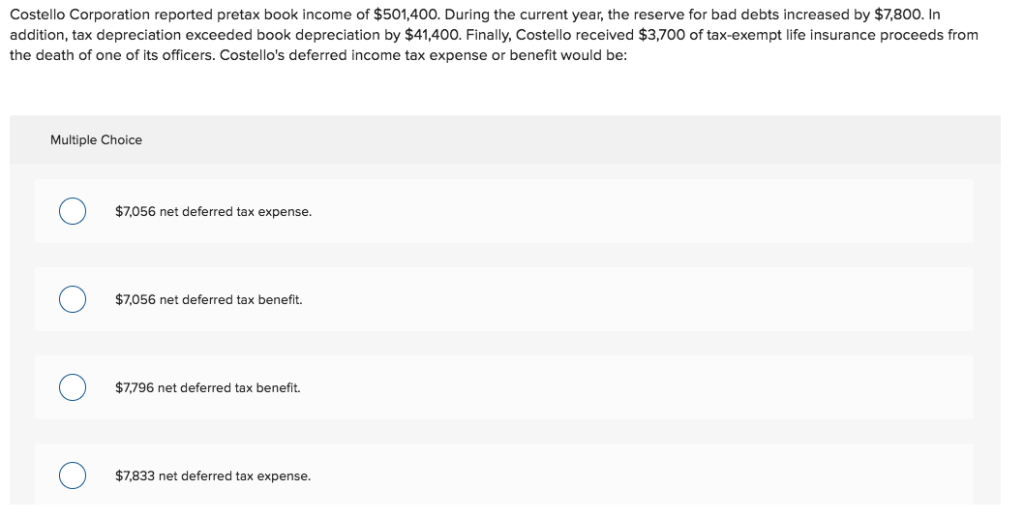

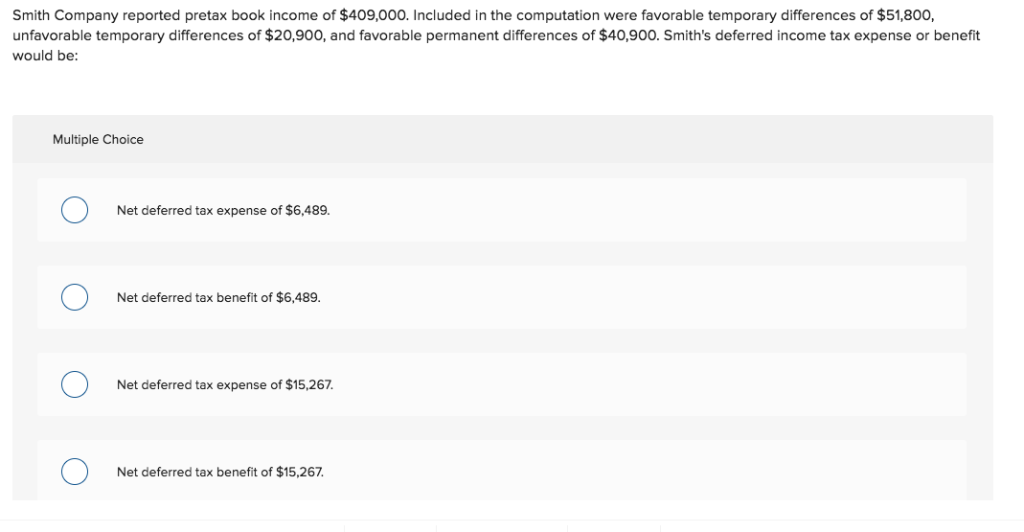

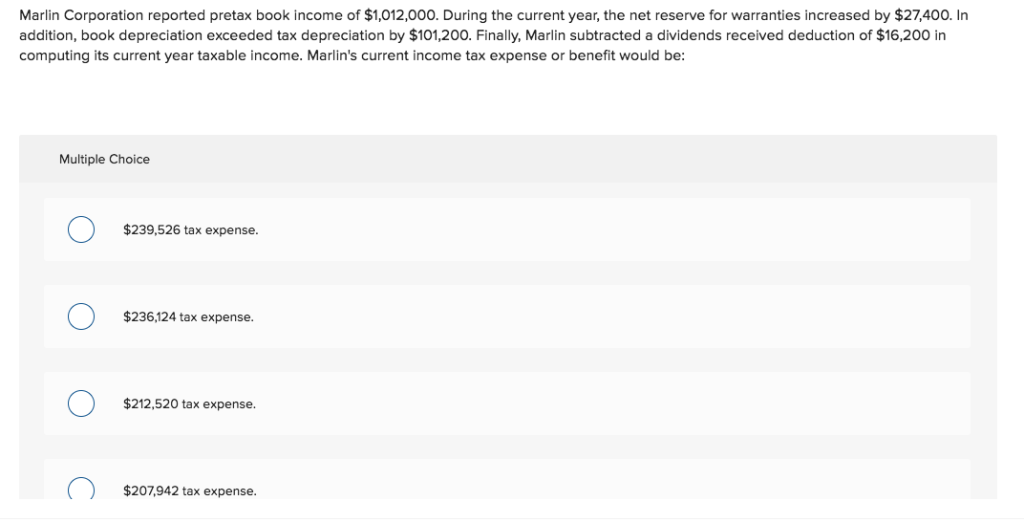

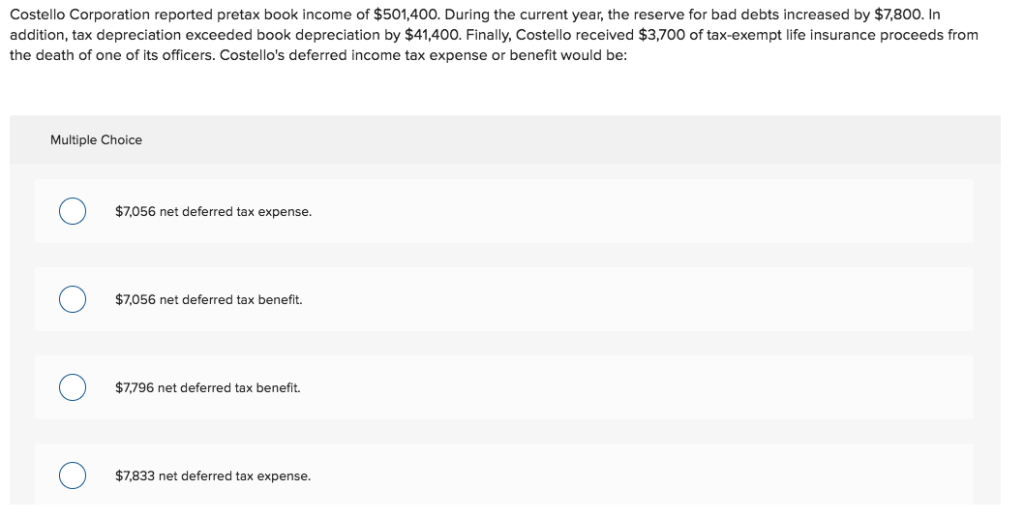

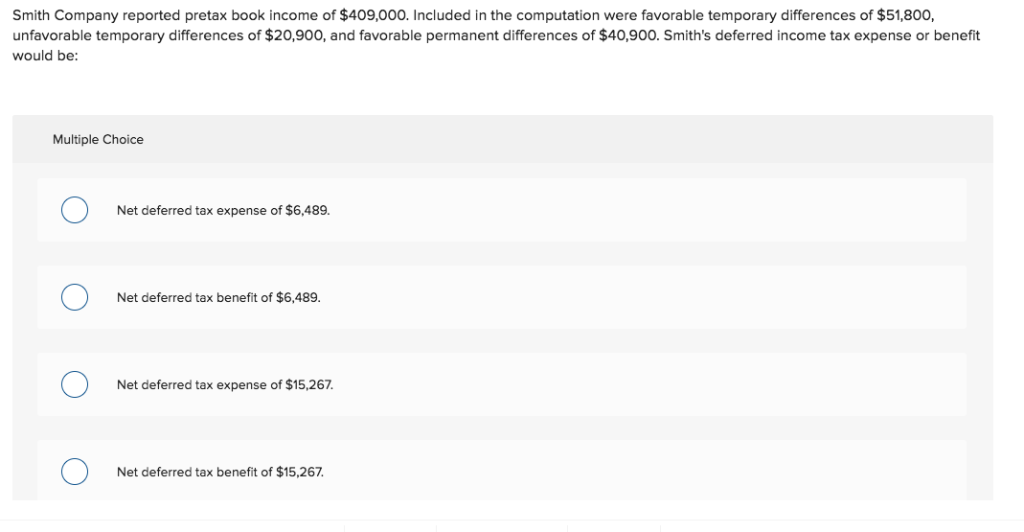

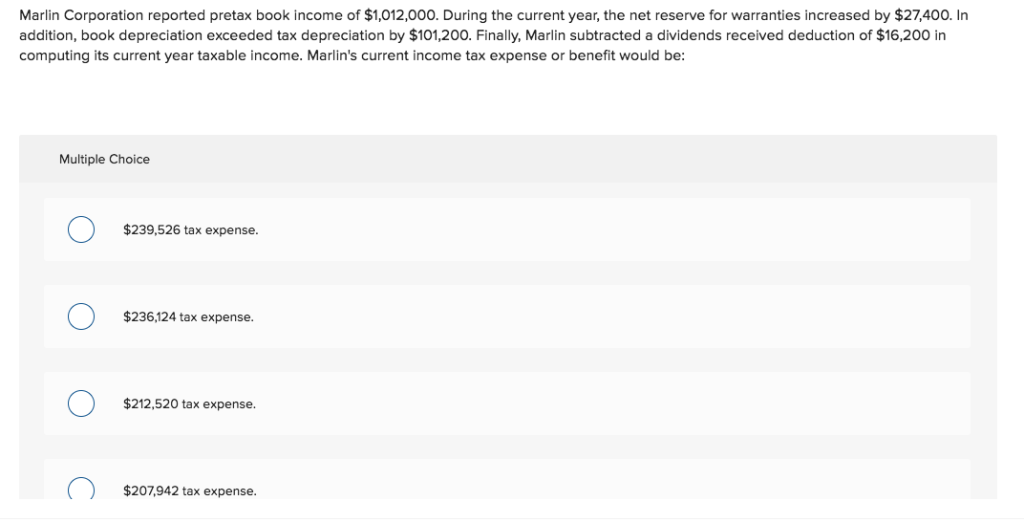

Costello Corporation reported pretax book income of $501,400. During the current year, the reserve for bad debts increased by $7,800. In addition, tax depreciation exceeded book depreciation by $41,400. Finally, Costello received $3,700 of tax-exempt life insurance proceeds from the death of one of its officers. Costello's deferred income tax expense or benefit would be: Multiple Choice $%7056 net dered tax expe $7,056 net deferred tax expense. $7,056 net deferred tax benefit. $7,796 net deferred tax benefit $7,833 net deferred tax expense Smith Company reported pretax book income of $409,000. Included in the computation were favorable temporary differences of $51,800, unfavorable temporary differences of $20,900, and favorable permanent differences of $40,900. Smith's deferred income tax expense or