Could someone enlighten me in finding and/or calculating the return on book assets and book equity for the next two years of Star River Electronics Ltd. case?

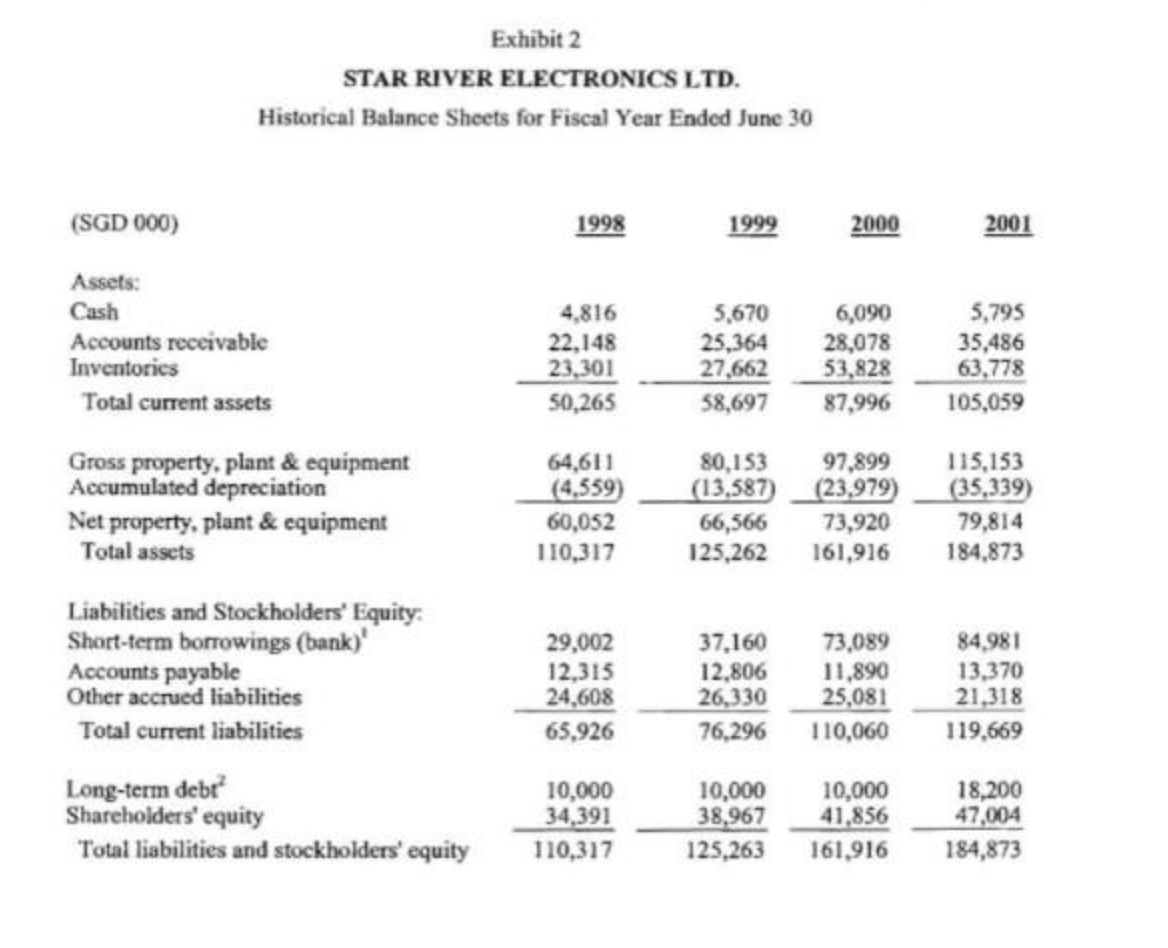

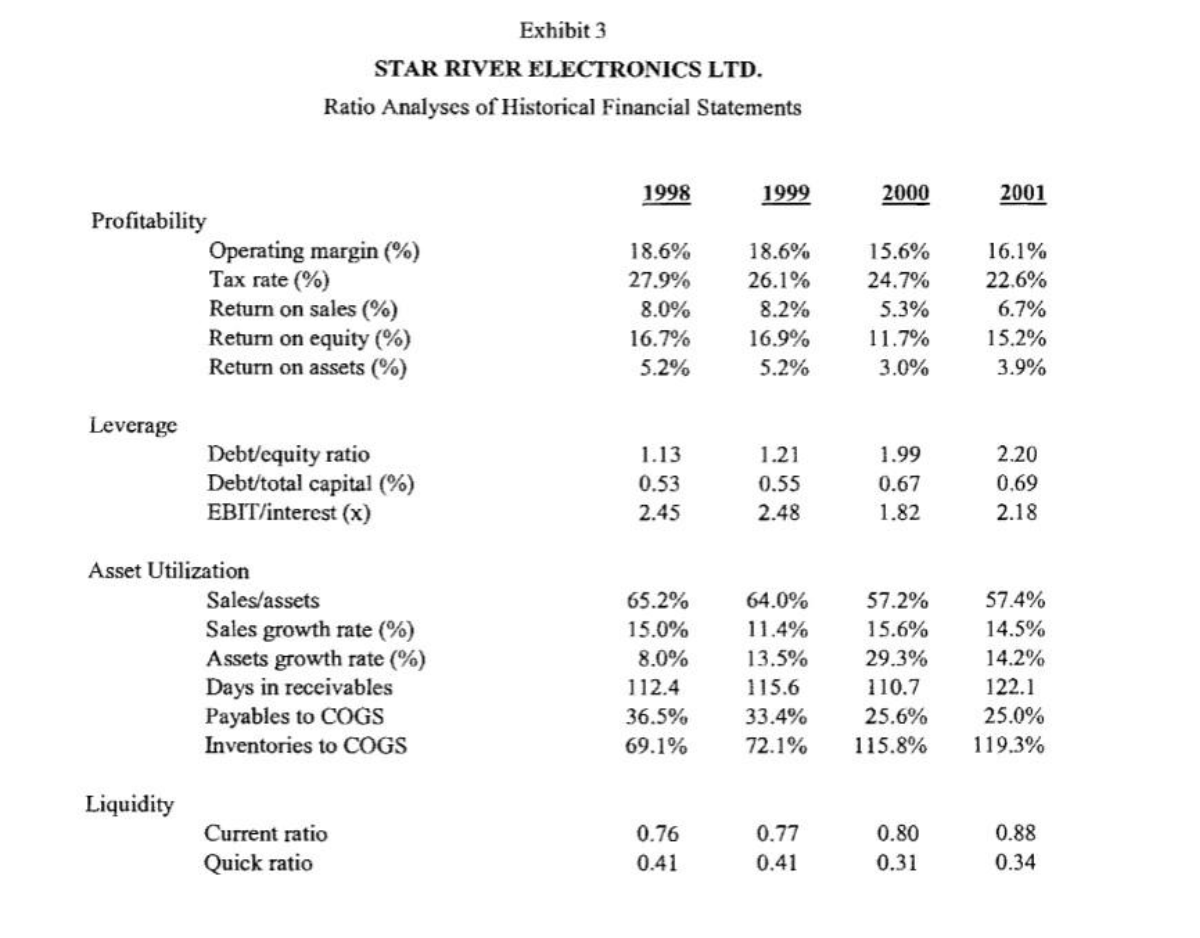

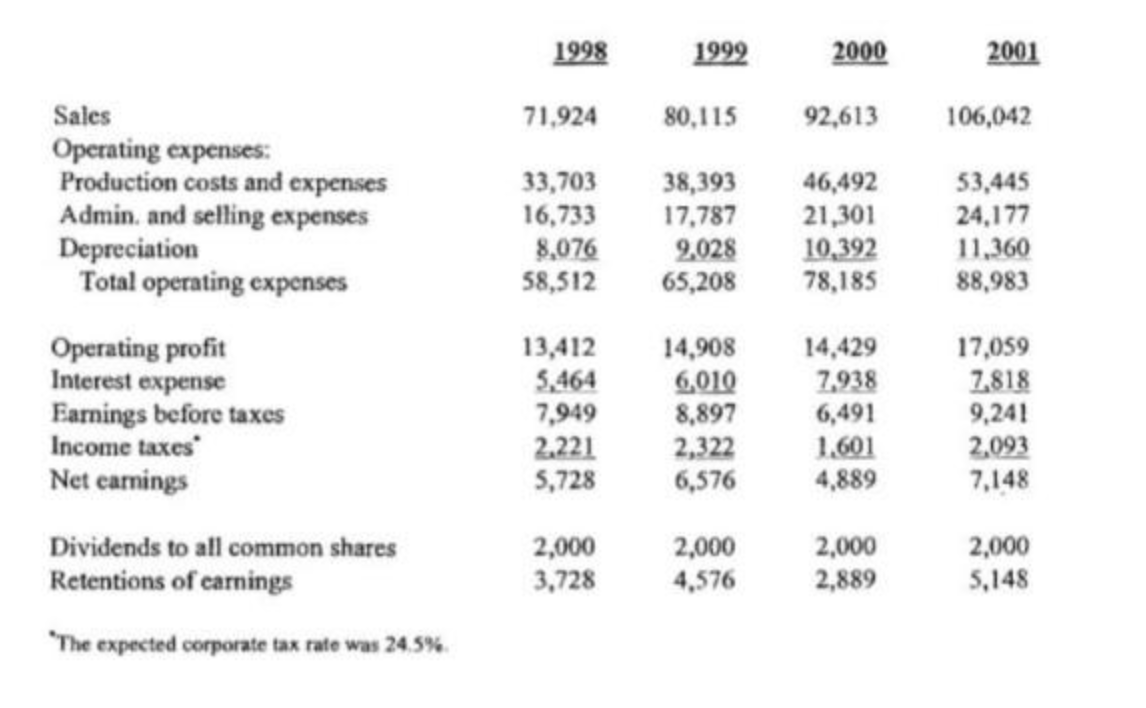

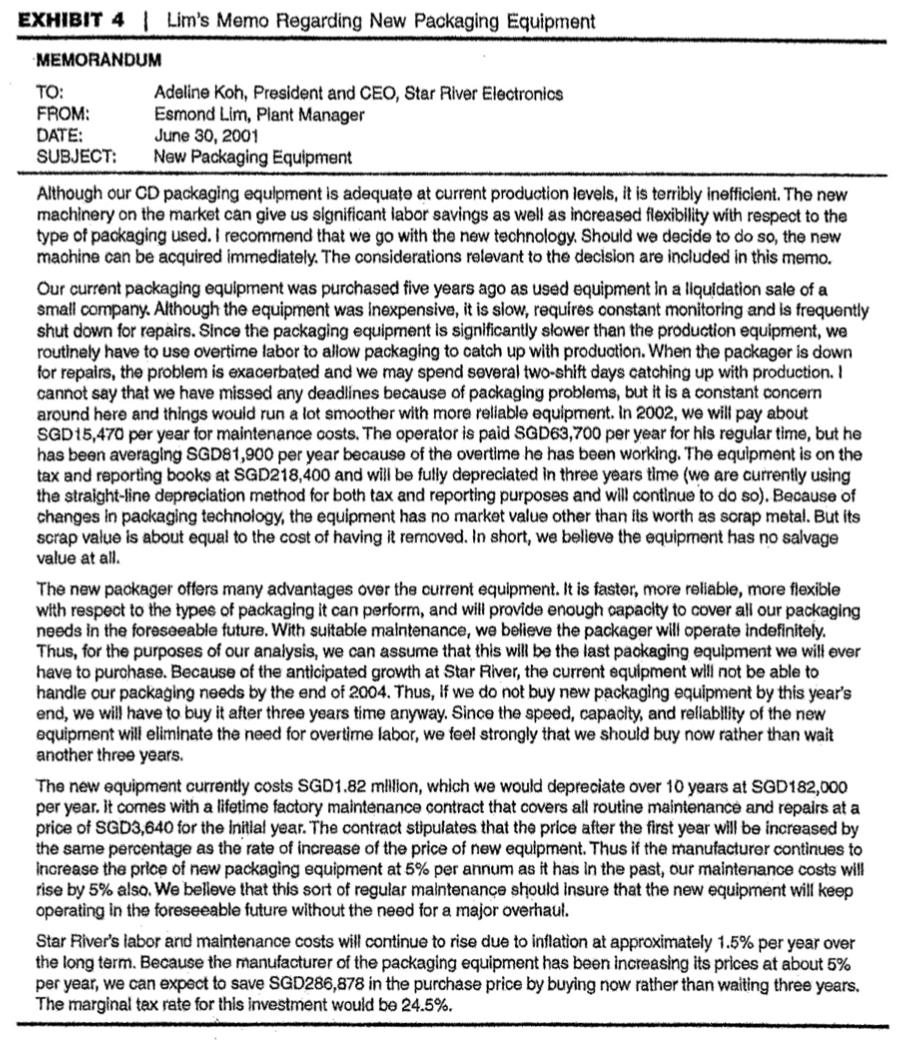

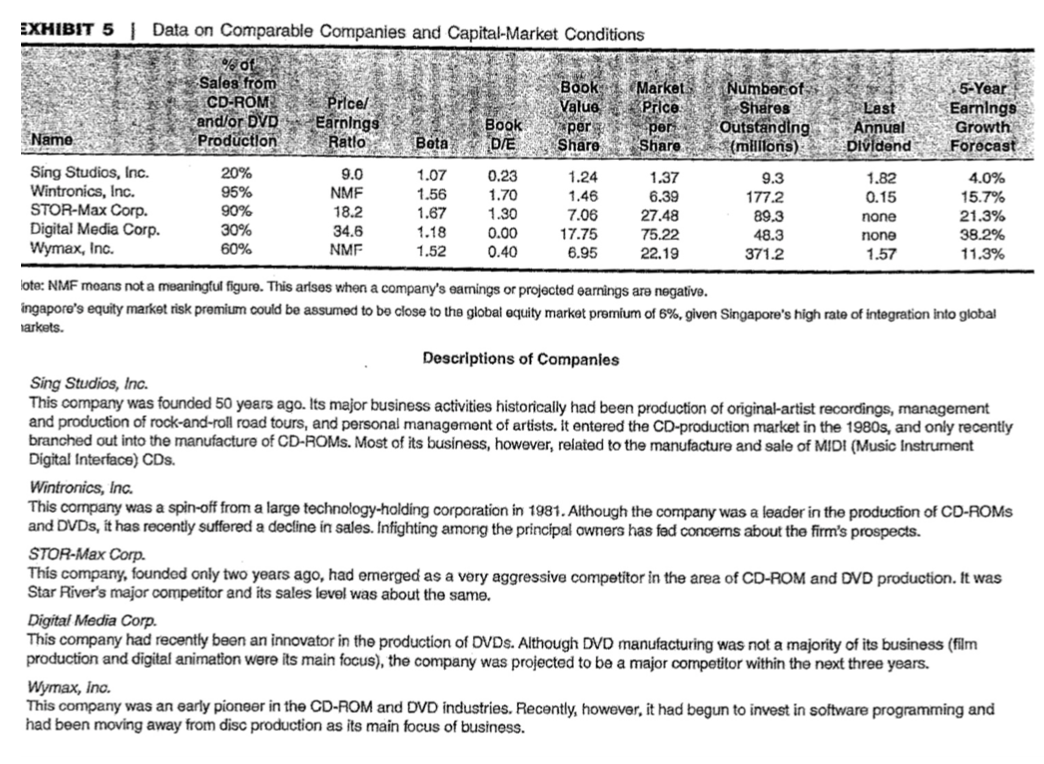

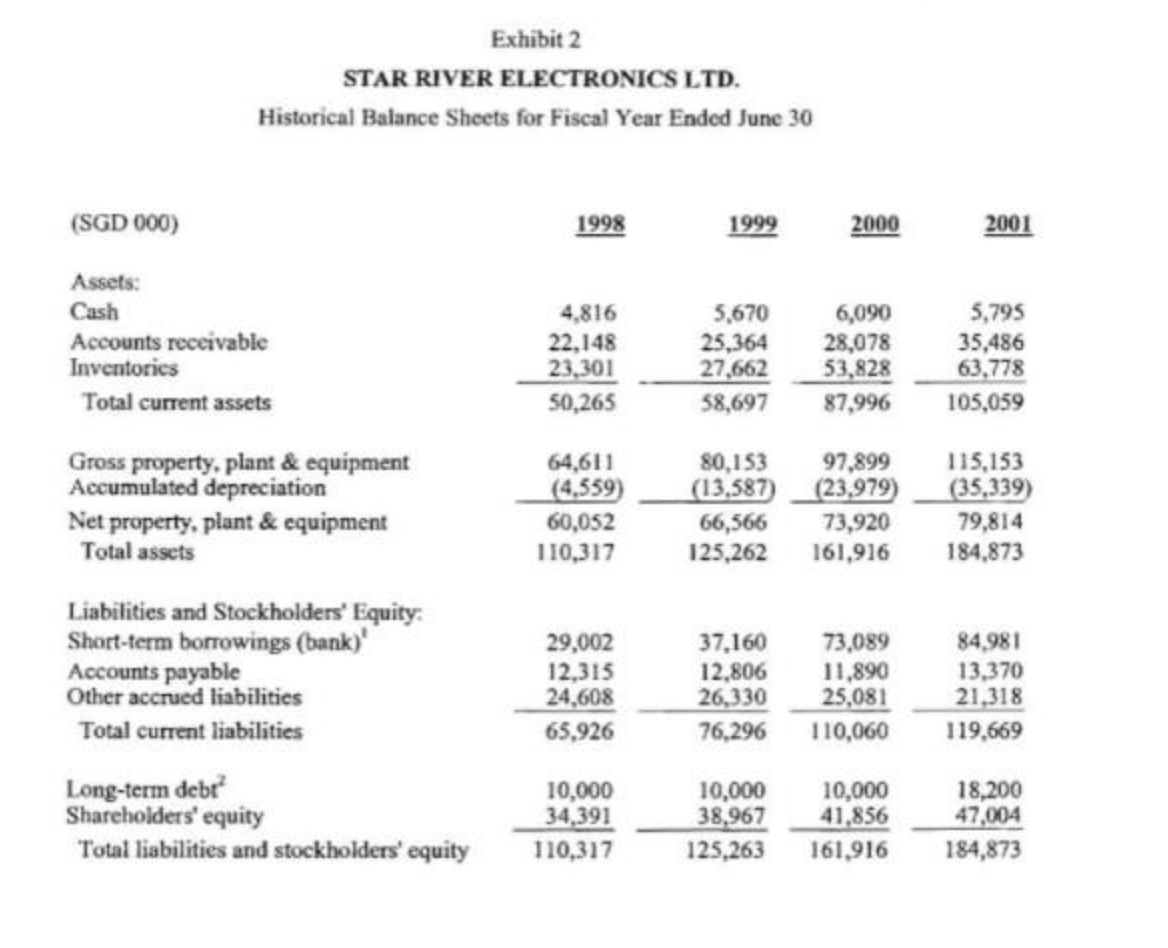

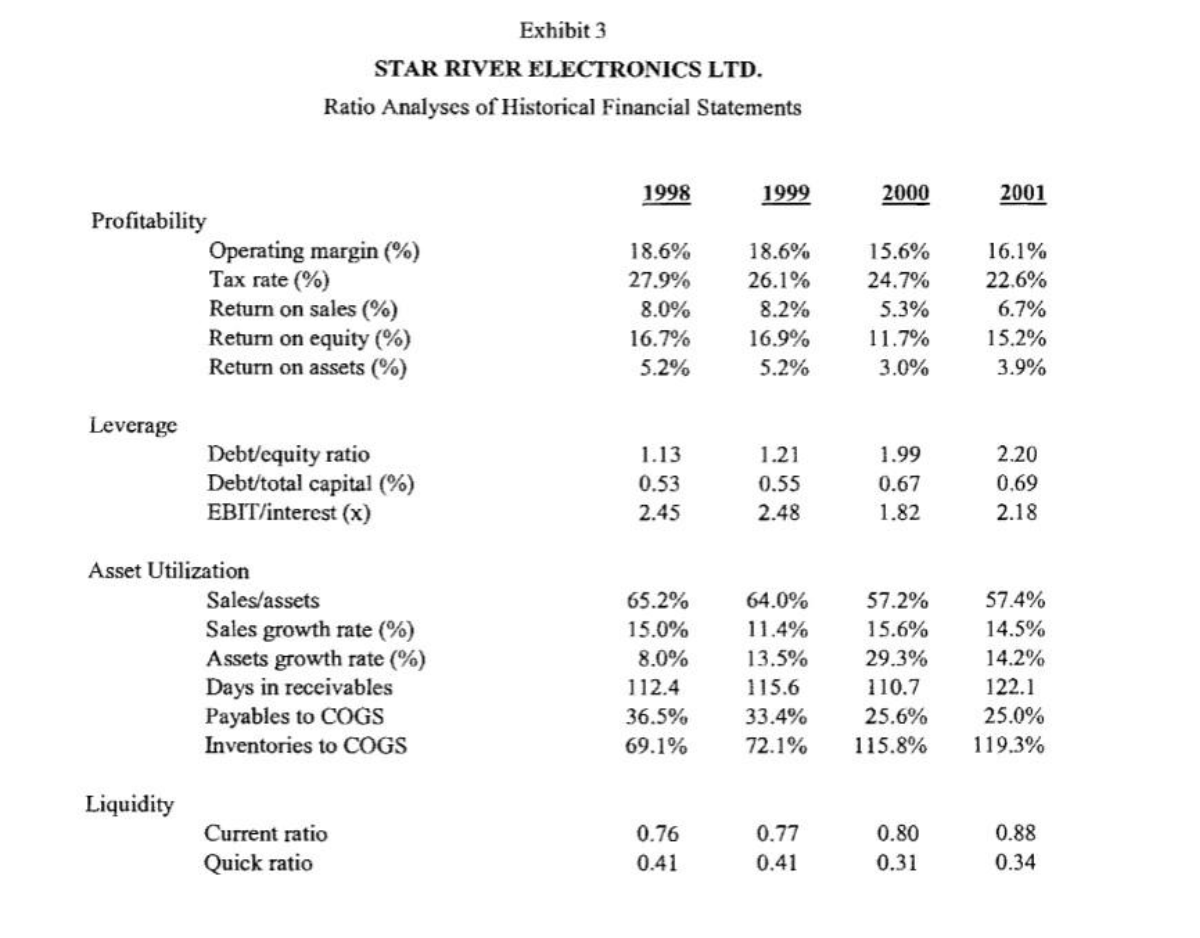

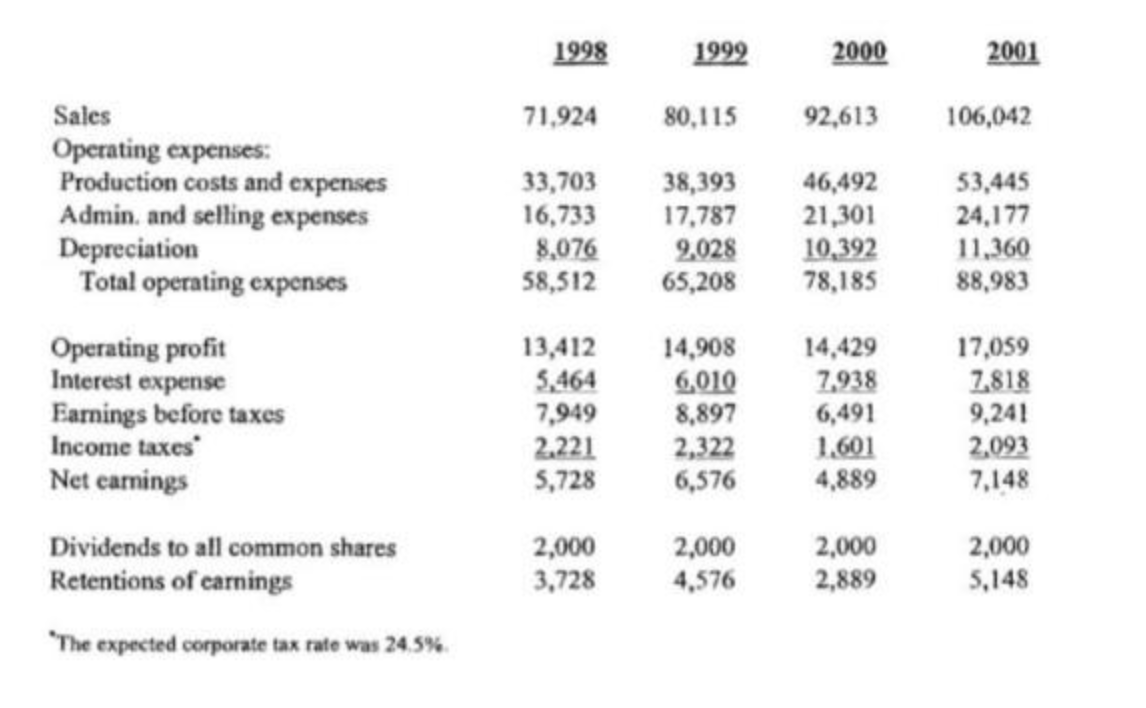

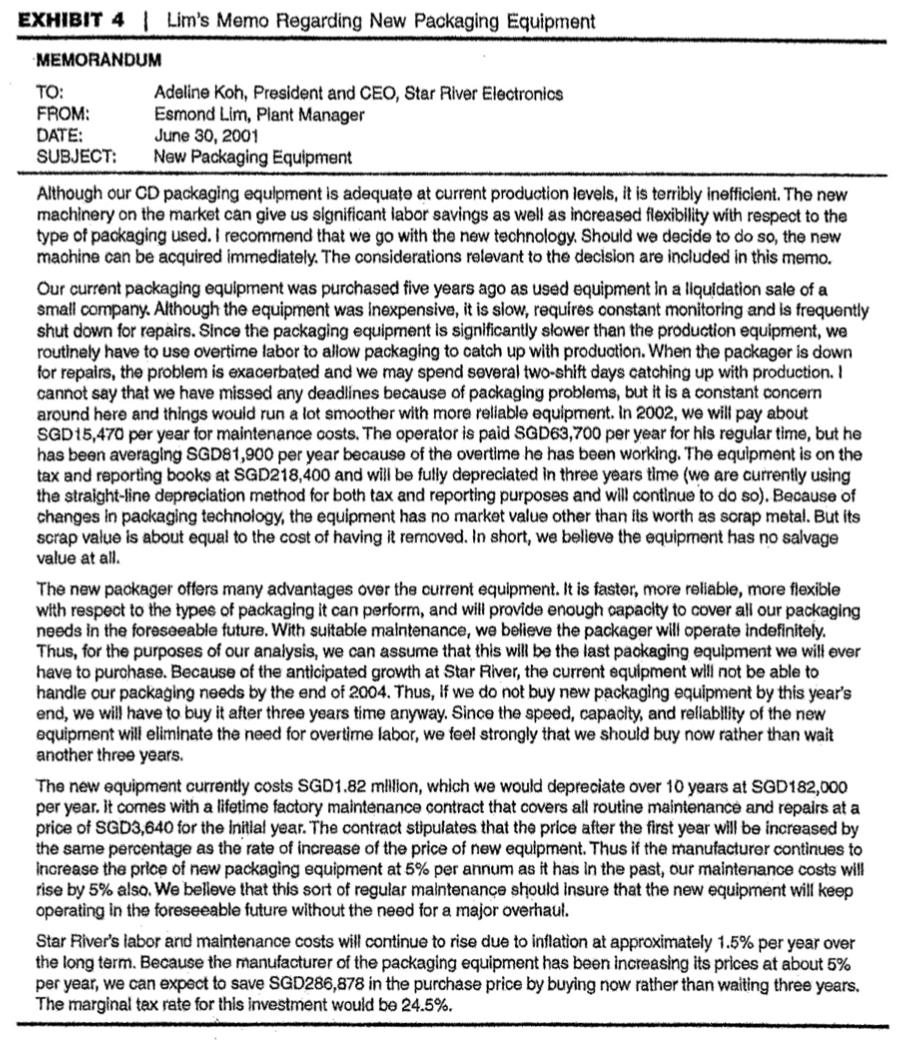

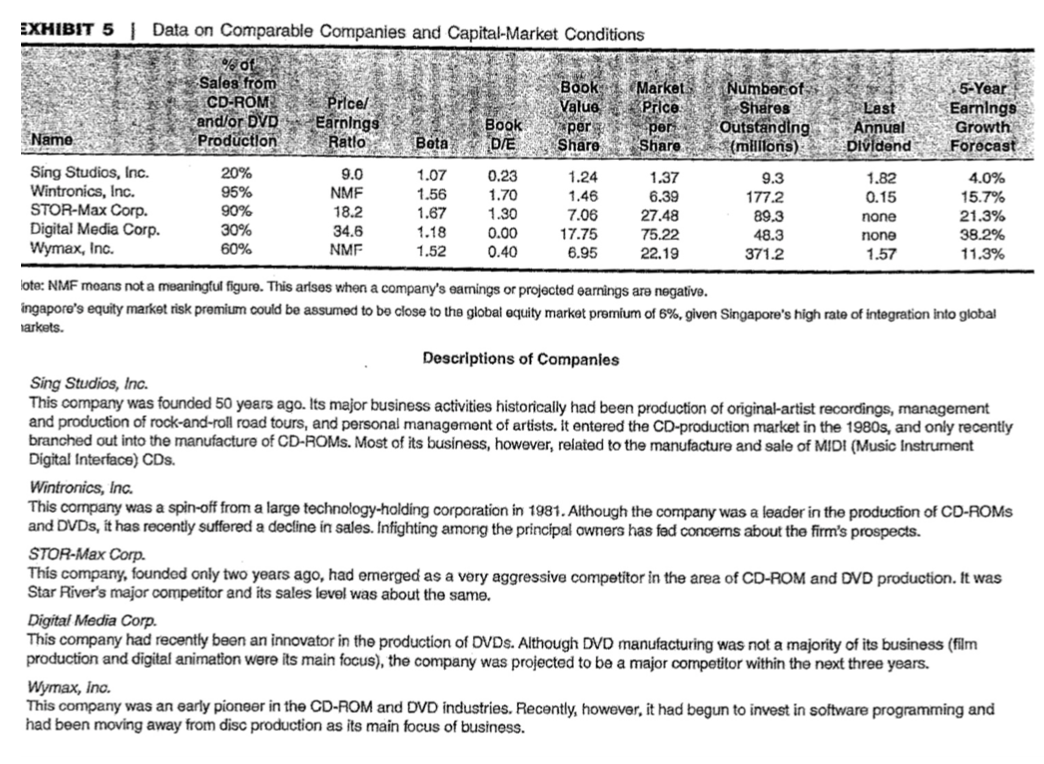

Exhibit 2 STAR RIVER ELECTRONICS LTD. Historical Balance Sheets for Fiscal Year Ended June 30 Exhibit 3 STAR RIVER ELECTRONICS LTD. Ratio Analyses of Historical Financial Statements The expected corporate tax rate was 24.5\%. SUBJECT: New Packaging Equipment