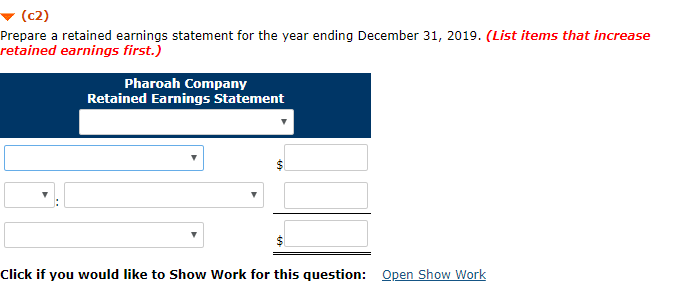

could someone help me with a retained earnings statement?

could someone help me with a retained earnings statement?

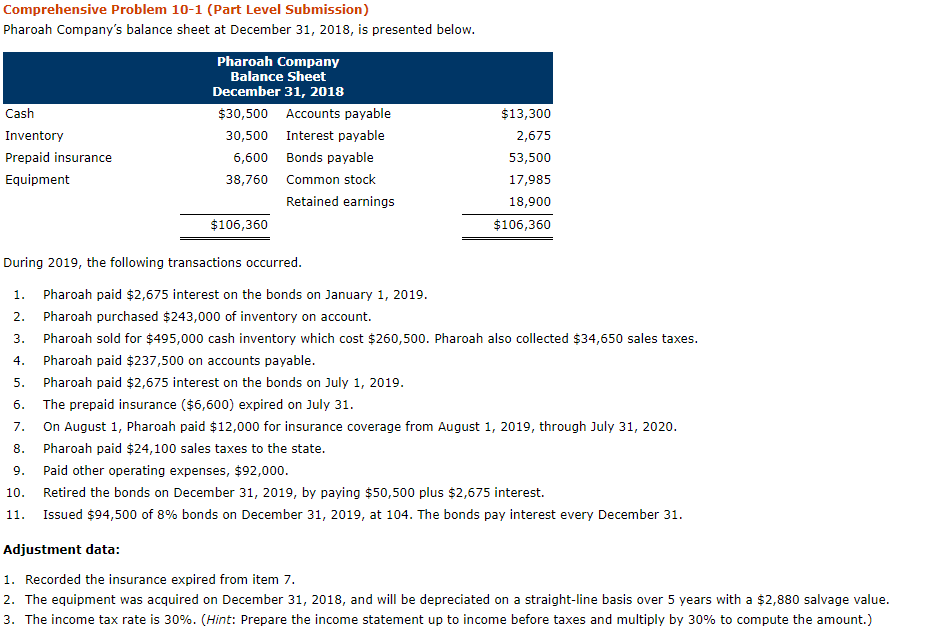

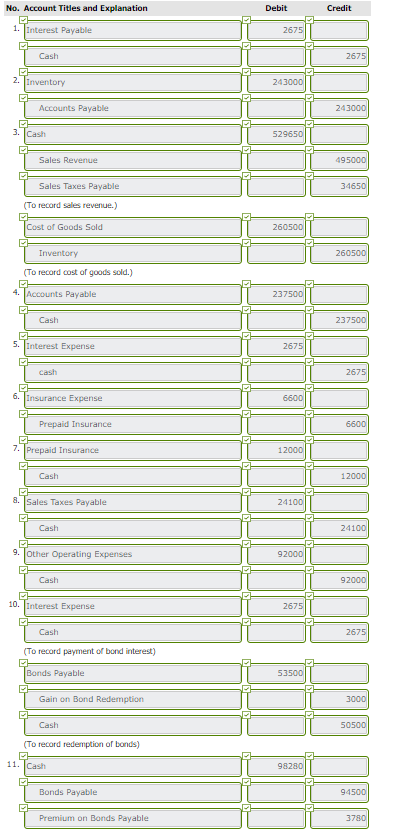

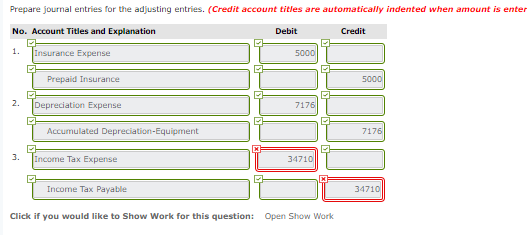

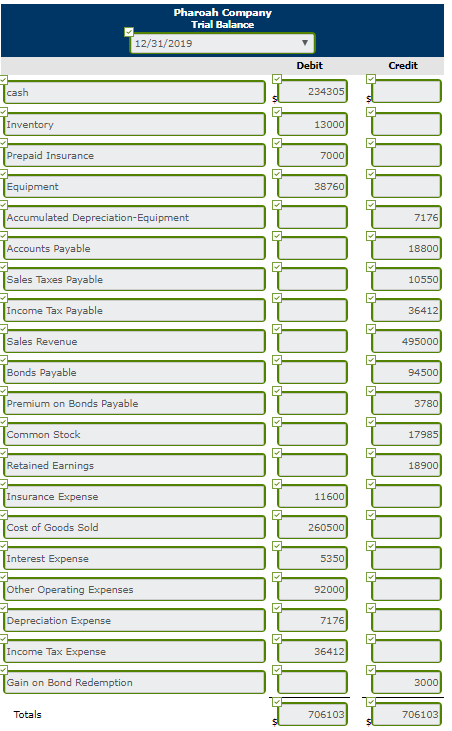

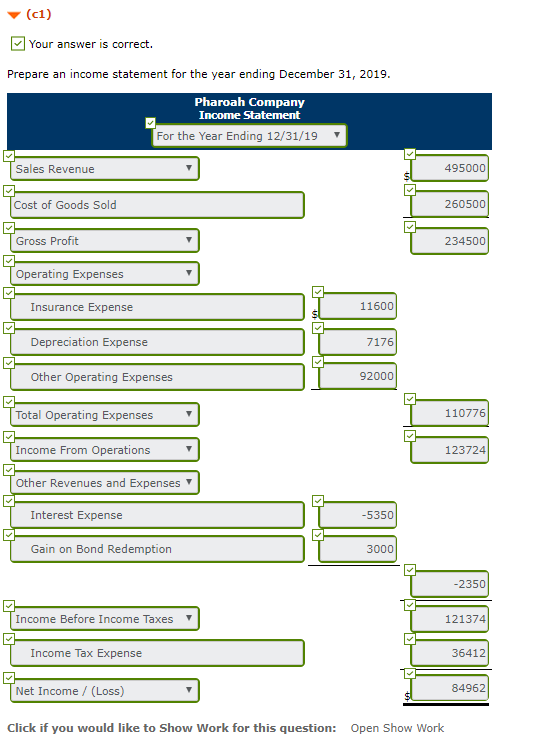

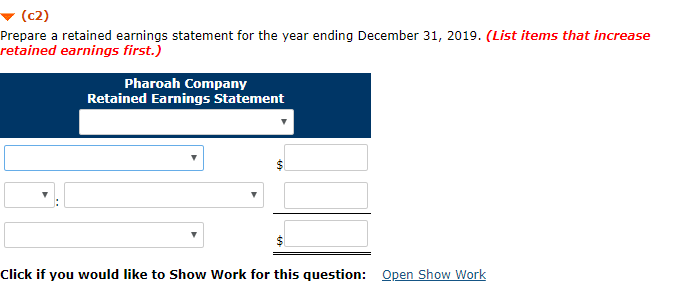

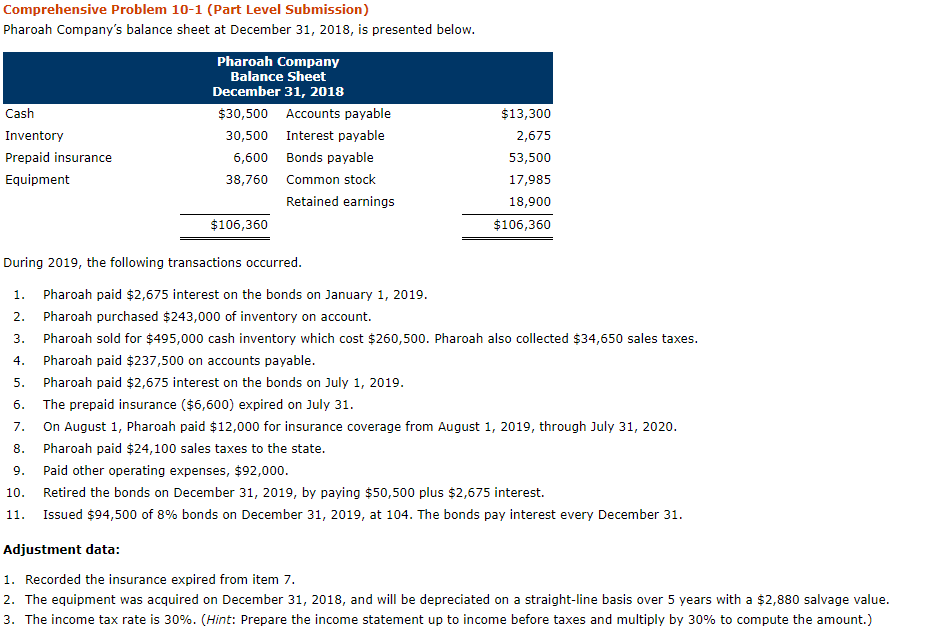

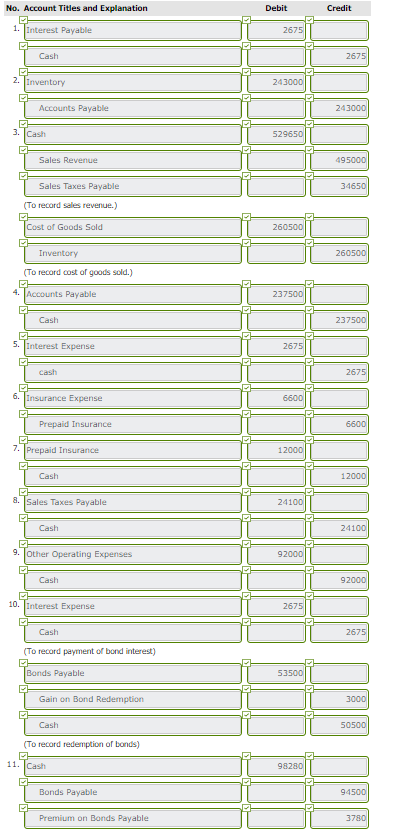

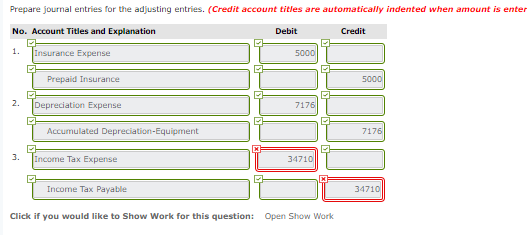

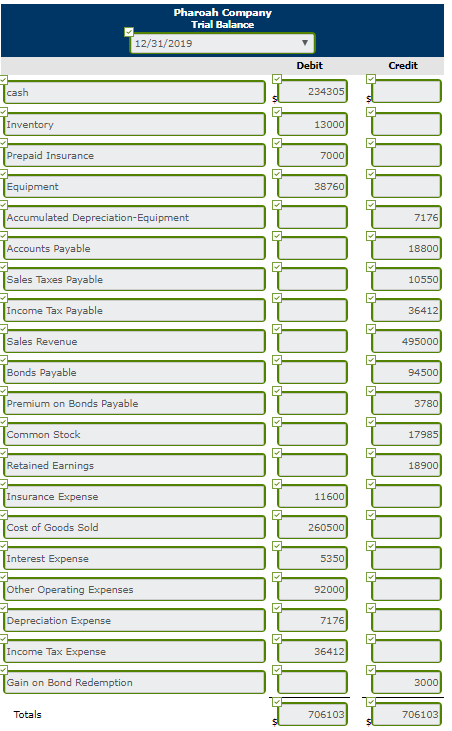

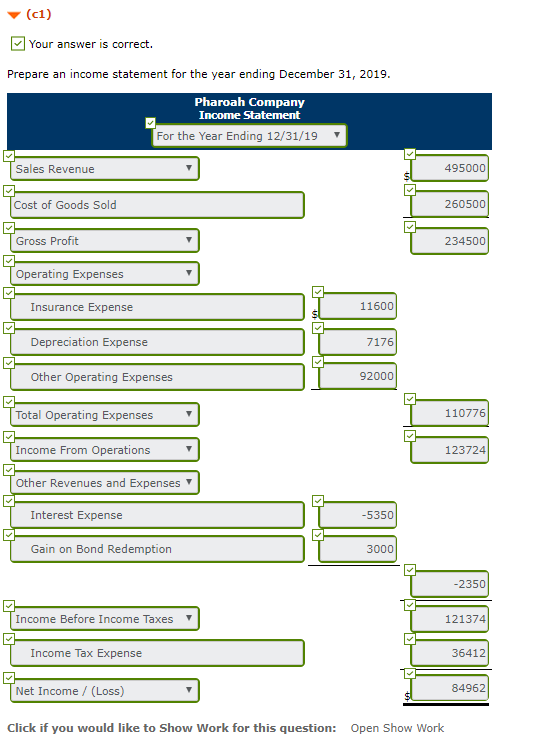

Comprehensive Problem 10-1 (Part Level Submission) Pharoah Company's balance sheet at December 31, 2018, is presented below Pharoah Company Balance Sheet December 31, 2018 Cash Inventory Prepaid insurance Equipment $30,500 Accounts payable 30,500 Interest payable 6,600 Bonds payable 38,760 Common stock $13,300 2,675 53,500 17,985 18,900 $106,360 Retained earnings $106,360 During 2019, the following transactions occurred 1. Pharoah paid $2,675 interest on the bonds on January 1, 2019 2. Pharoah purchased $243,000 of inventory on account. 