Could someone please assist with the following questions and how to go about it answering it. Thank you!

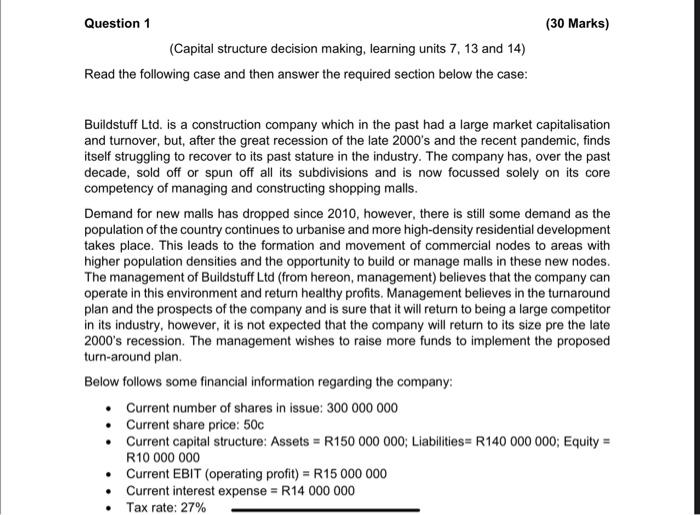

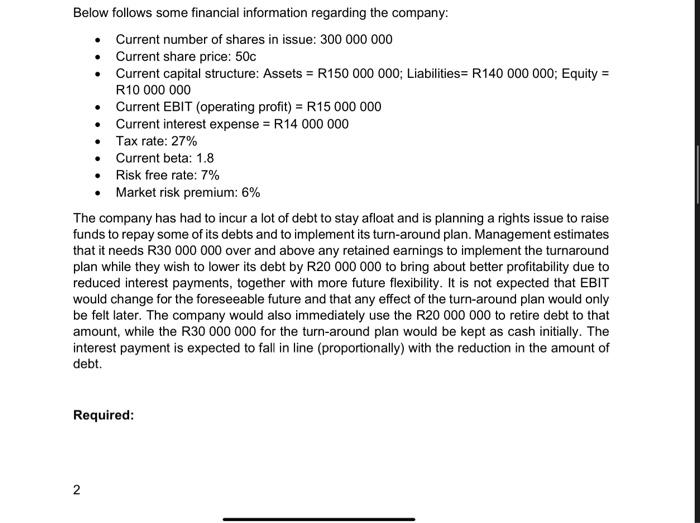

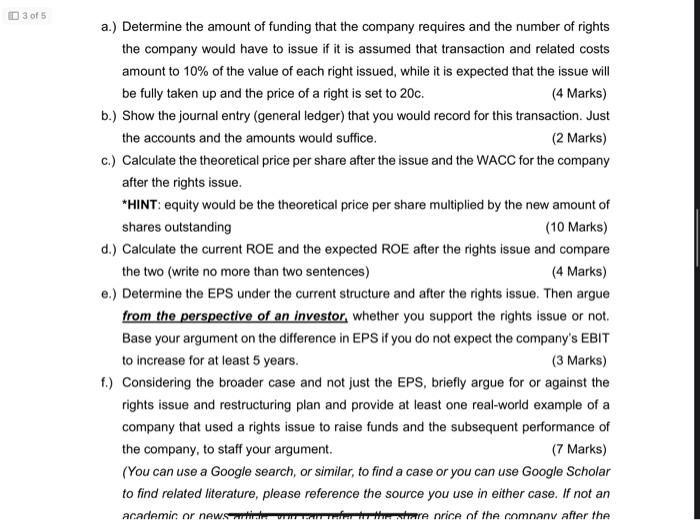

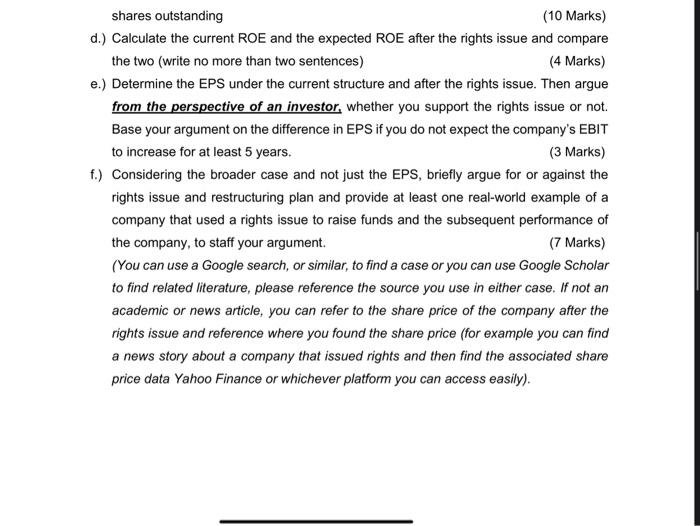

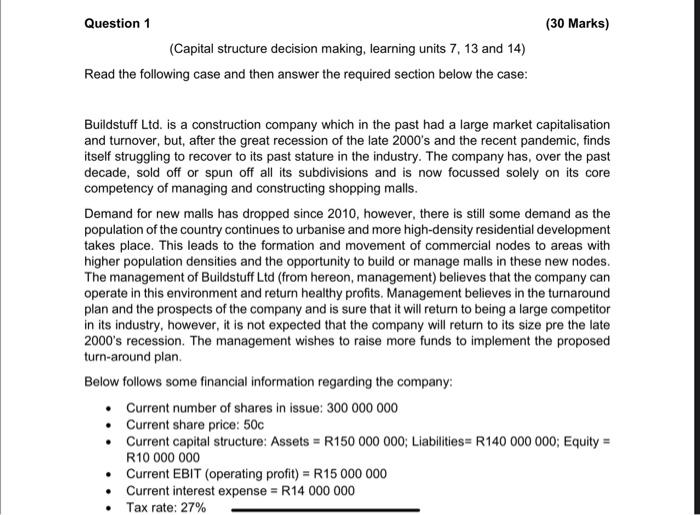

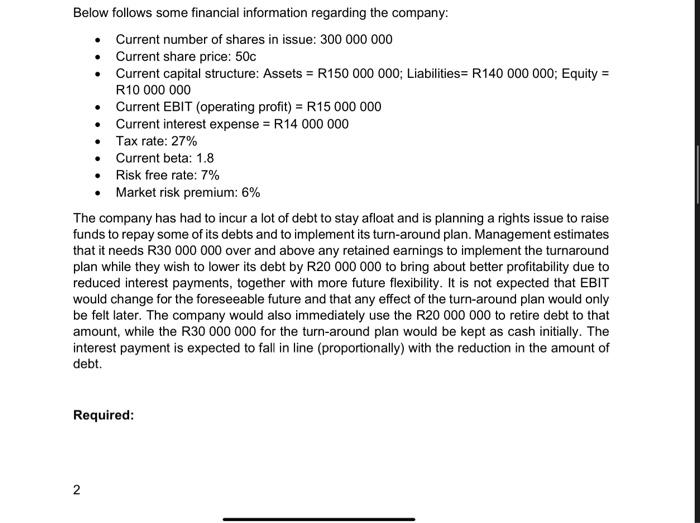

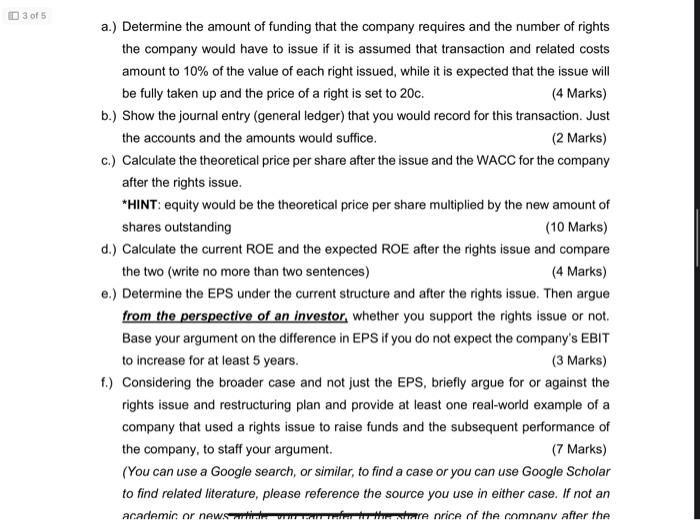

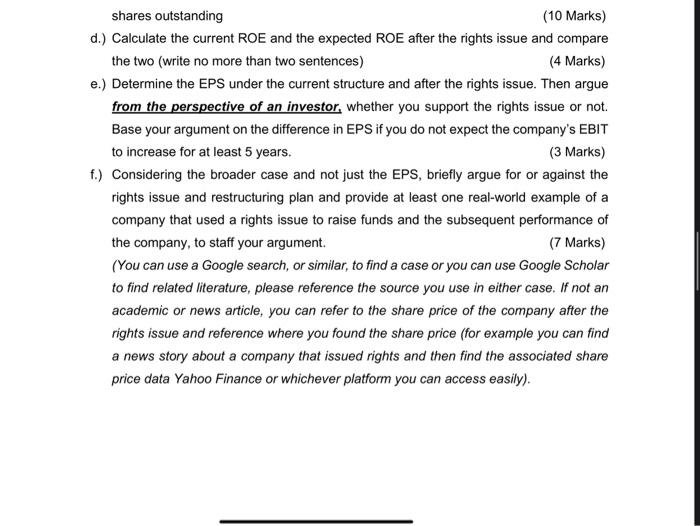

- Current number of shares in issue: 300000000 - Current share price: 50c - Current capital structure: Assets \\( = \\) R150 000 000; Liabilities= R140 000 000; Equity = R10 000000 - Current EBIT (operating profit) \\( =\\mathrm{R} 15000000 \\) - Current interest expense \\( = \\) R14 000000 - Tax rate: \27 - Current beta: 1.8 - Risk free rate: \7 - Market risk premium: \6 The company has had to incur a lot of debt to stay afloat and is planning a rights issue to raise funds to repay some of its debts and to implement its turn-around plan. Management estimates that it needs R30 000000 over and above any retained earnings to implement the turnaround plan while they wish to lower its debt by R20 000000 to bring about better profitability due to reduced interest payments, together with more future flexibility. It is not expected that EBIT would change for the foreseeable future and that any effect of the turn-around plan would only be felt later. The company would also immediately use the R20 000000 to retire debt to that amount, while the R30 000000 for the turn-around plan would be kept as cash initially. The interest payment is expected to fall in line (proportionally) with the reduction in the amount of debt. Required: a.) Determine the amount of funding that the company requires and the number of rights the company would have to issue if it is assumed that transaction and related costs amount to \10 of the value of each right issued, while it is expected that the issue will be fully taken up and the price of a right is set to \\( 20 \\mathrm{c} \\). (4 Marks) b.) Show the journal entry (general ledger) that you would record for this transaction. Just the accounts