Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could someone help me out with this one, please? Hannah Miller has engaged Cameron Jones, the owner of a small CPA firm, to prepare her

Could someone help me out with this one, please?

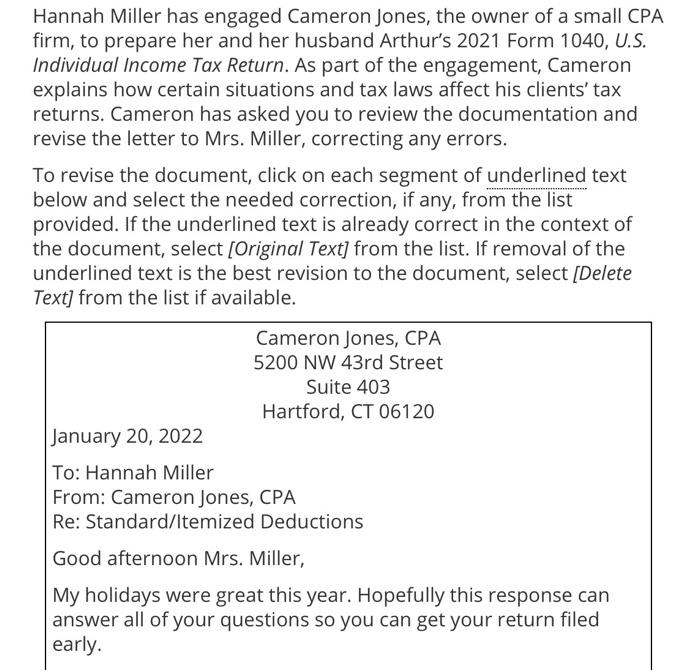

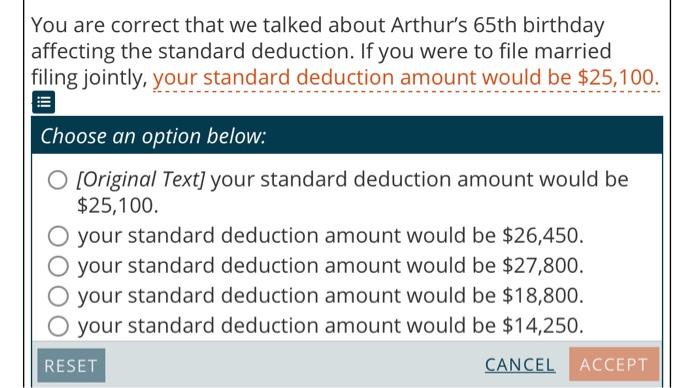

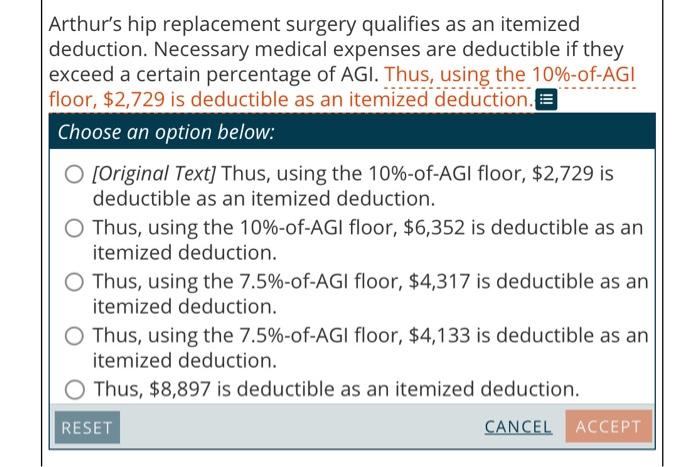

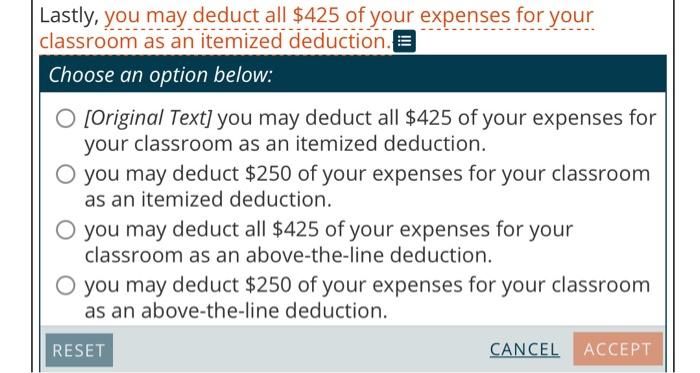

Hannah Miller has engaged Cameron Jones, the owner of a small CPA firm, to prepare her and her husband Arthur's 2021 Form 1040, U.S. Individual Income Tax Return. As part of the engagement, Cameron explains how certain situations and tax laws affect his clients' tax returns. Cameron has asked you to review the documentation and revise the letter to Mrs. Miller, correcting any errors. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select (Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Cameron Jones, CPA 5200 NW 43rd Street Suite 403 Hartford, CT 06120 January 20, 2022 To: Hannah Miller From: Cameron Jones, CPA Re: Standard/itemized Deductions Good afternoon Mrs. Miller, My holidays were great this year. Hopefully this response can answer all of your questions so you can get your return filed early. You are correct that we talked about Arthur's 65th birthday affecting the standard deduction. If you were to file married filing jointly, your standard deduction amount would be $25,100. Choose an option below: O [Original Text] your standard deduction amount would be $25,100. O your standard deduction amount would be $26,450. O your standard deduction amount would be $27,800. O your standard deduction amount would be $18,800. O your standard deduction amount would be $14,250. RESET CANCEL ACCEPT Arthur's hip replacement surgery qualifies as an itemized deduction. Necessary medical expenses are deductible if they exceed a certain percentage of AGI. Thus, using the 10%-of-AGI floor, $2,729 is deductible as an itemized deduction. E Choose an option below: O [Original Text] Thus, using the 10%-of-AGI floor, $2,729 is deductible as an itemized deduction. Thus, using the 10%-of-AGI floor, $6,352 is deductible as an itemized deduction. Thus, using the 7.5%-of-AGI floor, $4,317 is deductible as an itemized deduction. Thus, using the 7.5%-of-AGI floor, $4,133 is deductible as an itemized deduction. O Thus, $8,897 is deductible as an itemized deduction. RESET CANCEL ACCEPT Your donation to the Ronald McDonald House can also be deducted as an itemized deduction. You would be able to deduct $1,270 of your donation. Choose an option below: O [Original Text] can also be deducted as an itemized deduction. You would be able to deduct $1,270 of your donation. can also be deducted as an itemized deduction. You would be able to deduct $1,230 of your donation. can also be deducted as an itemized deduction. You would be able to deduct $1,500 of your donation. can also be deducted as an itemized deduction. You would be able to deduct the full $2,500 of your donation. cannot be deducted as an itemized deduction. You would not be able to deduct any of your donation. RESET CANCEL ACCEPT Lastly, you may deduct all $425 of your expenses for your classroom as an itemized deduction. E Choose an option below: O [Original Text] you may deduct all $425 of your expenses for your classroom as an itemized deduction. O you may deduct $250 of your expenses for your classroom as an itemized deduction. O you may deduct all $425 of your expenses for your classroom as an above-the-line deduction. you may deduct $250 of your expenses for your