Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could I have help with this question? I have my answers but want to check them against someone else who knows what theyre doing. LO

Could I have help with this question? I have my answers but want to check them against someone else who knows what theyre doing.

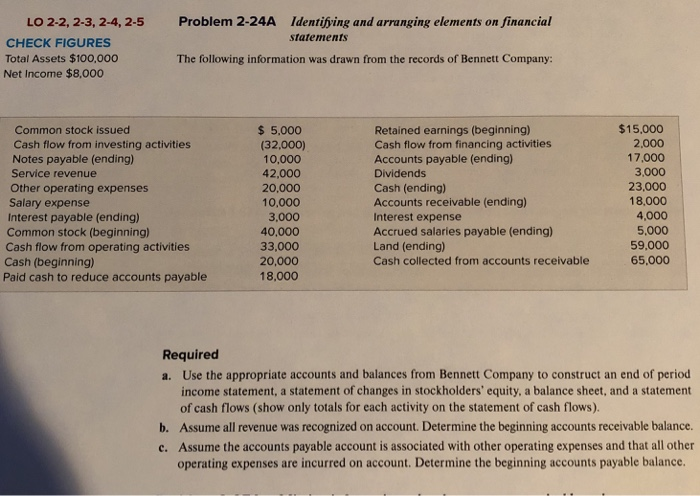

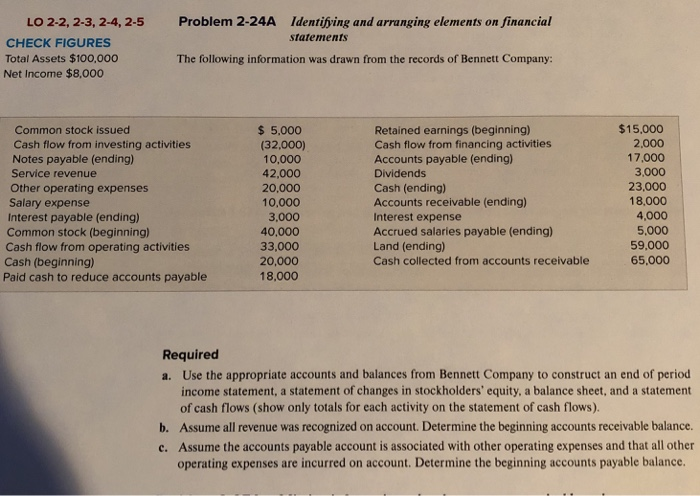

LO 2-2, 2-3, 2-4, 2-5Problem 2-24A Identifying and arranging elements on financial CHECK FIGURES Total Assets $100,000 Net Income $8,000 statements The following information was drawn from the records of Bennett Company: Common stock issued Cash flow from investing activities Notes payable (ending) Service revenue Other operating expenses Salary expense Interest payable (ending) Common stock (beginning) Cash flow from operating activities $5,000 (32,000) 10,000 42,000 20.000 10,000 3.000 40,000 33,000 20,000 18,000 Retained earnings (beginning) Cash flow from financing activities Accounts payable (ending) Dividends Cash (ending) Accounts receivable (ending) Interest expense Accrued salaries payable (ending) Land (ending) Cash collected from accounts receivable $15.000 2,000 17,000 3,000 23,000 18,000 4,000 5,000 59,000 65,000 Cash (beginning) Paid cash to reduce accounts payable Required Use the appropriate accounts and balances from Bennett Company to construct an end of period income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement a. of cash flows (show only totals for each activity on the statement of cash flows). b. Assume all revenue was recognized on account. Determine the beginning accounts receivable balance. c. Assume the accounts payable account is associated with other operating expenses and that all other operating expenses are incurred on account. Determine the beginning accounts payable balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started