Answered step by step

Verified Expert Solution

Question

1 Approved Answer

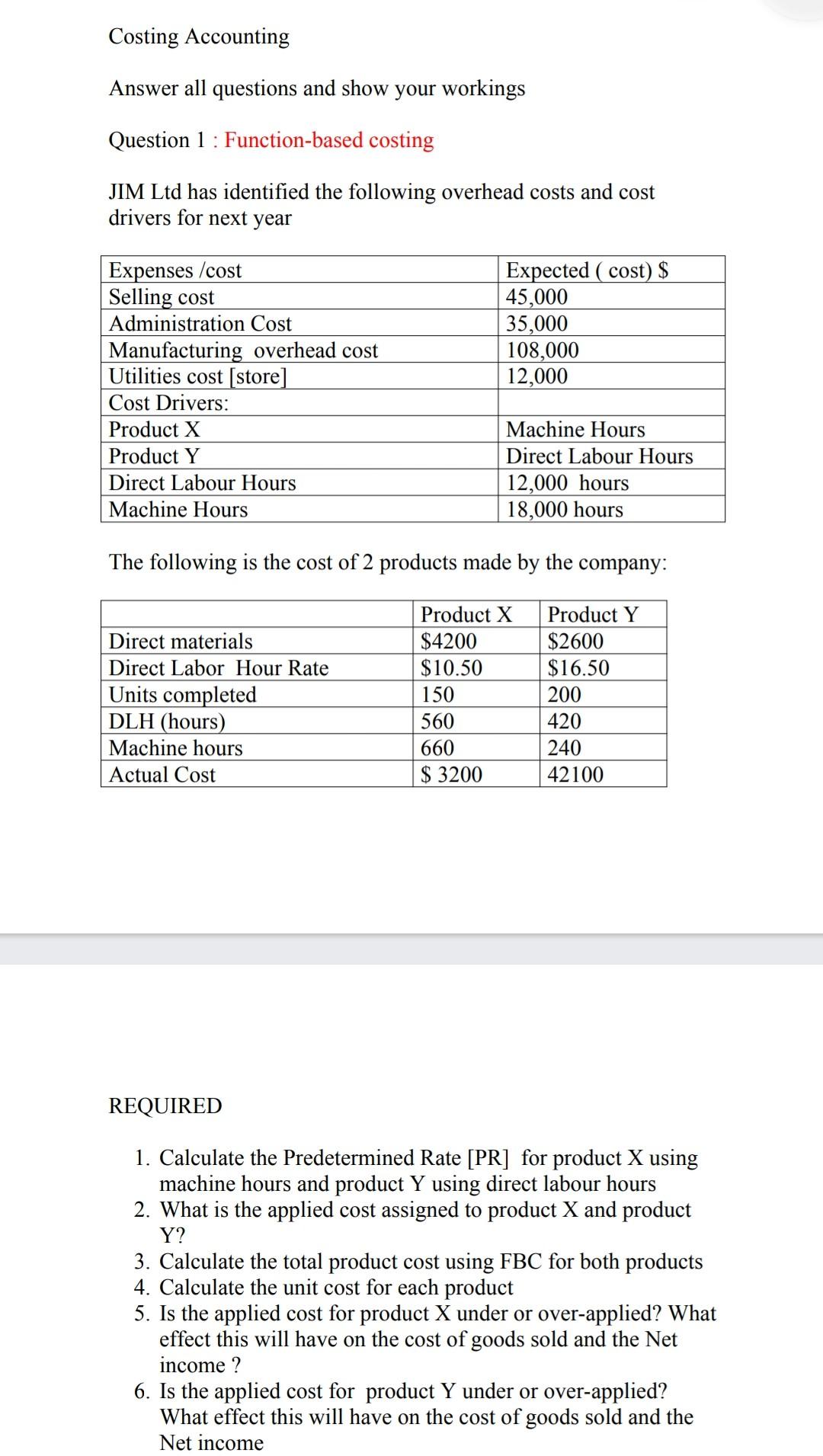

Costing Accounting Answer all questions and show your workings Question 1 : Function-based costing JIM Ltd has identified the following overhead costs and cost drivers

