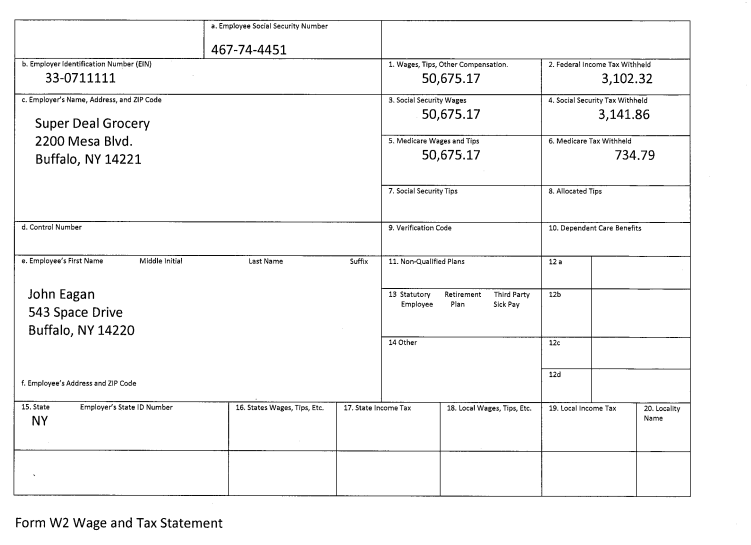

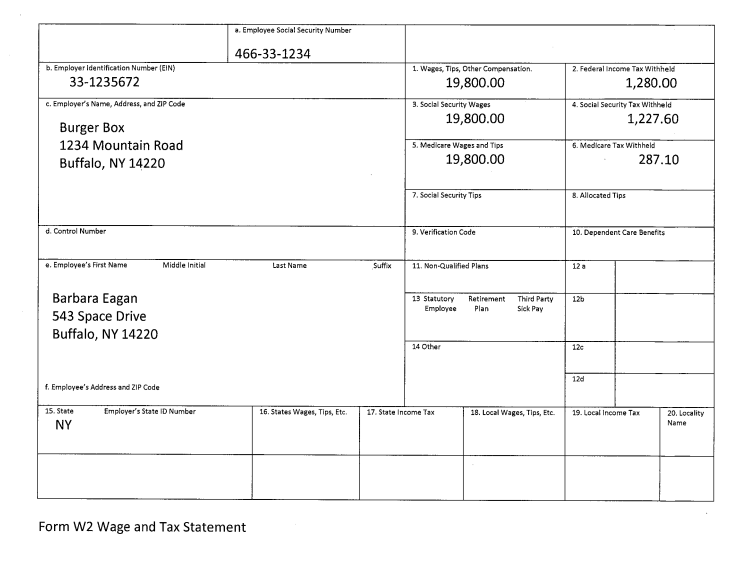

could someone file the taxes for this couple using the w2's and the information. im unsure if they file seperate or together could you determine that

