could skmeone solve using excel formulas

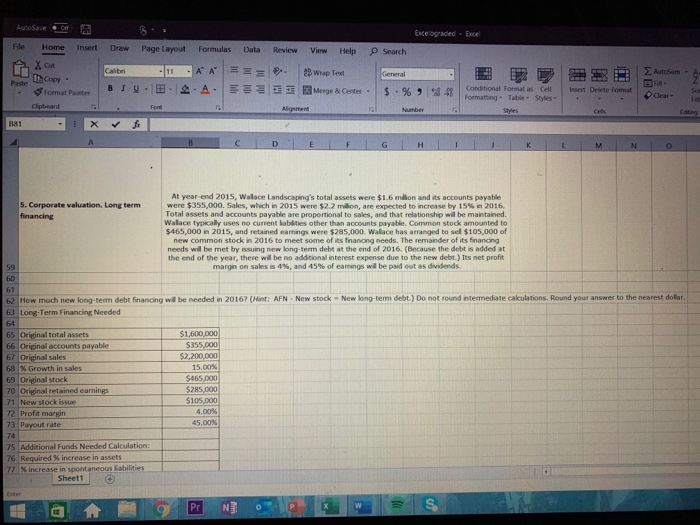

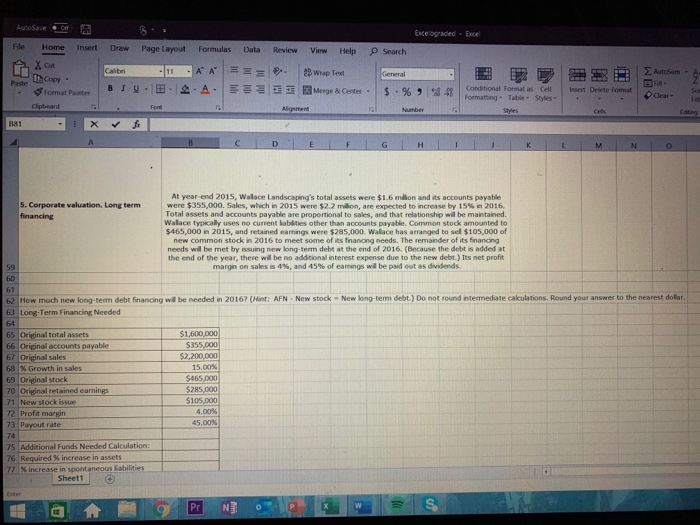

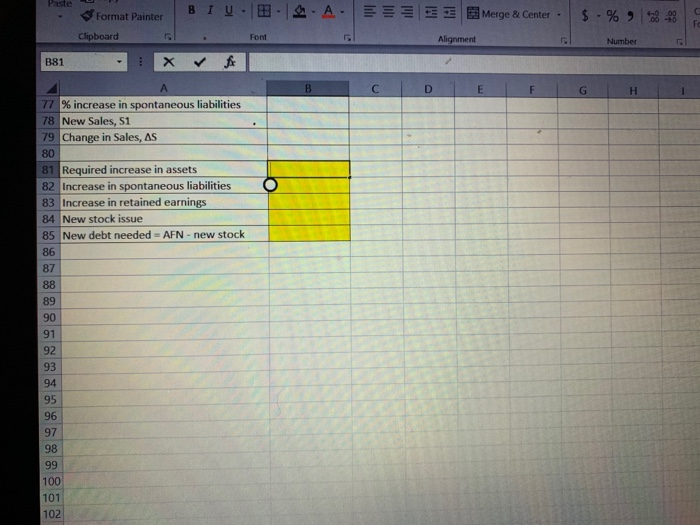

Exce graded - Excel Review Search AutoSave C E File Home Insert Draw Calibri Puse Copy - Format Painter B U Page Layout Formulas Data .11 A A === B 9.A. F View Help Wrap Test Merge & Center. Genera $. % 448 Conditional formatas Cell Tocmatting Table Styles Insert Delete format . CTDFGHIJKLMNO 5. Corporate valuation. Le financing At year-end 2015, Wallace Landscaping's total assets were $1.6 million and its accounts payable were $355,000. Sales, which in 2015 were $2.2 milion, are expected to increase by 15% in 2016 Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current abilities other than accounts payable. Common stock amounted to $465,000 in 2015, and retained camnings were $285,000. Wallace has arranged to sel $105,000 of new common stock in 2016 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 4%, and 45% of earnings will be paid out as dividends New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dolar. 62 How much new long-term debt financing will be needed in 2016? (Hint: AFN - New stock 63 Long Term Financing Needed 65 Original total assets 66 Original accounts payable 67 Original sales 68 % Growth in sales 69 Original stock 70 Original retained earnings 71 New stock issue 72 Profit margin 73 Payout rate $1,600,000 $355.000 $2,200,000 15.00 $465.000 $285,000 $105,000 4.00% 45.00% 75 Additional Funds Needed Calculation: 76 Required % increase in assets 77 x increase in spontaneous abilities Sheet1 Paste UP - . .A. A Merge & Center. Format Painter Clipboard -48 BIU. - . fx $ -% Number Font Alignment B81 - 1 x IcoTELEIGH 77 % increase in spontaneous liabilities 78 New Sales, S1 79 Change in Sales, AS 80 81 Required increase in assets 82 Increase in spontaneous liabilities 83 Increase in retained earnings 84 New stock issue 85 New debt needed = AFN - new stock