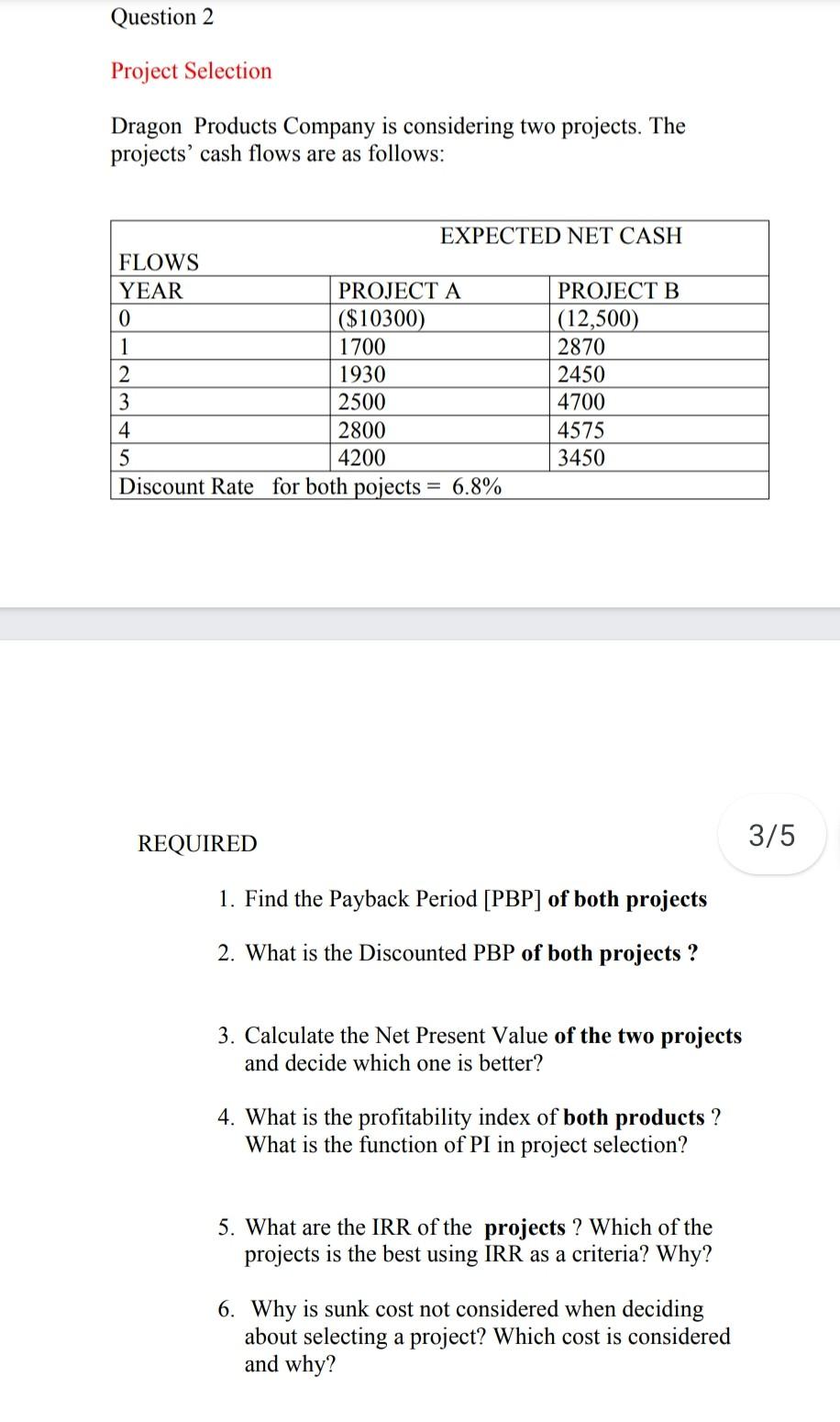

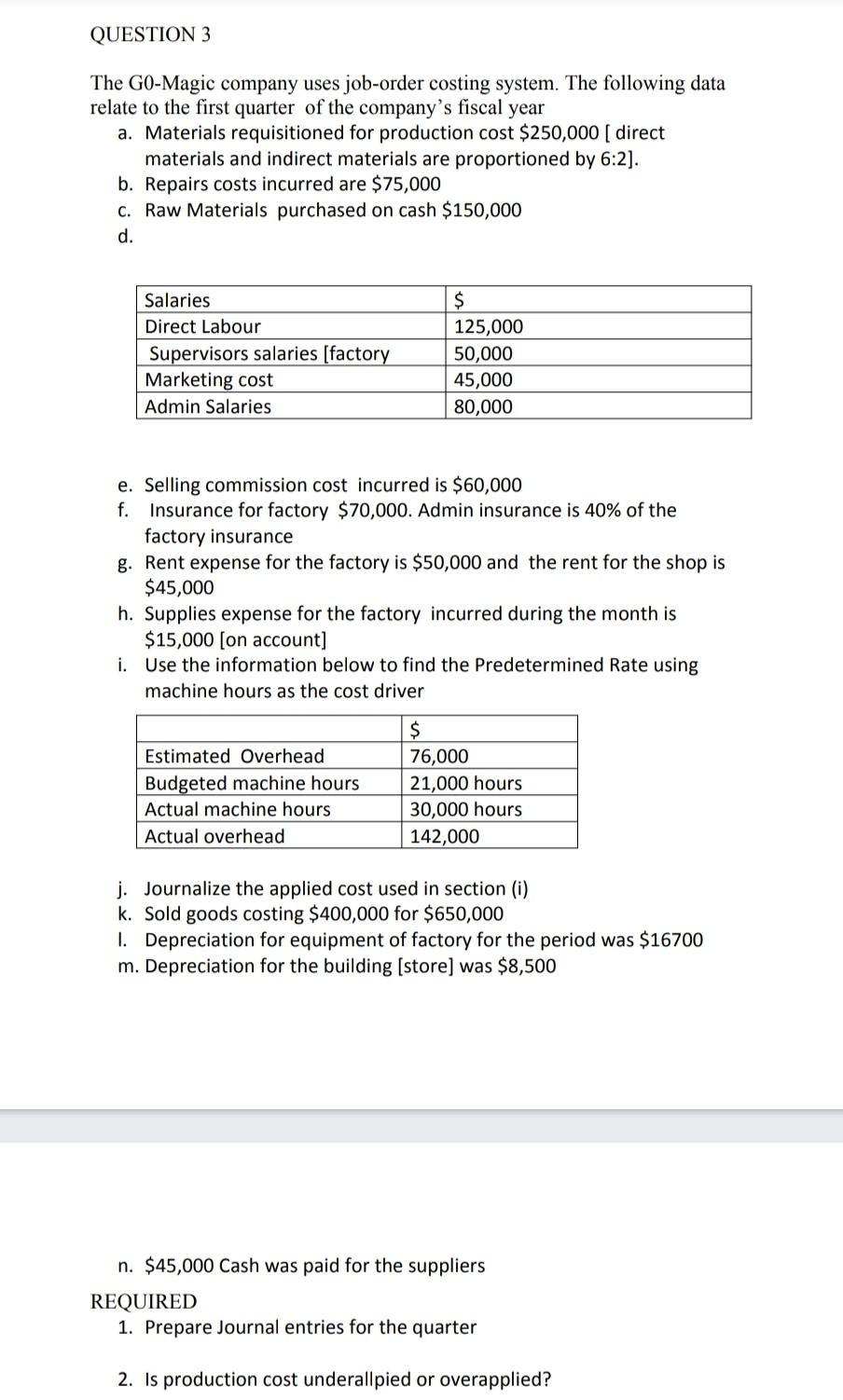

Costing Accounting Answer all questions and show your workings Question 1 : Function-based costing JIM Ltd has identified the following overhead costs and cost drivers for next year Expected ( cost) $ 45,000 35,000 108,000 12,000 Expenses /cost Selling cost Administration Cost Manufacturing overhead cost Utilities cost [store] Cost Drivers: Product X Product Y Direct Labour Hours Machine Hours Machine Hours Direct Labour Hours 12,000 hours 18,000 hours The following is the cost of 2 products made by the company: Direct materials Direct Labor Hour Rate Units completed DLH (hours) Machine hours Actual Cost Product X $4200 $10.50 150 560 660 $ 3200 Product Y $2600 $16.50 200 420 240 42100 REQUIRED 1. Calculate the Predetermined Rate [PR] for product X using machine hours and product Y using direct labour hours 2. What is the applied cost assigned to product X and product Y? 3. Calculate the total product cost using FBC for both products 4. Calculate the unit cost for each product 5. Is the applied cost for product X under or over-applied? What effect this will have on the cost of goods sold and the Net income? 6. Is the applied cost for product Y under or over-applied? What effect this will have on the cost of goods sold and the Net income Question 2 Project Selection Dragon Products Company is considering two projects. The projects' cash flows are as follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B 0 ($10300) (12,500) 1 1700 2870 2 1930 2450 3 2500 4700 4 2800 4575 5 4200 3450 Discount Rate for both pojects = 6.8% REQUIRED 3/5 1. Find the Payback Period [PBP] of both projects 2. What is the Discounted PBP of both projects ? 