Could anyone help answer question B ?

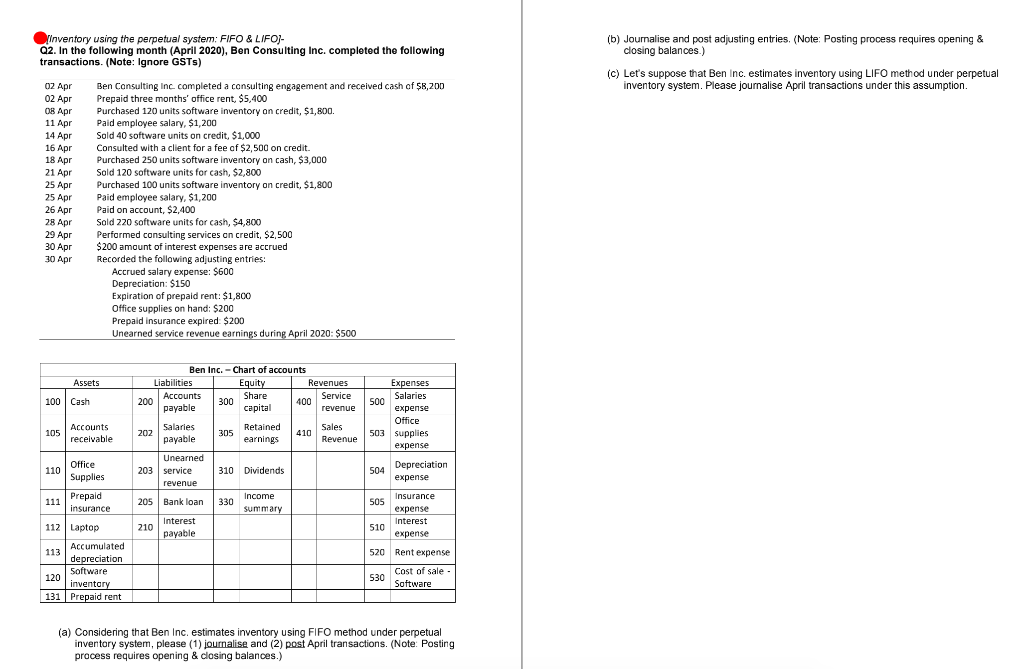

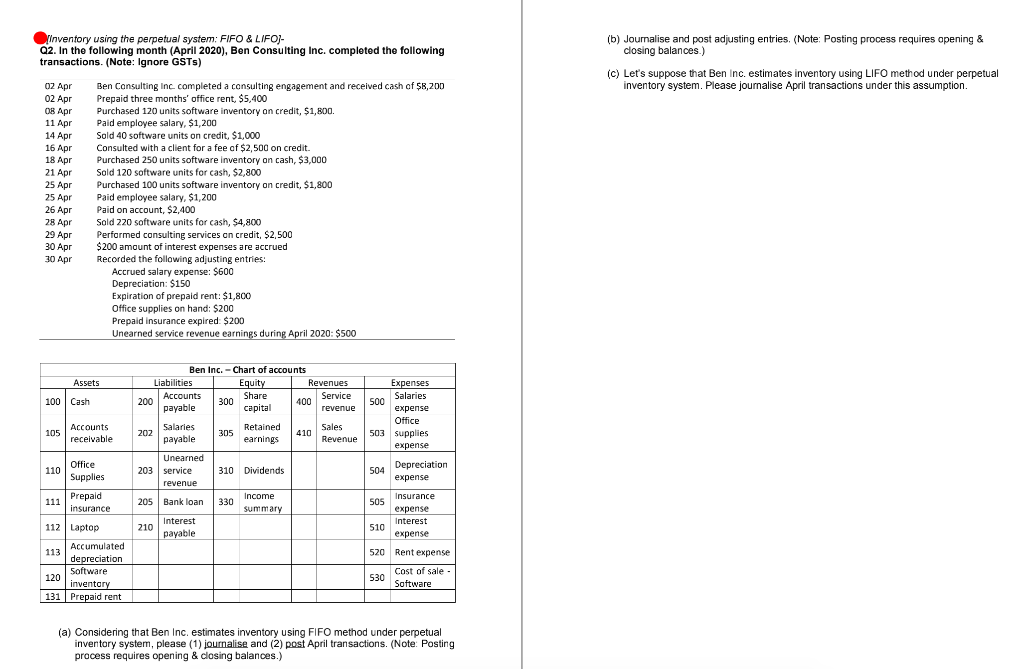

Inventory using the perpetual system: FIFO & LIFO)- Q2. In the following month (April 2020), Ben Consulting Inc, completed the following transactions. (Note: Ignore GSTs) (b) Journalise and post adjusting entries. (Note: Posting process requires opening & closing balances.) (c) Let's suppose that Ben Inc. estimates inventory using LIFO method under perpetual inventory system. Please journalise April transactions under this assumption 02 Apr 02 Apr 11 Apr 14 Apr 16 Apr 18 Apr 21 Apr 25 Apr 25 Apr 26 Apr 28 Apr 29 Apr 30 Apr 30 Apr Ben Consulting Inc completed a consulting engagement and received cash of $8,200 Prepaid three months' office rent, $5,400 Purchased 120 units software inventory on credit, $1,800. Paid employee salary, $1,200 Sold 40 software units on credit, $1,000 Consulted with a client for a fee of $2,500 on credit. Purchased 250 units software inventory on cash, $3,000 Sold 120 software units for cash, $2,800 Purchased 100 units software inventory on credit, $1,800 Paid employee salary, $1,200 Paid on account, $2,400 Sold 220 software units for cash, $4,800 Performed consulting services on credit, $2,500 $200 amount of interest expenses are accrued Recorded the following adjusting entries: Accrued salary expense: $600 Depreciation: $150 Expiration of prepaid rent: $1,800 Office supplies on hand: $200 Prepaid insurance expired: $200 Unearned service revenue earnings during April 2020: $500 Assets Ben Inc. -Chart of accounts Liabilities Equity Revenues Accounts Service payable capital revenue 100 Cash 200 300 Share 400 500 Expenses Salaries expense Office supplies expense Accounts receivable 202 Salaries payable 305 Retained earnings 410 Sales Revenue 503 Office Supplies 203 Unearned service revenue 310 Dividends Depreciation expense Prepaid insurance Income 205 Bank loan 330 505 summary Insurance expense Interest expense Interest 112 Laptop 210 payable 113 Accumulated depreciation Software inventory 131 Prepaid rent 520 Rent expense Cost of sale Software 120 530 (a) Considering that Ben Inc. estimates inventory using FIFO method under perpetual inventory system, please (1) journalise and (2) post April transactions. (Note: