Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cotton Lab Limited is a manufacturer of various types of bedding. The company has a 31 March financial year-end. Cotton Lab Limited valued its

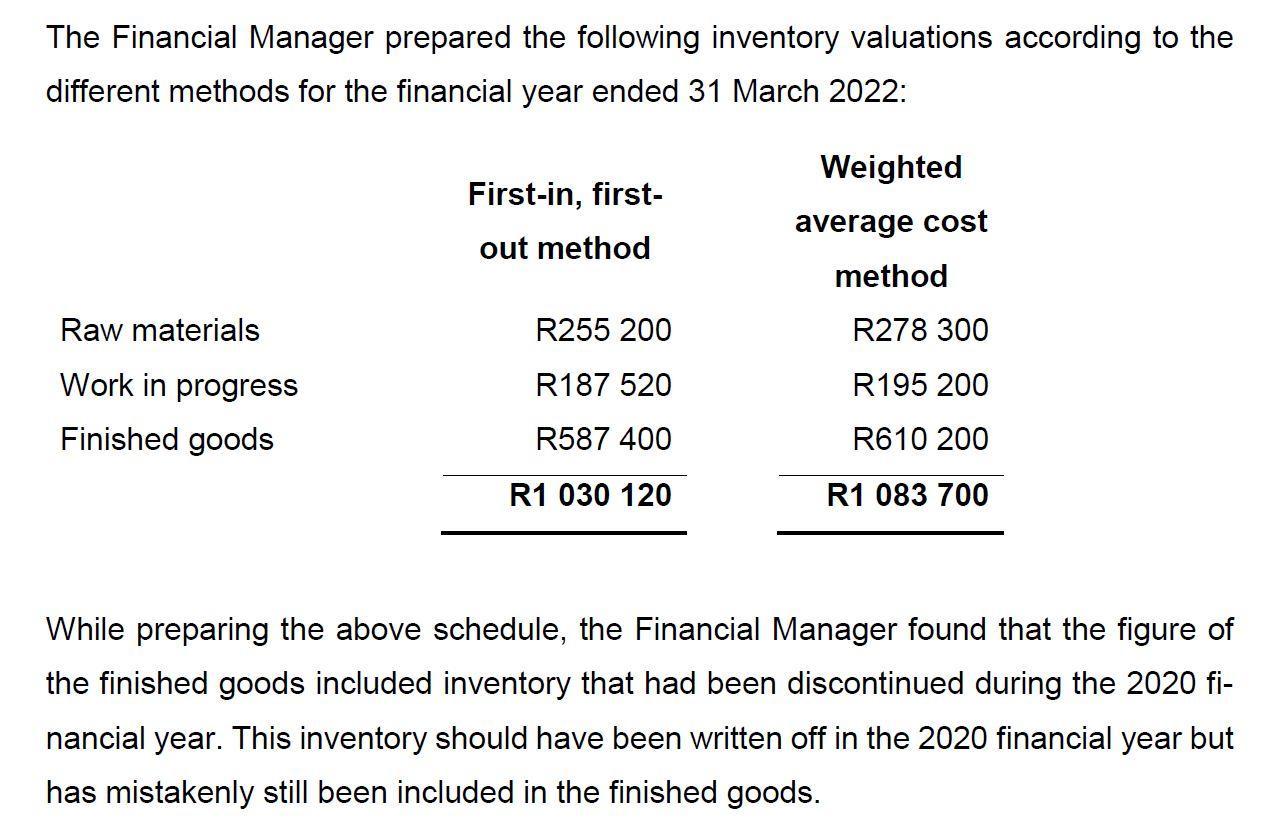

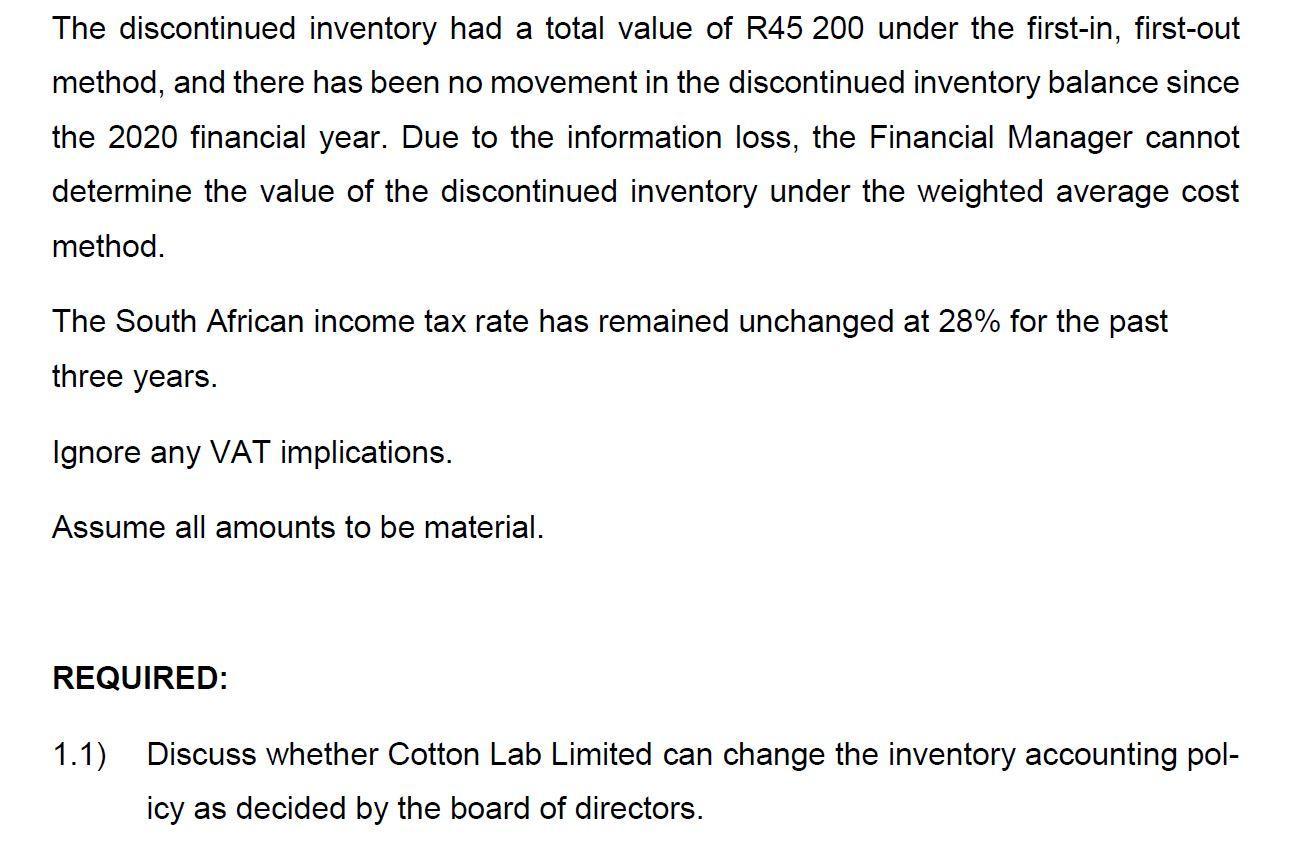

Cotton Lab Limited is a manufacturer of various types of bedding. The company has a 31 March financial year-end. Cotton Lab Limited valued its inventory using the first-in, first-out method and the Fi- nancial Manager prepared the draft financial statements for 31 March 2022 according to this method. While reviewing the draft financial statements at a board meeting, the directors decided to change the inventory valuation method to the weighted average cost method. They believe that it would be a more appropriate method to match the revenue with the expenses. Due to load shedding, one of the company's servers was damaged, and the server's information was partially lost. Included in the information lost was the inventory history for all years before the 2022 financial year. Therefore, Cotton Lab Limited could not determine the weighted average cost for any inventory before the 2022 financial year. The Financial Manager prepared the following inventory valuations according to the different methods for the financial year ended 31 March 2022: Raw materials Work in progress Finished goods First-in, first- out method R255 200 R187 520 R587 400 R1 030 120 Weighted average cost method R278 300 R195 200 R610 200 R1 083 700 While preparing the above schedule, the Financial Manager found that the figure of the finished goods included inventory that had been discontinued during