Answered step by step

Verified Expert Solution

Question

1 Approved Answer

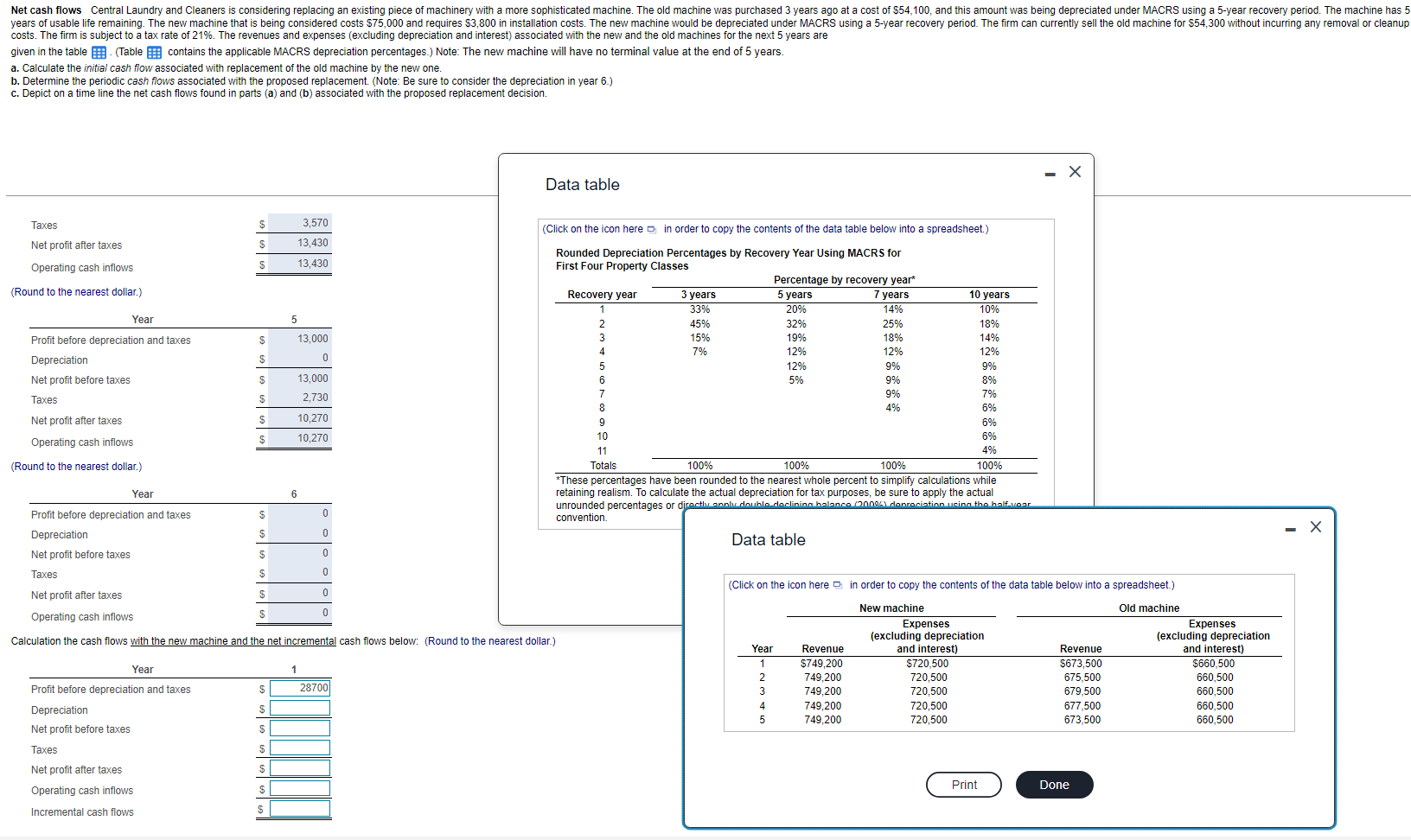

costs. The firm is subject to a tax rate of 2 1 % . The revenues and expenses ( excluding depreciation and interest ) associated

costs. The firm is subject to a tax rate of The revenues and expenses excluding depreciation and interest associated with the new and the old machines for the next years are given in the table Table contains the applicable MACRS depreciation percentages. Note: The new machine will have no terminal value at the end of years.

a Calculate the initial cash flow associated with replacement

of the old machine by the new one.

b Determine the periodic cash flows associated with the proposed replacement. Note: Be sure to consider the depreciation in year

c Depict on a time line the net cash flows found in parts a and b associated with the proposed replacement decision.

plz answer Calculation the cash flows with the new machine and the net incremental cash flows below all the information is on there.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started