Could someone hand solve this multi-part question for me?

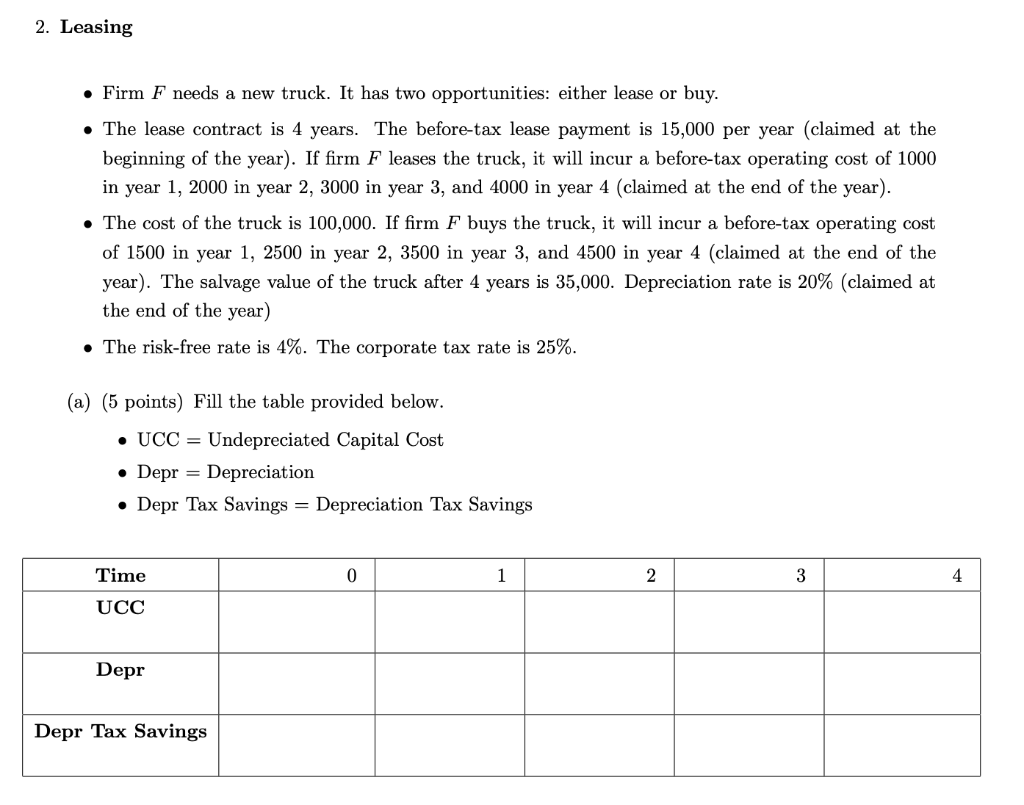

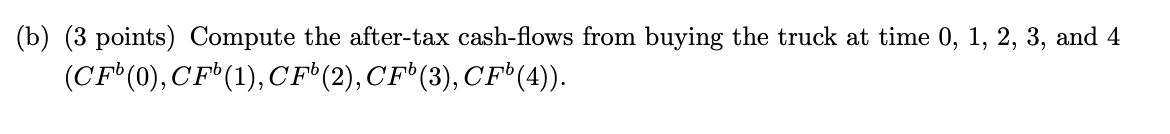

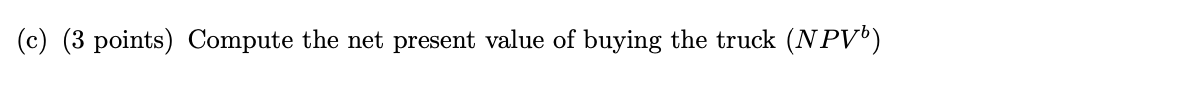

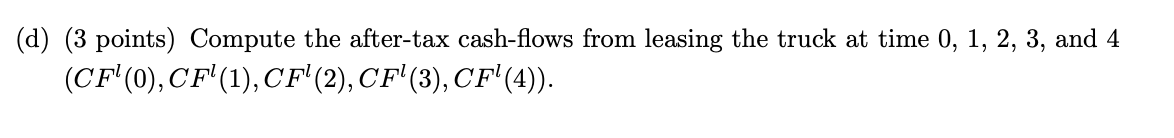

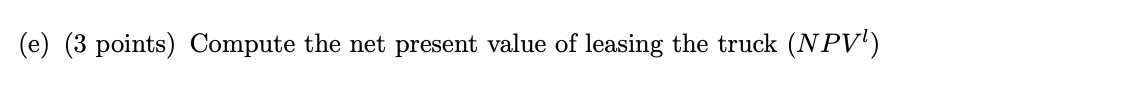

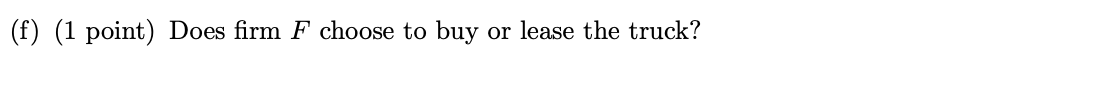

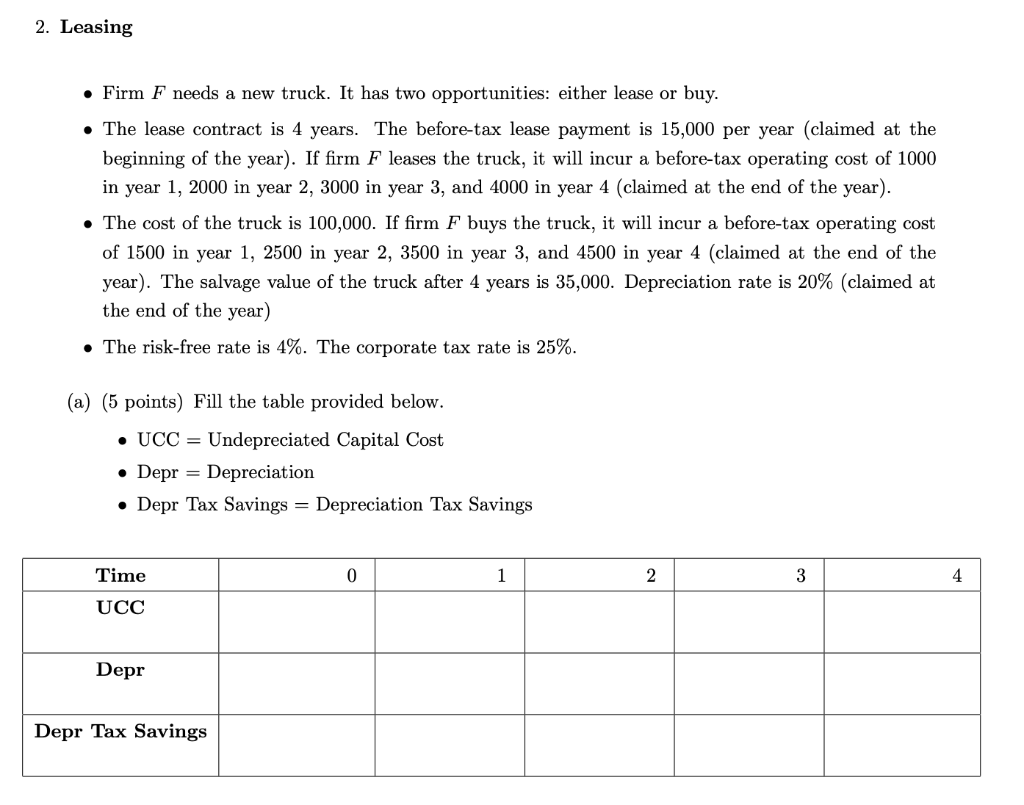

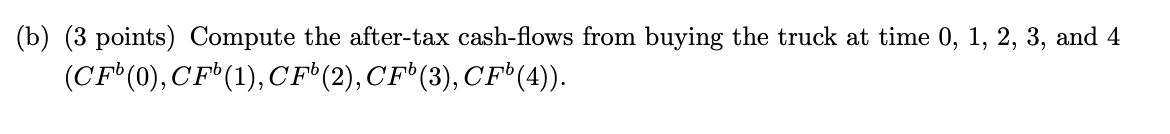

2. Leasing Firm F needs a new truck. It has two opportunities: either lease or buy. The lease contract is 4 years. The before-tax lease payment is 15,000 per year (claimed at the beginning of the year). If firm F leases the truck, it will incur a before-tax operating cost of 1000 in year 1, 2000 in year 2, 3000 in year 3, and 4000 in year 4 (claimed at the end of the year). The cost of the truck is 100,000. If firm F buys the truck, it will incur a before-tax operating cost of 1500 in year 1, 2500 in year 2, 3500 in year 3, and 4500 in year 4 (claimed at the end of the year). The salvage value of the truck after 4 years is 35,000. Depreciation rate is 20% (claimed at the end of the year) The risk-free rate is 4%. The corporate tax rate is 25%. (a) (5 points) Fill the table provided below. UCC = Undepreciated Capital Cost Depr = Depreciation Depr Tax Savings = Depreciation Tax Savings 3 Time UCC Depr Depr Tax Savings (b) (3 points) Compute the after-tax cash-flows from buying the truck at time 0, 1, 2, 3, and 4 (CF"(0), CF6(1), CF6(2), CF6(3), CF6(4)). (c) (3 points) Compute the net present value of buying the truck (NPVB) (d) (3 points) Compute the after-tax cash-flows from leasing the truck at time 0, 1, 2, 3, and 4 (CF'(0), CF'(1), CF(2), CF(3), CF'(4)). (e) (3 points) Compute the net present value of leasing the truck (NPV') (f) (1 point) Does firm F choose to buy or lease the truck? 