Could I please have closing entries for these events?

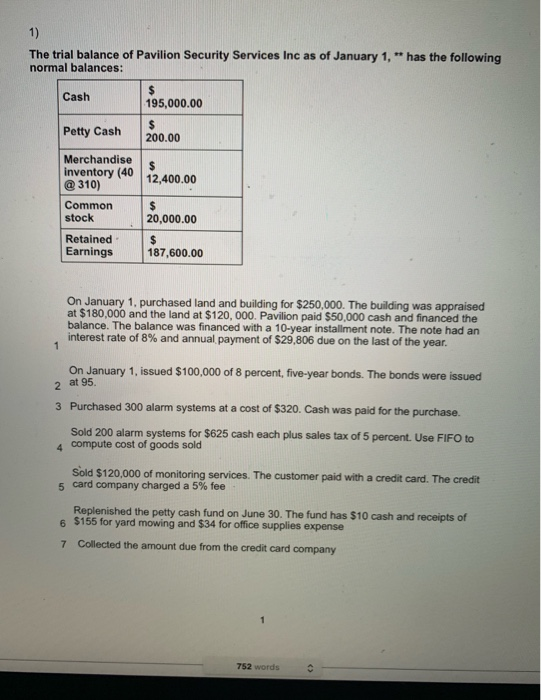

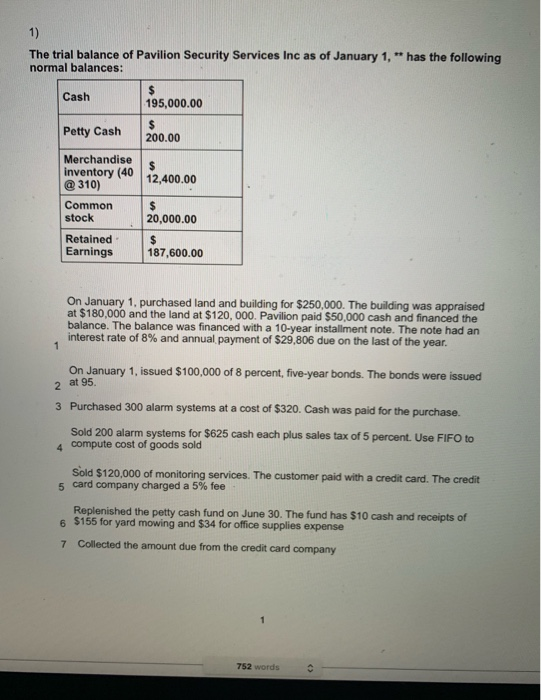

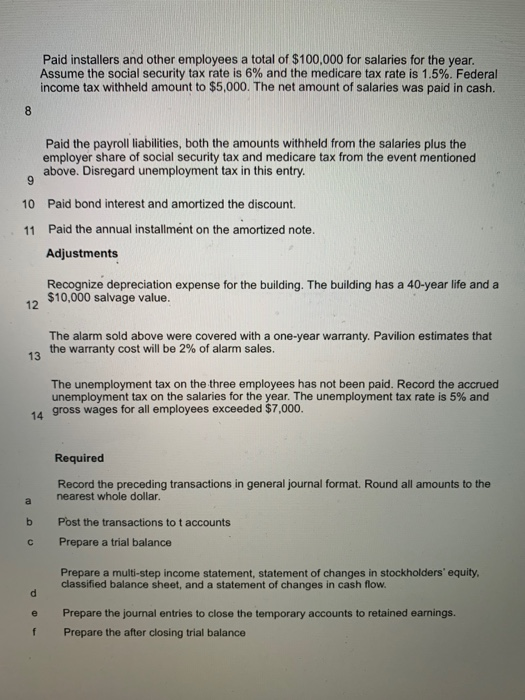

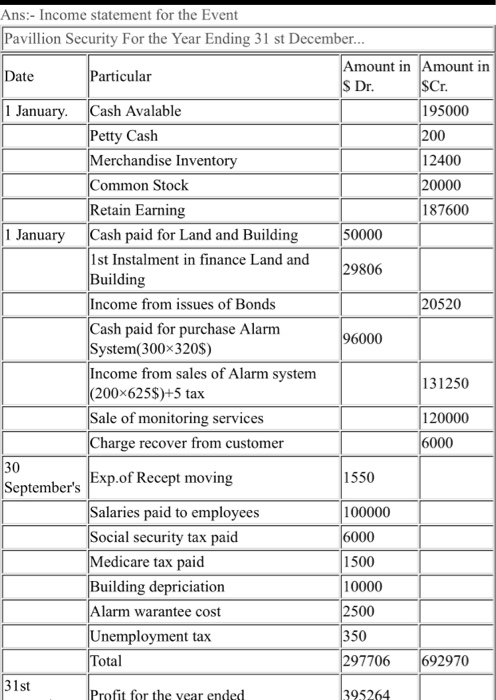

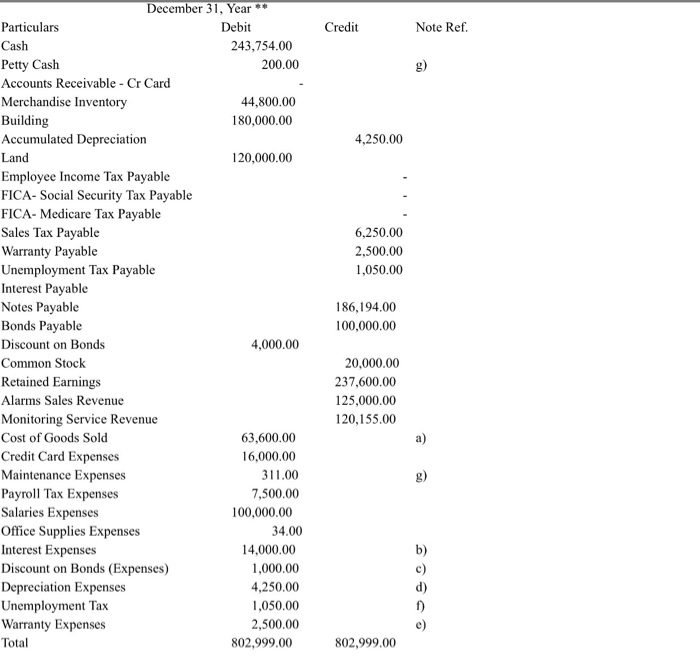

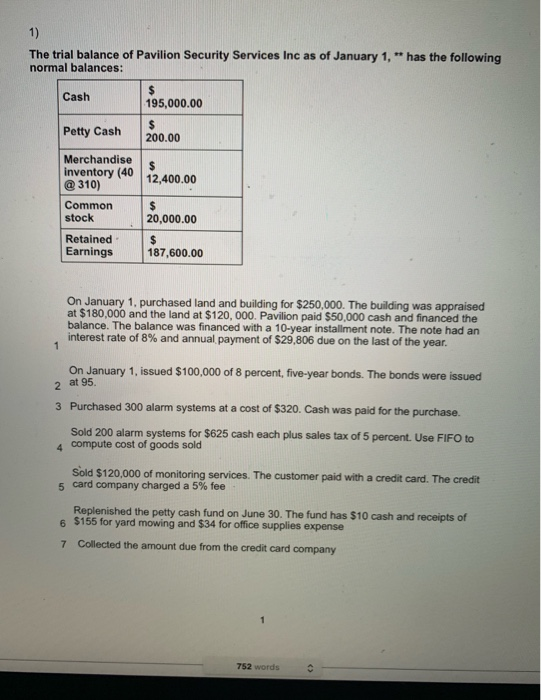

The trial balance of Pavilion Security Services Inc as of January 1, " has the following normal balances: Cash 195,000.00 Petty Cash 200.00 12,400.00 Merchandise inventory (40 @310) Common stock 20,000.00 Retained Earnings 187,600.00 On January 1, purchased land and building for $250.000. The building was appraised at $180,000 and the land at $120,000. Pavilion paid $50,000 cash and financed the balance. The balance was financed with a 10-year installment note. The note had an interest rate of 8% and annual payment of $29.806 due on the last of the year. On January 1, issued $100,000 of 8 percent, five-year bonds. The bonds were issued 2 at 95. 3 Purchased 300 alarm systems at a cost of $320. Cash was paid for the purchase. Sold 200 alarm systems for $625 cash each plus sales tax of 5 percent. Use FIFO to 4 compute cost of goods sold Sold $120,000 of monitoring services. The customer paid with a credit card. The credit card company charged a 5% fee 5 Replenished the petty cash fund on June 30. The fund has $10 cash and receipts of 6 $155 for yard mowing and $34 for office supplies expense 7 Collected the amount due from the credit card company 752 words - Paid installers and other employees a total of $100,000 for salaries for the year. Assume the social security tax rate is 6% and the medicare tax rate is 1.5%. Federal income tax withheld amount to $5,000. The net amount of salaries was paid in cash. Paid the payroll liabilities, both the amounts withheld from the salaries plus the employer share of social security tax and medicare tax from the event mentioned above. Disregard unemployment tax in this entry. 10 Paid bond interest and amortized the discount. 