Could anyone conduct a detailed analysis on the below aspects for analysing Amazon's business case?

1.Comment on the structure and details of the alliance. What do you recommend should have been taken care of?

2.What action would you recommend for the Amazon-Future Group partnership? What are the implications for your recommendations?

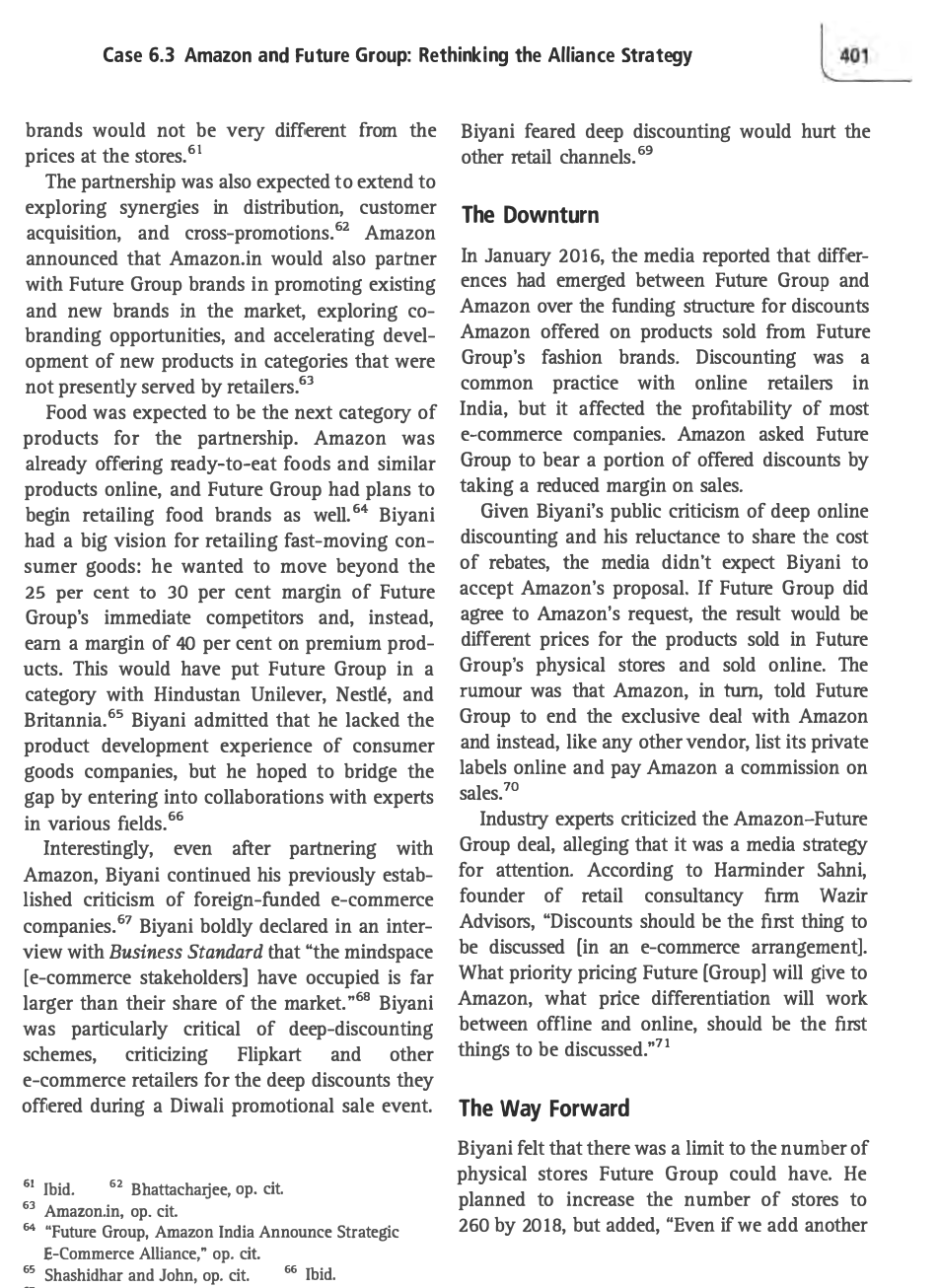

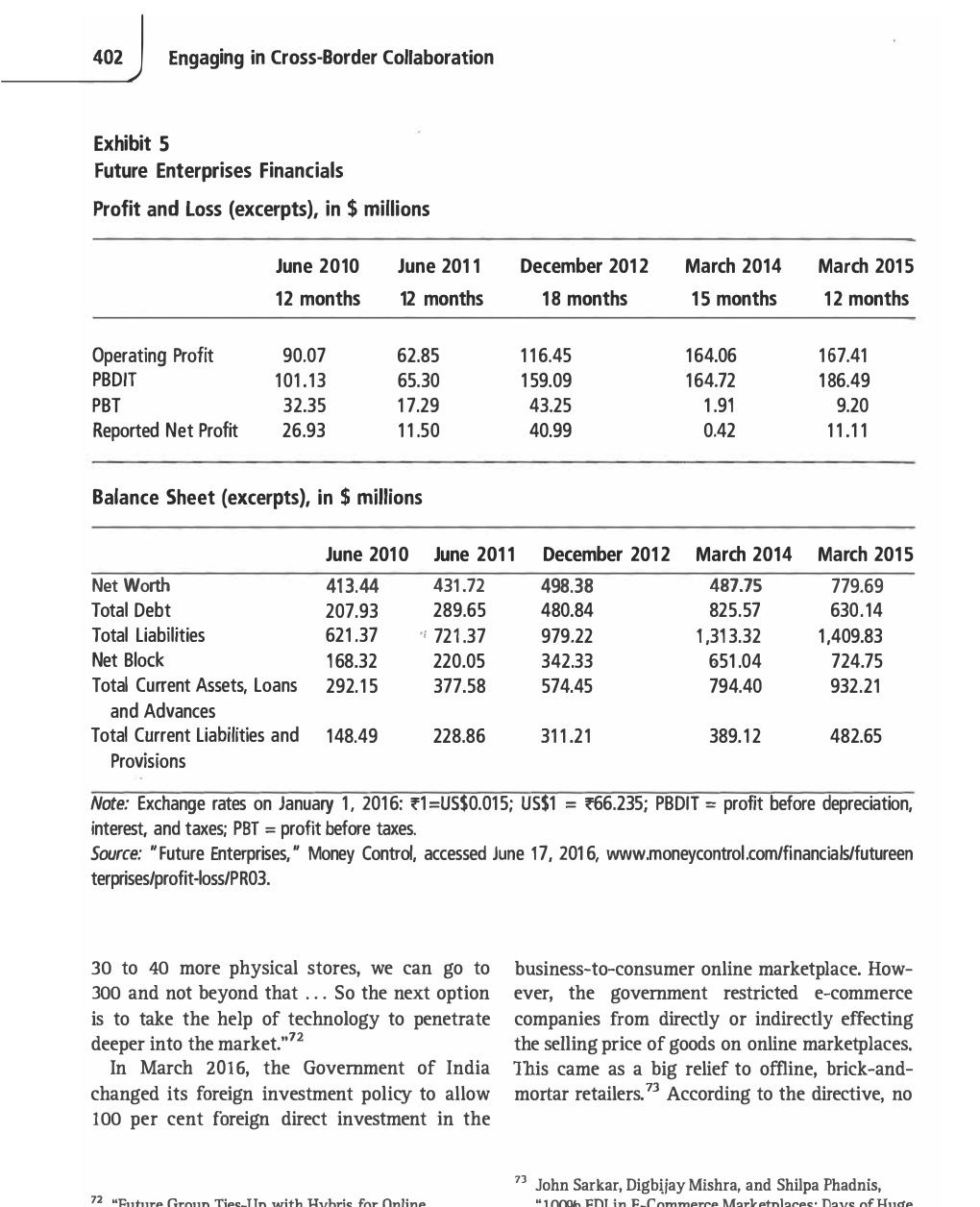

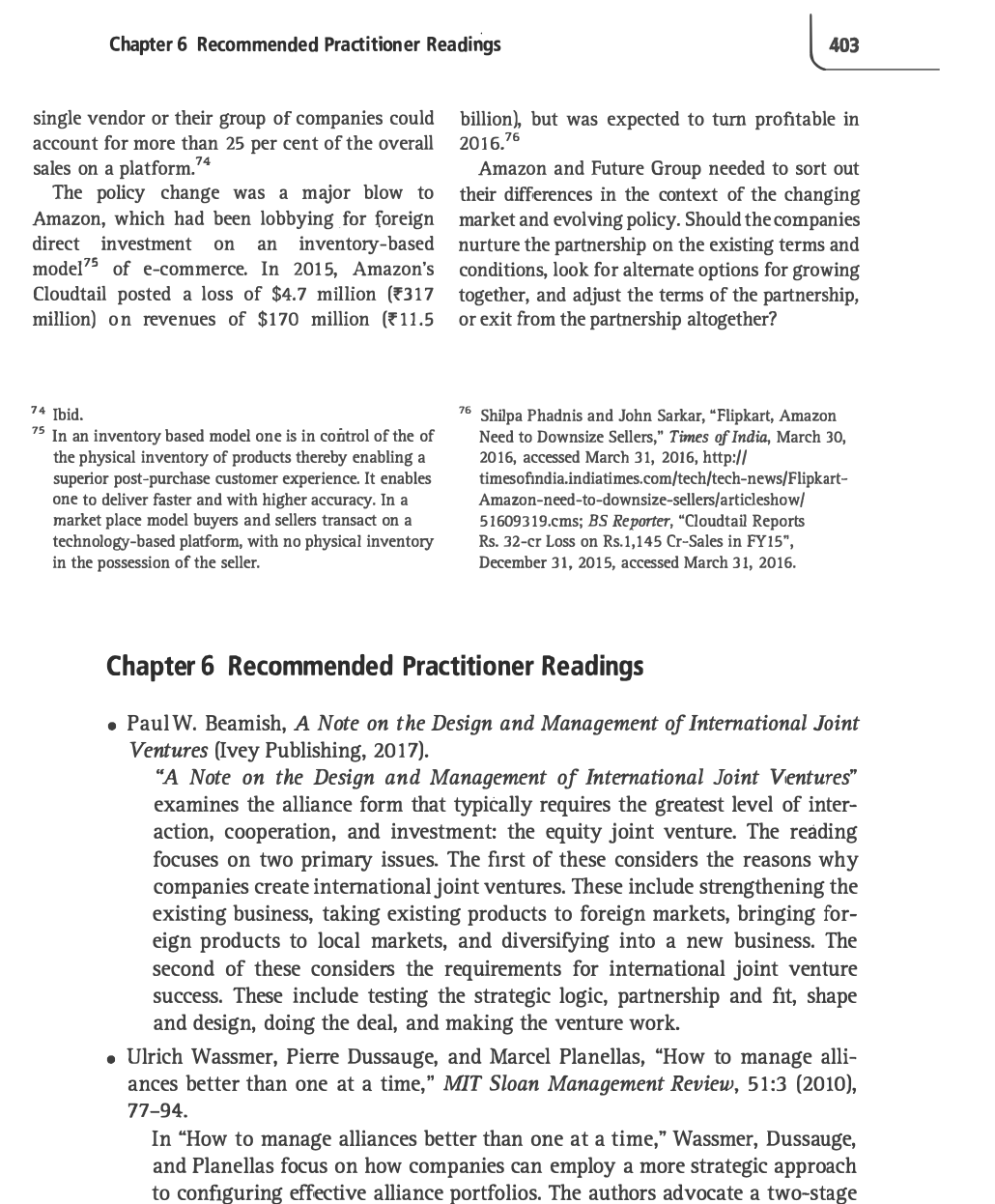

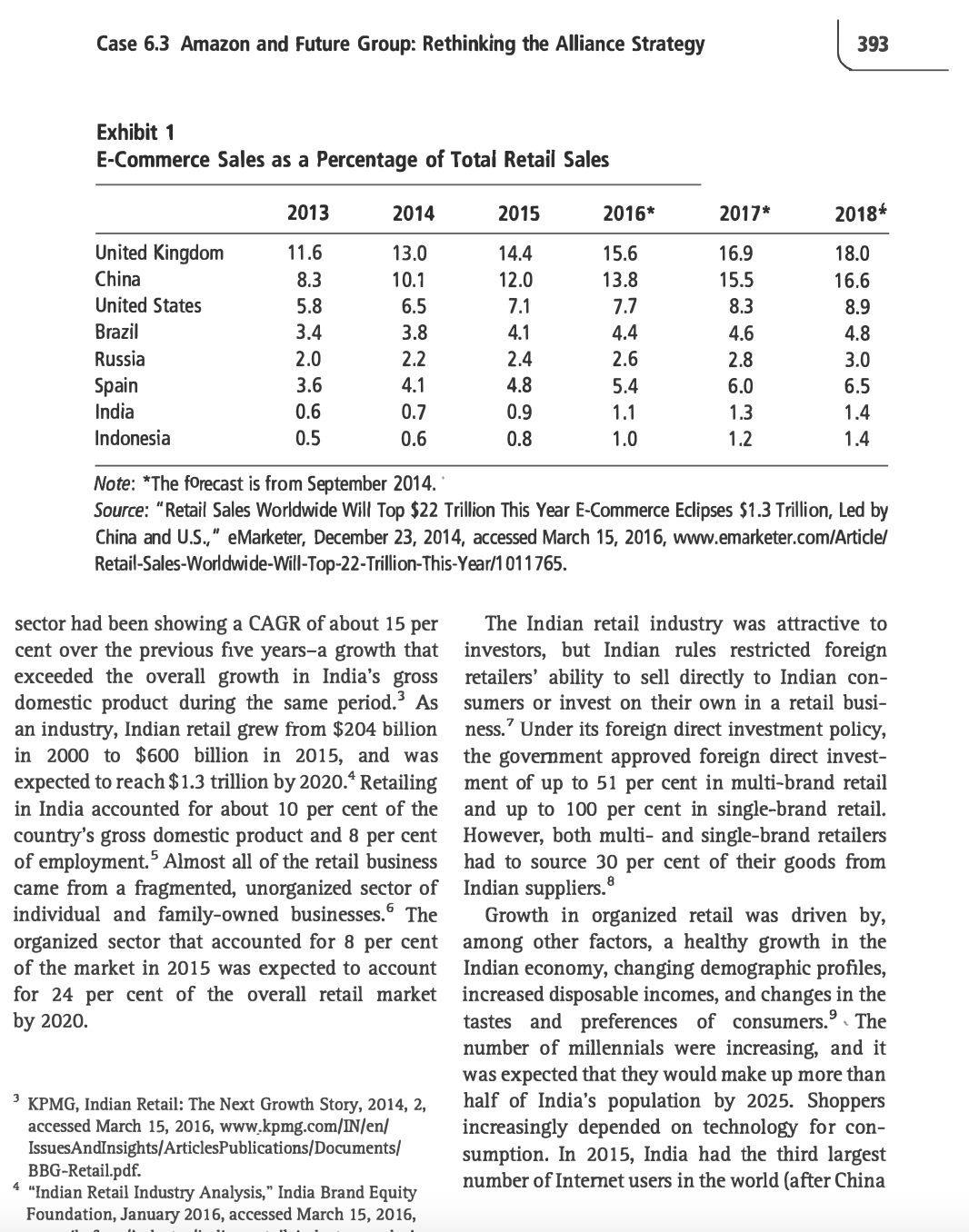

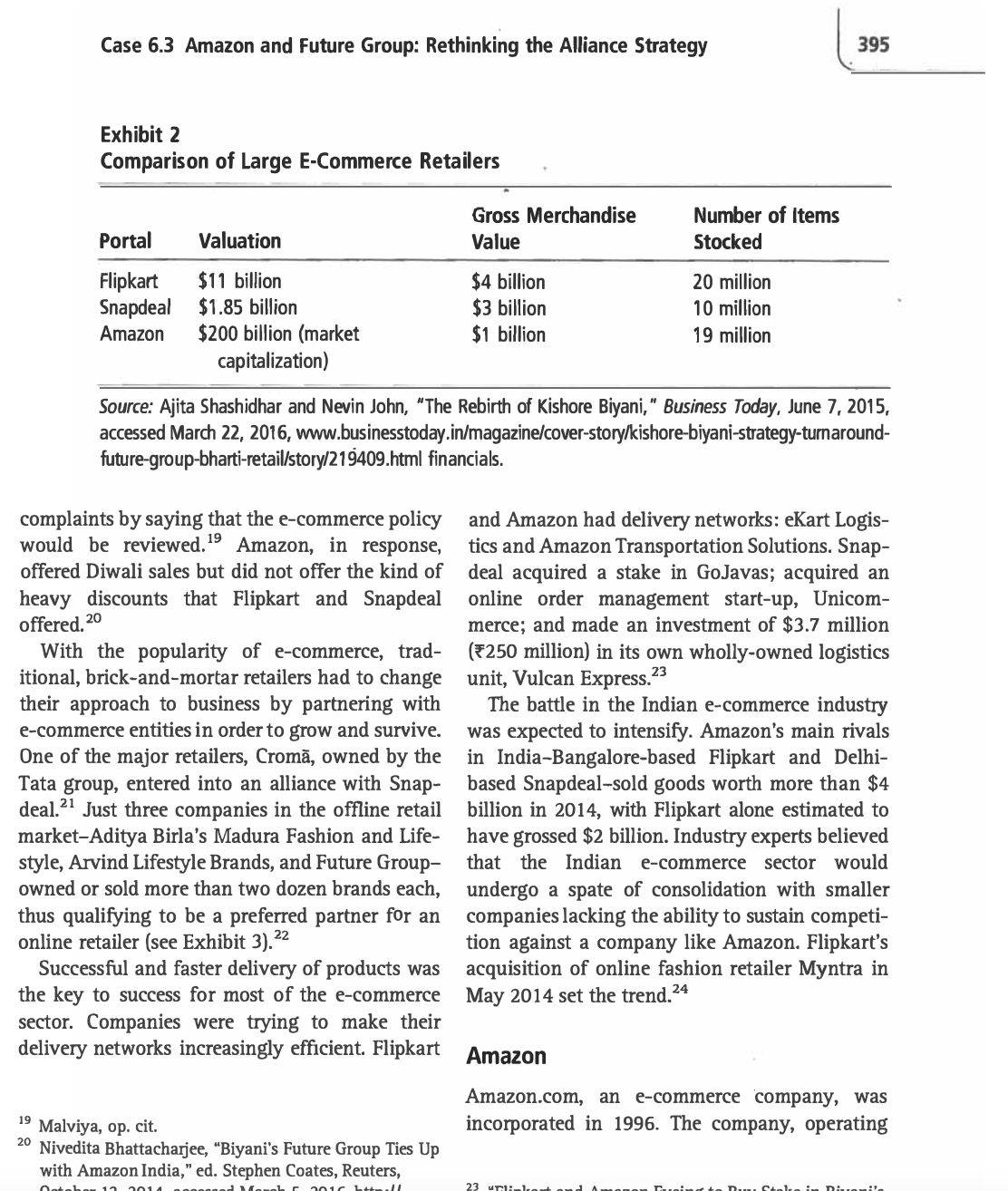

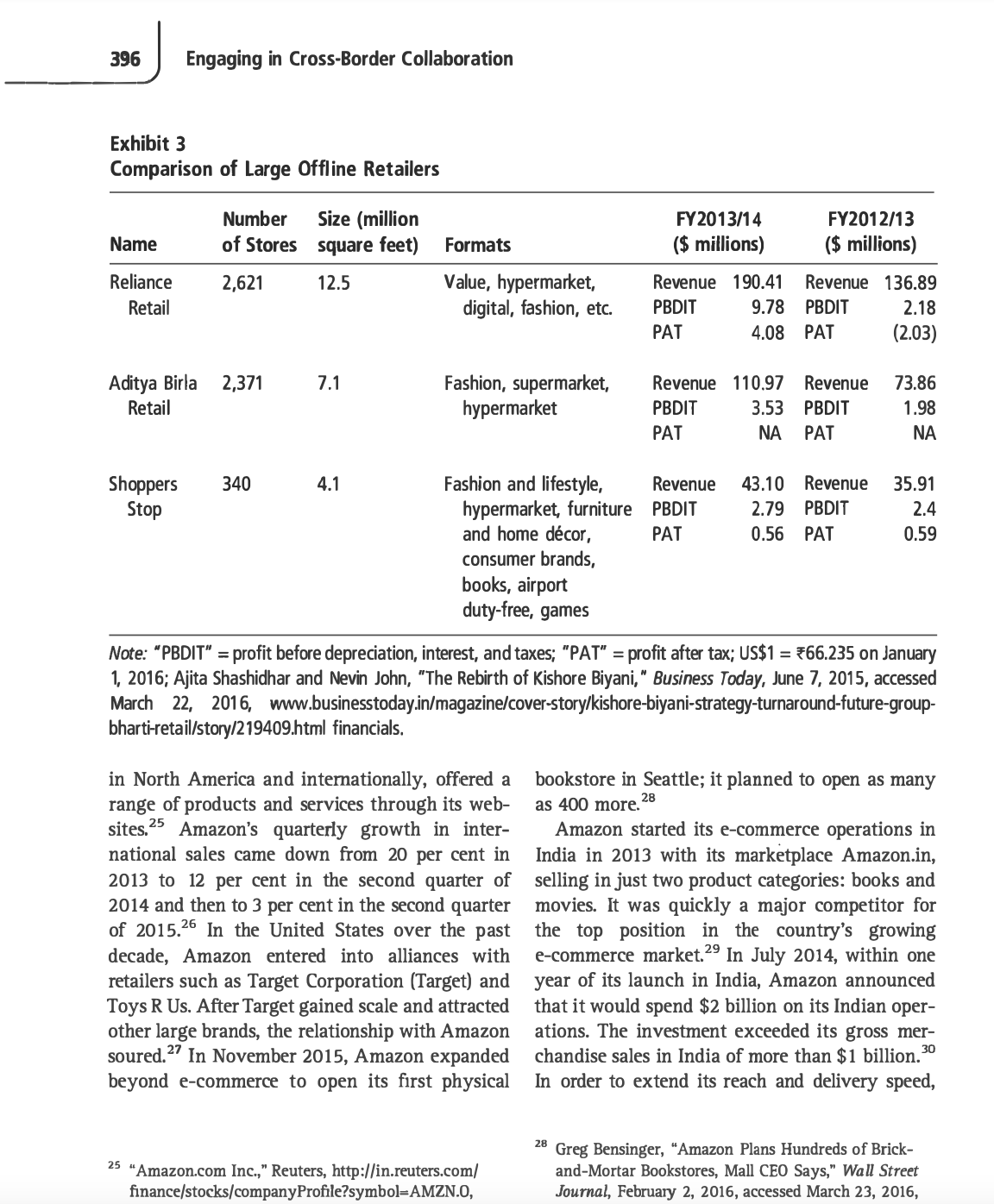

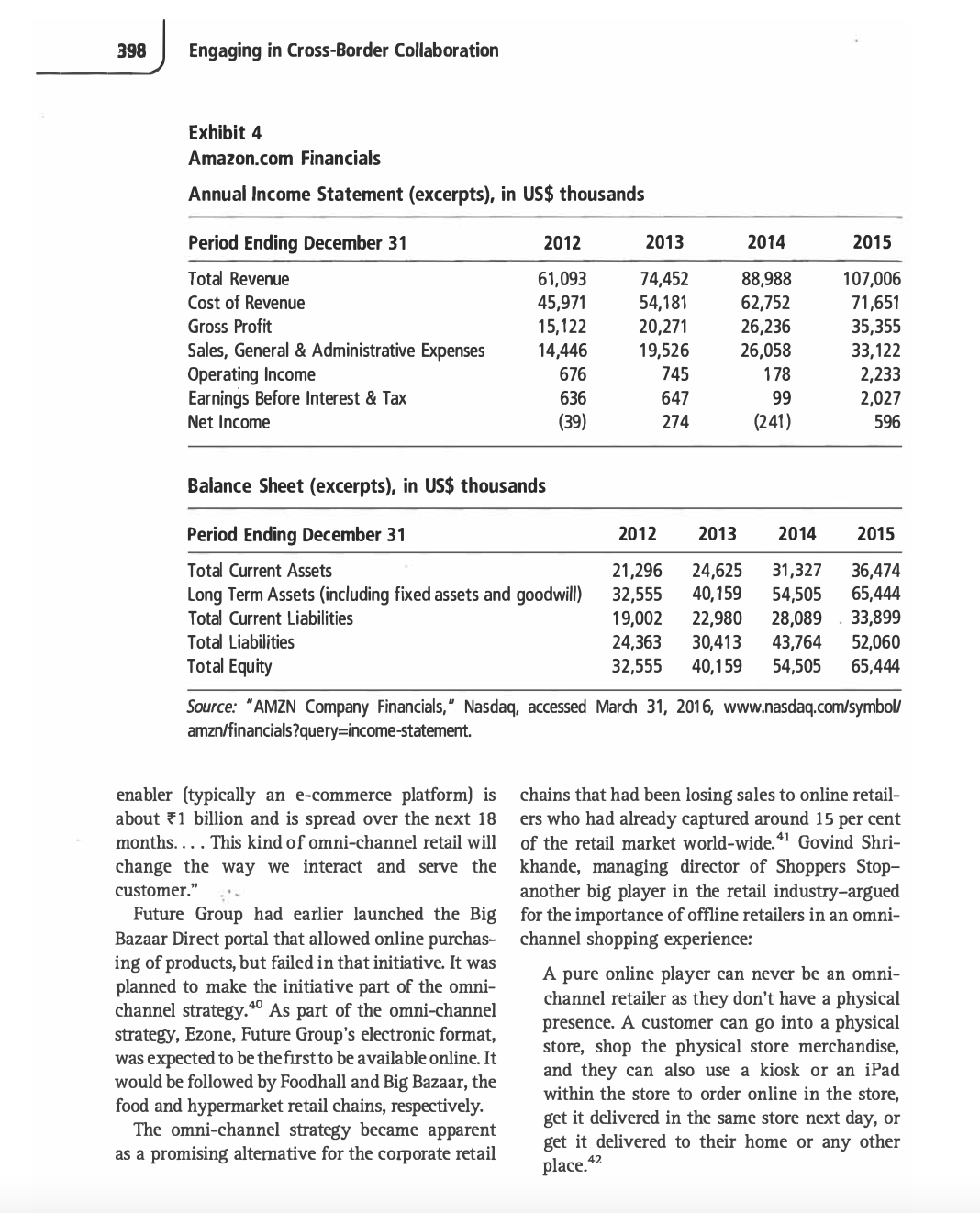

Manasenent Dhpment Insutute @Ivsy | Publishing slum GURGAON CASE 6.3 AMAZON AND FUTURE saoup: RETHIN KING THE ALLIANCE STRATEGY' Meeta Dasgupta wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation. The author may have csguised certain names and other identifying infonnaon to protect condentiality. This plblication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, NEG 0N1; It) 519.661.3208; (e) casesiveyxa; www.i\ eycases.com. Copyright 9 2016, Management Development Institute Gurgaon and Richard Ivey School of Business Foundation In 2014, Kishore Biyani, founder and chief executive ofcer (CEO) of Future Group, and .Ie' Bezos, foundr and CEO of Amazon, led their two Companies in a business alliance: Amazon would sell Future Group's clothing brands and eventu- ally retail other categories of goods for Future Group. The alliance started on an optimistic note, but by early 2016, the alliance partners were in conict over discounts and who would bear the burden of those costs. Could the partners nd a way to resolve the conflict or was it time for the companies to be independent again? Was the alliance continuing to deliver value for the companies? The Global Retail Industry The global retail industry had grown steadily from US$21.189 trillion in 2013 to $25366 tril lion in 2016, and was expected to reach $28300 Version: 2016-1026 trillion in 2018.2 Worldwide retail e-commerce sales had also grown. As a percentage of total retail sales, retail ecommerce sales grew from 5.1 per cent in 2013 ($1.077 trillion) to 5.9 per cent [$1.316 trillion} in 2014, 6.7 per cent [$1.592 trillion] in 2015 and 7.4 per cent in 2016 ($1.888 trillion}. They were expected to reach 8.8 per cent [$2.489 trillion} in 2018. Inter- estingly, although a majority of American con sumers were purchasing online, more than $10 out of every $1] were still spent in stores. In comparison, China and the United Kingdom, the other largest retail e-commerce markets, had much higher proportions of online to total retail sales [see Exhibit 1]. The Indian Retail Industry By 2000, the retail sector had emerged in India as one of the largest sectors in the country's econ omy, registering a Compound Annual Growth Rate [CAGR] of 7.45 per cent. By 2014, the retail Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy brands would not be very different from the prices at the stores.61 The partnership was also expected to extend to exploring synergies in distribution, customer acquisition, and cross-promotions.\" Amazon armounced that AmazorLin would also partner with Future Group brands in promoting existing and new brands in the market, exploring co- branding opportunities, and accelerating devel- opment of new products in categories that were not presently served by retailers.63 Food was expected to be the next category of products for the partnership. Amazon was already offering ready-to-eat foods and similar products online, and Future Group had plans to begin retailing food brands as well.\" Biyani had a big vision for retailing fast-moving con- sumer goods: he wanted to move beyond the 25 per cent to 30 per cent margin of Future Group's immediate competitors and, instead, earn a margin of 40 per cent on premium prod- ucts. This would have put Future Group in a category with Hindustan Unilever, Nestle, and Britannia.65 Biyani admitted that he lacked the product development experience of consumer goods companies, but he hoped to bridge the gap by entering into collaborations with experts in various elds.66 Interestingly, even after partnering with Amazon, Biyani continued his previously estab- lished criticism of foreign-funded e-commerce companies.