classroom as an above-the-line deduction. RESET CANCEL ACCEPT Please let me know if you have any further questions regarding your Form 1040. Best Regards, Cameron Jones, CPA Hannah Miller has engaged Cameron Jones, the owner of a small CPA firm, to prepare her and her husband Arthur's 2021 Form 1040, U.S. Individual Income Tax Return. As part of the engagement, Cameron explains how certain situations and tax laws affect his clients' tax returns. Cameron has asked you to review the documentation and revise the letter to Mrs. Miller, correcting any errors. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select (Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Cameron Jones, CPA 5200 NW 43rd Street Suite 403 Hartford, CT 06120 January 20, 2022 To: Hannah Miller From: Cameron Jones, CPA Re: Standard/itemized Deductions Good afternoon Mrs. Miller, My holidays were great this year. Hopefully this response can answer all of your questions so you can get your return filed early. You are correct that we talked about Arthur's 65th birthday affecting the standard deduction. If you were to file married filing jointly, your standard deduction amount would be $25,100. Choose an option below: O [Original Text] your standard deduction amount would be $25,100. O your standard deduction amount would be $26,450. O your standard deduction amount would be $27,800. O your standard deduction amount would be $18,800. O your standard deduction amount would be $14,250. RESET CANCEL ACCEPT Arthur's hip replacement surgery qualifies as an itemized deduction. Necessary medical expenses are deductible if they exceed a certain percentage of AGI. Thus, using the 10%-of-AGI floor, $2,729 is deductible as an itemized deduction. E Choose an option below: O [Original Text] Thus, using the 10%-of-AGI floor, $2,729 is deductible as an itemized deduction. Thus, using the 10%-of-AGI floor, $6,352 is deductible as an itemized deduction. Thus, using the 7.5%-of-AGI floor, $4,317 is deductible as an itemized deduction. Thus, using the 7.5%-of-AGI floor, $4,133 is deductible as an itemized deduction. O Thus, $8,897 is deductible as an itemized deduction. RESET CANCEL ACCEPT Your donation to the Ronald McDonald House can also be deducted as an itemized deduction. You would be able to deduct $1,270 of your donation. Choose an option below: O [Original Text] can also be deducted as an itemized deduction. You would be able to deduct $1,270 of your donation. can also be deducted as an itemized deduction. You would be able to deduct $1,230 of your donation. can also be deducted as an itemized deduction. You would be able to deduct $1,500 of your donation. can also be deducted as an itemized deduction. You would be able to deduct the full $2,500 of your donation. cannot be deducted as an itemized deduction. You would not be able to deduct any of your donation. RESET CANCEL ACCEPT Lastly, you may deduct all $425 of your expenses for your classroom as an itemized deduction. E Choose an option below: O [Original Text] you may deduct all $425 of your expenses for your classroom as an itemized deduction. O you may deduct $250 of your expenses for your classroom as an itemized deduction. O you may deduct all $425 of your expenses for your classroom as an above-the-line deduction. you may deduct $250 of your expenses for your classroom as an above-the-line deduction. RESET CANCEL ACCEPT Please let me know if you have any further questions regarding your Form 1040. Best Regards, Cameron Jones, CPA Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started