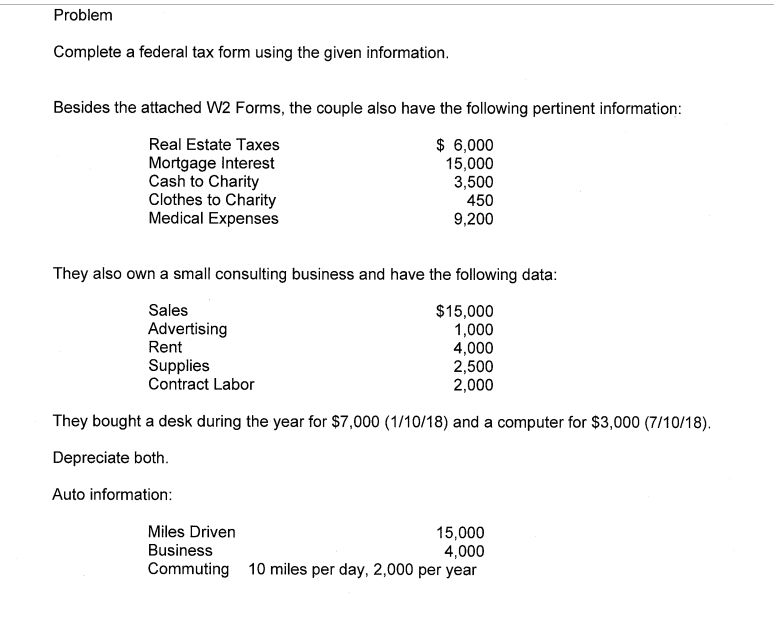

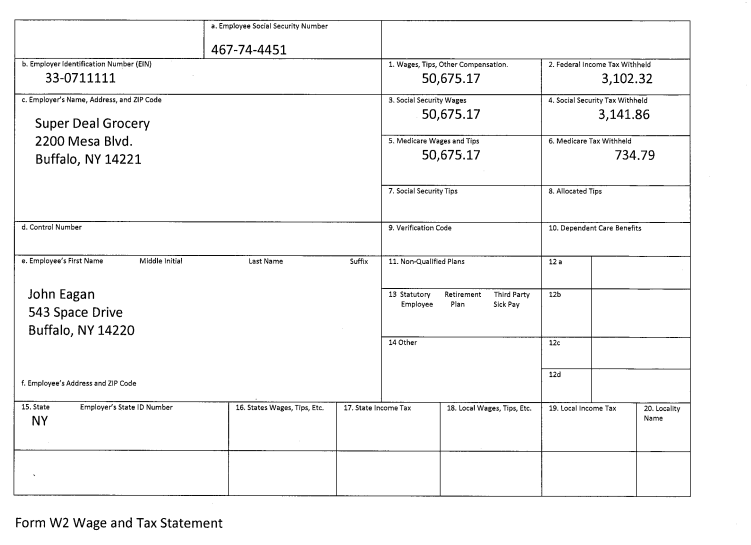

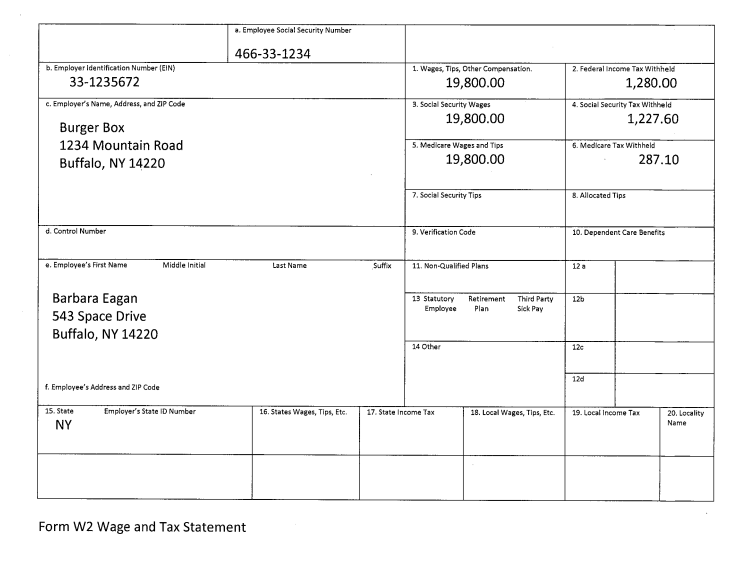

Problem Complete a federal tax form using the given information. Besides the attached W2 Forms, the couple also have the following pertinent information: Real Estate Taxes Mortgage Interest Cash to Charity Clothes to Charity Medical Expenses $ 6,000 15,000 3,500 450 9,200 They also own a small consulting business and have the following data: Sales Advertising Rent Supplies Contract Labor $15,000 1,000 4,000 2,500 2,000 They bought a desk during the year for $7,000 (1/10/18) and a computer for $3,000 (7/10/18). Depreciate both Auto information: Miles Driven Business Commuting 15,000 4,000 10 miles per day, 2,000 per year a. Employee Social Security Number 467-74-4451 b. Employer identification Number (EIN) 1. Wages, Tips, Other Compensation. 33-0711111 50,675.17 2. Federal Income Tax Withheld 3,102.32 c. Employer's Name, Address, and ZIP Code 9. Social Security Wages 50,675.17 4. Social Security Tax Withheld 3,141.86 Super Deal Grocery 2200 Mesa Blvd. Buffalo, NY 14221 6. Medicare Tax Withheld 5. Medicare Wages and Tips 50,675.17 734.79 7. Social Security Tips d. Control Number 9. Verification Code 10. Dependent Care Benefits e. Employee's First Name Middle Initial Suffix 11. Non Qualified Plans 13 Statutory Employee Retirement Plan Third Party Sick Pay John Eagan 543 Space Drive Buffalo, NY 14220 f. Employee's Address and ZIP Code Employer's State ID Number 16. States Wages, Tips, Etc. 17. State Income Tax 18. Local Wages, Tips, Etc. 19. Local Income Tax 20. Locality 15. State NY Form W2 Wage and Tax Statement a. Employee Social Security Number 466-33-1234 1. Wages, Tips, Other Compensation, 2. Federal income Tax Withheld b. Employer Identification Number (EIN) 33-1235672 19,800.00 1,280.00 c. Employer's Name, Address, and ZIP Code 3. Social Security Wages 19,800.00 4. Social Security Tax Withheld 1,227.60 Burger Box 1234 Mountain Road Buffalo, NY 14220 5. Medicare Wages and Tips 6. Medicare Tax Withheld 19,800.00 287.10 7. Social Security Tips 8. Allocated Tips . Control Number 9. Verification Code 10. Dependent Care Benefits e. Employee's First Name Middle initial 11. Non-Qualified Plans 125 13 Statutory Employee Retirement Plan Third Party Sick Pay Barbara Eagan 543 Space Drive Buffalo, NY 14220 14 Other f. Employee's Address and ZIP Code Employer's State ID Number 16. States Wages, Tips, Etc. 17. State Income Tax 19. Local Wages, Tips, Etc. 