Answered step by step

Verified Expert Solution

Question

1 Approved Answer

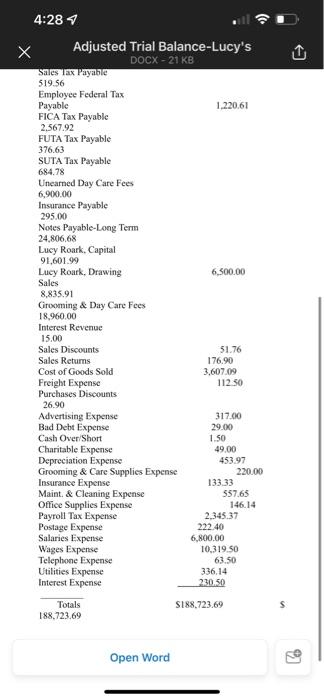

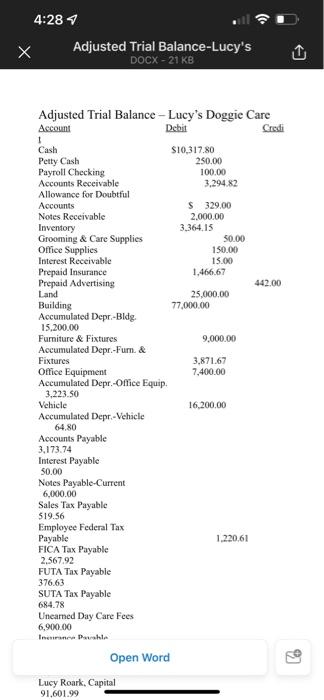

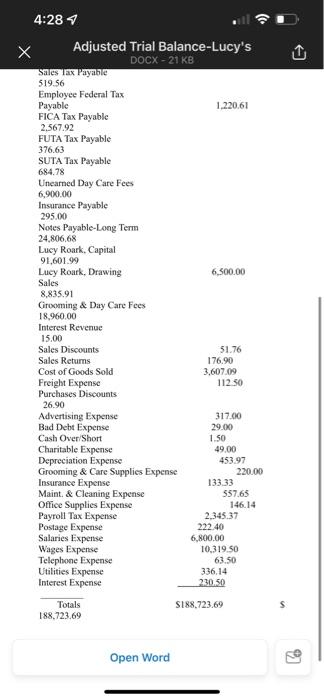

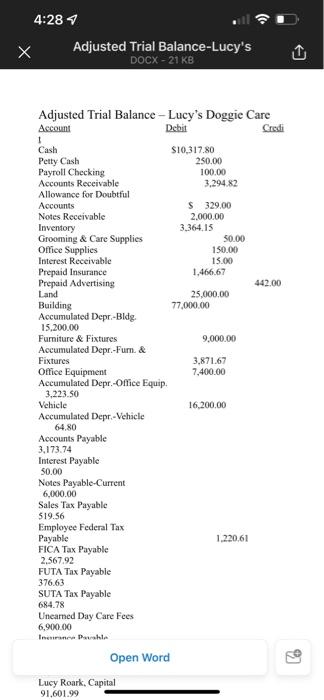

Could someone help out and put this info in an -income statement -statement of owners equity -balance Sheet 4:28 Adjusted Trial Balance-Lucy's DOCX-21 KB Sales

Could someone help out and put this info in an

4:28 Adjusted Trial Balance-Lucy's DOCX-21 KB Sales lax Payale 519.56 Employee Federal Tax Payable 1.220.61 FICA Tax Payable 2,567.92 FUTA Tax Payable 376.63 SUTA Tax Payable 684.78 Unearned Day Care Fees 6,900.00 Insurance Payable 295.00 Notes Payable-Long Term 24,806,68 Lucy Roark, Capital 91,601.99 Lucy Roark, Drawing 6,500.00 Sales 8.835.91 Grooming & Day Care Fees 18,960,00 Interest Revenue 15.00 Sales Discounts 51.76 Sales Returns 176.90 Cost of Goods Sold 3.607.09 Freight Expense 112.50 Purchases Discounts 26.90 Advertising Expense 317.00 Bad Debt Expense 29.00 Cash Over/Short 1.50 Charitable Expense 49.00 Depreciation Expense 453.97 Grooming & Care Supplies Expense 220.00 Insurance Expense 133.33 Maint & Cleaning Expense 557.65 Office Supplies Expense 146.14 Payroll Tax Expense 2,345,37 Postage Expense 222.40 Salaries Expense 6,800.00 Wages Expense 10,319 SO Telephone Expense 63.50 Utilities Expense 336,14 Interest Expense 230.50 Totals S188,723,69 188,723.69 Open Word 92 4:28 Adjusted Trial Balance-Lucy's DOCX - 21 KB Petty Cash Adjusted Trial Balance - Lucy's Doggie Care Account Debit Credi 1 Cash $10,317.80 250.00 Payroll Checking 100.00 Accounts Receivable 3.294.82 Allowance for Doubtful Accounts $ 329,00 Notes Receivable 2.000.00 Inventory 3,364.15 Grooming & Care Supplies 50.00 Office Supplies 150.00 Interest Receivable 15.00 Prepaid Insurance 1.466.67 Prepaid Advertising 442.00 Land 25,000.00 Building 77,000.00 Accumulated Depr.-Bldg. 15,200.00 Furniture & Fixtures 9,000.00 Accumulated Depr.-Furn. & Fixtures 3,87167 Office Equipment 7.400.00 Accumulated Depr.-Office Equip 3,223.50 Vehicle 16.200,00 Accumulated Depr.- Vehicle 64.80 Accounts Payable 3,173.74 Interest Payable Notes Payable-Current 6,000.00 Sales Tax Payable 519.56 Employee Federal Tax Payable 1.220.61 FICA Tax Payable 2.567.92 FUTA Tax Payable 376.63 SUTA Tax Payable 684.78 Uneared Day Care Fees 6,900.00 In Davala Open Word 50.00 92 Lucy Roark, Capital 91.601.99 -income statement

-statement of owners equity

-balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started