\" Biyani boldly declared in an inter- view with Business Standard that \"the mirrdspace [e-commerce stakeholders] have occupied is far larger than their share of the market. "63 Biyani was particularly critical of deep-discounting schemes, criticizing Flipkart and other e-commerce retailers for the deep discounts they offered during a Diwali promotional sale event. '1 Ibid. 6' Bhattacharjee,op. cit. '3 Amazonin, op. cit. 5\" \"Future Group. Amazon India Announce Strategic E-Commercc Alliance." op. cit. a: Shashidhar and John, op. cit. '6 lbid. m Biyani feared deep discounting would hurt the other retail channels.\" The Downturn In January 2016, the media reported that differ- ences had emerged between Future Group and Amazon over the funding structure for discounts Amazon offered on products sold from Future Group's fashion brands. Discounting was a common practice with online retailers in India, but it affected the protability of most e-commerce companies. Amazon asked Future Group to bear a portion of offered discounts by taking a reduced margin on sales. Given Biyani's public criticism of deep online discounting and his reluctance to share the cost of rebates, the media didn't expect Biyani to accept Amazon's proposal. If Future Group did agree to Amazon's request, the result would be different prices for the products sold in Future Group's physical stores and sold online. The rumour was that Amazon, in turn, told Future Group to end the exclusive deal with Amazon and instead, like any other vendor, list its private labels online and pay Amazon a commission on sales.To Industry experts criticized the AmazoneFuture Group deal, alleging that it was a media strategy for attention. According to Harrrrinder Sahni. founder of retail consultancy rm Wazir Advisors, \"Discounts should be the rst thing to be discussed [in an e-commerce arrangement]. What priority pricing Future [Group] will give to Amazon, what price differentiation will work between offline and online, should be the rst things to be discussed.\"1 The Way Forward Biyani felt that there was a limit to the number of physical stores Future Group could have. He planned to increase the number of stores to 260 by 2018, but added, \"Even if we add another 402 Engaging in Cross-Border Collaboration Exhibit 5 Future Enterprises Financials Profit and Loss (excerpts), in $ millions June 2010 June 2011 December 2012 March 2014 March 2015 12 months 12 months 18 months 15 months 12 months Operating Profit 90.07 62.85 116.45 164.06 167.41 PBDIT 101.13 65.30 159.09 164.72 186.49 PBT 32.35 17.29 43.25 1.91 9.20 Reported Net Profit 26.93 11.50 40.99 0.42 11.11 Balance Sheet (excerpts), in $ millions June 2010 J June 2011 December 2012 March 2014 March 2015 Net Worth 413.44 431.72 498.38 487.75 779.69 Total Debt 207.93 289.65 480.84 825.57 630.14 Total Liabilities 621.37 " 721.37 979.22 1,313.32 1,409.83 Net Block 168.32 220.05 342.33 651.04 724.75 Total Current Assets, Loans 292.15 377.58 574.45 794.40 932.21 and Advances Total Current Liabilities and 148.49 228.86 311.21 389.12 482.65 Provisions Note: Exchange rates on January 1, 2016: 71=US$0.015; US$1 = #66.235; PBDIT = profit before depreciation, interest, and taxes; PBT = profit before taxes. Source: "Future Enterprises," Money Control, accessed June 17, 2016, www.moneycontrol.com/financials/futureen terprises/profit-loss/PR03. 30 to 40 more physical stores, we can go to business-to-consumer online marketplace. How- 300 and not beyond that ... So the next option ever, the government restricted e-commerce is to take the help of technology to penetrate companies from directly or indirectly effecting deeper into the market."72 the selling price of goods on online marketplaces. In March 2016, the Government of India This came as a big relief to offline, brick-and- changed its foreign investment policy to allow mortar retailers. According to the directive, no 100 per cent foreign direct investment in the 73 John Sarkar, Digbijay Mishra, and Shilpa Phadnis,Chapter 6 Recommended Practitioner Readings single vendor or their group of companies could account