Could someone help explain how to do the ones that I got wrong.

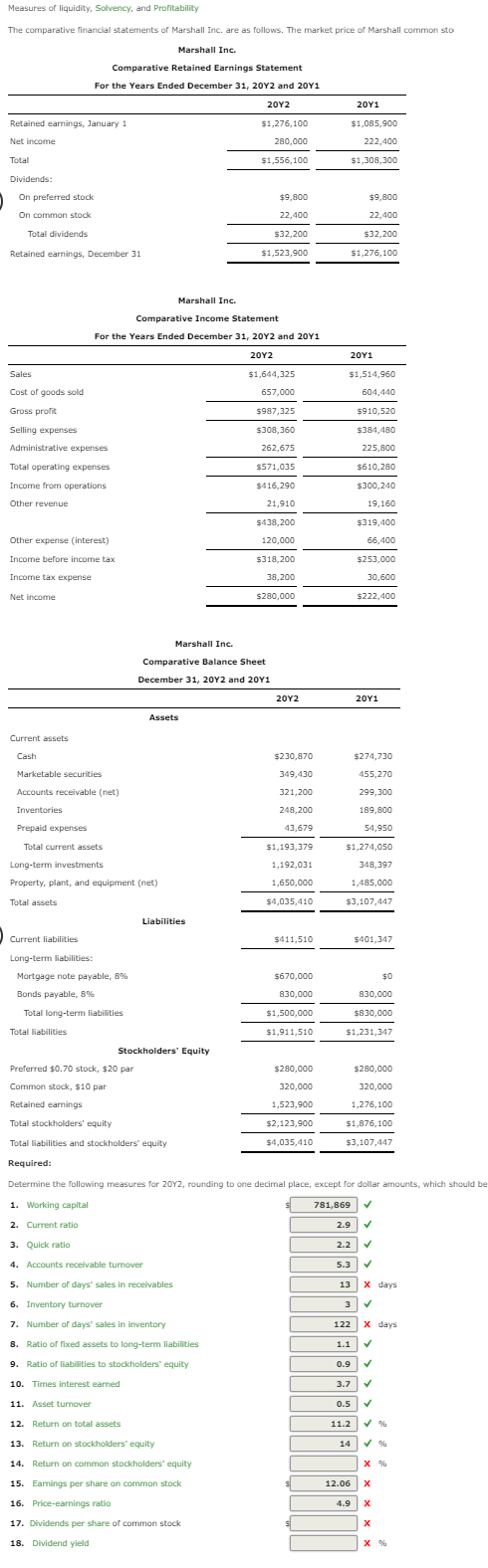

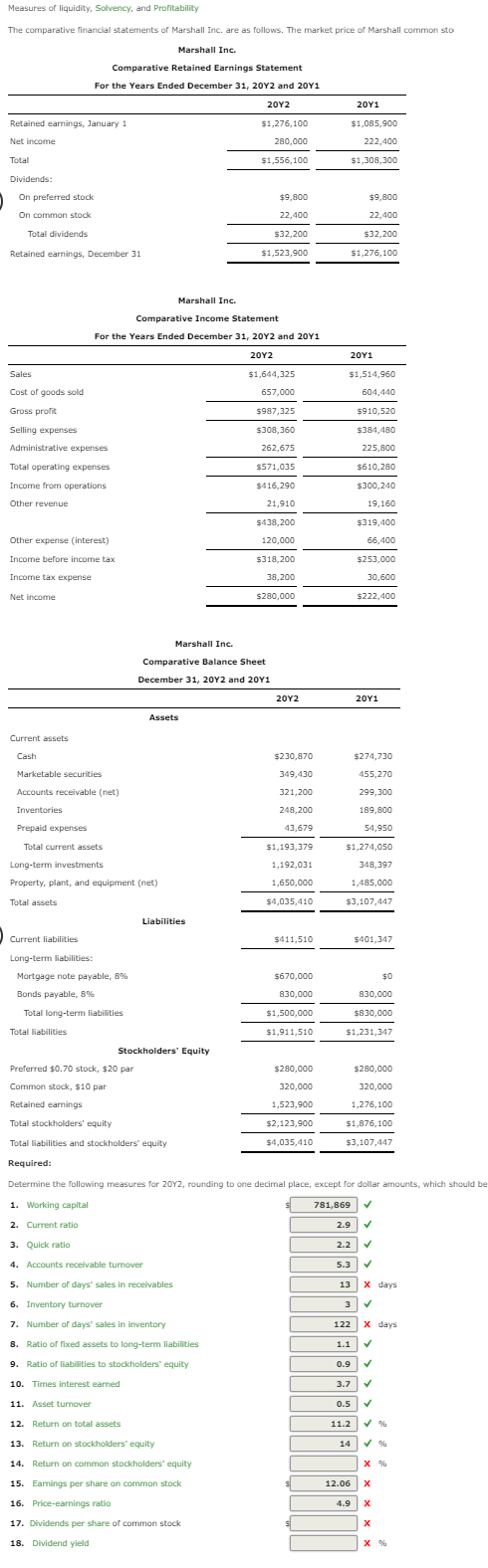

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common sto Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2041 2012 Retained earnings, January 1 $1,276,100 Net income 280,000 2011 $1,085,900 222,400 Total $1,556,100 $1,308,300 Dividends: On preferred stock On common stock $9,800 22,400 $9,800 22,400 $32,200 $1,523,900 Total dividends $32,200 $1,276,100 Retained earnings, December 31 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Sales Cost of goods sold Gross pront Selling expenses Administrative expenses $1,644,325 657,000 $987,325 $308,360 262,675 $571,035 $416,290 21,910 $438,200 120,000 $1,514,960 604,440 $910,520 $384,480 225,800 $610,280 $300,240 19,160 $319,400 66,400 Total operating expenses Income from operations Other revenue Other expense interest) Income before income tax $318,200 Income tax expense 38,200 $280,000 $253,000 30,600 $222,400 Net income Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2011 2042 2041 Assets Current assets Cash $274,730 455,270 Marketable securities Accounts receivable (net) Inventories $230,870 349,430 321,200 248,200 43,679 299,300 189,800 54,950 Prepaid expenses Total current assets Long-term investments $1,193,379 1,192,031 1,650,000 $4,035,410 $1,274,050 348,397 1,485,000 Property, plant, and equipment (net) Total assets Liabilities $3,107,447 Current liabilities $411,510 $401,347 Long-term liabilities: Mortgage note payable, 8% Bonds payable, 8% $670,000 830,000 Total long-term liabilities Total liabilities $1,500,000 $1,911,510 830,000 $830,000 $1,231,347 Stockholders' Equity Preferred $0.70 stock, $20 par Common stock, $10 par Retained earnings $280,000 320,000 1,523,900 $2,123,900 $4,035,410 $280,000 320,000 1,276,100 $1,876,100 $3,107,447 Total stockholders' equity Total liabilities and stockholders' equity Required: Determine the following measures for 2012, rounding to one decimal place, except for dollar amounts, which should be 781.869 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables X days 6. Inventory turnover 7. Number of days' sales in inventory X days 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield