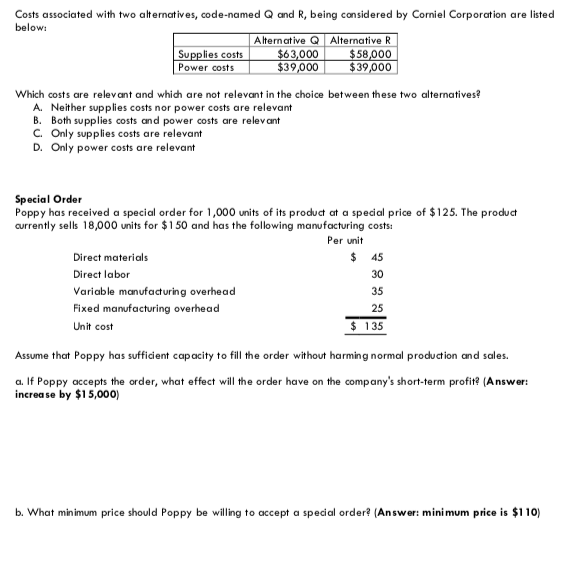

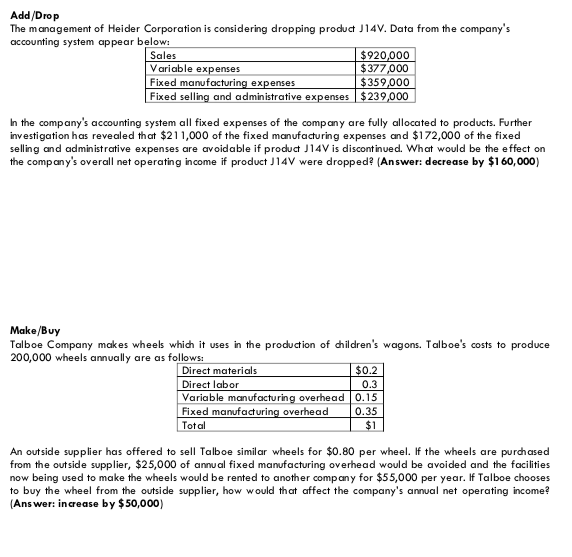

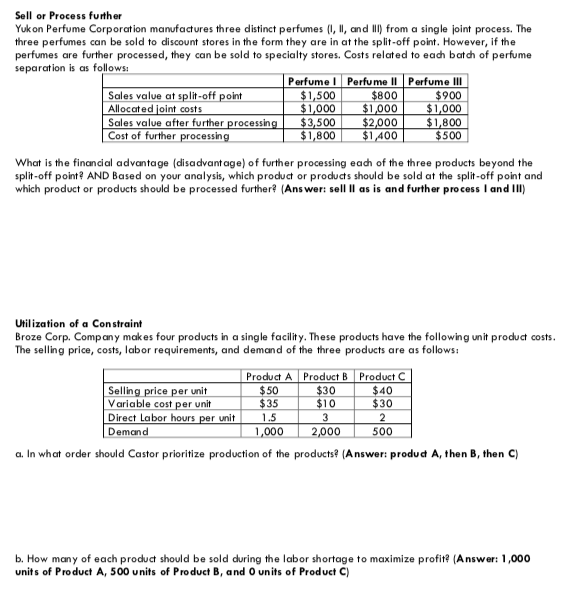

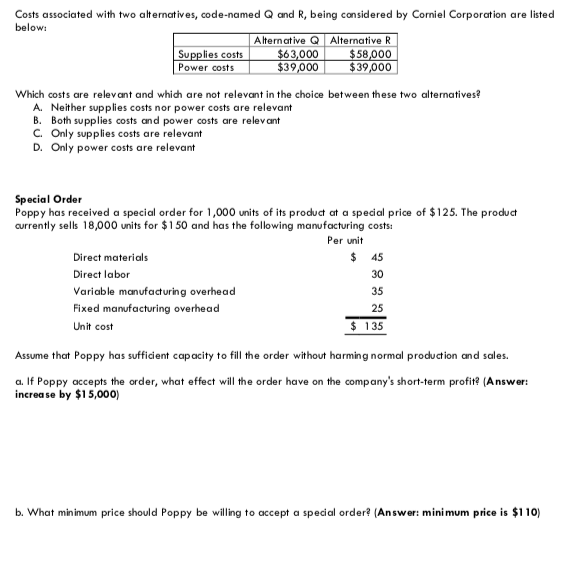

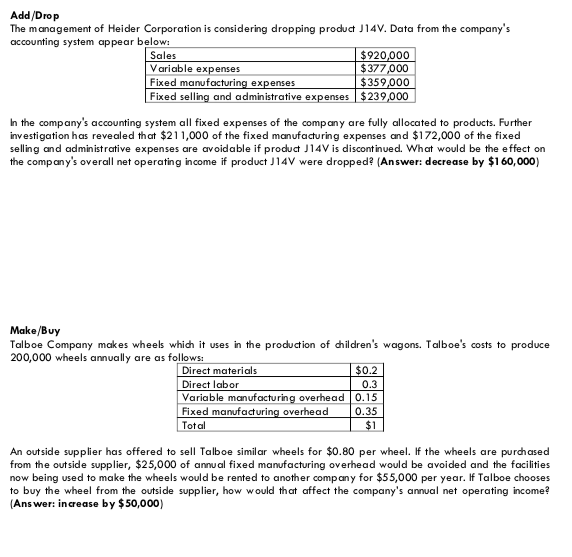

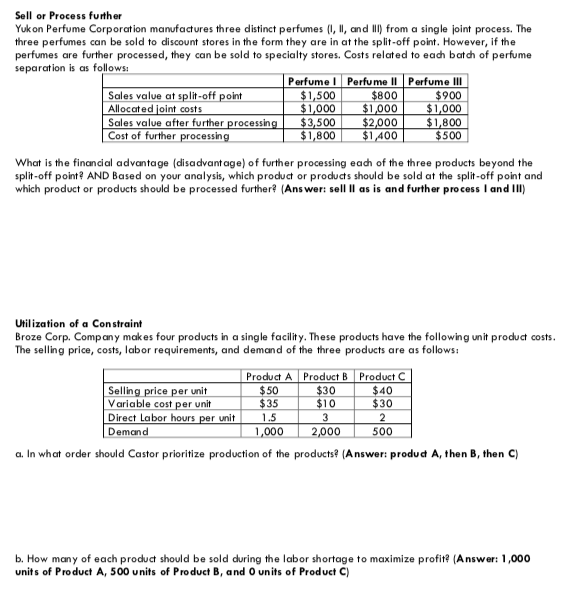

Costs associated with two alternatives, code-named Q and R, being considered by Corniel Corporation are listed below: Alternative Q Alternative R Supplies costs $63,000 $ 58,000 Power costs $39,000 $39,000 Which costs are relevant and which are not relevant in the choice between these two alternatives? A. Neither supplies costs nor power costs are relevant B. Both supplies costs and power costs are relevant C. Only supplies costs are relevant D. Only power costs are relevant Special Order Poppy has received a special order for 1,000 units of its product at a special price of $125. The product currently sells 18,000 units for $150 and has the following manufacturing costs: Per unit Direct materials $ 45 Direct labor 30 Variable manufacturing overhead 35 Fixed manufacturing overhead 25 Unit cost $ 135 Assume that Poppy has sufficient capacity to fill the order without harming normal production and sales. a. If Poppy accepts the order, what effect will the order have on the company's short-term profit? (Answer: increase by $15,000) b. What minimum price should Poppy be willing to accept a special order? Answer: minimum price is $110) Add/Drop The management of Heider Corporation is considering dropping product J14V. Data from the company's accounting system appear below: Sales $920,000 Variable expenses $377,000 Fixed manufacturing expenses $ 359,000 Fixed selling and administrative expenses $239,000 In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $172,000 of the fixed selling and administrative expenses are avoidable if product J14V is discontinued. What would be the effect on the company's overall net operating income if product J14V were dropped? Answer: decrease by $160,000) Make/Buy Talboe Company makes wheels which it uses in the production of children's wagons. Talboe's costs to produce 200,000 wheels annually are as follows: Direct