for more than 25 per cent of the overall sales on a platform.M The policy change was a major blow to Amazon, which had been lobbying for foreign direct investment on an inventory-based model" of e-commerce. In 2015, Amazon's Cloudtail posted a loss of $4.7 million ((317 million) on revenues of $170 million [(11.5 '4 Ibid. '5 In an inventory based model one is in control of the of the physical inventory of products thereby enabling a superior postapurchase customer experience. It enables one to deliver faster and with higher accuracy. In a market place model buyers and sellers transact on a technology-based platform. with no physical inventory in the possession of the seller. billion), but was expected to turn protable in 2015.75 Amazon and Future Group needed to sort out their differences in the context of the changing market and evolving policy. Should the companies nurture the partnership on the existing terms and conditions, look for alternate options for growing together, and adjust the terms of the partnership, or exit from the partnership altogether? '5 Shilpa Phadnis and John Sarkar, 'Flipkart, Amazon Need to Downsize Sellers,\" rm: d'l'ndia, March 30, 2016, accessed March 31, 2016, http:H timesondiajndiatimes.comftechitechnewlelipkart- Amazon-need-to-downsizesellersiarticleshowi 51609319.cms: BS Reporter, \"Cloudta Reports Rs. 32-cr Loss on Rs.1,145 Cr-Sales in FY15\Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 393 Exhibit 1 E-Commerce Sales as a Percentage of Total Retail Sales 2013 2014 2015 2016* 2017* 2018* United Kingdom 11.6 13.0 14.4 15.6 16.9 18.0 China 8.3 10.1 12.0 13.8 15.5 16.6 United States 5.8 6.5 7.1 7.7 8.3 8.9 Brazil 3.4 3.8 4.1 4.4 4.6 4.8 Russia 2.0 2.2 2.4 2.6 2.8 3.0 Spain 3.6 4.1 4.8 5.4 6.0 6.5 India 0.6 0.7 0.9 1.1 1.3 1.4 Indonesia 0.5 0.6 0.8 1.0 1.2 1.4 Note: *The forecast is from September 2014. Source: "Retail Sales Worldwide Will Top $22 Trillion This Year E-Commerce Eclipses $1.3 Trillion, Led by China and U.S., " eMarketer, December 23, 2014, accessed March 15, 2016, www.emarketer.com/Article/ Retail-Sales-Worldwide-Will-Top-22-Trillion-This-Year/1 011765. sector had been showing a CAGR of about 15 per The Indian retail industry was attractive to cent over the previous five years-a growth that investors, but Indian rules restricted foreign exceeded the overall growth in India's gross retailers' ability to sell directly to Indian con- domestic product during the same period. As sumers or invest on their own in a retail busi- an industry, Indian retail grew from $204 billion ness. " Under its foreign direct investment policy, in 2000 to $600 billion in 2015, and was the government approved foreign direct invest- expected to reach $ 1.3 trillion by 2020.* Retailing ment of up to 51 per cent in multi-brand retail in India accounted for about 10 per cent of the and up to 100 per cent in single-brand retail. country's gross domestic product and 8 per cent However, both multi- and single-brand retailers of employment. Almost all of the retail business had to source 30 per cent of their goods from came from a fragmented, unorganized sector of Indian suppliers. individual and family-owned businesses. The Growth in organized retail was driven by, organized sector that accounted for 8 per cent among other factors, a healthy growth in the of the market in 2015 was expected to account Indian economy, changing demographic profiles, for 24 per cent of the overall retail market increased disposable incomes, and changes in the by 2020. tastes and preferences of consumers." . The number of millennials were increasing, and it was expected that they would make up more than 3 KPMG, Indian Retail: The Next Growth Story, 2014, 2, half of India's population by 2025. Shoppers accessed March 15, 2016, www.kpmg.com/IN/en/ increasingly depended on technology for con- IssuesAndInsights/ArticlesPublications/Documents/ BBG-Retail.pdf. sumption. In 2015, India had the third largest 4 "Indian Retail Industry Analysis," India Brand Equity number of Internet users in the world (after China Foundation, January 2016, accessed March 15, 2016,394 Engaging in Cross-Border Collaboration and the United States), and was similarly