Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cotton Manufacturing Co. uses a job order cost system and maintains inventories under the perpetual method. Journalize the entry to show time tickets indicating

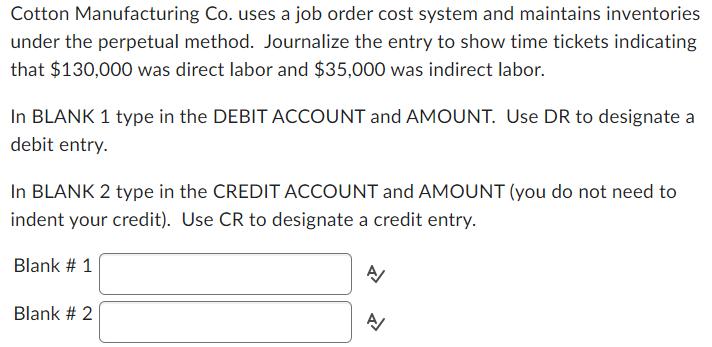

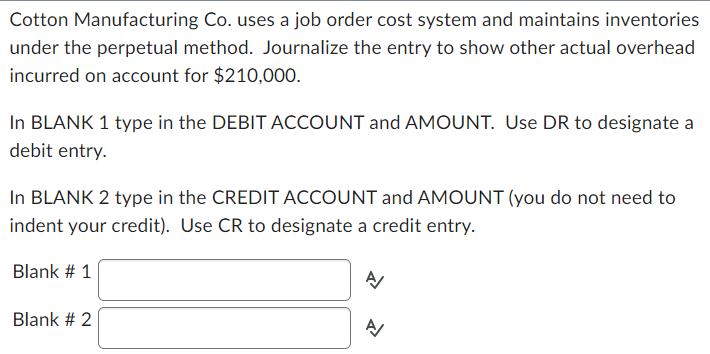

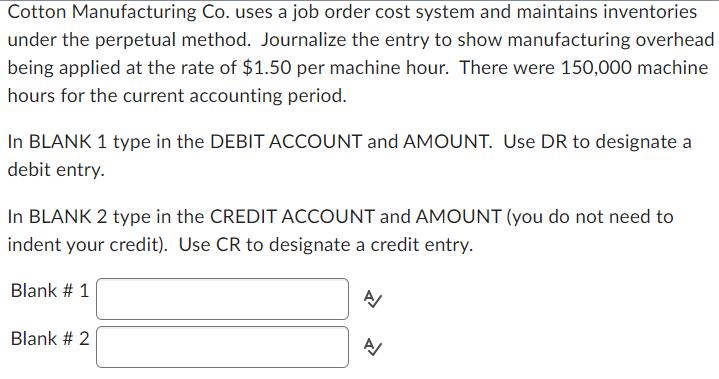

Cotton Manufacturing Co. uses a job order cost system and maintains inventories under the perpetual method. Journalize the entry to show time tickets indicating that $130,000 was direct labor and $35,000 was indirect labor. In BLANK 1 type in the DEBIT ACCOUNT and AMOUNT. Use DR to designate a debit entry. In BLANK 2 type in the CREDIT ACCOUNT and AMOUNT (you do not need to indent your credit). Use CR to designate a credit entry. Blank # 1 Blank # 2 A/ A/ Cotton Manufacturing Co. uses a job order cost system and maintains inventories under the perpetual method. Journalize the entry to show other actual overhead incurred on account for $210,000. In BLANK 1 type in the DEBIT ACCOUNT and AMOUNT. Use DR to designate a debit entry. In BLANK 2 type in the CREDIT ACCOUNT and AMOUNT (you do not need to indent your credit). Use CR to designate a credit entry. Blank # 1 Blank # 2 A/ A/ Cotton Manufacturing Co. uses a job order cost system and maintains inventories under the perpetual method. Journalize the entry to show manufacturing overhead being applied at the rate of $1.50 per machine hour. There were 150,000 machine hours for the current accounting period. In BLANK 1 type in the DEBIT ACCOUNT and AMOUNT. Use DR to designate a debit entry. In BLANK 2 type in the CREDIT ACCOUNT and AMOUNT (you do not need to indent your credit). Use CR to designate a credit entry. Blank # 1 Blank # 2 A/ A/

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Blank 1 Journal Entry for Direct Labor Expense Date Account Debit Credit Direct Labor Expense 130000 Cash or Bank 130000 Explanation Direct Labor Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started