Answered step by step

Verified Expert Solution

Question

1 Approved Answer

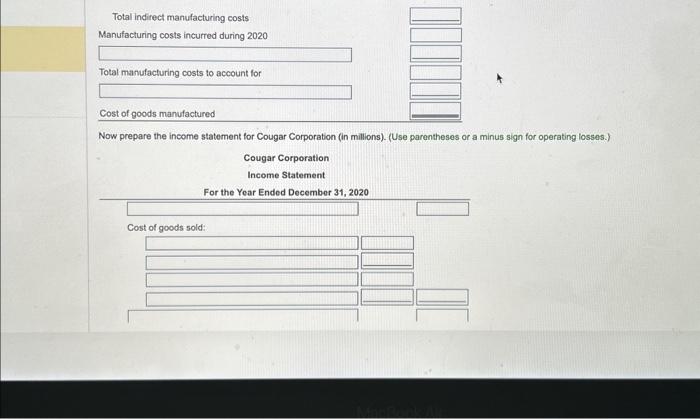

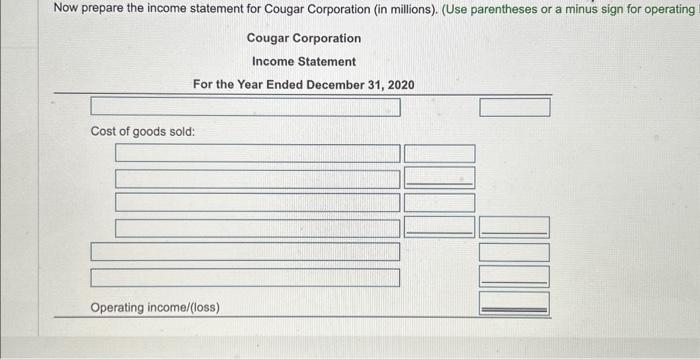

Cougar's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. Now prepare the income statement for Cougar

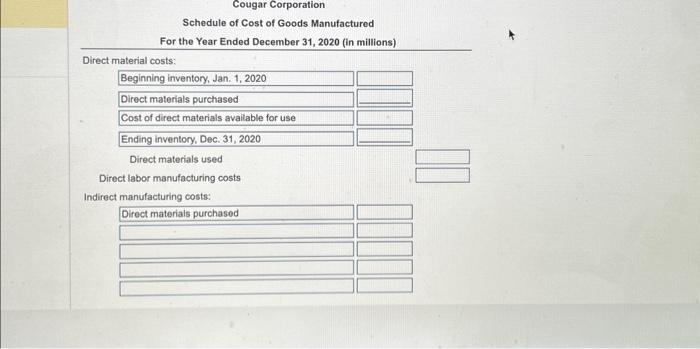

Cougar's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs.

