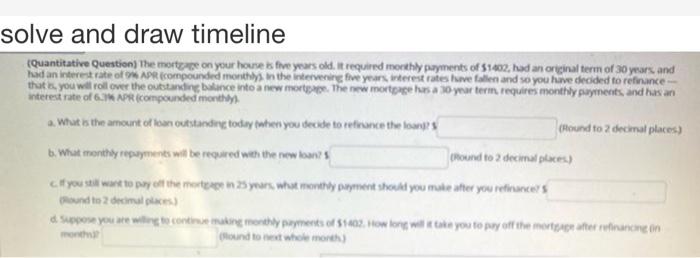

could someone draw timeline

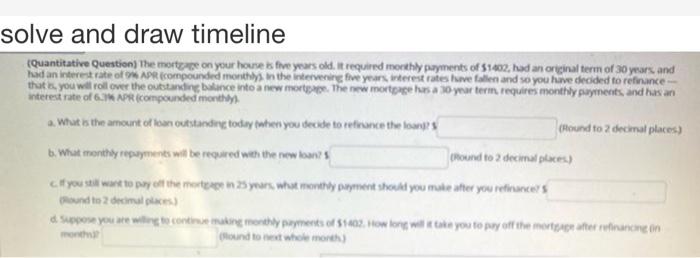

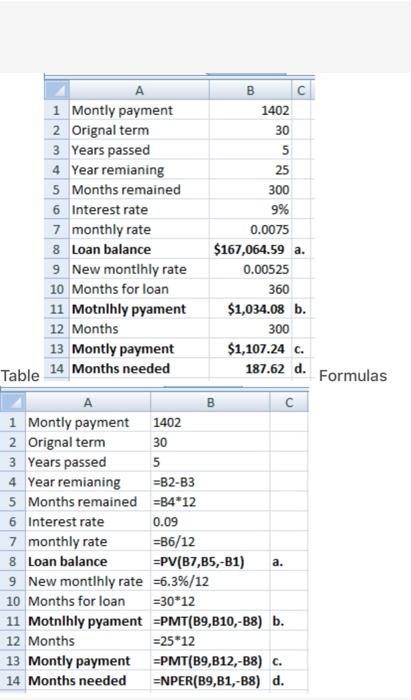

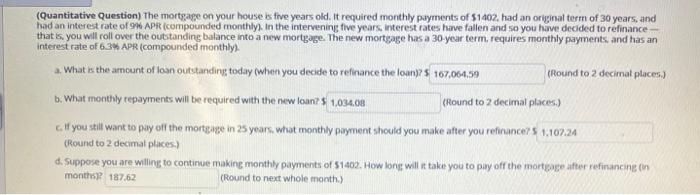

solve and draw timeline (Quantitative Question the mortere on your house is five years old. It required monthly payments of 1602, had an original term of 30 years and dan interest rate of APR compounded monthly in the intervening five years terest rates have fallen and so you have decided to refinance that is, you will roll over the outstanding Dance into a new morts. The new motorces a 10 year term requires monthly payments and has an interest rate of 6 APR compounded monthly a. What is the amount of an outstanding today when you decide to retrance the land? Hound to 2 decimal places) b. What monthy repayments will be required with the news Round to to decimal places) Cif you still want to pay of the more yours what monthly ment should you make after you retirances found to 2 decimale) dSupere you are we to continue on money payments of 51402. How long will take you to pay off the merger terrenaren mo 187.62 d. Formulas B 1 Montly payment 1402 2 Orignal term 30 3 Years passed 5 4 Year remianing 25 5 Months remained 300 6 Interest rate 9% 7 monthly rate 0.0075 8 Loan balance $167,064.59 a. 9 New montihly rate 0.00525 10 Months for loan 360 11 Motnlhly pyament $1,034.08 b. 12 Months 300 13 Montly payment $1,107.24 c. Table 14 Months needed A B 1 Montly payment 1402 2 Orignal term 30 3 Years passed 5 4 Year remianing =B2-B3 5 Months remained =B4*12 6 Interest rate 0.09 7 monthly rate =B6/12 8 Loan balance =PV(B7,B5,-31) 9 New monthly rate =6.3%/12 10 Months for loan =30*12 11 Motnlhly pyament =PMT(B9,110,-B8) b. 12 Months =25*12 13 Montly payment =PMT(B9,112,-B8) c. 14 Months needed =NPER(B9, B1,-B8) d. a. (Quantitative Question) The mortgage on your house is five years old. It required monthly payments of S1402. had an original term of 30 years, and had an interest rate of 9 APR (compounded monthly). In the intervening five years, interest rates have fallen and so you have decided to refinance - that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 30 year term requires monthly payments and has an interest rate of 63% APR (compounded monthly). What is the amount of loan outstanding today when you decide to refinance the loans 107,064,99 (Round to 2 decimal places) b. What monthly repayments will be required with the new loan? $ 1.034.08 (Round to 2 decimal places.) Cill you still want to pay of the mortgape in 25 years, what monthly payment should you make after you refinancers 1.107.24 Round to 2 decimal places.) d. Suppose you are willing to continue making monthly payments of 51402. How long will