3. Pharoah sold for $495,000 cash inventory which cost $260,500. Pharoah also collected $34,650 sales taxes 4. Pharoah paid $237,500 on accounts payable 5. Pharoah paid $2,675 interest on the bonds on July 1, 2019 6. The prepaid insurance ($6,600) expired on July 31 7. On August 1, Pharoah paid $12,000 for insurance coverage from August 1, 2019, through July 31, 2020 8. Pharoah paid $24,100 sales taxes to the state 9. Paid other operating expenses, $92,000 10. Retired the bonds on December 31, 2019, by paying $50,500 plus $2,675 interest. 11. issued $94,500 of 8% bonds on December 31, 2019, at 104. The bonds pay interest every December 31 Adjustment data: 1. Recorded the insurance expired from item 7 2. The equipment was acquired on December 31, 2018, and will be depreciated on a straight-line basis over 5 years with a $2,880 salvage value 3. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) No. Account Titles and Explanation Debit Credit 1. Interest Payable 2675 2. Inventory 243000 Accounts Payable 243000 529650 Sales Revenue 495000 Sales Taxes Payable To record sales revenue.) of Goods Sold To record cost af goods sold.) s Payable 237500 237500 5. Interest Expense 2675 11 urance Expense Prepaid Insurance 7. Prepaid Insurance 12000 12000 8. Sales Taxes Payable 24100 r Operating Expenses 92000 10. Interest Expense 2675 To record payment of bond interest) Bonds Payable Gain on Bond Redemption To record redemption of bonds) Bonds Payable Premium on Bonds Payable Prepare journal entries for the adjusting entries. (Credit account titles are automatically indented when amount is enter No. Account Titles and Explanation 1. Debit Credit Prepaid Insurance 2. |Depreciation Expense 7176 7176 34710 Income Tax Payable 34710 Click if you would like to Show Work for this question: Open Show Work Pharoah Company Trial Balance 12/31/2019 Debit Credit 234305 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Sales Taxes Payable Income Tax Payable 13000 7000 38760 7176 18800 10550 36412 Sales Revenue 495000 Bonds Payable 94500 Premium on Bonds Payable 3780 Common Stock 17985 Retained Earnings 18900 Insurance Expense 11600 Cost of Goods Sold 260500 Interest Expense 5350 Other Operating Expenses 92000 7176 Income Tax Expense 36412 Gain on Bond Redemption 3000 Totals 706103 706103 (c1) Your answer is correct. Prepare an income statement for the year ending December 31, 2019 Pharoah Company Income Statement For the Year Ending 12/31/19 Sales Revenue 495000 Cost of Goods Sold 260500 Gross Profit 234500 Operating Expenses 11600 Insurance Expense Depreciation Expense Other Operating Expenses 7176 92000 Total Operating Expenses 110776 Income From Operations 123724 Other Revenues and Expenses Interest Expense 5350 Gain on Bond Redemption 3000 2350 Income Before Income Taxes 121374 Income Tax Expense 36412 Net Income (Loss) 84962 Click if you would like to Show Work for this question: Open Show Work (c2) Prepare a retained earnings statement for the year ending December 31, 2019. (List items that increase retained earnings first.) Pharoah Company Retained Earnings Statement Click if you would like to Show Work for this question: Open Show Work

could someone help me with a retained earnings statement?

could someone help me with a retained earnings statement?