Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cougar Mountain Sports has recorded some transactions that occurred during July. In addition, adjusting entries for the month were recorded as well. (Record all normal

Cougar Mountain Sports has recorded some transactions that occurred during July. In addition, adjusting entries for the month were recorded as well. (Record all normal transactions and adjusting journal entry transactions at the same time and complete one adjusted trial balance.)

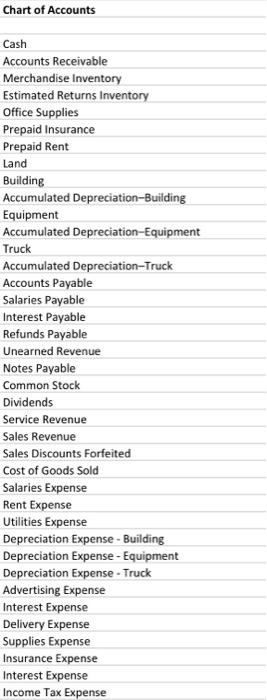

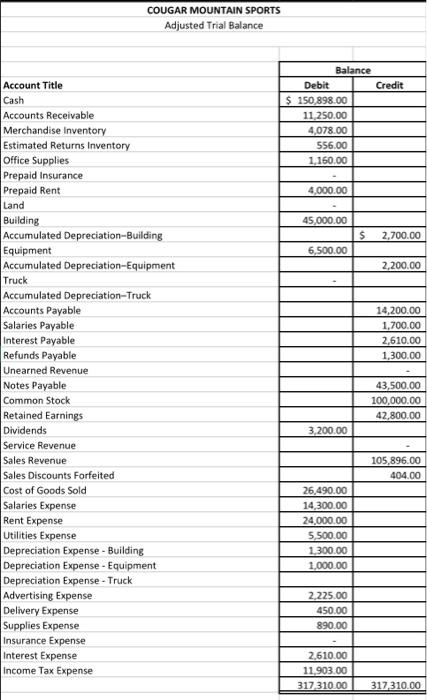

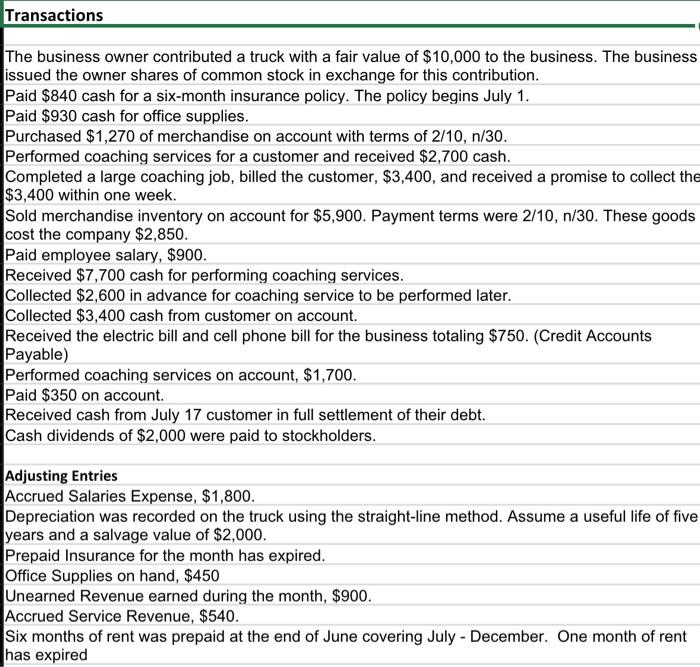

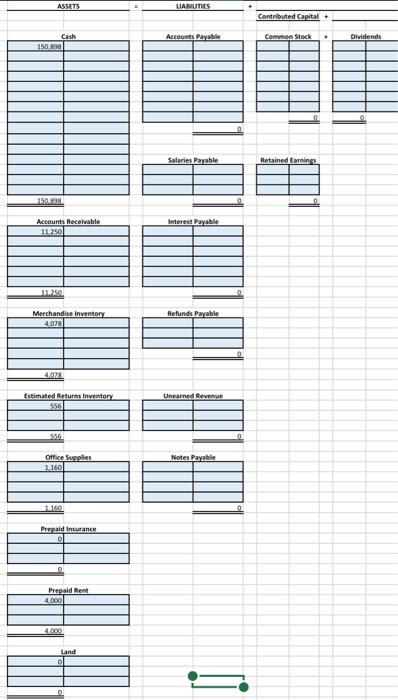

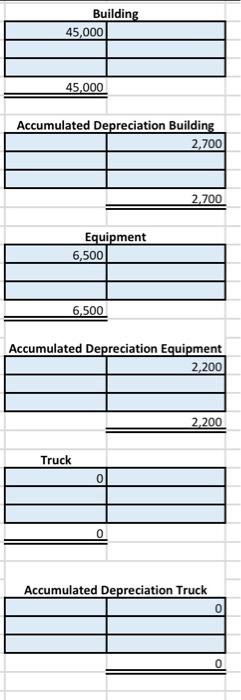

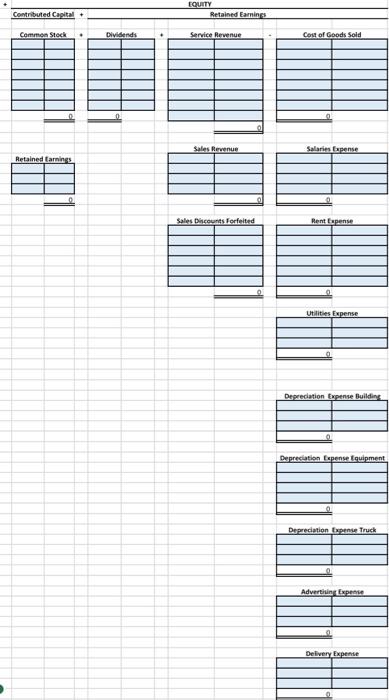

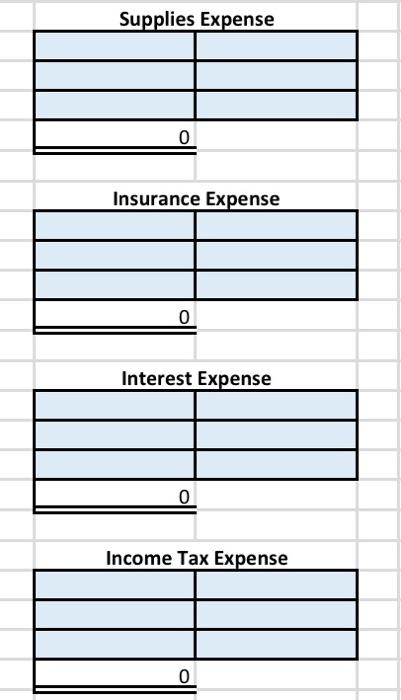

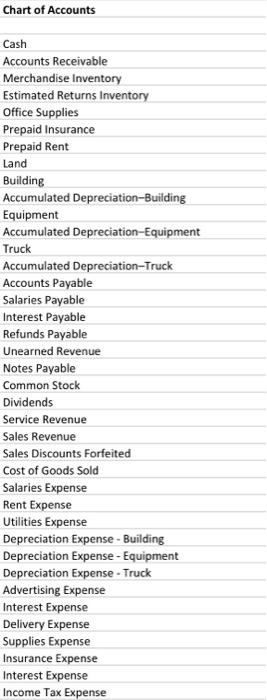

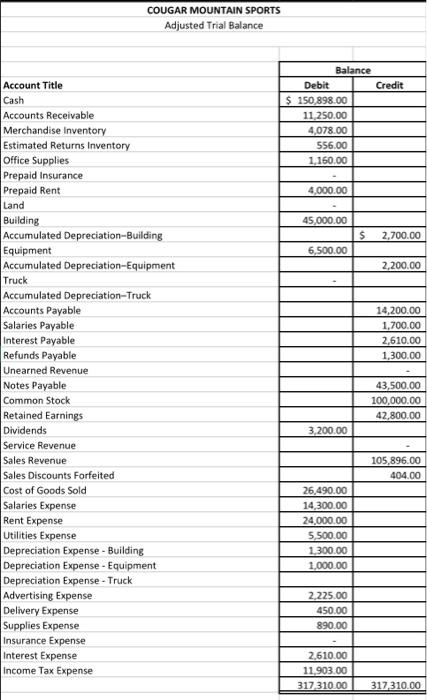

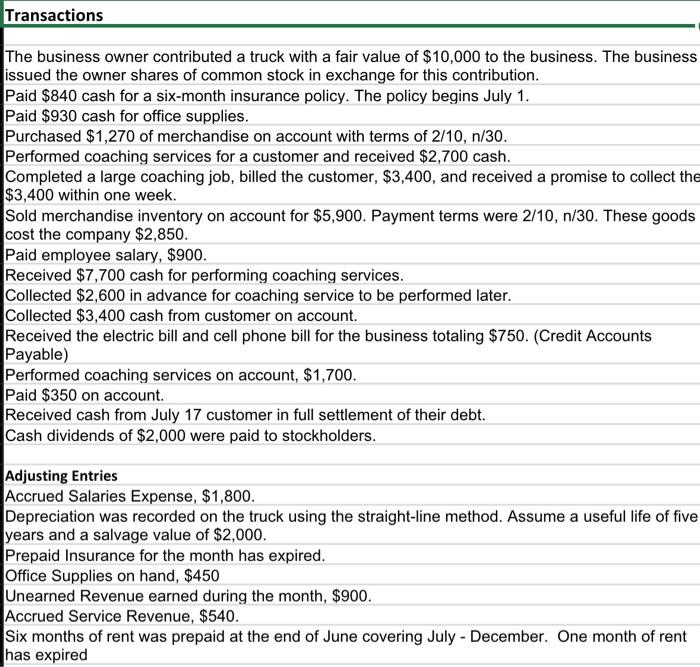

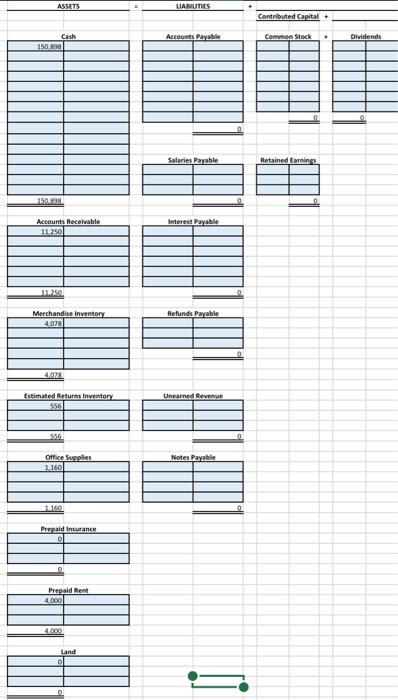

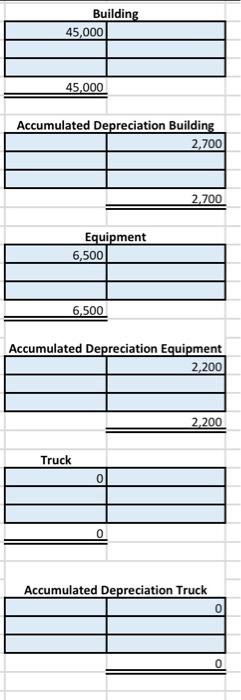

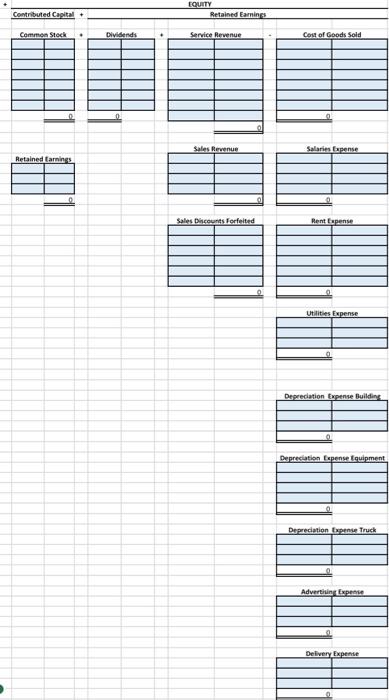

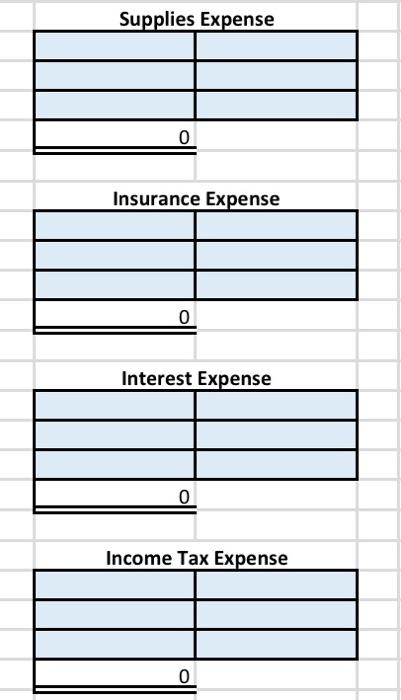

Chart of Accounts Cash Accounts Receivable Merchandise Inventory Estimated Returns Inventory Office Supplies Prepaid Insurance Prepaid Rent Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Truck Accumulated Depreciation-Truck Accounts Payable Salaries Payable