Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could I please get some help with this? You should use the information from the account list to create below items. A) Trial Balance B)

Could I please get some help with this?

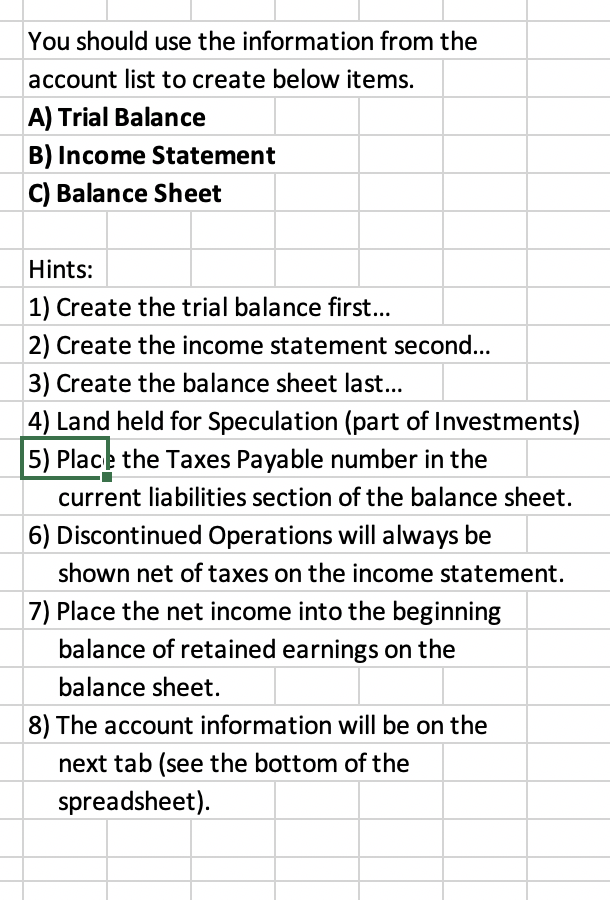

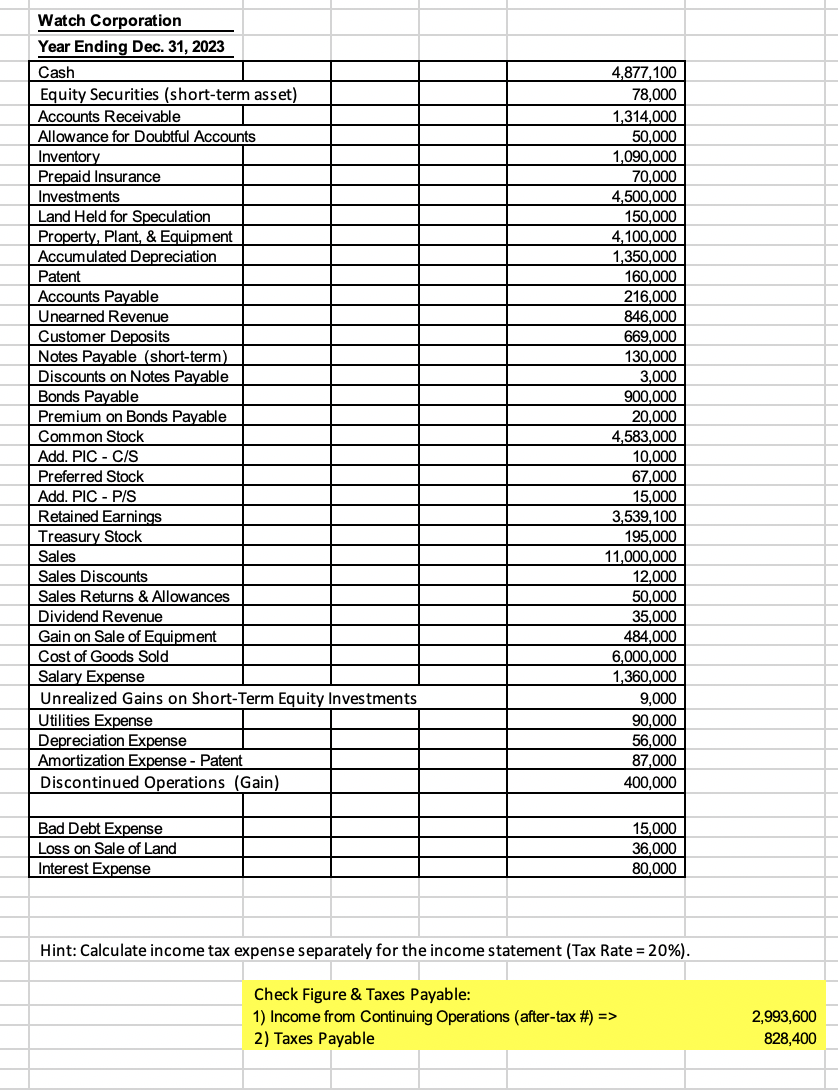

You should use the information from the account list to create below items. A) Trial Balance B) Income Statement C) Balance Sheet Hints: 1) Create the trial balance first... 2) Create the income statement second... 3) Create the balance sheet last... 4) Land held for Speculation (part of Investments) 5) Place the Taxes Payable number in the current liabilities section of the balance sheet. 6) Discontinued Operations will always be shown net of taxes on the income statement. 7) Place the net income into the beginning balance of retained earnings on the balance sheet. 8) The account information will be on the next tab (see the bottom of the spreadsheet). Watch Corporation Year Ending Dec. 31, 2023 Cash Equity Securities (short-term asset) Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Investments Land Held for Speculation Property, Plant, & Equipment Accumulated Depreciation Patent Accounts Payable Unearned Revenue Customer Deposits Notes Payable (short-term) Discounts on Notes Payable Bonds Payable Premium on Bonds Payable Common Stoc! Add. PIC-C/S Preferred Stock Add. PIC - P/S Retained Earnings Treasury Stock Sales Sales Discounts Sales Returns & Allowances Dividend Revenue Gain on Sale of Equipment Cost of Goods Sold Salary Expense Unrealized Gains on Short-Term Equity Investments Utilities Expense Depreciation Expense Amortization Expense - Patent Discontinued Operations (Gain) 4,877,100 78,000 1,314,000 50,000 1,090,000 70,000 4,500,000 150,000 4,100,000 1,350,000 160,000 216,000 846,000 669,000 130,000 3,000 900,000 20,000 4,583,000 10,000 67,000 15,000 3,539,100 195,000 11,000,000 12,000 50,000 35,000 484,000 6,000,000 1,360,000 9,000 90,000 56,000 87,000 400,000 Bad Debt Expense Loss on Sale of Land Interest Expense 15,000 36,000 80,000 Hint: Calculate income tax expense separately for the income statement (Tax Rate = 20%). Check Figure & Taxes Payable: 1) Income from Continuing Operations (after-tax #) => 2) Taxes Payable 2,993,600 828,400 You should use the information from the account list to create below items. A) Trial Balance B) Income Statement C) Balance Sheet Hints: 1) Create the trial balance first... 