2. Leasing Firm F needs a new truck. It has two opportunities: either lease or buy. The lease contract is 4 years. The before-tax lease payment is 15,000 per year (claimed at the beginning of the year). If firm F leases the truck, it will incur a before-tax operating cost of 1000 in year 1, 2000 in year 2, 3000 in year 3, and 4000 in year 4 (claimed at the end of the year). The cost of the truck is 100,000. If firm F buys the truck, it will incur a before-tax operating cost of 1500 in year 1, 2500 in year 2, 3500 in year 3, and 4500 in year 4 (claimed at the end of the year). The salvage value of the truck after 4 years is 35,000. Depreciation rate is 20% (claimed at the end of the year) The risk-free rate is 4%. The corporate tax rate is 25%. (a) (5 points) Fill the table provided below. UCC = Undepreciated Capital Cost Depr = Depreciation Depr Tax Savings = Depreciation Tax Savings 3 Time UCC Depr Depr Tax Savings (b) (3 points) Compute the after-tax cash-flows from buying the truck at time 0, 1, 2, 3, and 4 (CF"(0), CF6(1), CF6(2), CF6(3), CF6(4)). (c) (3 points) Compute the net present value of buying the truck (NPVB) (d) (3 points) Compute the after-tax cash-flows from leasing the truck at time 0, 1, 2, 3, and 4 (CF'(0), CF'(1), CF(2), CF(3), CF'(4)). (e) (3 points) Compute the net present value of leasing the truck (NPV') (f) (1 point) Does firm F choose to buy or lease the truck