ranked Growing Internet penetration, aggressive in penetration of smartphones. " Economic fore- pricing strategies, and e-commerce companies casters predicted that by 2020, India would be a with resources of investor cash spurred the growth. $3 trillion economy with 5.8 per cent of global Young companies like Flipkart and Snapdeal dom- spending happening in the country-a significant inated general e-commerce, and Myntra and increase from 2.6 per cent in 2015. Anil Agar- Jabong dominated in apparels. In FY2014/15, wal, then managing director of Amazon India, online retailers collectively captured $6 billion of observed, "Everything is nascent in India-the the $40 billion organized retail market (excluding seller ecosystem, the logistics, the payments.. . . kirana or small neighbourhood stores). Regular We have to connect the dots on a massive scale retail stores were on the decline as evidenced by that involves hundreds of cities, thousands of sales figures during the festival season in October sellers, and millions of products." 12 to November 2014; visits at most of the bricks and Even though the online retail industry in India mortar stores fell by 12 per cent. occupied only about 2 per cent of the country's The growing energy around online retail was overall retail industry, online retailing was grow- also reflected in the valuations of online retail ing quickly, from less than $500 million in companies (see Exhibit 2). At the end of 2014, 2009 to about $5 billion in 2014. According India's biggest online retailer, Flipkart, was to a report by the consulting firm Technopak, valued at $11 billion (7700 billion) while Future the overall retail industry was expected to double Group's three listed companies were collectively by 2020. The online retailing market represented valued at $1.2 billion (780 billion). The online an increasing portion of that growth; the $2.3 retailer, Snapdeal, then just five years old, was billion online retail market in 2014 was expected already valued at $1.85 billion (about 7117 bil- to be $32 billion by 2020, an increase from 2 per lion), and after a round of fundraising in 2015, cent to 3 per cent of the Indian retail sector. 14 was valued at $4.9 billion (about 7330 billion). 17 Heavy discounting was leading to increased level of conflict between the online and offline retailers. Traditional retailers that were being hit 10 "2BConsumers Worldwide to Get Smartphones by by aggressive pricing or undercutting protested 2016," eMarketer, December 11, 2014, accessed March Flipkart's Big Billion Day Sale held on October 6, 23, 2016, www.emarketer.com/Article/2-Billion- 2014. Flipkart promised to hold "the greatest sale Consumers-Worldwide-Smartphones-by-2016/ 1011694. ever in the history of our nation" on that day. 18 1 Ajita Shashidhar and Nevin John, "The Rebirth of The government responded to retailers' Kishore Biyani," Business Today, June 7, 2015, accessed March 22, 2016, www.businesstoday.in/magazine/ cover-story/kishore-biyani-strategy-turnaround- news/54970694_1_bangalore-based-flipkart-and- future-group-bharti-retail/story/219409.html snapdeal-future-group-kishore-biyani. financials. 15 "Why the Future Group-Amazon Tie-Up is a Win-Win 12 Saritha Rai, "Amit Agarwal Leads Amazon India as for Both," Money Control, October 14, 2014, accessed Online Retail is Taking Off," Forbes, June 4, 2015, March 5, 2016, www.moneycontrol.comews/ accessed June 13, 2016, www.forbes.com/sites/ business/whyfuture-group-amazon-tie-up-iswin-win-Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 395 Exhibit 2 Comparison of Large E-Commerce Retailers Gross Merchandise Number of Items Portal Valuation Value Stocked Flipkart $11 billion $4 billion 20 million Snapdeal $1.85 billion $3 billion 10 million Amazon $200 billion (market $1 billion 19 million capitalization) Source: Ajita Shashidhar and Nevin John, "The Rebirth of Kishore Biyani," Business Today, June 7, 2015, accessed March 22, 2016, www.businesstoday.in/magazine/cover-story/kishore-biyani-strategy-turnaround- future-group-bharti-retail/story/219409.html financials. complaints by saying that the e-commerce policy and Amazon had delivery networks: eKart Logis- would be reviewed. Amazon, in response, tics and Amazon Transportation Solutions. Snap- offered Diwali sales but did not offer the kind of deal acquired a stake in GoJavas; acquired an heavy discounts that Flipkart and Snapdeal online order management start-up, Unicom- offered. 