2) Create the income statement second... 3) Create the balance sheet last... 4) Land held for Speculation (part of Investments) 5) Place the Taxes Payable number in the current liabilities section of the balance sheet. 6) Discontinued Operations will always be shown net of taxes on the income statement. 7) Place the net income into the beginning balance of retained earnings on the balance sheet. 8) The account information will be on the next tab (see the bottom of the spreadsheet). Watch Corporation Year Ending Dec. 31, 2023 Cash Equity Securities (short-term asset) Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Investments Land Held for Speculation Property, Plant, & Equipment Accumulated Depreciation Patent Accounts Payable Unearned Revenue Customer Deposits Notes Payable (short-term) Discounts on Notes Payable Bonds Payable Premium on Bonds Payable Common Stoc! Add. PIC-C/S Preferred Stock Add. PIC - P/S Retained Earnings Treasury Stock Sales Sales Discounts Sales Returns & Allowances Dividend Revenue Gain on Sale of Equipment Cost of Goods Sold Salary Expense Unrealized Gains on Short-Term Equity Investments Utilities Expense Depreciation Expense Amortization Expense - Patent Discontinued Operations (Gain) 4,877,100 78,000 1,314,000 50,000 1,090,000 70,000 4,500,000 150,000 4,100,000 1,350,000 160,000 216,000 846,000 669,000 130,000 3,000 900,000 20,000 4,583,000 10,000 67,000 15,000 3,539,100 195,000 11,000,000 12,000 50,000 35,000 484,000 6,000,000 1,360,000 9,000 90,000 56,000 87,000 400,000 Bad Debt Expense Loss on Sale of Land Interest Expense 15,000 36,000 80,000 Hint: Calculate income tax expense separately for the income statement (Tax Rate = 20%). Check Figure & Taxes Payable: 1) Income from Continuing Operations (after-tax #) => 2) Taxes Payable 2,993,600 828,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started