Interest Payable Refunds Payable Unearned Revenue Notes Payable Common Stock Dividends Service Revenue Sales Revenue Sales Discounts Forfeited Cost of Goods Sold Salaries Expense Rent Expense Utilities Expense Depreciation Expense - Building Depreciation Expense - Equipment Depreciation Expense - Truck Advertising Expense Interest Expense Delivery Expense Supplies Expense Insurance Expense Interest Expense Income Tax Expense COUGAR MOUNTAIN SPORTS Adjusted Trial Balance Credit Balance Debit $ 150,898.00 11 250.00 4,078.00 556.00 1,160.00 4,000.00 45,000.00 $ 2,700.00 6,500.00 2,200.00 14,200.00 1,700.00 2,610.00 1,300.00 Account Title Cash Accounts Receivable Merchandise Inventory Estimated Returns Inventory Office Supplies Prepaid Insurance Prepaid Rent Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Truck Accumulated Depreciation-Truck Accounts Payable Salaries Payable Interest Payable Refunds Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Sales Revenue Sales Discounts Forfeited Cost of Goods Sold Salaries Expense Rent Expense Utilities Expense Depreciation Expense - Building Depreciation Expense - Equipment Depreciation Expense - Truck Advertising Expense Delivery Expense Supplies Expense Insurance Expense Interest Expense Income Tax Expense 43,500.00 100,000.00 42,800.00 3,200.00 105,896.00 404.00 26.490.00 14 300.00 24,000.00 