the 2020 fi- nancial year. This inventory should have been written off in the 2020 financial year but has mistakenly still been included in the finished goods. The discontinued inventory had a total value of R45 200 under the first-in, first-out method, and there has been no movement in the discontinued inventory balance since the 2020 financial year. Due to the information loss, the Financial Manager cannot determine the value of the discontinued inventory under the weighted average cost method. The South African income tax rate has remained unchanged at 28% for the past three years. Ignore any VAT implications. Assume all amounts to be material. REQUIRED: 1.1) Discuss whether Cotton Lab Limited can change the inventory accounting pol- icy as decided by the board of directors. 1.2) Assume that the change in accounting policy is allowed, discuss how Cotton Lab Limited should account for the change in accounting policy. No calcula- tions are necessary. 1.3) (7 marks) Disclose all the information above in the notes to the annual financial state- ments of Cotton Lab Limited for the financial year ended 31 March 2022, ac- cording to the requirements of only IAS 8 - Accounting policies, changes in accounting estimates, and errors. Show all workings. Round to the closest Rand where applicable. (22 marks)

Step by Step Solution

★★★★★

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

11 Cotton Lab Limiteds decision to change its inventory accounting policy from the firstin firstout FIFO method to the weighted average cost method raises several accounting and financial reporting co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started