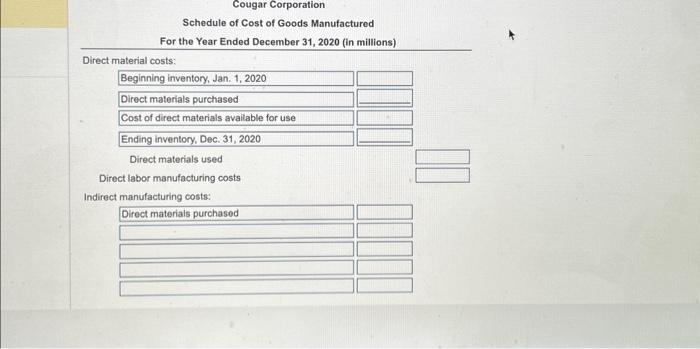

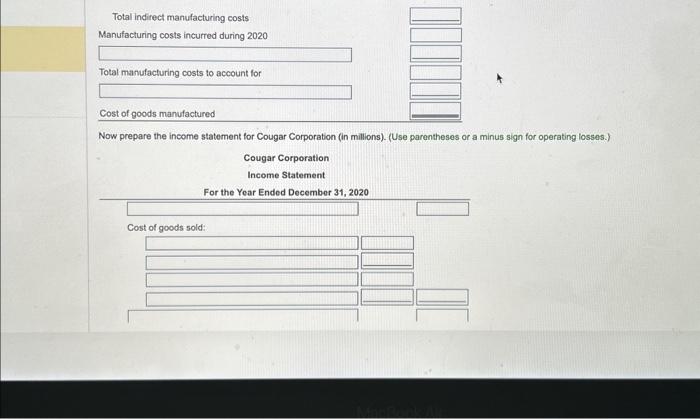

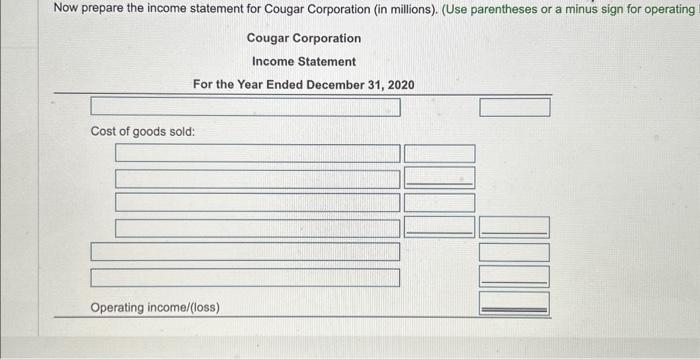

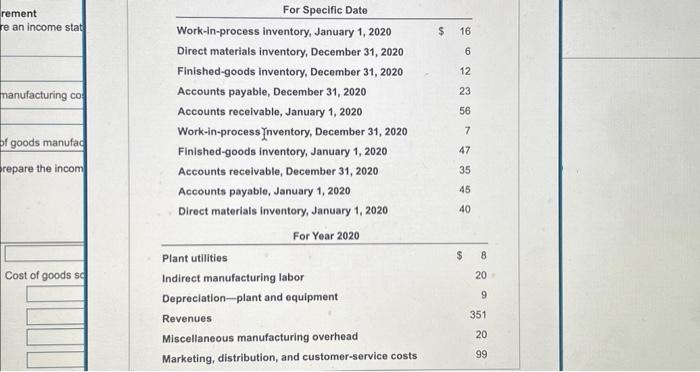

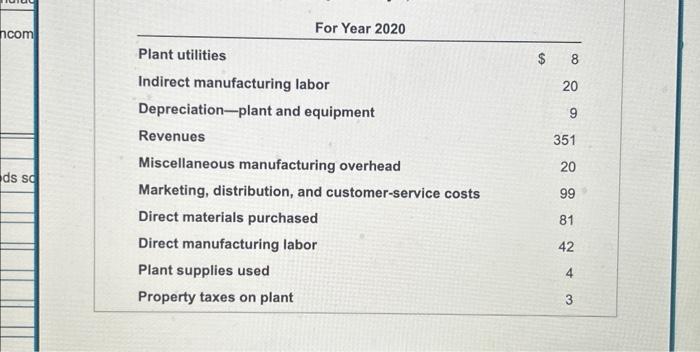

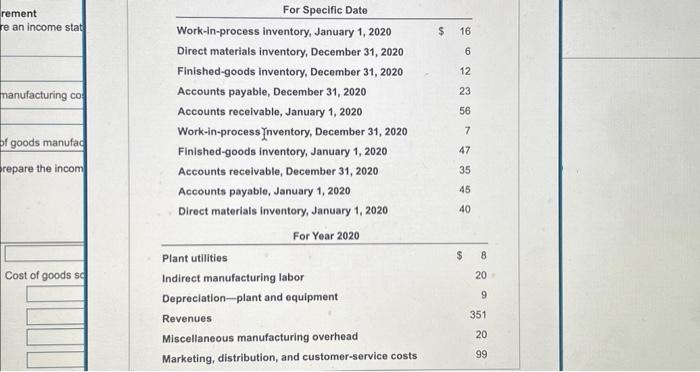

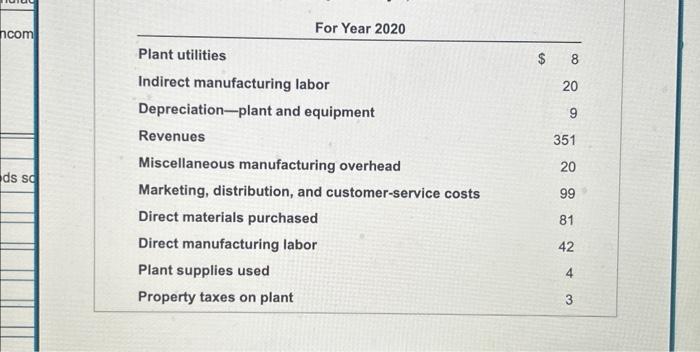

Now prepare the income statement for Cougar Corporation (in millions). (Use parentheses or a minus sign for operating Cougar Corporation Income Statement For the Year Ended December 31, 2020 Cost of goods sold: Operating income/(loss) For Year 2020 \begin{tabular}{lr} \hline Plant utilities & 8 \\ Indirect manufacturing labor & 20 \\ Depreciation-plant and equipment & 9 \\ Revenues & 351 \\ Miscellaneous manufacturing overhead & 20 \\ Marketing, distribution, and customer-service costs & 99 \\ Direct materials purchased & 81 \\ Direct manufacturing labor & 42 \\ Plant supplies used & 4 \\ Property taxes on plant & 3 \end{tabular} Now prepare the income statement for Cougar Corporation (in millions). (Use parantheses or a minus sign for operating losses.) Cougar Corporation Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2020 (in millions) Direct material costs: \begin{tabular}{l} \hline Beginning inventory, Jan. 1, 2020 \\ Direct materials purchased \\ Cost of direct materials avaliable for use \\ Ending inventory, Dec. 31,2020 \end{tabular} Direct materials used Direct labor manufacturing costs Indirect manufacturing costs: \begin{tabular}{|l|l|} \hline Direct materials purchased \\ \hline \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started