Answered step by step

Verified Expert Solution

Question

1 Approved Answer

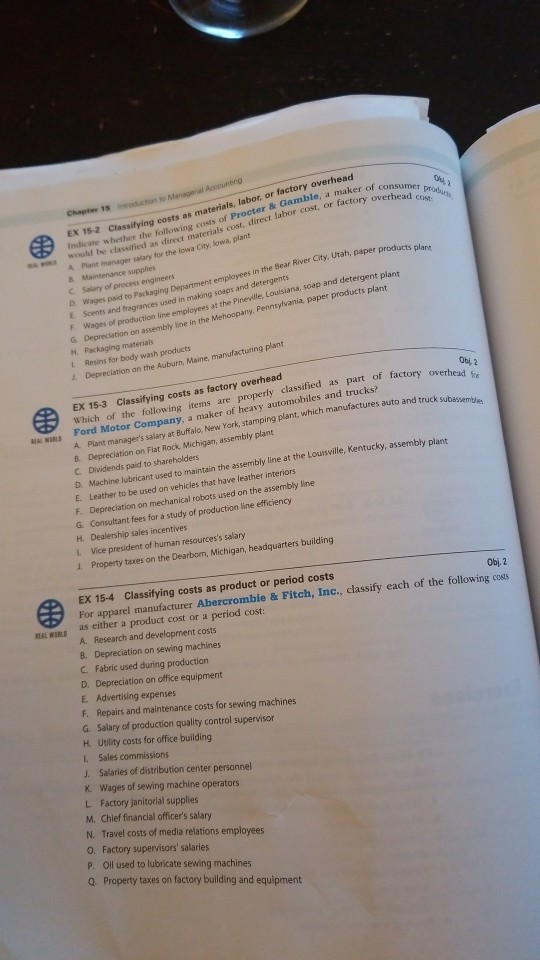

costs as materials, labor, or factory overhead r & Gamble, a maker of c EX 152 Clas labor cost,or factory overhead cop Indicate whether the

costs as materials, labor, or factory overhead r & Gamble, a maker of c EX 152 Clas labor cost,or factory overhead cop Indicate whether the following costs would be classified as direct materials cost, direct A Plant manager salary for the lowa City, kowa. plant B Maintenance supplies o Wages paid to Packaging Department employees in the Bear River City, Utah, Daper products E Scents and fragrances used in making soaps and detergents F Wages of production line employees at the Pineville, Lousiana, soap and detergent plant G Depreciation on assembly line in the Mehoopany, Pennsylvania, paper products plant H. Packaging material I. Resins for body wash products 1 Depreciation on the Auburn, Maime, manufacturing plant EX 15-3 Classifying costs as factory overhead of factory overhead Which of the following items are properly classified as part of fa Ford Mo tor Company, a maker of heavy automobiles and trucks? and truck subassemiblies Plant manager's salary at Buffalo, New York stamping plant. which manufactures auto B. Depreciation on Flat Rock Michigan, assembly plant C. Dividends paid to shareholders ouisville, Kentucky, assembly plant the assembly line at the L have leather interiors D. Machine lubricant used to maintain E. Leather to be used on vehicles that F. Depreciation on mechanical robots used on the assembly line G. Consultant fees for a study of production line efficiency H. Dealership sales incentives L Vice president of human resources's salary J. Property taxes on the Dearborn, Michigan, headquarters building EX 15-4 Classifying costs as product or period costs For apparel manufacturer Abercrombie & Fitch, Inc., classify each of the following coss as either a product cost or a period cost: A. Research and development costs B. Depreciation on sewing machines C. Fabric used during production D. Depreciation on office equipment E Advertising expenses F. Repairs and maintenance costs for sewing machines G. Salary of production quality control supervisor H. Utility costs for office building L Sales commissions J. Salaries of distribution center personnel K Wages of sewing machine operators L Factory janitorial supplies M. Chief financial officer's salary N. Travel costs of media relations employees 0. Factony supervisors' salaries P. oll used to lubricate sewing machines Q. Property taxes on factory building and equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started