Posting process requires opening & closing balances.) Inventory using the perpetual system: FIFO & LIFO)- Q2. In the following month (April 2020), Ben Consulting Inc, completed the following transactions. (Note: Ignore GSTs) (b) Journalise and post adjusting entries. (Note: Posting process requires opening & closing balances.) (c) Let's suppose that Ben Inc. estimates inventory using LIFO method under perpetual inventory system. Please journalise April transactions under this assumption 02 Apr 02 Apr 11 Apr 14 Apr 16 Apr 18 Apr 21 Apr 25 Apr 25 Apr 26 Apr 28 Apr 29 Apr 30 Apr 30 Apr Ben Consulting Inc completed a consulting engagement and received cash of $8,200 Prepaid three months' office rent, $5,400 Purchased 120 units software inventory on credit, $1,800. Paid employee salary, $1,200 Sold 40 software units on credit, $1,000 Consulted with a client for a fee of $2,500 on credit. Purchased 250 units software inventory on cash, $3,000 Sold 120 software units for cash, $2,800 Purchased 100 units software inventory on credit, $1,800 Paid employee salary, $1,200 Paid on account, $2,400 Sold 220 software units for cash, $4,800 Performed consulting services on credit, $2,500 $200 amount of interest expenses are accrued Recorded the following adjusting entries: Accrued salary expense: $600 Depreciation: $150 Expiration of prepaid rent: $1,800 Office supplies on hand: $200 Prepaid insurance expired: $200 Unearned service revenue earnings during April 2020: $500 Assets Ben Inc. -Chart of accounts Liabilities Equity Revenues Accounts Service payable capital revenue 100 Cash 200 300 Share 400 500 Expenses Salaries expense Office supplies expense Accounts receivable 202 Salaries payable 305 Retained earnings 410 Sales Revenue 503 Office Supplies 203 Unearned service revenue 310 Dividends Depreciation expense Prepaid insurance Income 205 Bank loan 330 505 summary Insurance expense Interest expense Interest 112 Laptop 210 payable 113 Accumulated depreciation Software inventory 131 Prepaid rent 520 Rent expense Cost of sale Software 120 530 (a) Considering that Ben Inc. estimates inventory using FIFO method under perpetual inventory system, please (1) journalise and (2) post April transactions. (Note: Posting process requires opening & closing balances.)