materials $0.2 Direct labor 0.3 Variable manufacturing overhead 0.15 Fixed manufacturing overhead 0.35 Total $1 An outside supplier has offered to sell Talboe similar wheels for $0.80 per wheel. If the wheels are purchased from the outside supplier, $25,000 of annual fixed manufacturing overhead would be avoided and the facilities now being used to make the wheels would be rented to another company for $55,000 per year. If Talboe chooses to buy the wheel from the outside supplier, how would that affect the company's annual net operating income? (Answer: increase by $50,000) Sell or Process further Yukon Perfume Corporation manufactures three distinct perfumes (I, II and II) from a single joint process. The three perfumes can be sold to discount stores in the form they are in at the split-off point. However, if the perfumes are further processed, they can be sold to specialty stores. Costs related to each batch of perfume separation is as follows: Perfume Perfume II Perfume III Sales value at split-off point $1,500 $800 $900 Allocated joint costs $1,000 $1,000 $1,000 Sales valve after further processing $3,500 $2,000 $1,800 Cost of further processing $1,800 $1,400 $500 What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? AND Based on your analysis, which product or products should be sold at the split-off point and which product or products should be processed further? Answer: sell II as is and further process I and III) Utilization of a constraint Broze Corp. Company makes four products in a single facility. These products have the following unit product costs. The selling price, costs, labor requirements, and demand of the three products are as follows: Product A Product B Product C Selling price per unit $50 $30 $40 Variable cost per unit $35 $10 $30 Direct Labor hours per unit 1.5 3 2 Demand 1,000 2,000 500 a. In what order should Castor prioritize production of the products? Answer: produd A, then B, then C) b. How many of each product should be sold during the labor shortage to maximize profit? (Answer: 1,000 units of Product A, 500 units of Product B, and 0 units of Product C)