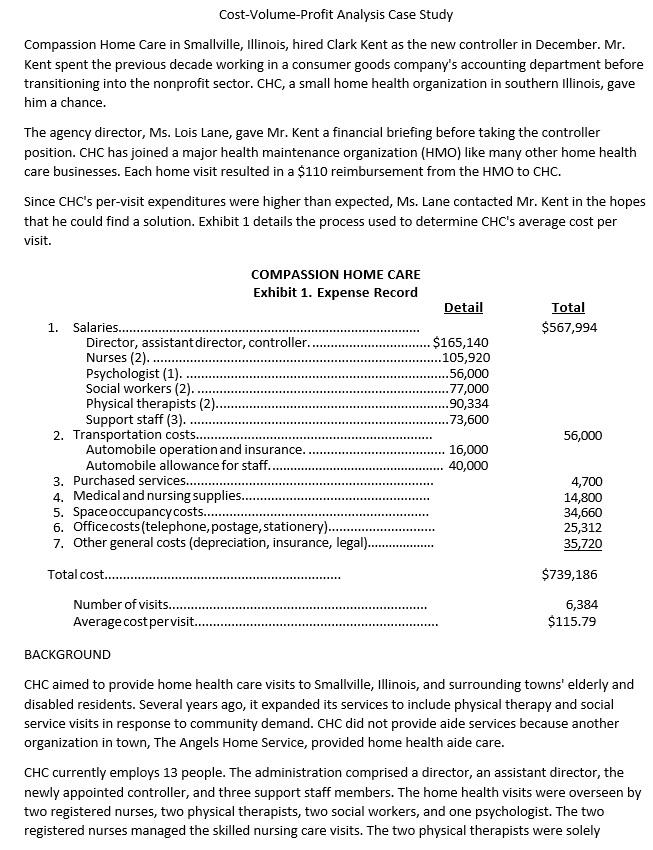

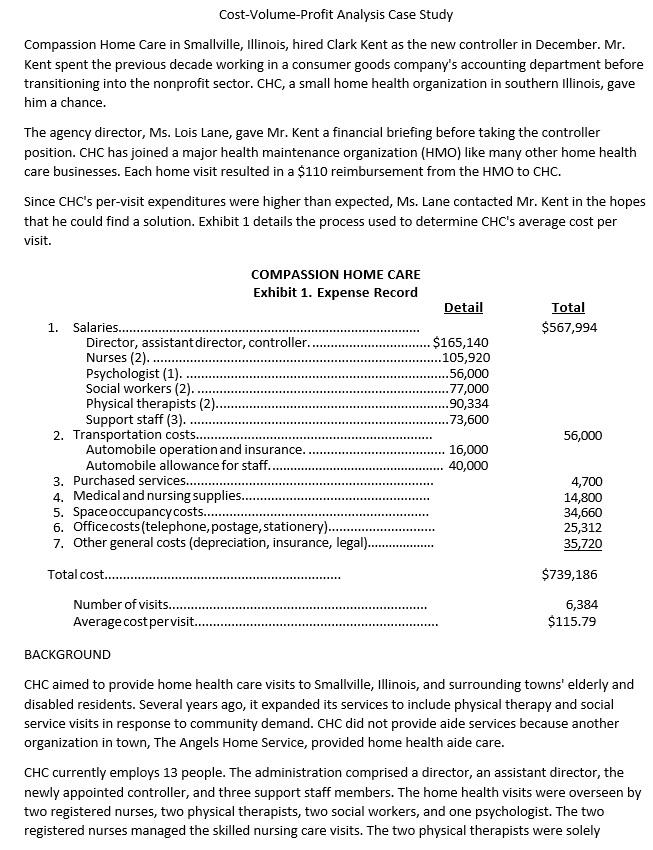

Cost-Volume-Profit Analysis Case Study Compassion Home Care in Smallville, Illinois, hired Clark Kent as the new controller in December. Mr. Kent spent the previous decade working in a consumer goods company's accounting department before transitioning into the nonprofit sector. CHC, a small home health organization in southern Illinois, gave him a chance. The agency director, Ms. Lois Lane, gave Mr. Kent a financial briefing before taking the controller position. CHC has joined a major health maintenance organization (HMO) like many other home health care businesses. Each home visit resulted in a $110 reimbursement from the HMO to CHC. Since CHC s per-visit expenditures were higher than expected, Ms. Lane contacted Mr. Kent in the hopes that he could find a solution. Exhibit 1 details the process used to determine CHC s average cost per visit. BACKGROUND CHC aimed to provide home health care visits to Smallville, Illinois, and surrounding towns' elderly and disabled residents. Several years ago, it expanded its services to include physical therapy and social service visits in response to community demand. CHC did not provide aide services because another organization in town, The Angels Home Service, provided home health aide care. CHC currently employs 13 people. The administration comprised a director, an assistant director, the newly appointed controller, and three support staff members. The home health visits were overseen by two registered nurses, two physical therapists, two social workers, and one psychologist. The two registered nurses managed the skilled nursing care visits. The two physical therapists were solely responsible for patient visits. Social workers made all social service visits in consultation with the psychologist (who did not make any visits). The CHC staff worked 240 days per year on average. The two registered nurses in charge of all nursing visits could provide up to seven daily visits. However, because case visits varied greatly in terms of time, effort, and location, the nurses only made 5.5 visits per day on average. The physical therapists made an average of 3.3 visits per day, though Ms. Lane believed their capacity could be increased by at least 33% if there was a demand. Ms. Lane thought the social workers' visits could increase to around 5.5 per day. DATA Mr. Kent spent his first few weeks reviewing CHC s financial statements, employee service sheets, and other working papers to become acquainted with the agency's financial situation and planning requirements. He realized the agency had been operating with no cost objectives. After a cursory review of previous records, he determined that his priority should be ensuring revenue exceeded costs. Mr. Kent determined that CHC had two types of costs, as shown in Exhibit 1, those that changed based on the number of visits provided and those that remained constant regardless of volume. He reasoned that CHC s revenue of $110 per visit would equal the total cost of the expenses generated by each visit plus the fixed expenses at their break-even point. Mr. Kent reviewed each item on the Expense Record to see what kind of cost it was. He believed that medical-related salaries and medical and nursing supplies varied directly with the number of visits. When he discussed his findings with Ms. Lane, she suggested that the staff automobile allowance be adjusted based on the number of visits because it referred to mileage incurred by medical personnel while performing home visits. Mr. Kent thought it was "terrific." "I can now calculate a variable cost per visit and easily determine the break-even point. I can show them their costs and revenues and where we'll have to operate to keep this agency running." REQUIRED: a. Estimate the total fixed costs and the variable cost per visit. You are free to make assumptions. b. Calculate the break-even point in number of visits. c. Ms. Lane knew negotiating a higher price or reimbursement per visit from the affiliated HMO was highly unlikely. Moreover, she also believed there was no demand in the community for more nursing, physical therapy, or social service visits. What should Ms. Lane and Mr. Kent do to continue operating the facility and earn a profit