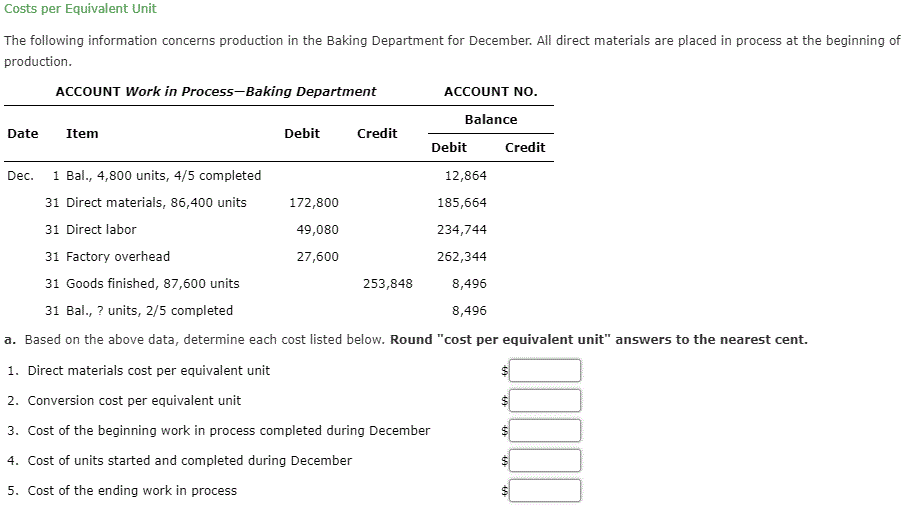

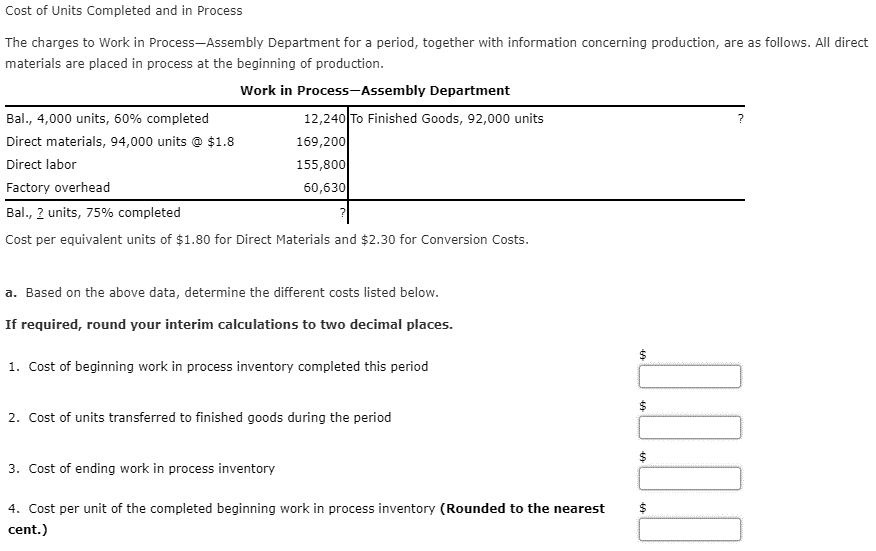

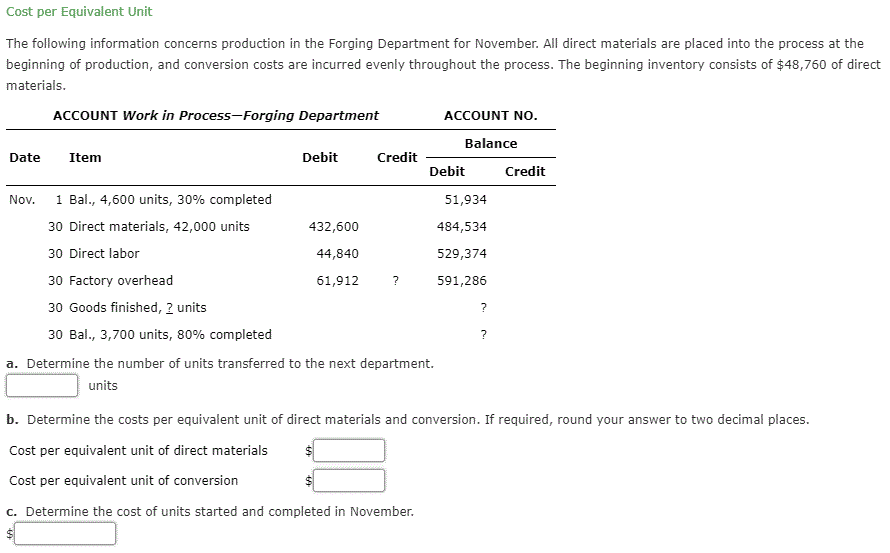

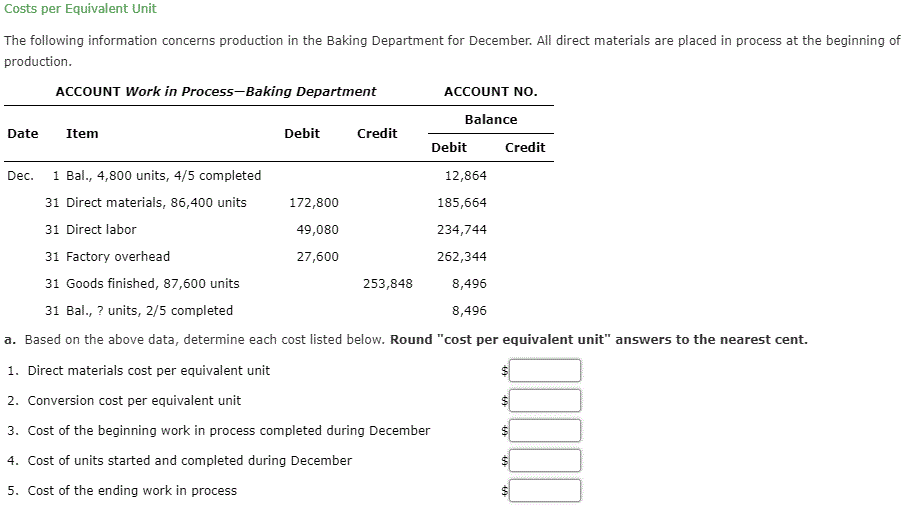

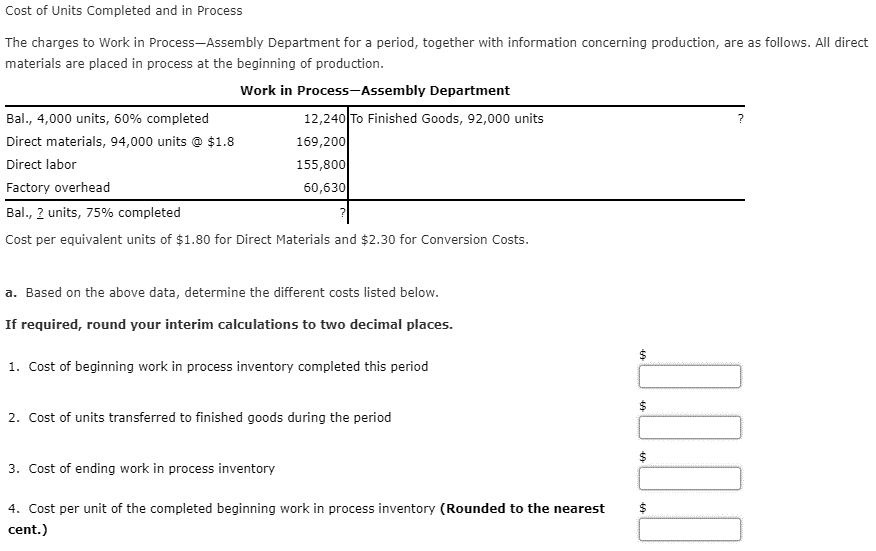

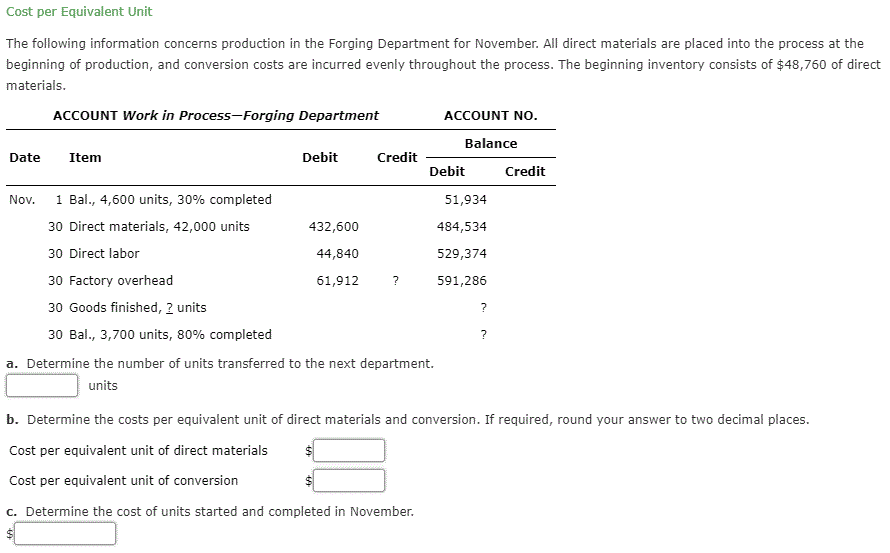

Costs per Equivalent Unit Dec. The following information concerns production in the Baking Department for December. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 1 Bal., 4,800 units, 4/5 completed 12,864 31 Direct materials, 86,400 units 172,800 185,664 31 Direct labor 49,080 234,744 31 Factory overhead 27,600 262,344 31 Goods finished, 87,600 units 253,848 8,496 31 Bal., 2 units, 2/5 completed 8,496 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during December 4. Cost of units started and completed during December $ $ $ 5. Cost of the ending work in process Cost of Units Completed and in Process The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 4,000 units, 60% completed 12,240 To Finished Goods, 92,000 units ? Direct materials, 94,000 units @ $1.8 169,200 Direct labor 155,800 Factory overhead 60,630 Bal., 2 units, 75% completed Cost per equivalent units of $1.80 for Direct Materials and $2.30 for Conversion Costs. a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. $ 1. Cost of beginning work in process inventory completed this period $ 2. Cost of units transferred to finished goods during the period TTTT $ 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) Cost per Equivalent Unit The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $48,750 of direct materials. ACCOUNT Work in Process-Forging Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit ? Nov. 1 Bal., 4,600 units, 30% completed 51,934 30 Direct materials, 42,000 units 432,600 484,534 30 Direct labor 44,840 529,374 30 Factory overhead 61,912 591,286 30 Goods finished, 2 units 30 Bal., 3,700 units, 80% completed ? a. Determine the number of units transferred to the next department. units ? $ b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of conversion c. Determine the cost of units started and completed in November