Although our CD packaging equlpment is adequate at current production levels, it is terribly inefficient. The new machinery on the market can give us significant labor savings as well as increased flexibility with respect to the type of packaging used. I recommend that we go with the new technology. Should we decide to do so, the new maohine can be acquired immediately. The considerations relevant to the decision are included in this memo. Our current packaging equipment was purchased five years ago as used equipment in a liquidation sale of a small company. Although the equipment was Inexpensive, it is siow, requires constant monitoring and is frequently shut down for repairs. Since the packaging equipment is significantly slower than the production equipment, we routinely have to use overtime labor to allow packaging to catch up with produotion. When the packager is down for repairs, the problem is exacerbated and we may spend several two-shift days catching up with production. I cannot say that we have missed any deadlines because of packaging problems, but it is a constant concern around here and things would run a lot smoother with more reliable equipment. in 2002, we will pay about SGD 5,470 per year for maintenance oosts. The operator is paid SGD63,700 per year for his regular time, but he has been averaging SGD81,900 per year because of the overtime he has been working. The equipment is on the tax and reporting books at SGD218,400 and will be fully depreciated in three years time (we are currently using the straight-line depreciation method for both tax and reporting purposes and will continue to do so). Because of changes in packaging technology, the equipment has no market value other than its worth as scrap metal. But its scrap value is about equal to the cost of having it removed. In short, we believe the equipment has no salvage value at all. The new packager offers many advantages over the current equipment. It is faster, more reliable, more flexible with respect to the types of packaging it can perform, and will provide enough capacity to cover all our packaging needs in the foreseeable future. With suitable maintenance, we believe the packager will operate indefinitely. Thus, for the purposes of our analysis, we can assume that this will be the last paokaging equipment we will ever have to purohase. Because of the anticipated growth at Star River, the current equipment will not be able to handle our packaging needs by the end of 2004. Thus, If