. 3. Based on the responses to requirements 1 and 2, carefully evaluate each of the four alternative strategies discussed in Delta's executive meeting. Try to find something positive and something negative about each proposal. Finally, make and support the strategy you recommend. (If you believe a fifth alternative may be better, describe it, identify the positive and negative factors related to it and say why you think it would be the best strategy.) 4. The analysis in this case is based on several simplifying assumptions. Identify factors that your quantitative evaluation does not include, but that may affect a comparison of Delta's operation to budget carriers. wanting to lose market share, suggests cutting Delta's fares to match the competition. "If JetBlue charges only $75 for that flight from New York, so must wel" Others, including the CFO, emphasize the potential for cutting costs. Another possibility is starting a new budget airline within Delta. The CEO cut the meeting short, and directed the CFO to "get some hard data." As a start, the CFO decides to collect cost and revenue data for a typical Delta flight, and the compare it to the data for a competitor. Assume she prepares the following schedule: Delta www.detBlue Route: New York to Tampa...... Flight 1247 Flight 53 Distance.. Seats per plane.. One-way ticket price. Food and beverage... 1,000 miles 1,000 miles 142 162 $80-$621 $75 Meal Snack Excluding food and beverage, the CFO estimates that the cost per available seat mile is 8.4 cents for Delta, compared to 5.3 cents for JetBlue. (That is the cost of flying a seat for one mile--- whether or not the seat is occupied-Is 8.4 cents for Delta, and 5.3 cents for JetBlue). Assume the average cost of food and beverage is $5 per passenger for snacks and $10 for a meal. Requirements 1. Use the data to determine for Delta a. the total cost of Flight 1247, assuming a full plane (100% load factor.) b. the revenue generated by Flight 1247, assuming a 100% load factor and average revenue per one-way ticket of $102. c. the profit per Flight 1247, given the responses to a. and b. 2. Use the data to determine for JetBlue a. the total cost of Flight 53, assuming a full plane (100% load factor). b. the revenue generated by Flight 53, assuming a 100% load factor, c. the profit per Flight 53, given the responses to a. and b. 3. Based on the responses to requirements 1 and 2, carefully evaluate each of the four alternative strategies discussed in Delta's executive meeting. Try to find something positive and something Requirements 1. Use the data to determine for Delta a. the total cost of Flight 1247, assuming a full plane (100% load factor.) b. the revenue generated by Flight 1247, assuming a 100% load factor and "average revenue per one-way ticket of $102. c. the profit per Flight 1247, given the responses to a. and b. 2. Use the data to determine for JetBlue a. the total cost of Flight 53, assuming a full plane (100% load factor). b. the revenue generated by Flight 53, assuming a 100% load factor. c. the profit per Flight 53, given the responses to a. and b. 3. Based on the responses to requirements 1 and 2, carefully evaluate each of the four alternative strategies discussed in Delta's executive meeting. Try to find something positive and something negative about each proposal. Finally, make and support the strategy you recommend. (If you believe a fifth alternative may be better, describe it, identify the positive and negative factors related to it and say why you think it would be the best strategy.) 4. The analysis in this case is based on several simplifying assumptions. Identify factors that your quantitative evaluation does not include, but that may affect a comparison of Delta's operation to budget carriers Marjor airlines like Anerican, Delta, and United are struggling to meet the challenges of budget carriers such as Southwest and JetBlue. Suppose the Delta CFO has just returned from a meeting on strategies for responding to competition from budget carriers. The vice president of operations suggested doing nothing.... As a start, the CFO decides to collect cost and revenue data for a typical Delta flight, and then compare it to the data for a competitor. Assume she prepares the following schedule:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started