11 Paid the annual installment on the amortized note. Adjustments Recognize depreciation expense for the building. The building has a 40-year life and a $10,000 salvage value. The alarm sold above were covered with a one-year warranty. Pavilion estimates that the warranty cost will be 2% of alarm sales. The unemployment tax on the three employees has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 5% and 14 gross wages for all employees exceeded $7,000. Required Record the preceding transactions in general journal format. Round all amounts to the nearest whole dollar. Post the transactions to accounts Prepare a trial balance Prepare a multi-step income statement, statement of changes in stockholders' equity. classified balance sheet, and a statement of changes in cash flow. Prepare the journal entries to close the temporary accounts to retained earnings. Prepare the after closing trial balance Date Account Titles Debit Credit Closing Entries Dec. Ans:- Income statement for the Event Pavillion Security For the Year Ending 31 st December... Amount in Amount in Date Particular S Dr. SCr. 1 January. Cash Avalable 195000 Petty Cash 200 Merchandise Inventory 12400 Common Stock 20000 Retain Earning 187600 1 January Cash paid for Land and Building 50000 1st Instalment in finance Land and 29806 Building Income from issues of Bonds 20520 Cash paid for purchase Alarm 96000 System(300x320$) Income from sales of Alarm system 131250 (200X625$)+5 tax Sale of monitoring services 120000 Charge recover from customer 6000 30 Exp.of Recept moving 1550 September's Salaries paid to employees 100000 Social security tax paid 6000 Medicare tax paid 1500 Building depriciation 10000 Alarm warantee cost 2500 Unemployment tax 350 Total 297706 692970 31st Profit for the year ended 395264 Credit Note Ref. 4,250.00 6,250.00 2,500.00 1,050.00 December 31, Year *** Particulars Debit Cash 243,754.00 Petty Cash 200.00 Accounts Receivable - Cr Card Merchandise Inventory 44,800.00 Building 180,000.00 Accumulated Depreciation Land 120,000.00 Employee Income Tax Payable FICA- Social Security Tax Payable FICA-Medicare Tax Payable Sales Tax Payable Warranty Payable Unemployment Tax Payable Interest Payable Notes Payable Bonds Payable Discount on Bonds 4,000.00 Common Stock Retained Earnings Alarms Sales Revenue Monitoring Service Revenue Cost of Goods Sold 63,600.00 Credit Card Expenses 16,000.00 Maintenance Expenses 311.00 Payroll Tax Expenses 7,500.00 Salaries Expenses 100,000.00 Office Supplies Expenses 34.00 Interest Expenses 14,000.00 Discount on Bonds (Expenses) 1,000.00 Depreciation Expenses 