3. Calculate the Net Present Value of the two projects and decide which one is better? 4. What is the profitability index of both products ? What is the function of PI in project selection? 5. What are the IRR of the projects ? Which of the projects is the best using IRR as a criteria? Why? 6. Why is sunk cost not considered when deciding about selecting a project? Which cost is considered and why? QUESTION 3 The GO-Magic company uses job-order costing system. The following data relate to the first quarter of the company's fiscal year a. Materials requisitioned for production cost $250,000 ( direct materials and indirect materials are proportioned by 6:2]. b. Repairs costs incurred are $75,000 C. Raw Materials purchased on cash $150,000 d. Salaries Direct Labour Supervisors salaries (factory Marketing cost Admin Salaries $ 125,000 50,000 45,000 80,000 e. Selling commission cost incurred is $60,000 f. Insurance for factory $70,000. Admin insurance is 40% of the factory insurance g. Rent expense for the factory is $50,000 and the rent for the shop is $45,000 h. Supplies expense for the factory incurred during the month is $15,000 (on account] i. Use the information below to find the Predetermined Rate using machine hours as the cost driver Estimated Overhead Budgeted machine hours Actual machine hours Actual overhead $ 76,000 21,000 hours 30,000 hours 142,000 j. Journalize the applied cost used in section (i) k. Sold goods costing $400,000 for $650,000 1. Depreciation for equipment of factory for the period was $16700 m. Depreciation for the building (store) was $8,500 n. $45,000 Cash was paid for the suppliers REQUIRED 1. Prepare Journal entries for the quarter 2. Is production cost underallpied or overapplied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started