20 merce; and made an investment of $3.7 million With the popularity of e-commerce, trad- (7250 million) in its own wholly-owned logistics itional, brick-and-mortar retailers had to change unit, Vulcan Express. 23 their approach to business by partnering with The battle in the Indian e-commerce industry e-commerce entities in order to grow and survive. was expected to intensify. Amazon's main rivals One of the major retailers, Croma, owned by the in India-Bangalore-based Flipkart and Delhi- Tata group, entered into an alliance with Snap- based Snapdeal-sold goods worth more than $4 deal." Just three companies in the offline retail billion in 2014, with Flipkart alone estimated to market-Aditya Birla's Madura Fashion and Life- have grossed $2 billion. Industry experts believed style, Arvind Lifestyle Brands, and Future Group- that the Indian e-commerce sector would owned or sold more than two dozen brands each, undergo a spate of consolidation with smaller thus qualifying to be a preferred partner for an companies lacking the ability to sustain competi- online retailer (see Exhibit 3). 22 tion against a company like Amazon. Flipkart's Successful and faster delivery of products was acquisition of online fashion retailer Myntra in the key to success for most of the e-commerce May 2014 set the trend.24 sector. Companies were trying to make their delivery networks increasingly efficient. Flipkart Amazon Amazon.com, an e-commerce company, was 19 Malviya, op. cit. incorporated in 1996. The company, operating 20 Nivedita Bhattacharyae, "Biyani's Future Group Ties Up with Amazon India," ed. Stephen Coates, Reuters,396 Engaging in Cross-Border Collaboration Exhibit 3 Comparison of Large Offline Retailers Number Size (million FY2013/14 FY2012/13 Name of Stores square feet) Formats ($ millions) ($ millions) Reliance 2,621 12.5 Value, hypermarket, Revenue 190.41 Revenue 136.89 Retail digital, fashion, etc. PBDIT 9.78 PBDIT 2.18 PAT 4.08 PAT (2.03) Aditya Birla 2,371 7.1 Fashion, supermarket, Revenue 110.97 Revenue 73.86 Retail hypermarket PBDIT 3.53 PBDIT 1.98 PAT NA PAT NA Shoppers 340 4.1 Fashion and lifestyle, Revenue 43.10 Revenue 35.91 Stop hypermarket, furniture PBDIT 2.79 PBDIT 2.4 and home decor, PAT 0.56 PAT 0.59 consumer brands, books, airport duty-free, games Note: "PBDIT" = profit before depreciation, interest, and taxes; "PAT" = profit after tax; US$1 = 766.235 on January 1, 2016; Ajita Shashidhar and Nevin John, "The Rebirth of Kishore Biyani, " Business Today, June 7, 2015, accessed March 22, 2016, www.businesstoday.in/magazine/cover-story/kishore-biyani-strategy-turnaround-future-group- bharti-retail/story/219409.html financials. in North America and internationally, offered a bookstore in Seattle; it planned to open as many range of products and services through its web- as 400 more. 2 sites.2 Amazon's quarterly growth in inter- Amazon started its e-commerce operations in national sales came down from 20 per cent in India in 2013 with its marketplace Amazon.in, 2013 to 12 per cent in the second quarter of selling in just two product categories: books and 2014 and then to 3 per cent in the second quarter movies. It was quickly a major competitor for of 2015.25 In the United States over the past the top position in the country's growing decade, Amazon entered into alliances with e-commerce market. In July 2014, within one retailers such as Target Corporation (Target) and year of its launch in India, Amazon announced Toys R Us. After Target gained scale and attracted that it would spend $2 billion on its Indian oper- other large brands, the relationship with Amazon ations. The investment exceeded its gross mer- soured." In November 2015, Amazon expanded chandise sales in India of more than $1 billion. beyond e-commerce to open its first physical In order to extend its reach and delivery speed, 26 Greg Bensinger, "Amazon Plans Hundreds of Brick- 25 "Amazon.com