and the amounts would suffice. (2 Marks) c.) Calculate the theoretical price per share after the issue and the WACC for the company after the rights issue. *HINT: equity would be the theoretical price per share multiplied by the new amount of shares outstanding (10 Marks) d.) Calculate the current ROE and the expected ROE after the rights issue and compare the two (write no more than two sentences) (4 Marks) e.) Determine the EPS under the current structure and after the rights issue. Then argue from the perspective of an investor, whether you support the rights issue or not. Base your argument on the difference in EPS if you do not expect the company's EBIT to increase for at least 5 years. (3 Marks) f.) Considering the broader case and not just the EPS, briefly argue for or against the rights issue and restructuring plan and provide at least one real-world example of a company that used a rights issue to raise funds and the subsequent performance of the company, to staff your argument. (7 Marks) (You can use a Google search, or similar, to find a case or you can use Google Scholar to find related literature, please reference the source you use in either case. If not an Question 1 (30 Marks) (Capital structure decision making, learning units 7, 13 and 14) Read the following case and then answer the required section below the case: Buildstuff Ltd. is a construction company which in the past had a large market capitalisation and turnover, but, after the great recession of the late 2000's and the recent pandemic, finds itself struggling to recover to its past stature in the industry. The company has, over the past decade, sold off or spun off all its subdivisions and is now focussed solely on its core competency of managing and constructing shopping malls. Demand for new malls has dropped since 2010 , however, there is still some demand as the population of the country continues to urbanise and more high-density residential development takes place. This leads to the formation and movement of commercial nodes to areas with higher population densities and the opportunity to build or manage malls in these