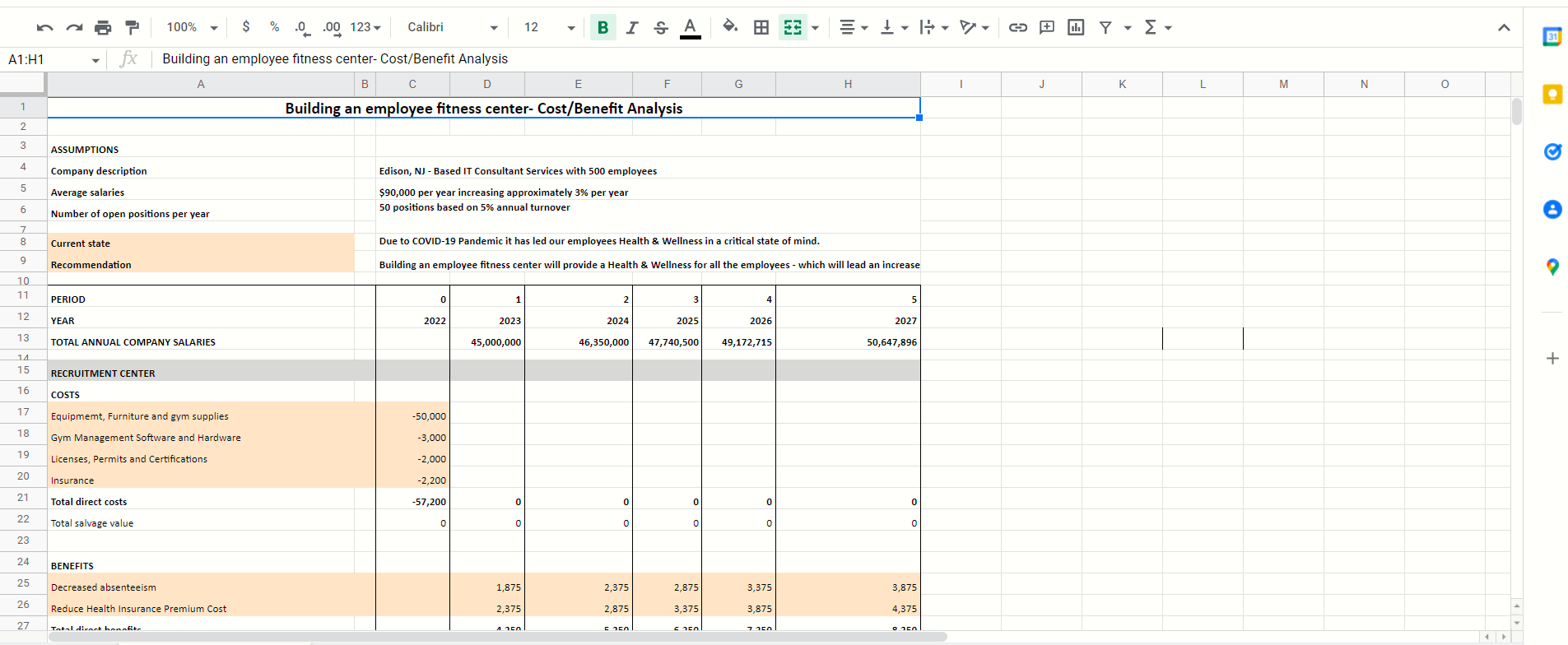

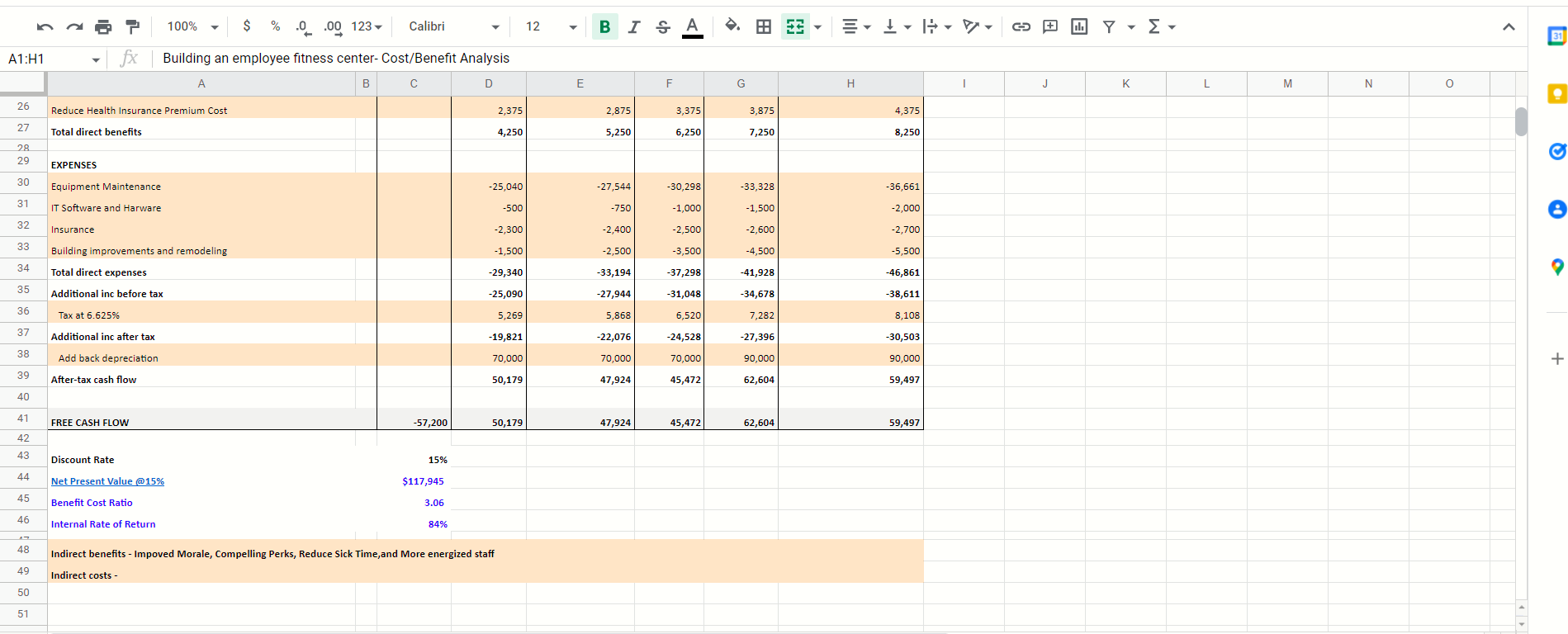

Cost-Benefit Analysis Using your Excel spreadsheet, this section outlines the following: Upfront investment costs and how you quantified them (Year 0) Benefits and how you quantified them (Years 1-5) Additional investment (if needed) and expenses and how you quantified them (Years 1-5)

Cost-Benefit Analysis Using your Excel spreadsheet, this section outlines the following: Upfront investment costs and how you quantified them (Year 0) Benefits and how you quantified them (Years 1-5) Additional investment (if needed) and expenses and how you quantified them (Years 1-5)