it take you to pay off the mortgage after refinancing on month 187.62 (Round to next whole mooth) solve and draw timeline (Quantitative Question the mortere on your house is five years old. It required monthly payments of 1602, had an original term of 30 years and dan interest rate of APR compounded monthly in the intervening five years terest rates have fallen and so you have decided to refinance that is, you will roll over the outstanding Dance into a new morts. The new motorces a 10 year term requires monthly payments and has an interest rate of 6 APR compounded monthly a. What is the amount of an outstanding today when you decide to retrance the land? Hound to 2 decimal places) b. What monthy repayments will be required with the news Round to to decimal places) Cif you still want to pay of the more yours what monthly ment should you make after you retirances found to 2 decimale) dSupere you are we to continue on money payments of 51402. How long will take you to pay off the merger terrenaren mo 187.62 d. Formulas B 1 Montly payment 1402 2 Orignal term 30 3 Years passed 5 4 Year remianing 25 5 Months remained 300 6 Interest rate 9% 7 monthly rate 0.0075 8 Loan balance $167,064.59 a. 9 New montihly rate 0.00525 10 Months for loan 360 11 Motnlhly pyament $1,034.08 b. 12 Months 300 13 Montly payment $1,107.24 c. Table 14 Months needed A B 1 Montly payment 1402 2 Orignal term 30 3 Years passed 5 4 Year remianing =B2-B3 5 Months remained =B4*12 6 Interest rate 0.09 7 monthly rate =B6/12 8 Loan balance =PV(B7,B5,-31) 9 New monthly rate =6.3%/12 10 Months for loan =30*12 11 Motnlhly pyament =PMT(B9,110,-B8) b. 12 Months =25*12 13 Montly payment =PMT(B9,112,-B8) c. 14 Months needed =NPER(B9, B1,-B8) d. a. (Quantitative Question) The mortgage on your house is five years old. It required monthly payments of S1402. had an original term of 30 years, and had an interest rate of 9 APR (compounded monthly). In the intervening five years, interest rates have fallen and so you have decided to refinance - that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 30 year term requires monthly payments and has an interest rate of 63% APR (compounded monthly). What is the amount of loan outstanding today when you decide to refinance the loans 107,064,99 (Round to 2 decimal places) b. What monthly repayments will be required with the new loan? $ 1.034.08 (Round to 2 decimal places.) Cill you still want to pay of the mortgape in 25 years, what monthly payment should you make after you refinancers 1.107.24 Round to 2 decimal places.) d. Suppose you are willing to continue making monthly payments of 51402. How long will it take you to pay off the mortgage after refinancing on month 187.62 (Round to next whole mooth)