Inc.," Reuters, http://in.reuters.com/ and-Mortar Bookstores, Mall CEO Says," Wall Street finance/stocks/companyProfile?symbol=AMZN.O, Journal, February 2, 2016, accessed March 23, 2016,Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy Amazon built two centres, one in Bangalore and the other in Bhiwadi on the outskirts of Mumbai?1 Sellers joined Amazon from all over India. In 2015, the number of sellers joining Amazon was two times more than those that joined in 2014. But the number of orders received by sellers in 2015 was three times the number of orders received in 2014, with sellers' total business increasing in the same period by $150,000 (if 10 million]. The number of sellers using fulllment centresinventory storage spaceincreased by three times, with 86 per cent of those _using the fulllment centres increasing their sales volume. The storage space provided to sellers increased from 28,000 square metres in 2014 to 765,000 square metres in 2015.32 Amazon's logistics innovation for the Indian market, EasyShip, was paying off. Amazon picked up products from suppliers' outlets and distributed them to customers using its logistics services. The number of sellers using EasyShip increased three times, and the sellers using Amazon's Easy Ship increased their sales by 40 per cent. In response, Amazon increased the shipping service from covering 2,000 postal codes in 2014 to covering 20,000 postal codes in 2015 (see Exhibit 4]. Future Group Future Group was controlled by Biyani, known in India as the man who introduced large scale retail to the country.\" Central, Big Bazaar, Foodhall, Planet Sports, Brand Factory, Home Town, and 3' Raghavendra Kamath, "Amazon Builds India Business 397 eZone were some of India's most favourite retail chains operated by Future Group. The company had more than 75 of its own brands that earned the Group at least 15 per cent higher margins on average compared to other national brands.\" The Group operated approximately 480,000 square metres (17 million square feet) of retail space in 98 urban, and 40 rural locations. Approximately 30,000 small, medium, and large enterprises were connected to its retail formats and about 300 mil lion customers yearly visited them.35 The com pany had 140,000 stock units across India.\" See Exhibit 5 for Future enterprises nancials. The core value of the Group was 'Indianness.\" Future Group believed in building a strong under standing of Indian consumers, and built its busi- ness based on Indian ideas. The Group's corporate principle was \"Rewrite rules, retain values\"? Future Group claimed to have a well-developed and wellequipped logistics system.38 In addition to its own logistics chain, the Group also had a thirdparty logistics arrangement that it planned to leverage for its omni-channel strategy.\" In September 2014, Future Group entered into a collaboration with SAP Hybris, an e~commerce service, for an omnichannel retail strategy that would allow the Group to converge its digital and physical channels. According to Rakesh Biyani, the joint managing director at Future Retail, \"The overall investment in this [business to consumer] 3" Malviya, op. cit. 35 \"Future Group, Amazon India Announce Strategic Iii-Commerce Alliance,\" op. cit. 35 \"Future Group Ties Up with Hybris for Online Synergy," Business Standard, September 3, 2014, accessed March 16, 2016. www.businessstandard.comlartic1el companicslfuture-group-in-pact-withsap-company- 390 l Engaging in Cross-Border Collaboration Exhibit 4 Amazon.com Financiais Annual Income Statement (excerpts). in US$ thousands Period Ending December 31 Totd Revenue Cost oi Revenue Gross Profit Sales. General 3: Administrative Expenses Operating Income Earnings Beiore Interest 8: Tax Net Income Balance Sheet (excerpts). in U55 thousands Period Ending December 31 Totd Current Assets Long Term Assets (inducing fixed assets and goodwill) Totai Current Liabilities Totd Liabilities Total Equity 2012 2013 2014 2015 61. 093 24.452 88.988 102.006 45.9?1 54.181 62.?52 3'1 .651 15.122 20.271 26.236 35.355 14.446 19.526 26.058 33.122 676 745 1 28 2.23 3 636 64? 99 2.02? (39) 214 (241 ) 596 2012 2013 2014 2015 21.296 24.625 31.3 2? 36.474 32.555 40.159 54.505 65.444 1 9.002 22.980 28.089 . 