5,500.00 1,300.00 1,000.00 2.225.00 450.00 890.00 2,610.00 11,903.00 317,310.00 317,310.00 Transactions The business owner contributed a truck with a fair value of $10,000 to the business. The business issued the owner shares of common stock in exchange for this contribution. Paid $840 cash for a six-month insurance policy. The policy begins July 1. Paid $930 cash for office supplies. Purchased $1,270 of merchandise on account with terms of 2/10, n/30. Performed coaching services for a customer and received $2,700 cash. Completed a large coaching job, billed the customer, $3,400, and received a promise to collect the $3,400 within one week. Sold merchandise inventory on account for $5,900. Payment terms were 2/10, n/30. These goods cost the company $2,850. Paid employee salary, $900. Received $7,700 cash for performing coaching services. Collected $2,600 in advance for coaching service to be performed later. Collected $3,400 cash from customer on account. Received the electric bill and cell phone bill for the business totaling $750. (Credit Accounts Payable) Performed coaching services on account, $1,700. Paid $350 on account. Received cash from July 17 customer in full settlement of their debt. Cash dividends of $2,000 were paid to stockholders. Adjusting Entries Accrued Salaries Expense, $1,800. Depreciation was recorded on the truck using the straight-line method. Assume a useful life of five years and a salvage value of $2,000. Prepaid Insurance for the month has expired. Office Supplies on hand, $450 Unearned Revenue earned during the month, $900. Accrued Service Revenue, $540. Six months of rent was prepaid at the end of June covering July - December. One month of rent has expired ASSETS UABUTES Contributed Capital Accounts Payable Common Stock Dividends Cash 150.898 Salaries Payable Retained Earning 150.898 0 Accounts Receivable Interest Payable 11.250 Merchandise Inventory 4,078 Refunds Payable 40 Estimated Returns Inventory Unearned Revenue 555 Office Supplies 1,160 Notes Payable Prepaid insurance Prepaid Rent 4.000 GARA Land Building 45,000 45,000 Accumulated Depreciation Building 2,700 2.700 Equipment 6,500 6.500 Accumulated Depreciation Equipment 2,200 2.200 Truck 0 Accumulated Depreciation Truck 0 0 Contributed Capital EQUITY Retained Earnia Common Stock . Dividends . Service Revenue Cost of Goods Sold Sales Revenue Salaries sense Retained Earnings Sales Discounts forfeited Rent Copense Utilities Expense Depreciation Eupense Building Depreciation Expense tuipment Depreciation pense Truck Adverthing Espese Delivery tapente Supplies Expense 0 Insurance Expense 0 Interest Expense 0 Income Tax Expense 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started