100% $ % .0 .00 123 Calibri 12 BI SA . ES- Il D 31 A1:H1 Building an employee fitness center-Cost/Benefit Analysis B D E F G H 1 J K L 3 M N O 1 Building an employee fitness center- Cost/Benefit Analysis 2 3 ASSUMPTIONS 4 Company description 5 Average salaries Edison, NJ - Based IT Consultant Services with 500 employees $90,000 per year increasing approximately 3% per year 50 positions based on 5% annual turnover 6 e Number of open positions per year 7 8 Current state Due to COVID-19 Pandemic it has led our employees Health & Wellness in a critical state of mind. 9 Recommendation Building an employee fitness center will provide a Health & Wellness for all the employees - which will lead an increase 10 11 PERIOD 0 2 4 5 12 YEAR 2022 2023 2024 2025 2026 2027 13 TOTAL ANNUAL COMPANY SALARIES 45,000,000 46,350,000 47,740,500 49,172,715 50,647,896 1 1 + 14 15 RECRUITMENT CENTER 16 COSTS 17 Equipment, Furniture and gym supplies -50,000 18 -3,000 Gym Management Software and Hardware Licenses, Permits and Certifications 19 -2,000 20 Insurance -2,200 21 Total direct costs -57,200 0 0 0 0 0 22 Total salvage value 0 0 0 0 0 23 24 BENEFITS 25 Decreased absenteeism 1,875 2,375 2,875 3,375 3,875 26 Reduce Health Insurance Premium Cost 2,375 2,875 3,375 3,875 4,375 27 Tatal dirant bonafit- 1200 200 On 100% $ % .0 .00 123 Calibri 12 BISA . ES ID [ii] - - 31 A1:41 Building an employee fitness center-Cost/Benefit Analysis B D E F G H J K K L M N 0 26 Reduce Health Insurance Premium Cost 2,375 2,875 3,375 3,875 4,375 27 Total direct benefits 4,250 5,250 6,250 7,250 8,250 28 29 g EXPENSES 30 Equipment Maintenance -25,040 -27,544 -30,298 -33,328 -36,661 31 IT Software and Harware -500 -750 -1,000 -1,500 -2,000 9 32 Insurance -2,300 -2,400 -2,500 -2,600 -2,700 33 Building improvements and remodeling -1,500 -2,500 -3,500 -4,500 -5,500 34 Total direct expenses -29,340 -33,194 -37,298 -41,928 -46,861 35 Additional inc before tax -25,090 -27,944 -31,048 -34,678 -38,611 36 Tax at 6.625% 5,269 5,868 6,520 7,282 8,108 37 Additional inc after tax -19,821 -22,076 -24,528 -27,396 -30,503 38 Add back depreciation 70,000 70,000 70,000 90,000 90,000 + + 39 After-tax cash flow 50,179 47,924 45,472 62,604 59,497 40 41 FREE CASH FLOW -57,200 50,179 47,924 45,472 62,604 59,497 42 43 Discount Rate 15% 44 Net Present Value (@15% $117,945 45 Benefit Cost Ratio 3.06 46 Internal Rate of Return 84% 48 Indirect benefits - Impoved Morale, Compelling Perks, Reduce Sick Time, and More energized staff 49 Indirect costs 50 51 100% $ % .0 .00 123 Calibri 12 BI SA . ES- Il D 31 A1:H1 Building an employee fitness center-Cost/Benefit Analysis B D E F G H 1 J K L 3 M N O 1 Building an employee fitness center- Cost/Benefit Analysis 2 3 ASSUMPTIONS 4 Company description 5 Average salaries Edison, NJ - Based IT Consultant Services with 500 employees $90,000 per year increasing approximately 3% per year 50 positions based on 5% annual turnover 6 e Number of open positions per year 7 8 Current state Due to COVID-19 Pandemic it has led our employees Health & Wellness in a critical state of mind. 9 Recommendation Building an employee fitness center will provide a Health & Wellness for all the employees - which will lead an increase 10 11 PERIOD 0 2 4 5 12 YEAR 2022 2023 2024 2025 2026 2027 13 TOTAL ANNUAL COMPANY SALARIES 45,000,000 46,350,000 47,740,500 49,172,715 50,647,896 1 1 + 14 15 RECRUITMENT CENTER 16 COSTS 17 Equipment, Furniture and gym supplies -50,000 18 -3,000 Gym Management Software and Hardware Licenses, Permits and Certifications 19 -2,000 20 Insurance -2,200 21 Total direct costs -57,200 0 0 0 0 0 22 Total salvage value 0 0 0 0 0 23 24 BENEFITS 25 Decreased absenteeism 1,875 2,375 2,875 3,375 3,875 26 Reduce Health Insurance Premium Cost 2,375 2,875 3,375 3,875 4,375 27 Tatal dirant bonafit- 1200 200 On 100% $ % .0 .00 123 Calibri 12 BISA . ES ID [ii] - - 31 A1:41 Building an employee fitness center-Cost/Benefit Analysis B D E F G H J K K L M N 0 26 Reduce Health Insurance Premium Cost 2,375 2,875 3,375 3,875 4,375 27 Total direct benefits 4,250 5,250 6,250 7,250 8,250 28 29 g EXPENSES 30 Equipment Maintenance -25,040 -27,544 -30,298 -33,328 -36,661 31 IT Software and Harware -500 -750 -1,000 -1,500 -2,000 9 32 Insurance -2,300 -2,400 -2,500 -2,600 -2,700 33 Building improvements and remodeling -1,500 -2,500 -3,500 -4,500 -5,500 34 Total direct expenses -29,340 -33,194 -37,298 -41,928 -46,861 35 Additional inc before tax -25,090 -27,944 -31,048 -34,678 -38,611 36 Tax at 6.625% 5,269 5,868 6,520 7,282 8,108 37 Additional inc after tax -19,821 -22,076 -24,528 -27,396 -30,503 38 Add back depreciation 70,000 70,000 70,000 90,000 90,000 + + 39 After-tax cash flow 50,179 47,924 45,472 62,604 59,497 40 41 FREE CASH FLOW -57,200 50,179 47,924 45,472 62,604 59,497 42 43 Discount Rate 15% 44 Net Present Value (@15% $117,945 45 Benefit Cost Ratio 3.06 46 Internal Rate of Return 84% 48 Indirect benefits - Impoved Morale, Compelling Perks, Reduce Sick Time, and More energized staff 49 Indirect costs 50 51

Cost-Benefit Analysis Using your Excel spreadsheet, this section outlines the following: Upfront investment costs and how you quantified them (Year 0) Benefits and how you quantified them (Years 1-5) Additional investment (if needed) and expenses and how you quantified them (Years 1-5)

Cost-Benefit Analysis Using your Excel spreadsheet, this section outlines the following: Upfront investment costs and how you quantified them (Year 0) Benefits and how you quantified them (Years 1-5) Additional investment (if needed) and expenses and how you quantified them (Years 1-5)