new nodes. The management of Buildstuff Ltd (from hereon, management) believes that the company can operate in this environment and return healthy profits. Management believes in the turnaround plan and the prospects of the company and is sure that it will return to being a large competitor in its industry, however, it is not expected that the company will return to its size pre the late 2000 's recession. The management wishes to raise more funds to implement the proposed turn-around plan. Below follows some financial information regarding the company: - Current number of shares in issue: 300000000 - Current share price: 50c - Current capital structure: Assets \\( = \\) R150 000 000; Liabilities \\( = \\) R140 000 000; Equity \\( = \\) R10 000000 - Current EBIT (operating profit) \\( =\\mathrm{R} 15000000 \\) - Current interest expense \\( = \\) R14000000 shares outstanding (10 Marks) d.) Calculate the current ROE and the expected ROE after the rights issue and compare the two (write no more than two sentences) (4 Marks) e.) Determine the EPS under the current structure and after the rights issue. Then argue from the perspective of an investor, whether you support the rights issue or not. Base your argument on the difference in EPS if you do not expect the company's EBIT to increase for at least 5 years. (3 Marks) f.) Considering the broader case and not just the EPS, briefly argue for or against the rights issue and restructuring plan and provide at least one real-world example of a company that used a rights issue to raise funds and the subsequent performance of the company, to staff your argument. (7 Marks) (You can use a Google search, or similar, to find a case or you can use Google Scholar to find related literature, please reference the source you use in either case. If not an academic or news article, you can refer to the share price of the company after the rights issue and reference where you found the share price (for example you can find a news story about a company that issued rights and then find the associated share price data Yahoo Finance or whichever platform you can access easily)