Answered step by step

Verified Expert Solution

Question

1 Approved Answer

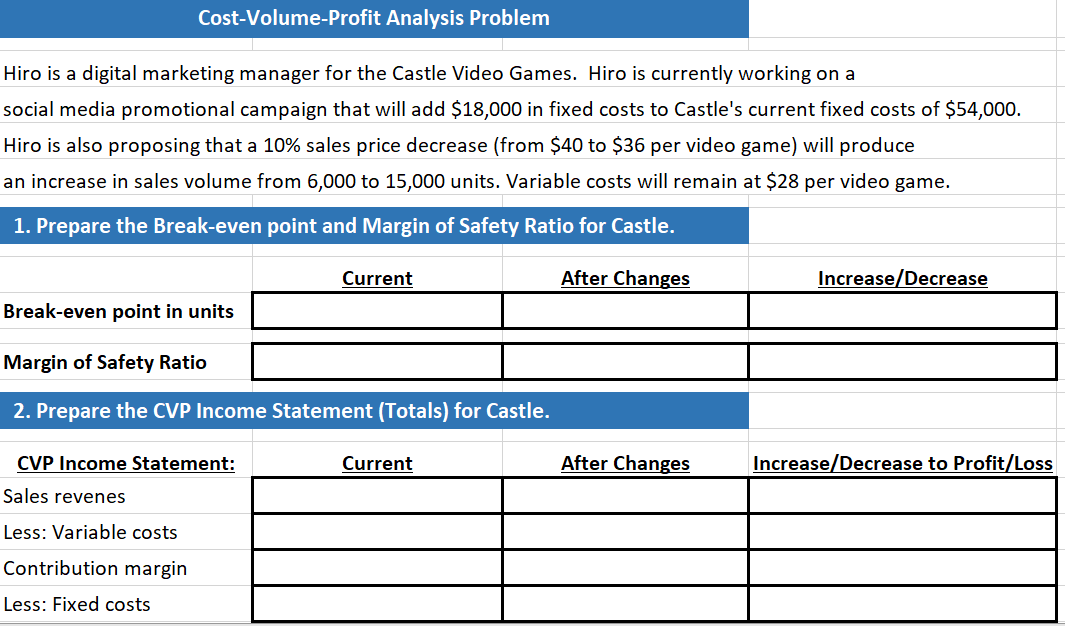

Cost-Volume-Profit Analysis Problem Hiro is a digital marketing manager for the Castle Video Games. Hiro is currently working on a social media promotional campaign

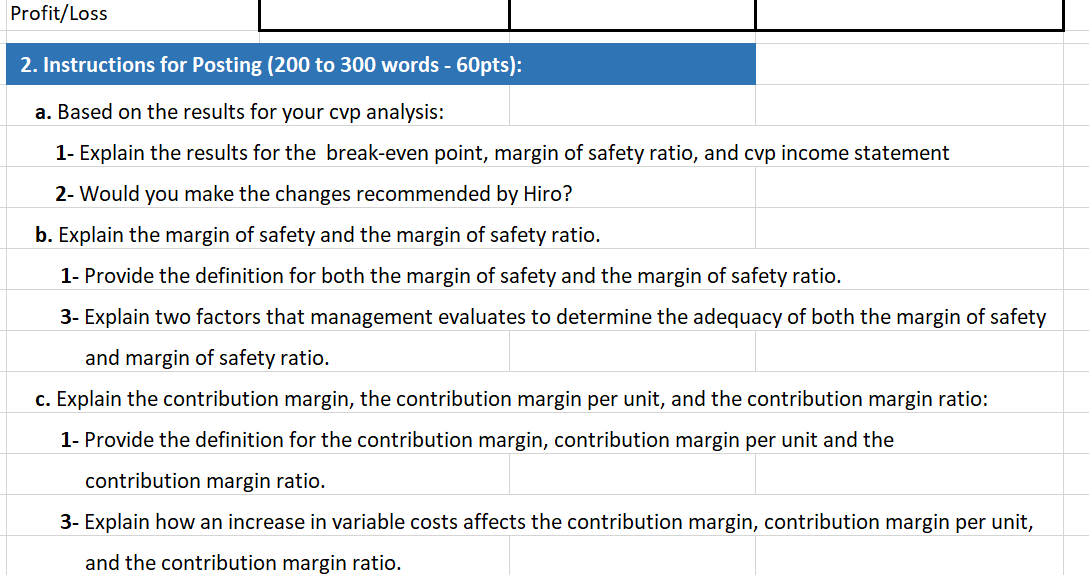

Cost-Volume-Profit Analysis Problem Hiro is a digital marketing manager for the Castle Video Games. Hiro is currently working on a social media promotional campaign that will add $18,000 in fixed costs to Castle's current fixed costs of $54,000. Hiro is also proposing that a 10% sales price decrease (from $40 to $36 per video game) will produce an increase in sales volume from 6,000 to 15,000 units. Variable costs will remain at $28 per video game. 1. Prepare the Break-even point and Margin of Safety Ratio for Castle. Current After Changes Increase/Decrease Break-even point in units Margin of Safety Ratio 2. Prepare the CVP Income Statement (Totals) for Castle. CVP Income Statement: Current Changes Increase/Decrease to Profit Sales revenes Less: Variable costs Contribution margin Less: Fixed costs Profit/Loss 2. Instructions for Posting (200 to 300 words - 60pts): a. Based on the results for your cvp analysis: 1- Explain the results for the break-even point, margin of safety ratio, and cvp income statement 2- Would you make the changes recommended by Hiro? b. Explain the margin of safety and the margin of safety ratio. 1- Provide the definition for both the margin of safety and the margin of safety ratio. 3- Explain two factors that management evaluates to determine the adequacy of both the margin of safety and margin of safety ratio. c. Explain the contribution margin, the contribution margin per unit, and the contribution margin ratio: 1- Provide the definition for the contribution margin, contribution margin per unit and the contribution margin ratio. 3- Explain how an increase in variable costs affects the contribution margin, contribution margin per unit, and the contribution margin ratio.

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Break Even Points is increased by 4500 units Margin of safety Ratio increased by 667 and Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started