33.899 24.363 30.413 43.264 52.060 32.555 40.159 54.505 65.444 Source: 'AMZN Company Financials.\" Nasdaq. accessed March 31. 2016. wwwhasdaqcmvsymboll anznrlinancials?query=incorne-staternent enabler [typically an e-commerce platform) is about t] billion and is spread over the next 18 months... . This kind of omni-channel retail will change the way we interact and serve the customer." _. . Future Group had earlier launched the Big Bazaar Direct portal that allowed online purchas ing of products. but failed in that initiative. It was planned to make the initiative part of the omni- channel strategy.\" As part of the omni-channel strategy. Ezone, Future Group's electronic format. was expected to be therstto be available online. It would be followed by Foodhall and Big Bazaar, the food and hypermarket retail chains, respectively. The omni-channel strategy became apparent as a promising alternative for the corporate retail chains that had been losing sales to online retail- ers who had already captured around 15 per cent of the retail market world-wide."l Govind Shri- khande. managing director of Shoppers Stop another big player in the retail industryargued for the importance of offline retailers in an omni- channel shopping experience: A pure online player can never be an omni- channel retailer as they don't have a physical presence. A customer can go into a physical store, shop the physical store merchandise, and they can also use a kiosk or an iPad within the store to order online in the store. get it delivered in the same store next day. or get it delivered to their home or any other place.'12 Case 6.3 Amazon and Future Group: Rethinkln'g the Aliance Strategy Over the next 18 months, Future Group aimed to earn approximately 20 per cent of revenue from online sales and around 40 per cent by 2020.\"3 Biyani's negotiations with Flipkart to jointly sell goods stretched over 20 days, then collapsed in October 2014. According to media sources, Future Group wanted a fee of $10 million for giving sole, online retail rights-a price that Flip- kart found excessive. Flipkart maintained that it did not pay for exclusive rights to retail products. Instead, Flipkart wanted Future Group to pay a commission on every sale on its platform. Future Group would have preferred a lower commission fee. A person involved in the talks said, "There was no warmth between the two parties.\" Another source said, "The Flipkart team felt the terms were onerous.\" Biyani was not in favour of marketplace models used by companies such as Amazon, Flip- Kart, and Snapdeal. He strongly believed their models were \"front-end retailing with smart accounting to dodge Indian laws that bar over- seas investment in these ventures.\"5 Biyani accused online marketplaces of trying to destroy competition by selling products below manufac- turing costs. He pointed out that online retailers were spending huge sums on advertising and customer acquisition. Biyani maintained, \"Just because [online retailers] have foreign funding, they can't kill local trade like that.\"6 The Amazon-Future Group Deal In October 2014, Biyani and Bezos met to nalize a deal to sell brands from Future Group's '3 Malviya, op. cit. '4 Radhika P. Nair, \"How Flipkart's Cold Response Scaled an..." F...\" n-ul A mun-\".5. h-nl N ETD-on" \"A.\" portfolio on Amazon's marketplace in India. Amazon 'would be the exclusive online platform for the brands.\" Fulllment of orders and cus- tomer service of the products on its portal would be handled by Amazon.\" To provide visibility of its brands on Amazon. in, Future Group entered into an exclusive marketing arrangement with Amazon. Cloudtail, a 49:51 joint venture between Amazon and the Indian investment rm Catamaran Ventures, would sell brands owned by or licensed to Future Group, including Lee Coopers, Converse, Indigo Nation, Scullers, Jealous 21, and 40 other private label brands owned by Future Group. The prod- ucts would be offered to customers at a discount of 30 per cent to 40 per cent.