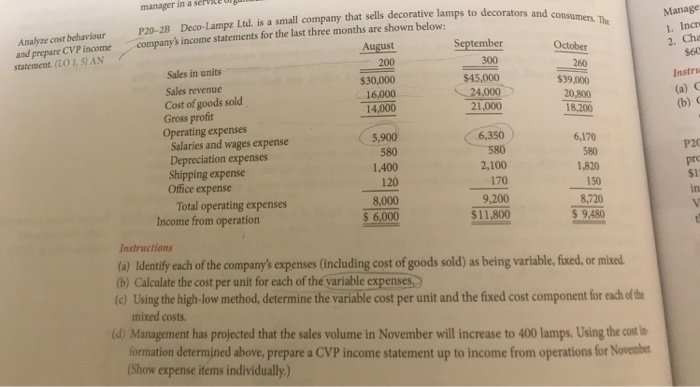

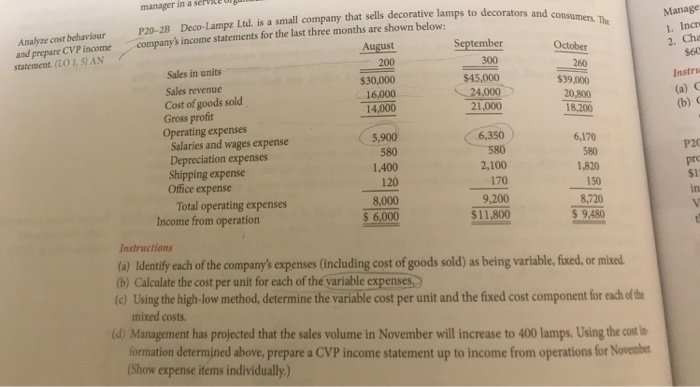

Cost-Volume-Profit Relationships INTRO 0-1 Tan company in P Desemine the variable cost per haircut, and the total monthly find out Cele therak-even point in unit and dollars. ara CVP graph, assuming a maximum of 1.300 hants in a month. Use increments of the hortal and increments of $3.000 on the vertical axis in the profit assuming 1.700 haircuts are given in a month Costo Seng Admi Total TAKING IT FURTHER Explain how the costing concepts would apply to a service organization manager in a service organization handle material costs? to decorators and A October cost behaviour and prepare CVP income et (OLAN Manager Incre 2. Chan 560. Inst $39,000 Deco-Lampu Led is a small company that sells decorative lamps to decorators and company income statements for the last three months are shown below: August September Sales in units 200 Sales revenue $30,000 $45.000 Cost of goods sold 16.000 24,000 Gross profit 14.000 Operating expenses Salaries and wages expense 5.900 6350 Depreciation expenses 580 Shipping expense 1.400 Office expense 170 Total operating expenses 8.000 9.200 Income from operation $ 6,000 S 1100 720 6,170 590 1,820 pro 2.100 519 inc Va 8.720 $ 9.480 Instructions (a) Identity each of the companys expenses (including cost of goods sold) as being variable, fed, or mixed (b) Calculate the cost per unit for each of the variable expenses c) Using the high-low method, determine the variable cost per unit and the fixed cost component for each of the mixed costs. (d) Management has projected that the sales volume in November will increase to 400 lamps. Using the cost formation determined above, prepare a CVP income statement up to income from operations for Novem (Show expense items individually.) CVP Income and calculate P20- Clearwater Comoration produces LOKAL, a fruit drink. The beverage is sold for 50 cents per to distributors who charge retailers 70 cents per bottle. At full (100%) plant capacity management vrators and consumers. The Manage 1. Incre 2. Cha Analyze cost behaviour prepare CVP Income statement (LO 1,5) AN October 260 $39.000 20.800 18,200 $66 Instru 14,000 manager in a service p202 Deco-Lampe Ltd. is a small company that sells decorative lamps to decorators and company's income statements for the last three months are shown below: August September 200 Sales in units 300 Sales revenue $30,000 $45.000 16,000 Cost of goods sold 24,000 Gross profit 21,000 Operating expenses Salaries and wages expense 5,900 6,350 Depreciation expenses 580 580 Shipping expense 1,400 2,100 Office expense 120 170 Total operating expenses 8,000 9.200 Income from operation $ 6,000 $11,800 P20 pro 6,170 580 1,820 150 8,720 $ 9,480 Instructions (a) Identify each of the company's expenses (including cost of goods sold) as being variable, fixed, or mixed. (b) Calculate the cost per unit for each of the variable expenses. (c) Using the high-low method, determine the variable cost per unit and the fixed cost component for each of the mixed costs. (d) Management has projected that the sales volume in November will increase to 400 lamps. Using the cost in formation determined above, prepare a CVP income statement up to income from operations for November (Show expense items individually.)