we do not buy new packaging equipment by this year's end, we will have to buy it after three years time anyway. Since the speed, capacity, and rellability of the new equipment will eliminate the need for overtime labor, we feel strongly that we should buy now rather than wait another three years. The new equipment currently costs SGD1.82 million, which we would depreciate over 10 years at SGD182,000 per year. it comes with a lifetime factory maintenance contract that covers all routine maintenance and repairs at a price of SGD3,640 for the initial year. The contract stipulates that the price after the first year will be increased by the same percentage as the rate of increase of the price of new equipment. Thus if the manufacturer continues to Increase the price of new packaging equipment at 5% per annum as it has in the past, our maintenance costs will rise by 5% also. We belleve that this sort of regular maintenance should insure that the new equipment will keep operating in the foreseeable future without the need for a major overhaul. Star River's labor and maintenance costs will continue to rise due to inflation at approximately 1.5% per year over the long term. Because the manufacturer of the packaging equipment has been increasing its prices at about 5% per year, we can expect to save SGD286,878 in the purchase price by buying now rather than waiting three years. The marginal tax rate for this investment would be 24.5%. EXHIBIT 5 I Data on Comparable Combanies and Canital-Markat Cinnditione lote: NMF means not a meaningfut figure. This arises when a company's eamings or projected earnings are negative. ingapore's equity market risk premium could be assumed to be close to the global equity market premium of 6%, given Singapore's high rate of integration into giobal larkets. Descriptions of Companies Sing Studios, tnc. This company was founded 50 years ago. Its major business activities historically had been production of original-artist recordings, management and production of rock-and-roll road tours, and personal management of artists. It entered the CD-production market in the 1980 s, and only recently branched out into the manufacture of CD-ROMs. Most of its business, however, related to the manufacture and sale of MIDI (Music instrument Digital Interface) CDs. Wintronics, Inc. This company was a spin-off from a large technology-holding corporation in 1981. Although the company was a leader in the production of CD-ROMs and DVDs, it has recently suffered a decline in sales. Infighting among the principal owners has fad concems about the firm's prospects. STOR-Max Corp. This company, foundod only two years ago, had emerged as a very aggressive competitor in the area of CD-ROM and DVD production. It was Star River's major competitor and its sales level was about the same. Digital Media Corp. This company had recently been an innovator in the production of DVDs. Although DVD manufacturing was not a majority of its business (film production and digital animation were its main focus), the company was projected to be a major competitor within the next three years. Wymax, Inc. This company was an early pioneer in the CD-POM and DVD industries. Recently, however, it had begun to invest in software programming and had been moving away from disc production as its main focus of business