19. Local Income Tax 15. State NY Form W2 Wage and Tax Statement Problem Complete a federal tax form using the given information. Besides the attached W2 Forms, the couple also have the following pertinent information: Real Estate Taxes Mortgage Interest Cash to Charity Clothes to Charity Medical Expenses $ 6,000 15,000 3,500 450 9,200 They also own a small consulting business and have the following data: Sales Advertising Rent Supplies Contract Labor $15,000 1,000 4,000 2,500 2,000 They bought a desk during the year for $7,000 (1/10/18) and a computer for $3,000 (7/10/18). Depreciate both Auto information: Miles Driven Business Commuting 15,000 4,000 10 miles per day, 2,000 per year a. Employee Social Security Number 467-74-4451 b. Employer identification Number (EIN) 1. Wages, Tips, Other Compensation. 33-0711111 50,675.17 2. Federal Income Tax Withheld 3,102.32 c. Employer's Name, Address, and ZIP Code 9. Social Security Wages 50,675.17 4. Social Security Tax Withheld 3,141.86 Super Deal Grocery 2200 Mesa Blvd. Buffalo, NY 14221 6. Medicare Tax Withheld 5. Medicare Wages and Tips 50,675.17 734.79 7. Social Security Tips d. Control Number 9. Verification Code 10. Dependent Care Benefits e. Employee's First Name Middle Initial Suffix 11. Non Qualified Plans 13 Statutory Employee Retirement Plan Third Party Sick Pay John Eagan 543 Space Drive Buffalo, NY 14220 f. Employee's Address and ZIP Code Employer's State ID Number 16. States Wages, Tips, Etc. 17. State Income Tax 18. Local Wages, Tips, Etc. 19. Local Income Tax 20. Locality 15. State NY Form W2 Wage and Tax Statement a. Employee Social Security Number 466-33-1234 1. Wages, Tips, Other Compensation, 2. Federal income Tax Withheld b. Employer Identification Number (EIN) 33-1235672 19,800.00 1,280.00 c. Employer's Name, Address, and ZIP Code 3. Social Security Wages 19,800.00 4. Social Security Tax Withheld 1,227.60 Burger Box 1234 Mountain Road Buffalo, NY 14220 5. Medicare Wages and Tips 6. Medicare Tax Withheld 19,800.00 287.10 7. Social Security Tips 8. Allocated Tips . Control Number 9. Verification Code 10. Dependent Care Benefits e. Employee's First Name Middle initial 11. Non-Qualified Plans 125 13 Statutory Employee Retirement Plan Third Party Sick Pay Barbara Eagan 543 Space Drive Buffalo, NY 14220 14 Other f. Employee's Address and ZIP Code Employer's State ID Number 16. States Wages, Tips, Etc. 17. State Income Tax 19. Local Wages, Tips, Etc. 19. Local Income Tax 15. State NY Form W2 Wage and Tax Statement