4,250.00 Unemployment Tax 1,050.00 Warranty Expenses 2,500.00 Total 802,999.00 186,194.00 100,000.00 20,000.00 237,600.00 125,000.00 120,155.00 802,999.00 The trial balance of Pavilion Security Services Inc as of January 1, " has the following normal balances: Cash 195,000.00 Petty Cash 200.00 12,400.00 Merchandise inventory (40 @310) Common stock 20,000.00 Retained Earnings 187,600.00 On January 1, purchased land and building for $250.000. The building was appraised at $180,000 and the land at $120,000. Pavilion paid $50,000 cash and financed the balance. The balance was financed with a 10-year installment note. The note had an interest rate of 8% and annual payment of $29.806 due on the last of the year. On January 1, issued $100,000 of 8 percent, five-year bonds. The bonds were issued 2 at 95. 3 Purchased 300 alarm systems at a cost of $320. Cash was paid for the purchase. Sold 200 alarm systems for $625 cash each plus sales tax of 5 percent. Use FIFO to 4 compute cost of goods sold Sold $120,000 of monitoring services. The customer paid with a credit card. The credit card company charged a 5% fee 5 Replenished the petty cash fund on June 30. The fund has $10 cash and receipts of 6 $155 for yard mowing and $34 for office supplies expense 7 Collected the amount due from the credit card company 752 words - Paid installers and other employees a total of $100,000 for salaries for the year. Assume the social security tax rate is 6% and the medicare tax rate is 1.5%. Federal income tax withheld amount to $5,000. The net amount of salaries was paid in cash. Paid the payroll liabilities, both the amounts withheld from the salaries plus the employer share of social security tax and medicare tax from the event mentioned above. Disregard unemployment tax in this entry. 10 Paid bond interest and amortized the discount. 11 Paid the annual installment on the amortized note. Adjustments Recognize depreciation expense for the building. The building has a 40-year life and a $10,000 salvage value. The alarm sold above were covered with a one-year warranty. Pavilion estimates that the warranty cost will be 2% of alarm sales. The unemployment tax on the three employees has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 5% and 14 gross wages for all employees exceeded $7,000. Required Record the preceding transactions in general journal format. Round all amounts to the nearest whole dollar. Post the transactions to accounts Prepare a trial balance Prepare a multi-step income statement, statement of changes in stockholders' equity. classified balance sheet, and a statement of changes in cash flow. Prepare the journal entries to close the temporary accounts to retained earnings. Prepare the after closing trial balance Date Account Titles Debit Credit Closing Entries Dec. Ans:- Income statement for the Event Pavillion Security For the Year Ending 31 st December... Amount in Amount in Date Particular S Dr. SCr. 1 January. Cash Avalable 195000 Petty Cash 200 Merchandise Inventory 12400 Common Stock 20000 Retain Earning 187600 1 January Cash paid for Land and Building 50000 1st Instalment in finance Land and 29806 Building Income from issues of Bonds 20520 Cash paid for purchase Alarm 96000 System(300x320$) Income from sales of Alarm system 131250 (200X625$)+5 tax Sale of monitoring services 120000 Charge recover from customer 6000 30 Exp.of Recept moving 1550 September's Salaries paid to employees 100000 Social security tax paid 6000 Medicare tax paid 1500 Building depriciation 10000 Alarm warantee cost 2500 Unemployment tax 350 Total 297706 692970 31st Profit for the year ended 395264 Credit Note Ref. 4,250.00 6,250.00 2,500.00 1,050.00 December 31, Year *** Particulars Debit Cash 243,754.00 Petty Cash 200.00 Accounts Receivable - Cr Card Merchandise Inventory 44,800.00 Building 180,000.00 Accumulated Depreciation Land 120,000.00 Employee Income Tax Payable FICA- Social Security Tax Payable FICA-Medicare Tax Payable Sales Tax Payable Warranty Payable Unemployment Tax Payable Interest Payable Notes Payable Bonds Payable Discount on Bonds 4,000.00 Common Stock Retained Earnings Alarms Sales Revenue Monitoring Service Revenue Cost of Goods Sold 63,600.00 Credit Card Expenses 16,000.00 Maintenance Expenses 311.00 Payroll Tax Expenses 7,500.00 Salaries Expenses 100,000.00 Office Supplies Expenses 34.00 Interest Expenses 14,000.00 Discount on Bonds (Expenses) 1,000.00 Depreciation Expenses 4,250.00 Unemployment Tax 1,050.00 Warranty Expenses 2,500.00 Total 802,999.00 186,194.00 100,000.00 20,000.00 237,600.00 125,000.00 120,155.00 802,999.00