\" Following the deal, more than 40 brands owned by Future Group were to be removed from other online marketplaces where they were presently being sold.50 While the deal involved fashion and food labels rst, Amazon was expected to pick up other categories frcm Future Group's portfolio in the future.51 The deal was meant to be an arrangement built on customer service. Biyani's strategy for Future Group retail was to know and cater to Indian consumers, "The bottom line in each of our retail success stories is 'know your customer.' Insights into the soul of Indian consumers-how they operate, think, dream, and live-helps us innovate and create mctionally differentiating products and experiences."52 Biyani saw Amazon as an opportunity to extend that strategy to customers in about 19,000 postal codes in India served by Amazon, \"Partnership with Amazon, which obsesses to be Earth's most customer-centric company, will enable us to leverage their strengths, '399 400 I Engaging in Cross-Border Collaboration investments, and innovations in technology to reach out to a wider set of consumers across India?\" Biyani's goals for the deal were considerable: \"We are targeting gross merchandise sales of f6!) billion in the next three years through the alliance?\" For Amazon, the partnership was an import- ant growth opportunity in the Indian retail industry. Future Group helped to provide Amazon with the Indian sources it needed under India's foreign directinvestment policy. The partnership was also expected to be a crucial step for Amazon's growth in the much sought alter fashion category. Because of high margins and growing demand, fashion was the focus category for most of the e-commerce retailers. Flipkart and Snapdeal were leading in terms of product assortment and number of sellers and brands, and Flipkart, Myntra, and .labong had their own private labels in India, which Amazon did not have.55 Amazon acknowledged the strategic partner- ship with Future Group. Amit Agrawal, vice- president and country manager for Amazon India reported: We are excited to collaborate, leverage each other's unique strengths, and serve custom- ers across India. The product portfolio of Future Group, their innate understanding of the Indian consumer mindset, and our ability to serve and deliver a convenient, easy, trusted, and reliable delivery experience to a nationwide set of customers is a winwin for all.56 53 Bailay and Chakravarty. op. cit: Malavika Velayanikal, \"Amazon Now Has a Powerful Brick-andMortar Ally in India. Flipkart and Snapdeal, Your Move,\" Tech in Asia, October 13. 2014. accessed June 14, 2016, ...... sun-.Lhuml- \"mlmn-n \"nut-n...- Rue"... unn The AmazonFuture Group partnership was evi~ dence of the importance of combining product with technology in omni-channel retailing Amazon India noted that the partnership would benet customers \"in making a purchase decision through rich product content, secure payments, fast delivery, and easy returns on the www.amazon.in platform. \"57 The media reported: The partnership is not one between two retailers but of vendor and technology plat- forms offering technology and logistics ser~ vices. This will help in the growth of new brands and private labels... . It establishes that leading brick and mortar retailers cannot be dismissive about e-commerce players, which have become a brand in the online space.\"3 News of the partnership triggered an intra-day jump in the shares of two of Future Group's listed companies: Future Retail Ltd. and Future Life- style Fashion Ltd.59 However, industry experts felt there were also possible pitfalls in the deal. Devangshu Dutta, chief executive officer at the retail consultancy firm Third Eyesight, said, \"If the business is not aligned in terms of orientation and customer service, then it could create issues going forward, especially when one of the biggest barriers for online sale is inconsistency of products'n Under the deal, Amazon and Future Group would work together to navigate the discounting conict between online and offline retailers. The two businesses would jointly develop the pricing and discounting strategy. To avoid a conict between the online and ofine channels that could, in the end, undermine the business efforts of both, Amazon and Future Group agreed that the online price of products under Future Group's 57 rm