benefit would be: Multiple Choice Net deferred tax expense of $6,489. Net deferred tax benefit of $6,489 Net deferred tax expense of $15,267 Net deferred tax benefit of $15,267 Marlin Corporation reported pretax book income of $1,012,000. During the current year, the net reserve for warranties increased by $27,400. In addition, book depreciation exceeded tax depreciation by $101,200. Finally, Marlin subtracted a dividends received deduction of $16,200 in computing its current year taxable income. Marlin's current income tax expense or benefit would be: Multiple Choice $239,526 tax expense $236,124 tax expense. $212,520 tax expense $207,942 tax expense Costello Corporation reported pretax book income of $501,400. During the current year, the reserve for bad debts increased by $7,800. In addition, tax depreciation exceeded book depreciation by $41,400. Finally, Costello received $3,700 of tax-exempt life insurance proceeds from the death of one of its officers. Costello's deferred income tax expense or benefit would be: Multiple Choice $%7056 net dered tax expe $7,056 net deferred tax expense. $7,056 net deferred tax benefit. $7,796 net deferred tax benefit $7,833 net deferred tax expense Smith Company reported pretax book income of $409,000. Included in the computation were favorable temporary differences of $51,800, unfavorable temporary differences of $20,900, and favorable permanent differences of $40,900. Smith's deferred income tax expense or benefit would be: Multiple Choice Net deferred tax expense of $6,489. Net deferred tax benefit of $6,489 Net deferred tax expense of $15,267 Net deferred tax benefit of $15,267 Marlin Corporation reported pretax book income of $1,012,000. During the current year, the net reserve for warranties increased by $27,400. In addition, book depreciation exceeded tax depreciation by $101,200. Finally, Marlin subtracted a dividends received deduction of $16,200 in computing its current year taxable income. Marlin's current income tax expense or benefit would be: Multiple Choice $239,526 tax expense $236,124 tax expense. $212,520 tax expense $207,942 tax expense